The bankruptcy trustee is represented by a specialist involved in the sale of the debtor's property through open auction. It confiscates and evaluates valuables, and also organizes and conducts auctions. The bankruptcy procedure is carried out exclusively on the condition that it is not possible to repay the debts of the debtor in other ways. It is considered the last stage of the procedure for declaring a person or company insolvent. The actions of the bankruptcy trustee must be based on legal requirements and the interests of creditors. Therefore, the bankruptcy trustee must prepare a report containing all the activities implemented by him within the framework of bankruptcy proceedings. This document is studied by creditors, judges and other officials if necessary.

Legislative regulation

The procedure for drawing up a report by the bankruptcy trustee during bankruptcy proceedings is carried out on the basis of the requirements of Federal Law No. 147. This regulatory act specifies the stages and consequences of the bankruptcy process of a private individual or enterprise.

Based on this law, the manager is obliged to report to the arbitration court within the established time frame regarding all actions performed. Additionally, the report is sent for study to all creditors included in the register.

Providing a report with a deviation from the standard form to the bankruptcy trustee

Reporting requirements Clause 2, Art. 143 of the Bankruptcy Law existing in our country specifies the requirements for the documentation drawn up by the bankruptcy manager. It must contain comprehensive information about the financial situation of the debtor company, property at the beginning and at the end of the stage of bankruptcy proceedings.

The management or owners of a bankrupt organization may be dissatisfied with the actions of the bankruptcy trustee. Then a highly qualified legal practitioner, acting on the side of representatives of the company or other interested parties, files a complaint against the actions of the manager.

What documents are attached?

The report of the bankruptcy trustee of Tatfondbank or another institution will always be individual, as it depends on the actions performed, the property confiscated and sold, as well as on other features. This report must be accompanied by other documents, which include:

- register of claims of all identified creditors;

- documentation confirming that the debtor's property was sold at auction;

- papers containing information about what debts were repaid as a result of the specialist’s activities.

The reporting is submitted to the arbitration court, but the manager must notify the creditors and the direct debtor of the actions being taken. Often information is passed on to regulatory authorities if they are involved in this process.

FU quarterly report

Colleagues, who reads this norm Article 213.9. Financial manager 8. The financial manager is obliged to: send the financial manager's report to creditors at least once a quarter, unless otherwise established by the meeting of creditors; Thus, the question arises: do a report once every 3 months and send it, or take calendar quarters and make reports on these dates, then a problem arises if, for example, you introduced the procedure on December 31, and the very next day you are obliged to send the report to creditors. Who thinks about this?

IMHO, an analogy with the bankruptcy of legal entities. once every three months Reactions: Colleagues, who reads this norm Article 213.9.

Financial manager 8. The financial manager is obliged to: send the financial manager's report to creditors at least once a quarter, unless otherwise established by the meeting of creditors; Thus, the question arises: do a report once every 3 months and send it, or take calendar quarters and make reports on these dates, then a problem arises if, for example, you introduced the procedure on December 31, and the very next day you are obliged to send the report to creditors. Who thinks about this?

Does this apply to bankruptcy creditors? Lawyer, Arbitration manager. I am looking for clients (citizens) for bankruptcy or intermediaries to attract them for %.

IMHO, an analogy with the bankruptcy of legal entities.

once every three months, but I have doubts; if they wanted an analogy with a meeting, they would have prescribed the same wording “once every three months.” The calendar year is divided into quarters.

Unfortunately, neither the AIC of the Russian Federation nor the plenum talks about such a concept as a “quarter”.

Plus, you need to understand the big difference between these concepts, so let’s take the 1st and 2nd quarters.

If you are guided by quarters, then in the 1st quarter you can send in January, and in the second in June. the difference is 5-6 months between reports. In my opinion, this contradicts the openness of the procedure (especially considering the short time frame for bankruptcy of physicists) Or at a meeting of creditors, a report must be handed in against signature.

Report of the financial manager: bankruptcy of a citizen (sample)

→ → Current as of: August 8, 2020 A financial manager is an arbitration manager approved by an arbitration court for mandatory participation in a bankruptcy case of a citizen, including an individual entrepreneur (, , - hereinafter Law N 127-FZ). The responsibilities of the financial manager include ():

- maintaining a register of creditors' claims;

- analysis of a citizen’s financial condition;

- identifying signs of deliberate and fictitious bankruptcy;

- identifying an individual’s property and ensuring the safety of this property;

- and other.

- monitoring the implementation of the debt restructuring plan of an individual, reviewing reports on the progress of the plan provided by the debtor, drawing up conclusions on these reports and presenting conclusions to the meeting of creditors;

- notification of creditors about holding meetings of creditors.

Also, the financial manager must send the financial manager’s report to creditors at least once a quarter.

And within 10 days after the end of the bankruptcy procedure in relation to individual entrepreneurs - debt restructuring or sale of property - include in the report on the results of the procedure (,). The reports on the results of the implementation of the debt restructuring plan or the sale of the individual entrepreneur’s property indicate ():

- the date the court issued a ruling (decision) on the introduction of the relevant procedure, on its completion, on changing its terms;

- number of employees (including former employees) of individual entrepreneurs who have

- the date of the meeting of creditors based on the results of the implementation of the individual entrepreneur’s debt restructuring plan or based on the results of the sale of the individual entrepreneur’s property, as well as information about the operative part of the judicial act issued following the results of the procedure;

- the amount of creditors' claims (according to the register of claims) as of the date when the court issued a ruling on the completion of debt restructuring, or on the date of closing the register of claims, as well as the total amount of claims satisfied within the framework of the procedure, for each line of claims;

General information about the work of a specialist

The arbitration court is responsible for the appointment of a bankruptcy trustee. The selected specialist must be included in the register of such managers. Additionally, a specialist may be approved by a meeting of creditors if the appropriate permission from the court is first obtained.

The appointed manager must perform many different tasks, which include the preparation of a special report. Additionally, it implements the following actions:

- determines all property that belongs to the debtor and can be sold at auction in order to obtain the required amount of funds to pay off existing debts;

- preparing identified valuables for the upcoming sale;

- organization of tenders;

- holding an auction;

- making settlements with creditors based on the amounts of funds received.

The bankruptcy trustee's report is mandatory. It contains information about all actions performed by this specialist. Typically, a specialist has to prepare several reports at once as part of one bankruptcy proceeding. Periodically, the document is submitted to creditors or to the court, as it contains information about what actions were performed by the specialist, as well as what amount of funds he received as a result of these actions. At the end of the bankruptcy process, a final report is issued.

How is a bankruptcy trustee appointed?

Bankruptcy trustees are people who are specially trained and perform certain actions at the time of bankruptcy of an object, who are members of a self-regulatory organization of bankruptcy trustees.

The bankruptcy trustee is appointed by the arbitration court. The bankruptcy trustee is the head of the insolvent entity and its management bodies, as well as the owner of the debtor’s property, if such is a unitary enterprise.

To appoint a bankruptcy trustee, the court issues an appropriate ruling, which can be appealed. The action of the bankruptcy trustee ends at the moment of termination of the bankruptcy proceedings.

To become a bankruptcy trustee, you need to work as a lawyer, economist, or have experience doing business work.

Let us note that the bankruptcy trustee has an irregular working schedule, works with a large amount of information, and is involved in the complex procedure of preparing the bankrupt’s property for sale.

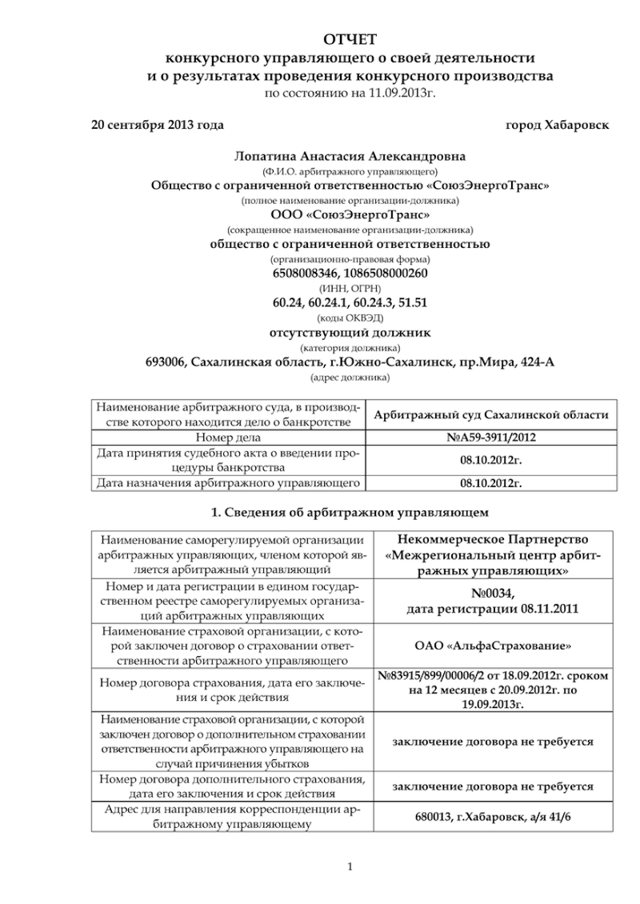

Form of the bankruptcy trustee's report

Specialists should only use the standard form, but if necessary, they can make any changes and new items to it. Standardly, the document contains the following information:

- date and place of documentation generation;

- information about the manager provided by his full name and residential address;

- the name of the arbitration court in which a specific case of bankruptcy of a person or company is being considered;

- number of the case under consideration;

- documents are listed that confirm the existence of an open case;

- the document on the basis of which the specific manager was approved is indicated;

- information is provided on the validity period of the manager's liability policy for causing damage to any property owned by the bankrupt;

- information about the bankrupt is entered, and if he is represented by an individual, then his full name, residential address and passport details are indicated;

- if a company is bankrupt, then its name, organizational form, registration address and information from the constituent documentation are written down;

- includes information about employees who are involved in conducting a specific case in an arbitration court;

- information is provided on what remuneration the manager and involved employees will receive;

- lists data on complaints that were filed against the manager for his inaction or any illegal actions;

- the results of consideration of each complaint against the manager are indicated;

- information about the SRO to which the manager is a member is provided.

The above information is basic, but if necessary, other important data can be included in the bankruptcy trustee’s report.

Its structure

The preparation of this document is strictly regulated by Order of the Ministry of Justice of the Russian Federation No. 195 dated August 14, 2003. The appendix to this regulatory act contains an approved standard report form. It is a set of tables where information relating to specific bankruptcy proceedings is entered.

The document consists of the following elements:

- Information about the debtor (name, address, TIN) and the court in which the case is being heard.

- Information about the arbitration manager - full name, tax identification number, registration address, name of the self-regulatory organization in which he is a member, its tax identification number and location.

- Information about specialists hired to work with property. This could be an auditor, an appraiser, or another employee. This block indicates the position, full name, details of the employment contract, validity period, amount of remuneration and source of funding for remuneration.

- The timing of the bankruptcy procedure, indicating extensions, if any.

- A list of actions that were performed by the manager as part of the performance of his duties. These may be requests to government agencies, applications for reclaiming property owned by third parties, and so on.

- Data on complaints about the actions of the manager. You must specify:

- the applicant;

- qualification of the offense;

- when and by what authority it was reviewed;

- what decision was made;

- number of the act in which the decision is recorded.

a brief description of the subject of the complaint;

If no complaints have been received, then you should write “Absent”.

- lawsuits to declare transactions invalid or void;

- where information about the commencement of bankruptcy proceedings was published;

- about those dismissed during bankruptcy proceedings;

- bank where accounts were previously opened;

Documents for download (free)

- Manager's report template

- Sample of filling out a report

When is it compiled?

The Federal Law “On Insolvency” contains information on how often the manager needs to prepare this report. For this purpose, the rules of the meeting of creditors are taken into account, since it is to them that the manager must report on his activities.

The final report of the bankruptcy trustee on its activities is formed after financial settlements with creditors represented by individuals or companies, but they must be included in the register of claims.

Periodic reports are prepared at least once every three months, but creditors may require this documentation at any time if the relevant decision is made at the meeting. The manager may refuse to compile a report if it is required more than once a month.

Only within a month can the manager complete any work for which he needs to report. Such work may consist of searching for property, selling valuables, or paying off debts of a bankrupt.

The final reports of bankruptcy insolvency practitioners are sent for examination not only to creditors, but also to the arbitration judge considering the case. Only with such a report can the bankruptcy case of a company or a citizen end.

Sample report of a financial manager in case of bankruptcy of a citizen: how to draw it up correctly

It is important to understand that the outcome of the procedure depends on the activities of the financial manager: whether all sources of income of the debtor citizen will be identified, whether it will be possible to foreclose on all the property actually owned by the debtor. Part of the property may simply “go away” on the eve of a citizen’s bankruptcy due to invalid transactions, which, nevertheless, can be challenged; the debtor may simply not notify the court and participants in the bankruptcy procedure about part of the property.

Not just any person can be appointed as a financial manager; the candidate must meet the following requirements:

- Be a citizen of the Russian Federation;

- Be a member of a self-regulatory organization (SRO) of financial managers.

SROs, in turn, are required to establish fairly high requirements that their members must meet: having a higher education, experience in leadership work, passing a qualification exam, the absence of compromising facts, such as exclusion from other SROs, previous exposure to liability that calls into question competence and reputation of a specialist. It is legally prohibited to appoint a citizen as a financial manager:

- who may be considered an interested party associated with other participants (the criteria for classifying a candidate as an interested party are described in detail in Article 19 of the Insolvency Law);

- about whose integrity there are reasonable doubts (due to the presence of debt confirmed in court proceedings due to losses caused by inadequate performance of duties during other bankruptcies; due to the existing procedure for declaring the manager bankrupt; if the candidate was suspended from participation in another bankruptcy less than a year ago bankruptcy process

How do we deal with a bad financial manager?

These requirements in one way or another guarantee the integrity of the manager, because if these circumstances are identified (even if they appeared after the appointment), the court may remove the financial manager at the request of other participants in the process. There is also the possibility of removing the financial manager from performing his duties by a court decision if he is negligent in his duties and because of his similar behavior:

- there have been violations of the rights and (or) legitimate interests of the participants in the process (for example, measures were not taken in a timely manner to invalidate a citizen’s suspicious transaction; the citizen’s property, subject to inclusion in the bankruptcy estate, was deliberately incorrectly valued; during the restructuring of debts, the manager gave consent for the debtor to carry out a transaction, clearly contrary to the interests of bankruptcy creditors);

- the participants in the process have incurred or could have incurred losses.

It is important to understand that for the practical implementation of the opportunity to timely remove a negligent, incompetent or dishonest manager from the process (as well as to justify a possible claim for compensation for losses), a control mechanism is needed that allows participants in the process:

- Find out about existing problems in a timely manner;

- Obtain evidence of inadequate quality of performance by the manager of his duties.

Types of financial manager reports

The law contains references to several types of reports that the financial manager is required to prepare:

- Final reports on the results of the completed procedure (respectively, debt restructuring or sale of property), which are necessarily published in the Unified Federal Register of Bankruptcy Information, an open public source;

- A report on the activities of the financial manager, presented by him at the first meeting of creditors after the introduction of the debt restructuring procedure and submitted to the court before he makes a decision (in the form of a determination) approving the plan for restructuring the identified debts of the citizen;

- A report on the results of the debtor’s execution of the debt restructuring plan, which is sent to both the participants in the process and the court, along with documentary evidence of the debt repayments that have taken place (the report is sent in the original, confirmation - in the form of copies certified by the arbitration manager).

- Report on the results of the sale of the debtor's property. Presented to court. Based on the results of consideration of the document (with attachments), a court ruling is issued confirming the completion of the process of selling the property (or indicating the impossibility of selling the property for some reason). Approval of the document completes the citizen’s settlements with creditors.

- The manager’s conclusions on the progress of debt restructuring, which he prepares based on the results of familiarization with the debtor’s reports on the implementation of the approved restructuring plan.

Anyone can easily familiarize themselves with the reports specified in the first paragraph on the Internet. It also provides for the manager’s obligation to compile and transmit to the citizen’s bankruptcy creditors current reports of the financial manager.

At the same time, the wording in the law is very streamlined, not only regarding the timing (“at least once a quarter,” but the meeting of creditors has the right to change the timing), but also regarding the form of documents, as well as the procedure for transferring them to recipients.

If such a significant document is transferred, it is advisable to exclude a situation in which the parties will then break their spears and find out (in the worst case scenario - in court) whether a document sent by fax or a regular file sent by email is considered transferred.

The most convenient option is if at the level of the SRO, of which the manager is a member, there is a document mandatory for participants that contains specifics on the issues raised. If such a document is missing, the law does not prohibit the meeting of creditors by its decision to agree on:

- frequency of provision of current reports to financial managers;

- in what form these documents are drawn up (options: electronic, certified by an electronic signature or in a regular written form);

- how documents are transmitted to interested parties.

An important point: when transmitting financial manager reports, you should be guided by the rules for the exchange of legally significant messages established by civil law.

Why do you need a manager when an individual goes bankrupt?

The financial manager is an obligatory participant in the procedure by which a person is declared insolvent. Thanks to the participation of a professional in the process, it is possible to:

- Find out the financial situation of the debtor.

- Identify all potential participants in the process (creditors).

- Have a connection between creditors and debtor.

While participating in the case, he performs the following functions:

- analyzes the financial condition of the obligated person;

- carries out the development of measures aimed at restoring solvency;

- maintains a register of all creditors of a person;

- ensures the safety of property, maintains accounting records of the person;

- conducts an analysis of the possibility of special bankruptcy;

- takes measures to ensure the functioning of the debtor's payment system in bankruptcy mode.

Sample compilation and design

The procedure for preparing financial statements by a financial manager is regulated, in addition to the Insolvency Law, by Order of the Ministry of Justice No. 195 “On approval of standard forms of reports (conclusions) of an arbitration manager.” This document approves the reporting form, which is mandatory for use at any stage of the procedure for declaring a person insolvent.

Read more about the signs of bankruptcy of a legal entity in 2020.

What are the consequences of corporate bankruptcy for a director? The answer is here.

Any report from the financial manager must be in writing. The document must reflect the following information:

- date and place where the document is drawn up;

- information about the manager;

- complete information about the debtor;

- information about the judicial authority in which the procedure was initiated;

- information about complaints received (if they were reported during the activity);

- measures taken by the manager to preserve the debtor’s property;

- information on how the register of creditors was maintained;

- information about the property mass of the obligated person, as well as his financial condition.

Russian legislation provides for several types of reports of the arbitration manager:

- final reporting on the results of the completed procedure (debt restructuring/property sale). Reports must be published in the EFRSB, an open public source;

- reporting on the activities of the manager. Provided at the first meeting of creditors after the introduction of restructuring and to the court before making a decision on restructuring;

- reporting on the results of the bankrupt’s implementation of the debt restructuring plan. Sent to the participants in the process and to the court along with documents confirming the repayment of the debt;

- reporting on the results of property sales. Provided to the court;

- conclusions on the progress of debt restructuring, which the financial manager prepares after analyzing the debtor's reports on the implementation of the plan.

Attention: The final reports on the results of the completed procedure are publicly available and anyone can read them.

Also, the following conditional division into types can be applied to the reporting of the arbitration manager:

- report of the interim manager;

- external manager reports;

- bankruptcy trustee reports.

Therefore, the best option would be to have a document at the SRO level, of which the manager is a member, that outlines the specifics on these issues. Otherwise, the meeting of creditors has the right to independently agree on:

- frequency of current reporting;

- form of documents: electronic, certified by electronic signature or written;

- method of transferring documents to interested parties.

At the legislative level, there is no provision for approval of the financial manager's reporting by a meeting of creditors. Some documents are subject to mandatory submission to the court, and the committee of creditors is first familiarized with them, so that lenders can prepare petitions for going to court in advance.

Next

Source: https://SudVoronezh.ru/obrazecz-otcheta-finansovogo-upravlyayushhego-pri-nesostoyatelnosti-grazhdanina/

Rules for requesting reports

The meeting of creditors or the immediate judge may request a report from the bankruptcy trustee of an LLC or a private citizen at any time. The specialist must promptly draw up a document, specifying in it all the actions performed within the framework of a specific production. The achieved results are also presented.

If the request was made by a judge, then the creditors are required to be notified that a report is being sent to the court. The manager must prove that he effectively copes with his main tasks, therefore he is engaged in the search and sale of the debtor’s property. With the help of information from such documentation, creditors and the judge will be able to understand whether it is possible to pay off most of his debts with the help of the property owned by the bankrupt.

What are the documentation requirements?

When compiling this report, the following requirements are taken into account:

- only the actions actually performed by the manager are given;

- a standard form is used, but it is allowed to include any additional items;

- it is not allowed to embellish information in any way or even include false information in the document;

- only reliable data is indicated on the identified property, funds received from bankruptcy proceedings, as well as on the measures taken by the specialist to preserve valuables;

- transactions are listed that, at the initiative of the manager, were declared invalid, since with their help the debtor tried to first get rid of the property.

If the reports compiled by the selected specialist do not contain the necessary information, then creditors have the right to decide to change the manager.

Rules for considering a document in court

The bankruptcy trustee's report is transmitted not only to creditors, but also to the judge who is considering the arbitration case. The rules for the transfer and preparation of this document include:

- the judge may request a document at any time;

- the main purpose of obtaining documentation is control over all actions carried out by the manager;

- if there are no positive results from the work of a specialist, then the judge may decide to change him;

- the judge examines not only the report, but also all complaints filed against the manager, as well as other materials related to the actions carried out by him.

Practice shows that usually managers working in official and reliable SROs take their responsibilities responsibly, so no problems arise during their activities.

Where can I view the report?

Information about the reports is posted in open sources on special websites designed for conducting bankruptcy cases of companies or individuals. Using such resources, you can find out when the report is published, who the debtor is, and information about the insolvency administrator.

The remaining information regarding the amount of the debtor’s property, items sold and funds received can only be obtained by persons directly related to this case.

Rules for consideration of a document by the court

The bankruptcy trustee's report on the results of the bankruptcy proceedings must be examined by the court within a maximum of one month. The judge analyzes not only the information contained in this document, but also other materials of the case.

Based on the information received, a final determination is made. After this, the bankruptcy proceedings officially end. Creditors receive appropriate notifications, after which the bankruptcy procedure for a particular debtor is completed.

The bankruptcy trustee's report on his activities

Receivers are appointed when legal entities undergo bankruptcy procedures appointed by arbitration courts. At its final stage, the stage of bankruptcy proceedings is carried out. As a result, whenever possible, the claims of all creditors of the enterprise are satisfied.

Existing debts are paid in order established by law. The stage usually lasts up to one year, sometimes it is further extended for six months, in rare cases – even longer. Based on the results of the final stage of bankruptcy, the bankruptcy trustee prepares reports.

The property of the debtor (company, individual entrepreneur) is officially called the bankruptcy estate.

Where can I view the bankruptcy trustee's report?

If you need to find out open information about a commercial company or bankruptcy proceedings, you can look at official documents. Now there are specialized websites that publish information related to bankruptcy. There, anyone can see publications of reports that interest them. They look like this:

- publication date (Moscow time);

- debtor company;

- address of the debtor enterprise;

- type of report provided;

- type of procedure performed;

- information about the appointed arbitration manager.

For example, March 27, 2020 LLC “Sibirskoe” Novosibirsk region, Novosibirsk, st. K. LIEBKNECHTA, 116, off.; final; bankruptcy proceedings, Ivanov Pyotr Petrovich. Another option: April 14, 10:25:20, Technological Company LLC, Novosibirsk region, Barabinsk, st.

Lenina, 20, off. 41, Final, Competitive proceedings, Vasiliev Ivan Petrovich. The obligation to publish final (final) reports has existed since 2014. This is stated in the Federal Law of July 2, 2013 No. 189-FZ. Now this information is available to everyone interested.

Familiarization and analysis of reports

Based on the requirements of the arbitration, the bankruptcy trustee must immediately send the required information related to the procedure being carried out, including reports on the work performed. There is a law that establishes this (clause 3 of Article 143 of the Bankruptcy Law).

Reporting at the end of the procedure is regulated by paragraph 1 of Article 147 of the same law.

Immediately, within one month from the time of receipt of the report of the appointed responsible person, the court carefully reviews the documents and makes a final determination on the end of bankruptcy proceedings.

All available creditors must also be notified of this immediately. As a result, the company's bankruptcy procedure ends here. The current documentation provided is checked for the effectiveness of the actions taken.

Nuances

What features of accounting and reporting can be noted during bankruptcy proceedings? When this procedure is opened, the authority to manage the company immediately vests in the officially appointed bankruptcy trustee.

During the procedure, the company's production activities are not carried out.

At the same time, accounting is still maintained, and the bankruptcy trustee’s reports are provided in connection with receiving information about the sale of the company’s property.

Source: https://bankrotstvoved.ru/arbitrazhnyj-upravlyayusshij/otchyot-konkursnogo-upravlyayushhego