Photo from website: fb.ru

Often in life there are situations when loved ones ask to lend some amount, and if possible, then why not help relatives, friends, work colleagues or just friends. Moreover, no one even thinks that it would be worth taking from a person a receipt or other legally valid document that would subsequently confirm both the existence of the debt itself and the agreed repayment period. However, it often turns out that no one is in a hurry to return the money, and it is completely unclear how to extract the debt from the debtor without a receipt. So is there anything you can do to prevent your financial situation from getting worse? It turns out that this can be done. True, it is not as easy and simple as we would like, but, nevertheless, it is definitely worth a try.

Illegal methods of debt repayment

How to knock out and get money from a person if he owes?

Not all citizens adequately perceive the need to motivate the debtor to return the money. Unfortunately, many people understand this as violent actions and the use of threats. This strategy of behavior, moreover, is only reinforced by a positive outcome: indeed, with the described attitude, the debt is repaid quickly in most cases.

But there is a big “but”. Anyone who has taken out a loan and is in no hurry to repay the money can contact the police if there is excessive pressure on them. Then the creditor will be at a disadvantage.

There is such a 163rd article of the Criminal Code of the Russian Federation - “Extortion”. The punishment provided for is imprisonment for a term of 4 to 15 years, as well as a fine of up to 1 million rubles.

.

The mentioned sanction is very serious. It should discourage the use of illegal methods of debt collection.

Note 1.

Abuse of power, threats to the debtor himself or his relatives, dissemination of information about the existence of debt obligations, the use of methods of pressure on the psyche, provocations, etc. - This is the path towards problems with the law. Those who do not shy away from such methods are called not too disingenuous words: these are banal “knockouts/bouncers//bandits.”

Important! The creditor has the right to correctly request payment of the debt and warn of his intention to go to court.

Remember that the state will be on the side of a citizen who owes a certain amount if his health, or even more so his life, is threatened by someone or something. He has every right to defense in this case.

What's worse than a trial?

- What is the amount?

— 5 thousand dollars

— The debtor lives in Moscow, the receipt is not older than three years?

- In Moscow, no older...

— Drive up, bring 15 thousand rubles plus 1 thousand for the power of attorney plus 2 thousand state duty. And you will pay 20% of the returned amount upon receipt, we do not take money in advance!

— ???

I don’t understand anything: what does it mean - we don’t take money in advance, but, excuse me, 15 thousand rubles. plus power of attorney plus state duty? Collection agency employee Nikolai condescendingly explains that 15 thousand is quite official money, and that they need it to file a lawsuit, and that the amount of 5 thousand dollars is too small for “serious guys with soldering irons” to approach your friend -send to the debtor (!), and that these 15 thousand rubles taken from me. they will additionally include it in the claim against my debtor and return it along with the debt. So in the end it won’t cost me anything... If they return it, maybe it won’t, but if not?..

The collection company I have chosen has four offices in Moscow, I’m going to the branch closest to me - on Novoslobodskaya. Nikolai gives me a whole bunch of complex legal documents, after reading them carefully, I understand: at best, I will “treat” for 3 thousand rubles. (the power of attorney plus the state fee are not returned), on average - for another plus 15 thousand (the same ones that will be included in the claim against the debtor after I pay them!), in the worst case - I’ll pay it’s not clear how much, because there may be “ Unexpected expenses". Seeing the doubt on my face, Nikolai, with an advertising gesture, opens the door to the next room and insinuatingly whispers:

- You, of course, can directly contact the bailiff, but by law he must withdraw the debt within two months, but officially this is impossible, the tax office takes months to respond to the request, so we draw up hundreds of thousands of acts on the impossibility of collection... But we have our own methods, look what specialists they are! All are former law enforcement officers, with special psychological training, one even knows Japanese. By the way, it was he who came up with an excellent move - he registered on the Odnoklassniki website in the debtor’s community and influenced him through his closest childhood friends. Or one of our employees brilliantly treated a debtor: she went with a stroller to the playground, where she was walking with a child, and unobtrusively told women “horror stories” about collecting debts, without getting close to the “ordered” girl. She returned the debt to our client within a week!

I become even more gloomy, imagining that suddenly such an “unobtrusive employee of a collection agency” with a fake stroller might someday show up in my real yard...

However, to protect against rampant debt collectors, there are... anti-collection agencies! They will explain to you that no one has the right to call you a “debtor” before a court decision, that you can sue debt collectors who call at night, that perhaps the bank will not impose any terrible fines on you for an overdue loan - the lawyer will carefully read your agreement and will help to sue illegally accrued fines, but... also for money and also for quite a lot. In general, it is cheaper not to lend and not to delay loan payments than to pay for expensive wars between collectors and anti-collectors... You can see for yourself what is happening.

Receipt

Let's consider two situations: when a person took out a loan against a receipt and when he did it without drawing up this paper.

If she is

Here, the correct way to get your funds back is to file an application with the court.

If you have a written certificate of provision of money for temporary use, collection will not be a big problem.

It is advisable that the following points be recorded in the receipt:

- credit amount;

- amount of remuneration – i.e. interest (if such was agreed upon);

- payment schedule or loan repayment date;

- procedure, methods of making calculations.

It is important for both parties to pay special attention to the last point. The most profitable option is to return funds by crediting them to an account with a banking company

. This circumstance may subsequently play a significant role in court.

Example 1.

The borrower transferred the money to the account specified by the lender on a pre-agreed date. Then the proof of his actions will be a check - it can be presented during the trial to attest to the fulfillment of his obligations. If the creditor has not received his funds back, he will present an account statement - in this case, sanctions will be applied to the offender.

Important! The limitation period for debt is 3 years.

The best option is to have the receipt notarized.

Then the case in court will go easier if problems arise with the loan. You just need to file a claim at the defendant’s place of residence.

If she's not there

In the case where the loan was provided on the basis of an oral agreement, and the date of its return was not immediately determined, it is still possible to get the money back - legally.

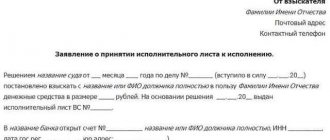

The first thing to do is

– contact the borrower with a demand to return the funds. It is permissible to record the conversation on a voice recorder. The lender also has the right to involve a witness who will subsequently confirm the existence of obligations to repay the loan.

Second chronological measure

– filing a claim if, after 30 days, the debt has not been covered.

Important! The absence of a receipt or agreement is not a reason for refusal of judicial collection measures.

Audio and video recordings, as well as testimony, are quite sufficient for the court to oblige the defendant to repay the borrowed funds.

About receipt of funds

With the help of a receipt, it is much easier to return funds.

A promissory note is a document that records the transfer of funds from one person to another. The Civil Code of the Russian Federation provides for the preparation of this paper in situations where the loan amount exceeds 10 thousand rubles.

Notarization for this transaction is not a mandatory condition, but can be used at the request of the parties. When lending money against a receipt, you must draw it up in accordance with the general recommendations:

- the document indicates the full names of the parties, the place and date of conclusion of the agreement, the amount of debt (in words and figures), as well as the date and conditions of return;

- the text is written by hand, but a typewritten document is allowed;

- when borrowing foreign currency, you must indicate the rate at which the return will occur;

- When drawing up a receipt, the support of witnesses has no legal force.

If the fact of transfer of money from one person to another has not been documented, it will be difficult to collect the debt from an unscrupulous borrower.

However, human rights activists argue that legislation can support the lender and create conditions for debt repayment.

Assistance from government agencies

Now let’s pay attention to how to interact with law enforcement agencies and the courts.

Statement to the police

Before resorting to the law, it is necessary to warn the debtor of this intention. At the same time, it is important to inform him of criminal liability under Art. 159 and 159.1 of the Criminal Code of the Russian Federation.

First of all, paragraph 1 of the first of these articles is interesting here: “Fraud, that is, the theft of someone else’s property or the acquisition of the right to someone else’s property by deception or abuse of trust.”

Punishment – imprisonment for up to 10 years and a fine of up to 1,000,000 rubles

.

To prove that the borrower has violated the law, you should write a statement to the police. From there it will go to court. The document is written in free form.

Going to court

Judicial resolution of the issue is the most effective method. Especially when the creditor has a receipt.

You should apply to the court at the defendant’s place of residence. The application, as in the case of the police, is free-form. The paper needs to reflect information such as:

- surname, name and patronymic of the creditor and debtor;

- date, month, year of transfer of money;

- borrowed amount;

- the time frame within which the debt had to be repaid;

- basis for refund (receipt or oral agreement).

Here it is necessary to mention that the person who took the borrowed money ignored the request to return it after the loan period expired. At the end, a demand is indicated - to repay the debt.

To consolidate your position, it is better to refer to the Civil Code of Russia

. These are the articles:

- 807 – “Loan Agreement”;

- 808 – “Form of loan agreement”;

- 810 – “Obligation of the borrower to repay the loan amount.”

The court must take into account all these points and ultimately oblige the defendant to return the money.

Who collects loan debts and can demand its repayment? Please note: bailiffs will deal with the issue of debt repayment. They have the right to forcibly collect funds from an unscrupulous borrower or sell the property belonging to him.

In view of all the points outlined, it is appropriate to ask the question: “Is it worth engaging in any kind of debt collection if you can go the absolutely legal route?” The correct answer is no.

There is only one drawback to all these events. Time. Enforcement proceedings will take quite .

How to return money without a receipt and witnesses: collecting evidence

To begin with, you must understand that according to the legislation of our country, any transactions and debt obligations whose amount exceeds a thousand rubles can and must be drawn up in writing, and in accordance with all the rules of a legal nature, which is described in detail in article number 808 of the Civil Code RF.

Photo from website: fb.ru

Regarding the return of debts, there are also options that protect the private property of citizens. For example, Article 162 of the same Civil Code states that when applying to judicial authorities, you can refer not only to a receipt, testimony of witnesses, but also to other types of evidence. It is clear that always, without any exceptions, it is worth acting exclusively in accordance with the letter of the law, that is, without going beyond the limits, so that the question of how to extract a debt from a person without a receipt does not turn out to be fatal for you, leading to serious consequences. There are three main options for what you need to do if the debtor makes contact, and it is better if there are as many similar materials as possible and they are more varied.

We write video and audio: how to collect a debt from a debtor without a receipt

This method of obtaining evidence is only possible in the only case where you continue to communicate with the debtor, call him on the phone, talk in person, and he does not disappear from sight, like a light haze from spring gardens in the morning. Moreover, you will have to acquire the appropriate technical support, that is, recording and recording means.

- High-quality digital voice recorder with loud playback capabilities.

- A mobile phone or a landline version, but with a speakerphone function.

- A video camera where you can set the shooting date would also be helpful.

It is clear that you will first need to find out the phone number of the person who owes you a certain sum and does not want to return it for some reason. Both a mobile number and a landline number will do, there is no difference. It would be optimal to ask your relative or friend to help you collect the debt without a receipt; he will just have to videotape your call, and nothing else will be required. It wouldn’t hurt to invite a couple more uninterested individuals; extra witnesses wouldn’t hurt at all. You need to prepare thoroughly for filming so that when you go to court you will be fully prepared.

Photo from the site: sovets.net

- To begin with, you need to clearly and clearly state the date of recording, as well as its time on camera.

- You also need to say out loud the phone number of the caller, as well as the subscriber to whom the call is being made.

- It is also necessary to voice the names and surnames of those persons who make the call, as well as those who are present during it.

During the conversation, be sure to also name the amount of debt, as well as the time and place of their transfer from one person to another. Do not forget that when thinking about how to return the money without a receipt, the video also needs to announce the requirement for the return of funds within the required time frame. It also doesn’t hurt to say at the end of the conversation how long it lasted, as well as the exact time it ended. All this information can later be verified by expert authorities, who will decipher printouts and extracts from these phone numbers, if the matter naturally comes to him.

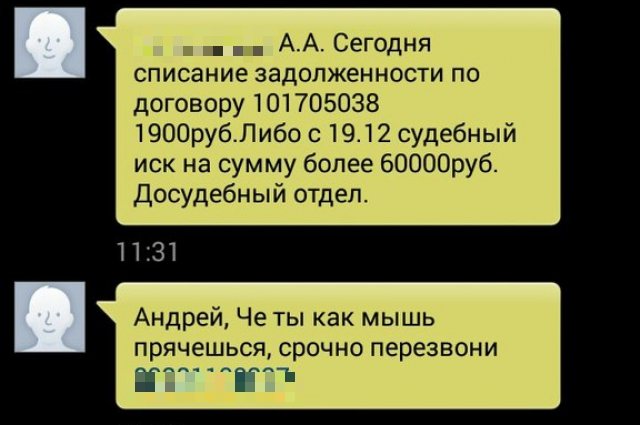

How to collect a debt if there is no receipt: text evidence, messages and letters

Evidence can also be obtained in another way, in the form of text messages. Of course, ideally you need to write a regular letter and hope that they will also respond to you in writing. However, the twenty-first century has long been outside the windows of our apartments and you can use the debtor’s email, his accounts on social networks and even SMS messages.

It is clear that you will need to write a letter by email, but first, you need to somehow indicate that the address from where you will send it definitely belongs to you. If you receive a response, you simply need to print it out, along with your initial request. Therefore, it is imperative to formalize it properly, never using obscene language or threats.

Photo from the site: aif.ru

- If you have an SMS correspondence with your debtor saved in your phone, then it is also best to copy it in front of witnesses and print it on a tangible medium. Moreover, you will also need to draw up an act about this, therefore, in order to comply with all the formalities, you will have to turn to a lawyer for help.

- An expert assessment with confirmation of authenticity would also not hurt.

- Thus, it turns out that it is optimal to immediately go to a notary with your phone, who will call the experts himself and then certify the contents in order to do everything quickly and in one go.

True, many courts are quite skeptical about such evidence, since the defendant can always say that at the time of that significant correspondence, he had lost his phone long ago, and he has no idea who answered. Therefore, it is recommended to collect as much diverse evidence as possible so that it helps and supports your version of events.

Selling debts to collectors

In general, it is quite unprofitable for creditors to interact with debt collectors when collecting debts. However, sometimes this method is still resorted to.

Note 2.

Collection agencies work for individuals and can buy out debt with a discount of 50% or more if it is recent and large enough (usually we are talking about an amount of more than 500,000 rubles).

Important! It is possible to assign the right to claim a loan to a third party when such a clause is pre-defined in the loan agreement.

If the borrower has consented to the transfer of personal data to third parties (i.e., in the circumstances under consideration, to collectors), then the sale of debt is a legal action. Otherwise, the creditor himself may face the law.

What to do if you are being scammed out of funds?

Debtors cannot do anything about the seizure of funds by government agencies, since the tools used are within the limits of the law. However, when confronted with debt collectors, individuals and legal entities can protect themselves from illegal actions. To do this, you will need to follow the recommendations for interaction with the agency:

- If collectors contact you, you should make sure that they have paper on the basis of which they carry out their work. For example, this could be the act of transferring a debt to an agency. If there are no papers, you can contact law enforcement agencies, since any actions of specialists in this case are illegal;

- If you receive threats or blackmail, you need to record them on a voice recorder in order to take the materials to the police. Calls at night are illegal. The actions of debt collectors may well be considered extortion;

- If collectors are contacting you legally, it is better to contact them. An even better idea is to contact the creditor directly if they have not sold the debt. This will help prevent harsh impacts. You will also be able to achieve softer refund conditions. Lenders often meet halfway by forgiving fines or extending loan repayment periods.

Legislators planned to put the actions of collectors under control back in 2013, watch a short video on this topic:

Extorting money from individuals and legal entities has its differences. If a legal entity has a debt, an insolvency procedure may be initiated in its favor, which will help the creditor return its funds.

Tips for the lender

In order to minimize risks and prevent the occurrence of any problems regarding the loan, you should follow a few fairly simple rules:

- Check the borrower's solvency. Clarify for yourself the situation with the level of his actual income.

- Apply for a loan secured by property if you have doubts about the financial capabilities of the person to whom you are lending.

- Draw up a receipt or agreement and have the papers certified by a notary office. You will have to pay for the service, but there will be official guarantees.

- Check the contact numbers, actual residence address, and place of work provided by the borrower.

All these measures are quite simple, but they will help protect your finances.