Last modified: August 2020

In everyday life, situations often arise when several persons are responsible for each other to one creditor. For example, spouses for common debts, family members for paying utility bills, heirs for inheriting the property of the testator. In this regard, the issue of dividing joint and several debts between debtors becomes relevant. In the article we will consider what a joint and several debt is, what forms of joint debt there are, whether it is possible to divide a joint and several debt, and the division of a joint and several obligation by agreement of the parties and through the court.

What is joint and several debt?

A joint and several debt is a debt obligation incurred by two or more persons in relation to one creditor. In this case, joint liability lies with the debtors in equal shares.

The creditor has the right to present his claims for debt both to all debtors jointly and to any of them (Article 323 of the Civil Code of the Russian Federation).

The joint obligation of debtors arises in the following cases:

- The presence of obligations among the participants of the joint stock company that arose before the registration of the company;

- Shared use of living quarters by family members;

- Disposal of a bank account that is pledged;

- Guarantee for improper performance of an obligation;

- Fulfillment of obligations under a contract by two or more persons;

- Inheritance of property and debts by several heirs;

- Indivisibility of the subject of the obligation.

In case of compensation of a joint and several debt by one of the debtors, he has the right to demand from other joint debtors compensation of their shares in the joint debt.

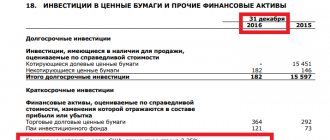

Interest rates on government obligations

Borrowing by national governments, with rare exceptions, is carried out in the form of credit funds under different conditions. One of the most important factors determining the attractiveness of a particular type of government obligation is the interest rate. Its size depends on many factors, including the following:

- Maturity period. For long-term loans this figure is significantly lower than for short-term loans.

- The degree of trust in the government authorities of a given country. Investors take a certain risk by providing resources to their own or foreign governments. Accordingly, the cost of borrowing increases.

- The economic policy pursued by the state.

- The level of the refinancing rate set by the national bank. This indicator is one of the reliable indicators of the solvency of government agencies.

- Projected GDP growth for the current year and for the near future.

There are other factors that have a certain impact on the level of interest rates on government debt. They can be objective or subjective in nature and are largely determined by such a concept as market expectations. Often states find themselves in a vicious circle, borrowing to compensate for the budget deficit exceeds a certain limit.

After this, the government is forced to conduct additional issues of securities to attract all resources on an ever-increasing scale. The money received is used to service previous obligations, and interest rates on these types of securities naturally increase. Ultimately, such a financial policy leads to the government declaring a technical default.

What forms of joint and several debt are there?

Due to the fact that various legal relationships arise in civil trade, in practice there are several forms of joint and several debt. Let's look at them in more detail.

Passive form of joint and several debt

In the passive form, joint and several debt arises on the part of the debtors. That is, there is one creditor and two or more debtors who are liable to him for a debt obligation. Each of them can pay off the debt regardless of the size of their own share.

Example 1. After the death of Stepanov A.V. his property was inherited by two sons Stepanov N.A. and Stepanov E.A. The estate includes an apartment acquired by the testator during his lifetime on a mortgage. The heirs accepted the property as an inheritance, and therefore became joint and several debtors on the mortgage loan.

Active form of joint and several debt

In the active form, one debtor is liable for debt to several creditors. Any of the creditors has the right to demand full repayment of the debt from him. Payment of a debt in full to one creditor releases the debtor from obligations to other joint creditors.

Example 2. Spouses Afanasyev D.A. and N.E. entered into a purchase and sale agreement for an apartment with E.V. Gutorova. The buyer transferred the money for the property to D.A. Afanasyev, for which a receipt was issued in his name. Obligations to joint creditors were terminated. The funds entered the family budget and acquired the status of joint property.

Mixed joint and several debt

The latter form of joint and several debt obligation is rare. Several people participate in this legal relationship, both on the part of the creditor and on the part of the debtor. Joint and several obligations acquire a reciprocal nature.

Consequences of accumulation of public debt

Numerous studies show that the degree and nature of the impact of public debt on the economy is ambiguous for different groups of countries, while there is a critical threshold of external debt for developing countries, after which the impact on economic growth becomes negative; for developed countries such a threshold was more often absent:

- G. Shimanovich, based on a linear growth model, identified a negative relationship between external debt and economic growth in post-socialist countries for the period from 1995 to 2007: an increase in the ratio of external debt to GDP by 1% reduces the growth rate of per capita GDP by 0.06%

- K. Reinhart and K. Rogoff, using a sample of 20 developed and 24 developing countries, conducted a comparative analysis of the impact of domestic public debt and the country's total external debt on the dynamics of economic growth. For developing countries, the authors identified a higher threshold value of public debt compared to total external debt, the excess of which negatively affects changes in per capita GDP. Thus, when the level of external debt reaches 60% of GDP, the average annual growth rate of GDP decreases by 2%; if the level of external debt exceeds 90% of GDP, the growth rate is reduced by half.

- T. Efthymiadis and P. Tsinzos, based on a study of the endogenous growth model, came to the conclusion that reducing the share of external borrowing in the structure of public debt has a positive effect on long-term economic growth, mainly due to a reduction in the outflow of domestic capital abroad

- S. Shabbir, using data on the external debt burden for 24 developing countries for the period from 1976 to 2003, found that external debt is negatively correlated with investment dynamics, which in turn leads to a decrease in economic growth rates

- A. Shklarek and F. Ramon-Ballester, based on the results of an analysis of a sample of 20 Latin American countries for the period 1970–2002, came to the conclusion that total and public external debt negatively correlates with the dynamics of GDP per capita; the main channel of the impact of external debt on growth dynamics is change in the level of capital accumulation rather than its productivity

- D. Amassoma analyzed the impact of internal and external debt on economic growth using the example of Nigeria for the period from 1970 to 2009. As a result of the analysis, it was found that the relationship between the dynamics of per capita GDP and internal debt is positive, and, conversely, with external debt it is negative. .

Other consequences:

Dynamics of Russian public debt in 1999-2010, as a percentage of GDP.

- Shifting the tax burden to future generations (in cases where GDP growth is less than the cost of debt servicing).

- Redistribution of income among the population. Those who invest their savings in the government debt receive it back with interest, while those who do not have this option are forced to only pay a tax to service it.

- Crowding out (reduction) of private investment due to the issue of government securities.

- Decreased resistance of the country's economy to negative risks (for example, now servicing American debt is very cheap due to the low interest rate, but in a financial crisis, rates may increase, which will increase the burden on the contracting economy due to a decrease in business activity and, as a consequence, a decrease in collected taxes , budget). Particularly dangerous from this point of view are external debts in foreign currency (for example, see the debt crisis in Greece)

The peak of Russian public debt occurred in 1998 (146.4% of GDP).[2] As of January 1, 2000, external debt reached $146 billion (and the total external and internal public debt amounted to 84% of GDP). At the beginning of 2007, public external debt was reduced to $52 billion (5% of GDP).

For comparison, the public debt of other hydrocarbon exporting countries (IMF, 2011), % of GDP:

Kuwait - 7.4% Saudi Arabia - 7.5% Uzbekistan - 9.1% Kazakhstan - 11% Azerbaijan - 10% Norway - 30%

Public debt by European Union countries as a percentage of GDP in 2013([3]:

France - 93.5% Germany - 78.4% Portugal - 129.0% Italy - 132.6% Greece - 175.1%

For comparison: USA - 116.4% of GDP (2016) Japan - 239.2% of GDP (2016)

Is it possible to divide a joint and several debt?

Many citizens who have become joint and several debtors decide not to pay another person’s debts. At some point, other debtors begin to evade their obligations, which leads to the fact that all responsibility for the debt falls entirely on one person.

In addition to the principal debt, interest for the use of other people's funds or contractual penalties is added, which increases the total amount of debt. In this regard, there is a need to divide the joint debt.

Civil legislation allows for the division of joint and several debts on a loan, writ of execution, utilities and other obligations.

By loan

Most often, the division of joint and several loan debts is carried out when dividing the joint property of the spouses. For example, during their marriage, a husband and wife purchased an apartment with a mortgage, which acquired the status of jointly acquired property.

If the spouses have not entered into a prenuptial agreement under which the apartment and debts are transferred to the husband or wife, then they can divide the apartment and mortgage debt upon divorce. Each of them receives 1/2 of the ownership of residential real estate, and also assumes the obligation to repay half of the debt to the bank.

The division of debt is formalized by two loan agreements, which are concluded with each of the spouses. In the future, the ex-husband and wife are independently responsible for their half of the loan debt.

You should know! The division can be carried out in such a way that all rights to housing are transferred to one spouse, and the second is paid compensation for his share. The obligation to pay the loan also passes to the person who has become the sole owner of the apartment.

According to the writ of execution

It happens that the court issues a writ of execution to collect debt from several people at once. The bailiff is not obliged to divide the amount of debt by the number of debtors and collect equal amounts from them. Recovery is made from the person whose property is found the fastest.

After repaying the debt, debtors decide on dividing the paid amount in certain shares with payment of compensation to the citizen who paid the entire amount of the debt. If one of them avoids reimbursing his part of the debt, the issue is resolved by filing a claim by way of recourse.

For utilities

Family members living in the same apartment bear joint obligations to pay for utilities. If one of them systematically does not pay bills or refuses to pay their share for the use of utilities, the question arises of dividing the debt for the apartment between the residents.

The most convenient option is to split the personal account, after which each tenant will be issued a separate receipt indicating the payment amount corresponding to his share. Residents draw up an agreement on payment for housing and communal services, determining the shares of each of them and transfer it to the RCC.

Division of joint and several debt by agreement

Joint and several debts can be divided by agreement of the parties or through the court. Let us examine how joint and several debts are divided by agreement between debtors, using the example of joint and several debt for utilities.

Residents living in an apartment sign an agreement regarding the procedure for paying bills for the apartment. The document is drawn up in free form and must contain the following information:

- Information about joint debtors (full name, residential address, passport details);

- Information about the ownership of the apartment (certificate, date of entry into the Unified State Register of Real Estate, registration number);

- Distribution of shares from the accrued payment for housing and communal services among joint debtors;

- The obligation to fully pay your share of the housing and communal services fees;

- Duration of the agreement;

- Signatures of the parties.

We must remember! If the tenants are not the owners of the apartment and live in it on the basis of a social tenancy agreement, then when the personal account is divided, it loses its force. In this case, an individual social rental agreement is concluded with each of them separately.

After signing the agreement, residents contact the RCC with an application to divide their personal account. An agreement and a document on the ownership of residential real estate are attached to it.

Division of joint and several debts through court

In the case where the joint debtors have not agreed on the division or the creditor is against the debt being divided between them, the issue is resolved through the court. This situation is possible, for example, when a mortgage loan is divided between spouses after a divorce, when the bank is against such a division.

To divide the joint mortgage debt, one of the spouses goes to court with a statement of claim. The claim contains the following information:

- The name of the court to which the plaintiff is applying;

- Full name of the plaintiff and defendant, their addresses and contact numbers;

- Name of the bank that issued the loan, which is attracted as a third party;

- Date of marriage and divorce;

- Information about the loan agreement;

- Information about the absence of an agreement on the voluntary division of joint debt and the absence of the bank’s consent to such a division;

- Links to legal norms;

- Proposed option for dividing joint debt and mortgaged apartment;

- Request for division of a joint and several debt (procedure for payment of debt, amount of compensation for a share in an apartment, etc.);

- List of applications;

- Date and signature.

Important! When filing a claim, a state fee must be paid. Its size is determined based on the cost of the apartment, the amount of debt, and the share of each spouse. For example, the total cost of residential real estate is RUB 2,500,000. + amount of debt on the loan is 500,000 rubles. The state duty will be calculated from the following amount: 3,000,000 / 2 = 1,500,000 rubles. Its size will be 13,200 + 0.5% × (1,500,000 – 1,000,000) = 15,700 rubles. (Clause 1 of Part 1 of Article 333.19 of the Tax Code of the Russian Federation).

Footnotes and notes

- ↑ 12Government debt of the Russian Federation. The essence and forms of public debt.

- Address by the Ambassador of the Russian Federation P. V. Stegniy to the participants of the Black Sea forum on the development of business cooperation. Istanbul, March 3, 2004 // Embassy of the Russian Federation in Turkey

- This comparison is not entirely correct due to the varying degrees of involvement of the listed states in the economy. With a high degree of involvement (Russia, Kazakhstan), the volume of public debt should also include the external debt of corporations, in proportion to the degree of state participation

- Eurostat: GDP and main components. April, 2014 Eurostat: GDP and components, April 2014.

(English) - Eurostat: Government deficit/surplus. Marz, 2014 Eurostat: Budget deficit/surplus, April 2014.

(English) - Eurostat: General government gross debt. 2014 Eurostat: Public debt, 2014.

(English) - Eurostat: Population. 2013 Eurostat: Population 2014.

(English) - IMF: World Economic Outlook Database, USA, April 2014

(English) - IMF: World Economic Outlook Database, China, April 2014

(English) - IMF: World Economic Outlook Database, Japan, April 2014

(English) - IMF: World Economic Outlook Database, Brazil, April 2014

(English) - IMF: World Economic Outlook Database, Russia, April 2014

(English) - IMF: World Economic Outlook Database, India, April 2014

(English)

How to divide a joint and several debt in court after it has been paid by one debtor?

It happens that the creditor has collected the full amount of the debt from one of the joint debtors. In this case, the debtor has the right to recover the amount of debt that exceeds his share from other joint and several debtors (regressive claim).

The debtor, who has paid the full amount of the debt, must file a claim with the court for its recovery by way of recourse from joint and several debtors who have evaded fulfillment of the obligation. You must justify your position with reference to Article 325 of the Civil Code of the Russian Federation.

If a positive decision is made, the joint and several debtors are obliged to pay their shares in the joint and several debt to the collector. If they refuse to fulfill their obligation voluntarily, the claimant has the right to contact the bailiff service in order to initiate enforcement proceedings for the purpose of forced collection.