Refusal to interact with debt collectors

The economic situation on the market is unstable. This is why many citizens who take out loans end up in debt.

In this situation, debtors should know that the law is on their side, and they have the right to refuse to interact with debt collectors after four months from the date of delay in obligations. To do this, you will need to send them a corresponding application.

Of course, no one will forgive the defaulter his debts, and he will still have to pay his financial obligations. You can issue a refusal to interact with collectors in the following ways:

- telephony;

- personal contact;

- messages via telegraph;

- any text messages sent via telecommunications.

But this law does not apply to any messages sent to a postal address.

What do we have to do

To protect his interests, the defaulter has the right to legally avoid communicating with debt collectors. To do this, you should follow a simple algorithm of actions :

- Wait until the end of the 4 month period specified in the law. Previously, this opportunity could be used by citizens who were declared bankrupt or disabled people of the first group. In addition, after the court decision on debt collection comes into force, at least a month must pass, after which you can apply to refuse to communicate with debt collectors.

- Fill out the application form. There is a single sample here that is filled out according to a specific form. Free form filling is not allowed.

- Send the completed application to creditors or collectors. This point can be fulfilled with the help of a notary, sending the application by mail, or in person (when submitting the application, the receiving party must sign the author’s copy).

Debtors may feel protected. In cases where collectors cross the line, there is always the opportunity to contact the FSSP with a complaint. If the service employees behave adequately, it is better to interact with them, since paying off your debts is, first of all, the interest of the defaulter.

How does a refusal occur?

Typically, citizens take such measures as refusing to interact with the collection service when the latter goes beyond the boundaries in its desire to achieve communication with the debtor.

Company employees can make a large number of calls to the defaulter, as well as send SMS or notifications.

And so that he cannot prove that the limit for such calls has been exceeded, they use different phone numbers.

In such situations, it is difficult to talk about a peaceful resolution of the situation. Then the debtor turns to legal protection in order to prohibit service employees from calling him, sending SMS messages, or coming to his house.

If a refusal is received, claimants will only be able to use postal correspondence.

In this case, it is important to correctly draw up the application that is sent to creditors. The header should indicate the name of the company to which the notification will be sent. After this, the applicant’s details are entered, indicating his place of residence and contact telephone number.

The notice should indicate your desire to refuse further interaction with debt collectors. By any possible means, except by post, collectors will no longer be able to seek communication with the debtor.

Here you will also need to enter the details of a document that will confirm the citizen’s debt. At the end, the notice must be signed and sent to creditors in a way convenient for you.

Many citizens, wanting to protect themselves from dealing with debt collectors, are in too much of a hurry, without waiting the time required by law. And if this provision is violated, the applicant may be denied satisfaction of his wishes.

When the debtor fills out the corresponding notice, there are often cases that he skips filling out some items, thereby not providing all the necessary data. In this case, there will also be a refusal.

Communication through court

When a collection company or creditor receives an official refusal to communicate , their only option is to resolve the issue in court. Although collectors still have the opportunity to communicate with the debtor through mail, this method is not effective.

When, after court proceedings, a decision is made in favor of the creditor, the debtor's legal ability not to communicate with creditors is suspended for some time.

The law provides a two-month period for collectors to convince the violator to fulfill all of his financial obligations.

Source: //jurysti.ru/otkaz-ot-vzaimodejstviya-s-kollektorami/

Refusal to interact with collectors sample

In 2020, after the entry into force of Federal Law No. 230-FZ of July 3.

2016 “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts,” debtors, their colleagues and relatives have a new way to get rid of annoying calls from debt collectors. Now you can refuse to interact with collectors.

Especially for readers of the site Paritet.guru, we tell you how to write a statement of refusal to cooperate with a collection agency and officially prohibit collectors from calling about a credit debt.

The bank and collectors can interact with the debtor in 3 main “standard” ways:

- directly - meet in person, call;

- send letters by mail;

- send telegrams, SMS, text messages and other messages via mobile communications, via the Internet.

If the bank wants to interact with you in some other, non-standard way, it must stipulate this in a written agreement with you.

You can refuse to comply with this agreement at any time, without any restrictions. It is enough to write a special application to the bank. This application can be delivered personally against signature, sent by registered mail with notification, or submitted through a notary. With phone calls and other standard methods of interaction, everything is more complicated.

Application for refusal to interact with collectors (for the debtor) In the application, indicate that you refuse to interact with the bank / collectors in other ways than directly, by mail, telegraph, telecommunication networks.

Option 1. You belong to a certain category of debtors

- bankrupts, incl. those who, by decision of the arbitration court, have undergone debt restructuring;

- deprived or limited in legal capacity by court;

- debtors with disability group I;

- debtors undergoing treatment in a hospital;

- minor debtors. This usually happens if loan debts are inherited by a child. But this rule does not apply to emancipated children.

In all these cases, you can refuse direct interaction with collectors as soon as you receive supporting documents. For example, a court decision declaring bankruptcy or deprivation of legal capacity, sick leave or an extract from a card, medical history, etc. Unfortunately, the bank and collectors will still be able to send letters, SMS, and email. But there will be no calls or personal meetings.

Option 2. You have appointed yourself a representative lawyer

By law, the debtor has the right to transfer all communications with the bank and debt collectors to his representative. Unfortunately, you cannot appoint a friend, wife, mother-in-law or an ordinary lawyer as your representative.

By law, only a lawyer can represent a debtor regarding a credit debt. In the application for interaction through a representative, you need to indicate the full name, contact phone number, postal address and email of your lawyer.

From the date of receipt of your application, the bank and debt collectors will be required to communicate with you only through a lawyer.

Be careful: When concluding an agreement with a lawyer and transferring all communications with the bank to him, demand that the lawyer spell out in the agreement specific actions that he will carry out in your interests.

For example, conduct negotiations to restructure a loan.

If the lawyer’s responsibilities are not clearly formulated, there is a chance that his participation in interaction with the bank will end with simply providing his contact information, and the lawyer simply will not answer calls.

Option 3. For all other debtors

Those who do not have supporting documents from option 1 and money for a lawyer will have to follow the general scheme, that is, endure calls from the bank and from collectors for 4 months from the date the loan became overdue.

You can try to write a statement of refusal to cooperate with the bank earlier, but according to the law it will still not be considered valid. There is one more problem. If your loan debt was collected by court and the decision has already entered into legal force, the bank and collectors have the right to communicate with you again within 2 months.

If you did not have time to refuse to interact with debt collectors before the court decision, you can submit such an application a month after the decision comes into force.

Instructions for debtors: how to prohibit calls from collectors?

- Wait until 4 months have passed since the start of the delay. Or obtain documents that allow you to refuse direct interaction with the bank and collectors earlier (bankruptcy, group 1 disability, etc.).

Or wait 1 month from the date of entry into force of the court decision on debt collection. Or appoint a representative - a lawyer. - Write a statement of refusal to interact or appoint a representative. The application form is uniform, generally binding, and was approved by order of the Federal Bailiff Service of Russia dated January 18, 2018 No. 20.

There is no need to write applications in any form or pay lawyers to draw them up; you can quickly fill them out yourself. statements of refusal to interact with debt collectors. - Send the application to the bank or collectors. The application can be submitted to the bank/collectors in 3 ways: in person (against signature on your copy of the application), by mail, through a notary.

I don’t want collectors to call my work or friends about my debts.

This can be solved very simply. The debtor can prohibit the bank and collectors from calling other people about their loan at any time, without any restrictions.

If you value the peaceful sleep of your relatives and friends and do not want to spoil your relationship with them, or do not want your debt to be known at work, be sure to submit an application to the bank at the first opportunity to revoke your consent to interact with third parties.

The application can be taken personally to the bank and handed over against a receipt, or sent by registered mail with notification, or submitted through a notary. By law, after receiving such a statement, the bank and debt collectors are required to stop calling strangers about your loan debt.

I am an acquaintance, relative, colleague of the debtor, do not call me

230-FZ states that collectors can call people about other people’s debts under 2 conditions:

- there is consent from the debtor himself to interact with third parties regarding his debt. Typically, this consent is taken when applying for a loan along with consent to the processing of personal data;

- third parties did not report that they were against communicating with collectors and the bank regarding the debt of their colleague, friend, or relative.

It turns out that in the absence of your official refusal, collectors can call you without any problems about other people’s credit debts. Have you received your first alarm call about a debt from a relative or colleague? Get started right away.

How to prohibit calls from debt collectors regarding other people's loans?

- Gather information. For the first time, talk in detail and carefully with the collectors and try to get as much information as possible from them: which collection agency is calling, which bank has the debt, contact numbers and addresses of the collectors, etc.

Write down what you learn. If there is very little data or the collector refused to provide it, try searching in Yandex or Google by phone number. There is a chance that you will immediately find reviews from dissatisfied citizens and find out which company is calling from this number. - Write a statement of disagreement with the interaction. There is no generally required form for such a statement.

The application can be drawn up according to our example: Application to refuse calls regarding someone else’s loan Be sure to write in it that you do not agree to interact with you regarding the overdue credit debt of such and such and ask them to stop calling. If the bank is located in your city, you can take the application in person and hand it over against signature on your copy.You can also send this application by registered mail with notification or a valuable letter with a list of attachments. There is also the possibility of submitting the application through a notary.

- Wait for a response from the bank or collectors. We recommend waiting about a month.

If during this time the calls do not stop and you are not sent an official response, you can move on and write complaints.

: Decision to cancel the liquidation of LLC sample 2020

Where can I complain if debt collectors keep calling?

If you have submitted all the necessary applications, but the bank and debt collectors have not stopped calling you, write a complaint. The authority to verify compliance by collectors with the requirements of 230-FZ has been transferred to the Federal Bailiff Service (FSSP). For violating collectors there is a special article 14.57 of the Administrative Code of the Russian Federation.

For taking actions to return overdue debts with violations, collectors face fines from 20 to 200 thousand rubles. If collectors are included in the special register of the FSSP, the fine will be higher - from 50 to 500 thousand rubles or suspension of activities for up to 90 days.

Be prepared to attach evidence - details of calls from a mobile operator, SMS printouts, your own letters to collectors about refusal to interact and their responses, etc.

The complaint can be taken to the bailiff department in person, sent by registered mail with notification, or through the FSSP online reception.

By the way, if you wish, you can also file a lawsuit against the bank and the offending collectors and demand compensation for moral damages and compensation for all losses.

There is a second option.

Source: //domsoveti.ru/dokumenty/otkaz-ot-vzaimodeystviya-s-kollektora.html

I don’t want collectors to call my work or friends about my debts.

This can be solved very simply. The debtor can prohibit the bank and collectors from calling other people about their loan at any time, without any restrictions. If you value the peaceful sleep of your relatives and friends and do not want to spoil your relationship with them, or do not want your debt to be known at work, be sure to submit an application to the bank at the first opportunity to revoke your consent to interact with third parties. The application can be taken personally to the bank and handed over against a receipt, or sent by registered mail with notification, or submitted through a notary. By law, after receiving such a statement, the bank and debt collectors are required to stop calling strangers about your loan debt.

Read more: How to renew a collective agreement sample

230-FZ states that collectors can call people about other people’s debts under 2 conditions:

- there is consent from the debtor himself to interact with third parties regarding his debt. Typically, this consent is taken when applying for a loan along with consent to the processing of personal data;

- third parties did not report that they were against communicating with collectors and the bank regarding the debt of their colleague, friend, or relative.

It turns out that in the absence of your official refusal, collectors can call you without any problems about other people’s credit debts. Have you received your first alarm call about a debt from a relative or colleague? Get started right away.

Refusal to interact: how to prevent debt collectors from calling about your loan?

In 2020, after the entry into force of Federal Law No. 230-FZ of July 3.

2016 “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts,” debtors, their colleagues and relatives have a new way to get rid of annoying calls from debt collectors. Now you can refuse to interact with collectors.

Especially for readers of the site Paritet.guru, we tell you how to write a statement of refusal to cooperate with a collection agency and officially prohibit collectors from calling about a credit debt.

How to submit an application to refuse to communicate with debt collectors

Thanks to the constant changes and improvements in the legislative and legal framework of the Russian Federation, at the beginning of 2020, consumers in the financial sector who have overdue payments of various lengths of time were given the opportunity to refuse calls from collectors or any other contacts with debt collectors.

Now debtors will be able to calmly develop tactics for further actions on their own, without pressure, without recruitment, having analyzed the current situation with peace of mind in order to independently get out of the debt hole.

Despite strict control and stricter requirements in the activities of collection institutions, at present many of them exceed their powers, violate the law, thereby oppressing the rights of debtors. Moreover, even despite the statute of limitations, such offenders continue to harass borrowers. Illegal debt collectors do not hesitate to use the most unpleasant prohibited methods of pressure:

- use banking collection mechanisms in order to extract the greatest possible benefit from everyone,

- they try to turn everyday life into a real hassle as much as possible by all means possible,

- they intimidate not only the consumers themselves, but also apply pressure using references to elderly relatives or children,

- treat the debtor personally inappropriately and become “you”

- and so on…

Naturally, the best weapon of any citizen is knowledge of his rights and responsibilities, so this article offers you an excellent tool in the fight against illegal debt collectors.

New legislative amendments that protect the rights of citizens will help to eradicate at the very beginning and stop such unpleasant situations with knockouts before they arise. How to take advantage of this opportunity:

- By registered mail or through a notary's office, you must fill out a “statement of refusal to communicate with debt collectors.”

- This document can be drawn up after 4 months from the date of delay .

- It is possible to obtain your own right to communicate with representatives of collection agencies exclusively through your own representative (if you require this option and still want to receive any information regarding your debt from the agent).

The accepted application, upon entry into force, obliges the collectors to stop any communication and contacts with the borrower, or, as we just announced, to communicate with you only through your representative.

Filling out an application that will help you refuse calls and visits from debt collectors:

- In the upper left corner, in the header of your application, indicate : Full name (if available) (for

- an individual) a creditor and (or) a person acting in his interests on his behalf

- and (or) name (for a legal entity)

It will be necessary to indicate the fact that you refuse to interact through radiotelephone communications, telecommunications, text messages, telegraphic messages or any other messages, telephone conversations of any kind, as well as personal meetings with debt collectors.

The same option is drawn up if you want to interact, but only through your own representative . The only addition to this option would be to indicate the contact details of the representative, namely:

- email addresses,

- mailing address,

- and it is also necessary to indicate telephone numbers with city codes if the telephones are landline.

When performing such actions, no collectors will ever bother you and waste your nerves and energy. A lawsuit will be the only solution to the financial dispute that has arisen. If, based on the results of the consideration of the case in court, a decision is made to collect the debt, then the bailiffs will execute the decision.

To prevent the occurrence of such situations, it is, of course, best to calculate your capabilities in advance, adhere to reasonable consumption, and when any difficult financial situations arise, try to save extra money so as not to receive money on interest.

Simply put, if, let’s say, you need a laptop not out of necessity, but out of spontaneous desire, and you don’t have the full amount to purchase it, it’s best to save up, save and get at least a little more than half of its cost, so that such a purchase does not become an expensive acquisition .

By taking out a loan that is 2 or 3 times less than the amount you need to spend on the purchase, you make such lending safer.

Source: //zaew.ru/zajavlenie-otkaza-obshhenija-s-kollektorami

Summarizing

The legislation allows each client of financial institutions to demand partial withdrawal of their personal data. This does not mean that the bank will not be able to contact you in any way. He can send letters by mail, but his employees will not be able to call you or your relatives, or make any visits to your home. In addition, this will prevent the debt from being transferred to a collector.

Refusal to interact with debt collectors - sample application

The law has been in force for three years, establishing a framework for the arbitrariness of collectors, who, with their persistence and use of illegal methods, brought former bank clients to nervous exhaustion, who for one reason or another became debtors and, against their will, were forced to communicate with semi-legal or outright criminal collectors who bought up the debt. from a bank or microfinance organization.

The debtor, in accordance with Art. 8 of Law No. 230-FZ, it became possible to refuse to interact with collectors (creditors) or entrust this to an intermediary by writing a statement.

When it's possible

The legislator did not dare to completely deprive collectors of the rights to carry out “work” to collect debts.

He simply limited this period, considering that 120 days is enough to encourage the debtor to take steps to pay off his existing debt, or to verify his insolvency and take the case to court, or more often, to write off the debt, the collection of which costs more than the amount of the debt itself.

The mentioned Art. 8 of the new law No. 230-FZ, provides an alternative:

Entrust the interaction to a professional lawyer, thereby relieving yourself of the burden of unpleasant contacts. This can be done immediately after the first reminder call about the need to repay the loan debt.

Along the way, the lawyer who is entrusted with interacting with the debt collectors will check the legality of their claims, compliance with the mechanism for transferring the debt (conclusion of an assignment agreement between the creditor and the debt reseller), the registration of the assignee in the register of collection agencies and his reputation.

Completely refuse interaction by sending a statement about this to the new creditor. This can only be done after 4 months.

If you send an application earlier, it will be considered invalid, and collectors, on completely legal grounds, will continue to make intrusive calls, send SMS and attempt personal communication with the debtor.

If on their part there are no violations in the number of allowed calls, the time of their receipt and they do not contain threats or insults, the debtor will have to endure and wait for the cherished 120 days to expire.

There are exceptions to this rule for some categories. There is no need to wait until the end of the four-month period to refuse communication:

- bankrupt;

- disabled people of group I;

- undergoing treatment in a hospital or sanatorium;

- incapacitated (fully or partially);

- minors (when passing on a debt by inheritance).

Instructions on how to opt out

The algorithm of actions is quite clearly set out in the law. It involves writing an application in the form approved by the FSSP Order. The text of the application is the same for delegating powers to interact with a lawyer, and for refusing to interact in the ways provided for in paragraphs 1 and 2. Available on the service of the legal systems “Garant” and “Consultant”.

Sample refusal

There are slight differences in filling out the application, as indicated by footnotes 1 and 2 at the end of the form. Option 1 is filled out by the debtor who wishes to refuse direct interaction after the expiration of the term, or due to belonging to one of the categories of citizens listed above.

: Refusal to interact with debt collectors

Sample waiver for those who wish to interact through a representative

For those wishing to refuse to communicate with debt collectors through a representative, Option 2 of the single standard debtor application form is provided. Must be indicated:

- representative's address;

- lawyer's identification number;

- data from the register of lawyers.

: Refusal to interact with debt collectors through a representative

How to properly submit a refusal application

In order not to create a conflict situation related to the collection agency’s failure to receive an application for refusal to cooperate, it should be sent only as provided for in Part 2 of Art. 8 of Law No. 230-FZ, in ways:

- in person, against a receipt with registration in the journal of incoming correspondence to an agency representative;

- through a notary;

- By Russian Post by registered mail with acknowledgment of delivery.

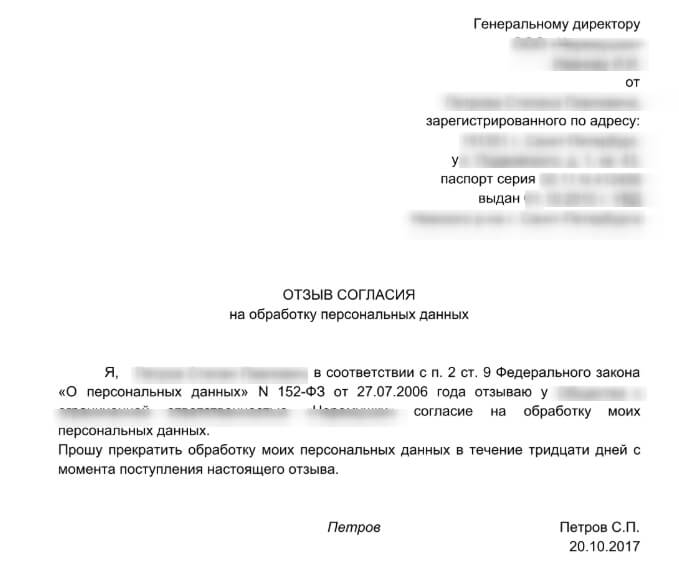

How to fill out an application for revocation of personal information

The application must be written on a standard A4 sheet. Make sure that the form contains the address of the bank to which you are sending the application. In addition, there must be:

- FULL NAME;

- registration information;

- the address to which you would like to receive a response (if it does not coincide with your registration address)

It is better to indicate the loan agreement number and passport details in the body of the application. This is necessary so that the lender can find information about you in its database. Next, you need to refer to the article of the Federal Law “On Personal Data”. You must enter what actions with your data you would like to stop. If you want to withdraw them, please indicate so in the application. In addition, mention may be made of Article 137 of the relevant law. She protects privacy. Finally, state your requirements.

Please attach a copy of your passport and loan certificate to your application. At the end, indicate your last name, signature, and date.

The application is standard, and you can draw it up yourself. But if a lending institution ignores your requests, to increase its chances of success, you can contact a qualified lawyer.