If commercial activity is unprofitable and does not allow the entrepreneur to pay off creditors, then it is not necessary to close or bankrupt the individual entrepreneur. In some situations, restructuring the debt of an individual entrepreneur turns out to be very effective, making it possible to resolve debt issues in a “gentle” manner. But not all entrepreneurs can get debt restructuring; sometimes they have to fight for a legal deferment or installment plan.

What is debt restructuring for individual entrepreneurs?

Restructuring the debts of a citizen-individual entrepreneur is a change in the schedule for fulfilling financial obligations. This is a kind of rehabilitation procedure and at the same time a manifestation of tolerance towards the debtor on the part of creditors. The lender meets the borrower halfway in cases where the latter faces a default and cannot fulfill the terms of the contract.

And if an individual entrepreneur cannot make payments for objective reasons, his creditor provides a deferment. This is a solution for those who are faced with financial problems due to falling demand and lower production volumes.

But there are other options. You can change the final repayment period or the amount of payments. An extended loan term and reduced monthly installments allow the debtor to make feasible payments.

It is also possible to partially sell the property to pay off the main debts. For example, sell or pledge equipment, restructure loans and borrowings to pay them off gradually. And thus preserve the trademark, licenses and customers.

Alexey Zhumaev

financial manager

Advantages of debt restructuring:

- extension of the term of a loan or other debts;

- reducing the financial burden by reducing the size of regular payments;

- changing the terms of debt payment in a direction favorable to the borrower.

In the case of individual entrepreneurs, the restructuring process follows a standard procedure. In addition to bank holidays and lower interest rates, an entrepreneur can:

- Attract additional investors.

- Set off debts by issuing counterclaims.

A convenient option is restructuring through bankruptcy. In bankruptcy, loan terms are reviewed under the control of the court and financial manager

:

- interest is accrued within the refinancing rate;

- first, the individual entrepreneur pays off the principal debt, then interest and penalties (most often, they are not included in the debt repayment plan and are written off);

- bailiffs, banks and the tax office cannot arbitrarily collect money from an individual entrepreneur’s account;

- a repayment schedule has been established that takes into account the income of individual entrepreneurs and all claims of creditors - employees, suppliers;

- The bankrupt himself is given a payment within the regional subsistence minimum for a working citizen, plus for each dependent (or alimony). The salary or other income of the husband/wife, if the spouse works separately, has nothing to do with the bankruptcy of the individual entrepreneur.

To completely write off debts through bankruptcy, it is necessary to declare insolvency in an arbitration court. An individual is declared bankrupt if obligations have not been fulfilled for three months and the amount of debt is greater than the property base.

The requirements for individual entrepreneurs are similar, and a citizen can get rid of loans arising as a result of conducting commercial activities, both while in the status of an individual entrepreneur and after termination of registration as an entrepreneur.

Ask a lawyer whether your financial situation is suitable for personal bankruptcy, and what are the prospects for loan write-off in your case.

Let's consider a step-by-step strategy for an entrepreneur who has decided to restructure debts:

- Notify investors of possible restructuring.

- Negotiate with creditors.

- Conclude a preliminary agreement on restructuring.

- Enter into a final agreement.

The debtor may also be offered a credit holiday or refinancing. Sometimes it is beneficial to take out a loan from another bank to cover unprofitable loans.

How to restructure the debts of individual entrepreneurs and legal entities - is it possible to get rid of them?

In such a case, the legislation of the Russian Federation provides for the restructuring of the debt of individual entrepreneurs and legal entities. Banks are willing to accommodate their clients halfway and offer various types of restructuring in order to restore the solvency of borrowers and not end up in the red themselves.

Loan restructuring can occur in several ways:

- Prolongation – implies an extension of the term of the debt agreement with a reduction in the amount of monthly payments. Increasing the loan term also increases the amount of overpayment, which is determined by the monthly interest rate.

- A credit holiday is a period of time during which the borrower repays only the principal debt, without interest.

- Refinancing by a bank of its own loan is a new lending in which the money issued under the program is used to repay a loan issued earlier. The new loan is for a longer term or at a lower interest rate, which provides the borrower with relief.

- Changing the currency is the best option when the exchange rate increases.

- Cancellation of fines and penalties - with this arrangement, all accrued penalties are written off, leaving only the principal debt and interest on it.

- Partial debt forgiveness is a rather rare option, but some lenders agree to this step in order to return at least part of the money issued on the loan.

A combination of two or more types of debt restructuring is possible, but in any case, only the borrower and the lender participate in the program. Refinancing with a third-party bank is not a restructuring.

Debt restructuring of an individual entrepreneur

The status of a citizen-individual entrepreneur obliges an individual to comply with the law. In particular, the set of legislative rules includes the timely repayment of debt obligations to credit institutions.

In 2020, a law came into force that takes into account the specifics of the bankruptcy procedure for individual entrepreneurs due to financial insolvency.

Previously, the implementation of the program on the insolvency of individual entrepreneurs was carried out according to the type of bankruptcy of individuals with minor changes.

In 2020, amendments were made to this law to regulate the bankruptcy program and the process of restructuring the debts of individual entrepreneurs.

An individual entrepreneur can apply for recognition of his bankruptcy if he proves that he cannot pay creditors according to the established payment schedule.

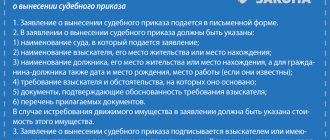

In addition to the debtor himself, bankruptcy creditors, which include the authorized body, have the right to apply for bankruptcy to the arbitration court.

The basis for filing an application may be a court decision that has entered into force to recover a certain amount from the individual entrepreneur. If there is no such solution, the motivation may be as follows:

- the need to pay mandatory amounts;

- protesting an unpaid bill;

- the individual entrepreneur’s disagreement with the payment presented to him.

When is it profitable to renegotiate the terms of a loan?

Unbearable credit load is becoming an increasingly common situation for companies or individual entrepreneurs. To solve the problem, the Russian government is urgently taking measures: in 2020, banks are required to more responsively consider requests for debt restructuring in connection with the coronavirus and business unprofitability due to the crisis.

At the same time, business entities that are unable to repay debts can benefit from the debt restructuring procedure. The introduction of restructuring makes it possible to review bank loans and debts to counterparties: clients and business partners of the entrepreneur.

Through a restructuring agreement, the debtor is able to overcome the financial crisis. In this situation, the loan restructuring agreement is a private law agreement concluded by the debtor with one or more creditors.

Registration of debt restructuring of individual entrepreneurs privately - without introducing a bankruptcy procedure for the entrepreneur, is relevant in the following cases:

- long delays in payments for rent, communication services;

- in case of credit debts;

- in case of debt with counterparties, which cannot be repaid;

- for tax debts.

The status of “Individual entrepreneur” is assigned to a citizen through official registration. The individual entrepreneur runs the business independently. And all earned finances are the property of an individual registered as an individual entrepreneur (after full payment of taxes). However, the individual entrepreneur is also responsible for financial risks. An individual who is also an entrepreneur bears full responsibility for his property.

The status of an individual entrepreneur is complicated by the fact that the activities are similar to the work of legal entities. However, a different approach to liability for debts is practiced - they will be “asked” from the individual in court.

Moscow, September 28, 2017, 16:30 — REGNUM The restructuring of regional debts was the first attempt in a long time by the federal authorities to encourage the constituent entities of the Russian Federation to solve their problems by developing economic conditions and increasing their own tax base. Candidate of Political Sciences, Associate Professor of the Department of State and Municipal Administration of the Russian Economic University named after A.I. G. V. Plekhanov Kirill Parfenov .

“Of course, the strength of the initiative is the attempt to stimulate the constituent entities of the federation to increase the tax base. This is clearly a “market” management decision for ten to fifteen years, aimed at developing the economy, and not at encouraging passive attitudes,” Parfenov said.

However, this solution, as always, has its pitfalls, the expert pointed out. The problem, in particular, lies in the very structure of the Russian fiscal system of the Russian Federation, in which there are taxes assigned to a certain level of government and collections from which are fully credited to the budget, and taxes, the proceeds from which are distributed between levels of government.

“As a rule, collections from taxes of a smaller volume, more “volume” taxes, mainly to the federal budget, are credited in full to the budgets of the subjects. These are, for example, a hydrocarbon production tax, a value added tax, a number of excise taxes and some others,” Parfenov said.

The most significant for the subjects of the federation themselves is the corporate income tax, the rate of which is 20%, of which only 3% goes to the federal budget, and 17% to the budget of the subject of the federation.

“However, in a crisis, profits decrease along with effective demand, and, accordingly, revenues from this tax decrease. Simply put, the increase in the tax base in this case is determined by the general state of affairs in the economy, and not by the aspirations of the authorities of the subject of the federation,” the political scientist explained.

In this regard, the positive effect of the announced debt restructuring initiative could be enhanced by the transfer to the level of constituent entities of the Russian Federation of part of the revenue from steadily collected taxes, Parfenov believes.

“For example, value added tax, which is now fully credited to the federal budget,” he pointed out.

Let us recall that the program for restructuring the regions' credit debt to the federal budget starts on January 1, 2020 and is designed for seven years, and for certain regions it can be extended for 12 years. At the same time, for the first two years, it will be necessary to return financial resources to the budget in the amount of only five percent.

Conditions for debt restructuring

An individual entrepreneur can count on judicial restructuring if he is unable to pay creditors. The procedure is established within the framework of a bankruptcy case of an entrepreneur at the request of both the debtor and his creditor.

But in 2020, due to the coronavirus, a temporary moratorium on bankruptcy of companies and individual entrepreneurs was introduced at the request of creditors or the tax service.

The entrepreneur himself is not deprived of the right to file for bankruptcy, and can also refuse the moratorium by publishing an announcement on Fedresurs:

We've covered the bankruptcy moratorium in detail here.

After considering the application, the arbitration court makes a decision to accept or leave this application without progress if additional documents are required. The refusal is issued if the individual entrepreneur does not meet the bankruptcy criteria. For example, there is an outstanding criminal record or less than five years have passed since the previous bankruptcy.

A businessman is insolvent if his application contains the following grounds:

- the total amount of the individual entrepreneur's debt to creditors exceeds 500 thousand rubles;

- the duration of arrears on obligations exceeded 90 days;

- the entrepreneur’s property (including personal property) is not enough to pay off debts;

- fulfillment of more than 10% of obligations is impossible.

If the court finds that the individual entrepreneur can pay the debts, he will not be declared insolvent. Refusal to recognize bankruptcy usually occurs when hidden assets are discovered. For example, property was found abroad or it was possible to collect receivables.

What conditions can be offered to an entrepreneur as part of debt restructuring?

The most common solution to the problem is to change the terms of the initial agreement. This option is suitable for entrepreneurs with large debts, when the parties are committed to long-term cooperation in the future. As part of the restructuring agreement, a variety of conditions are negotiated, namely:

- the entrepreneur is given a deferment on repayment of the principal debt;

- regular payments are being reviewed;

- other conditions are created for optimal resolution of a difficult situation.

In the latter case, we are talking about signing an additional agreement with certain conditions for the return of funds. The citizen is given time so that he can earn some profit to pay off the debt.

Requirements for the debtor during restructuring in bankruptcy

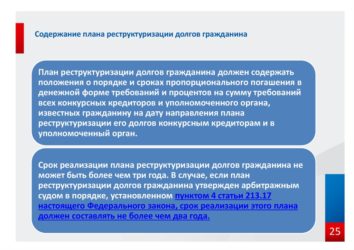

To file an application for restructuring with the court, the debtor must meet the following criteria:

- have a constant source of income that allows you to repay loan debts within a maximum of 3 years;

- have no criminal record for economic crimes;

- not previously been brought to administrative responsibility for offenses in the economic sphere;

- not to participate in the procedure of one’s own bankruptcy or debt restructuring over the past three years.

It is worth considering that during bankruptcy, an individual entrepreneur is subject to more thorough checks, unlike an individual. Accordingly, the financial manager will check all income and expense transactions of the debtor, and any inconsistencies may raise suspicion of false bankruptcy.

Laws on debt restructuring of individual entrepreneurs

A debtor entrepreneur has the right to use restructuring to solve the problem of temporary insolvency when it makes sense to preserve the business. This is a time-consuming process - you need to involve your creditors in negotiations.

By deferring or installment payment of obligations, private business will be able to keep production afloat, retain employees, wait for revenue and thus overcome the financial crisis.

In bankruptcy, when agreeing on the terms and preparing the plan, the claims of creditors are taken into account according to the register of claims, and the current costs of running a business are calculated separately - employee salaries, utility bills, taxes, equipment maintenance.

The debt restructuring agreement is accompanied by a report from the manager, which:

- confirms the reliability of the enterprise’s data, and also confirms or not the information contained in the accounting documentation;

- confirms the possibility of concluding a restructuring agreement, with an assessment of the real prospects of settlements with creditors within a three-year period.

An entrepreneur who is interested in concluding a restructuring agreement with creditors must submit an application along with the following documents:

- an updated report on the financial position of the enterprise and individual;

- analytical and evaluative status of activities;

- a list of names of creditors, indicating the amount of debts and the reasons for preferential repayment;

- a list of owners of assets owned by the debtor over the past 3 years;

- a plan containing an analytical description of the methods and timing for implementing the agreement.

Restructuring of debts of individual entrepreneurs must be carried out in accordance with the provisions of Chapter X of the Bankruptcy Law No. 127-FZ. In particular, when introducing bankruptcy restructuring, the parties are obliged to follow the provisions of Art. 213.11.

If the restructuring of an individual entrepreneur’s loan debt is carried out voluntarily between the debtor and the bank, then the agreement must meet the requirements of the Law on Consumer Loans No. 353-FZ.

Bankruptcy Trustee

If the bankruptcy application is recognized as justified by the court, a financial manager is appointed, who takes measures to identify the property and income of the individual entrepreneur. It also notifies creditors of the commencement of the restructuring and holds their meetings.

Responsibilities of the financial manager:

- determination of the entrepreneur’s property: checking the inventory of property submitted by the debtor and searching for hidden property;

- ensuring the safety of property intended for sale and repayment of part of the claims;

- analysis of the debtor’s financial condition;

- control over the debtor’s implementation of the agreed plan;

- maintaining a register of creditors' claims.

In the process of restructuring the entrepreneur’s debts, the financial manager has the authority to view data on accounts and deposits, money transfers and balances. The financial manager has the right to challenge completed transactions of the individual entrepreneur or prohibit future ones if they are not beneficial for creditors.

He holds meetings of the bankrupt’s creditors and reports to the Arbitration Court:

- at the beginning of the procedure, reports on the financial situation of the individual entrepreneur;

- reports on the progress of the procedure once every three months, and also holds meetings to coordinate transactions with the debtor’s expensive property,

- at the end - reports on the results, whether it was possible to pay off creditors and to what extent.

The financial manager is the central figure in the judicial procedure; the quality of his work determines whether the individual entrepreneur’s debts will be written off in bankruptcy. Our specialists will select an arbitration manager for your case, based on the specific situation and region of operation. Call now, it's free.

Tax benefits and payment schedule

A payer who has repaid half of the debt within 2 years receives the right not to pay half of the amount for fines and penalties.

If the debt is repaid within 4 years, then full exemption is given. A prerequisite is the absence of debts on current payments to the budget.

Typically, debt payments are required to be made once every 4 months; if opportunities exist, the company can make payments more often and more than the schedule. Installment plans, as well as the right to start paying debts after a year, are provided after approval of the corresponding schedule.

Cancellation of benefits

A delay in payments accrued according to schedule or the appearance of a tax debt (a month's delay) entails the cancellation of benefits. Therefore, it is not worth bringing it to this point; it is more profitable to pay bills on time.

Attention: watch a video on the topic of tax audits and disputes with tax authorities, ask your question in the comments to the video and get free legal advice on the YouTube channel, just don’t forget to subscribe:

Approval of a debt restructuring plan for individual entrepreneurs

The plan is drawn up by the debtor, a lawyer representing his interests, and a financial manager. Several plans can be transmitted at the same time. Creditors have the right to receive copies for analysis and consideration of the plan; approval occurs at a meeting of creditors.

Based on the outcome of the meeting, the decision on restructuring can be approved or rejected by the participants; a decision can also be made to cancel the restructuring - then a decision is made to declare the individual entrepreneur bankrupt.

The plan being developed contains the conditions for repayment of all claims.

If, during the implementation of the terms of the plan, it turns out that the level of solvency of a citizen with individual entrepreneur status does not allow him to comply with all its conditions, the debt restructuring procedure will be cancelled. Next, the court will declare the person bankrupt, and a procedure for the sale of property will be introduced against him.

Restructuring loans during the coronavirus pandemic

On March 29, the President of Russia instructed the Government to develop and implement a set of measures to support citizens who find themselves in a difficult financial situation due to quarantine and the crisis. We are talking about borrowers who need installments due to a sharp reduction in income.

Credit holidays are the name of this measure of state support for citizens.

If income fell by more than 30% in 2020 due to the coronavirus epidemic, it should be possible not to make loan payments for some time without accruing penalties and fines. Borrowers - individuals and individual entrepreneurs - can apply to a bank or microfinance organization for a deferment on payments for up to 6 months.

To take advantage of credit holidays, just dial the bank’s number and inform the specialist about your decision. The credit institution has the right to demand from the borrower documents indicating that he is now in a difficult financial situation. A citizen can provide such documents not immediately, but within 3 months from the date of contacting the bank.

The following may exercise the right to apply for a deferred payment:

- borrowers who took out a car loan in an amount not exceeding 600,000 rubles;

- citizens with a mortgage in the regions of the Russian Federation of no more than 2,000,000 rubles, in St. Petersburg and the Far East - no more than 3,000,000, in Moscow no more than 4,500,000;

- individuals who have taken out a consumer loan for no more than 250,000 rubles, individual entrepreneurs for no more than 300,000;

- borrowers with credit cards with a limit of no more than 100,000 rubles.

A citizen whose income in the month preceding the month of filing the application has decreased by more than 30% compared to the average earnings for 2020 can apply for a loan holiday, and this decrease is due to the difficult economic situation in the country at the moment.

You can submit an application for such a deferment on debts to the bank for up to 6 months. The bank will not charge penalties (fines and penalties) during this period.

After the expiration of the deferment, the agreement with the bank will be valid on the same terms. But the loan term can be extended during the loan holiday.

Let's look at the pros and cons of deferring payments.

Pros:

- It is possible to overcome a difficult financial situation associated with a decrease in income.

- For individual entrepreneurs, this is an opportunity to survive an unfavorable time when profits have fallen sharply due to the pandemic situation.

Minuses:

- The loan term increases, which means the debtor will have to pay more money in interest. This situation is beneficial only to the bank.

- Penalties and fines may be added to the accrued loan payments if you do not submit the documents required by the bank within 90 days.

Before submitting an application to the bank for a credit holiday under a loan agreement, lawyers advise you to carefully re-read the terms of the agreement. Deferment of payments will lead to an increase in the amount of interest.

It is worth submitting an application to the bank only when the situation with debt servicing is really serious, and it is possible to confirm it with documents. The deadline to apply for a deferment is September 30, 2020.

In addition, SME loan restructuring

— Individual entrepreneurs and companies operating in the area most affected by the coronavirus can participate in the program. An entrepreneur can find out whether he is on the list of victims on the Federal Tax Service website.

Restructuring in connection with the coronavirus for business provides for the introduction of a deferment on loans for up to six months, as well as a reduction in the amount of debt through the provision of subsidies. But subsidies are issued if the SME participates in a special program of the Ministry of Economic Development of the Russian Federation.

The period for providing credit holidays for individual entrepreneurs and organizations under this program is from 04/01/2020 to 10/01/2020. Moreover, the procedure for processing restructuring is similar to processing credit holidays for individuals.

In addition, if the creditor of the SME is Sberbank, VTB, Promsvyazbank and a number of other financial organizations that have joined the program of the Ministry of Economic Development of the Russian Federation, then the SME has the opportunity to reduce the amount of payments even after the end of the grace period due to subsidies.

The Federal Tax Service spoke about the restructuring of tax debts

Tax officials emphasized that tax debt does not always arise due to management errors. The tax service is ready to accommodate such companies halfway.

The Moscow Office of the Federal Tax Service explained how tax debt can be restructured. Experts said under what conditions a restructuring can be carried out and for how long the tax authorities can grant a deferment. The Federal Tax Service noted that due to circumstances, organizations have to resort to the procedure for settling tax debts. Moreover, the current situation is not always the result of management or production errors. In particular, a cash tranche that is not received on time can slow down not only the fulfillment of contractual obligations, but also tax obligations. In such cases, the state meets the taxpayer halfway, allowing them to use a different procedure for settling the budget.

Tax officials recalled that for organizations of the military-industrial complex executing state defense orders, the Government of the Russian Federation has specially developed the procedure and conditions for restructuring. The department explained under what conditions a deferment can be obtained:

- full payment by the organization of current tax payments to the federal budget within 1 month before the 1st day of the month the organization filed an application for restructuring, as well as full payment by the organization of current tax payments to the federal budget accrued from the 1st day of the month of the organization filing an application for restructuring until 1st day of the month the decision on restructuring is made;

- filing an application for restructuring, to which the following documents are attached: a) an extract from the consolidated register of organizations of the military-industrial complex on the presence of an organization in its composition;

b) a certificate from the federal executive body ensuring the implementation of a unified state policy in the sector of the economy in which the relevant strategic organization operates, confirming the organization’s participation in the implementation of the state defense order and the inclusion of the organization in the list of strategic organizations;c) a document confirming the existence and amount of deferments (installment plans) previously granted to the organization for the payment of taxes and fees to the federal budget, tax credit and investment tax credit, the validity of which has not expired on the day of filing the application for restructuring;

d) a draft settlement agreement with bankruptcy creditors and the federal executive body authorized by the Government of the Russian Federation to represent in the bankruptcy case and in bankruptcy proceedings claims for the payment of mandatory payments and claims of the Russian Federation for monetary obligations (hereinafter referred to as the authorized body), providing, among other things, repayment of debt in the manner established by this Resolution (in the event that an arbitration court initiates bankruptcy proceedings).

The Federal Tax Service reported that debt restructuring is carried out for a period of no more than 12 years. The organization repays the restructured debt on taxes and fees to the federal budget within eight years, and over the next four years - the amount of debt on penalties and fines. Interest on the amount is paid annually.

Let us recall that the operating procedure of the Federal Tax Service and its territorial divisions is regulated by Decree of the Government of the Russian Federation dated September 30, 2004 N 506. The document establishes that the Federal Tax Service is obliged to inform taxpayers free of charge about current taxes and fees, the procedure for their calculation and payment, about legislation, the rights and responsibilities of taxpayers , powers of tax authorities and their officials. The service also provides tax reporting forms and explains how to fill them out.

Detailed information on issues related to paying taxes can be found on our website in the “Tax Directory” section. It provides information about the tax base, rates, benefits and tax deductions, etc. You can find the upcoming dates for paying taxes, submitting accounting and tax reporting, as well as information to extra-budgetary funds in the “Accountant’s Calendar” section.

Consequences of individual entrepreneur debt restructuring

After the introduction of restructuring, the claims of creditors are fixed, the calculation of interest is stopped - that is, all debts are frozen. Enforcement proceedings are also suspended. Previously issued court orders for debt collection are suspended after the introduction of bankruptcy restructuring.

During the entire restructuring period, income and expenses are controlled. To conclude transactions for the purchase or sale of property, you must have a preliminary agreement from the financial manager.

If the individual entrepreneur fulfills the restructuring plan and repays the debts according to the schedule, all balances, penalties and fines are written off forever. The status of individual entrepreneur is retained, and business is carried out with old licenses and permits.

If the restructuring plan could not be implemented, the sale of property is introduced. Then, after a decision is made to declare an individual entrepreneur bankrupt, the court will send a notification to the Federal Tax Service about forced termination of status, and for five years it will be prohibited to register as an individual entrepreneur again.

During this period, you cannot engage in business in the form of an individual entrepreneur, hold leadership positions or be a founder of an LLC, or otherwise manage companies. Licenses, patents and permits issued to its OGRNIP also lose their validity.

But this situation arises because even entrepreneurs operating at a loss do not realize the seriousness of the risk of bankruptcy. But if your business is not among the affected industries, banks and the tax office have the right to file for bankruptcy with a debt of 500 thousand rubles. After the moratorium is lifted in October 2020, the number of bankruptcies initiated by banks will increase.

It is important to understand that the bank financial manager is not interested in saving your business. His goal is to sell as much of your property as possible to satisfy the claims of the bank that appointed him. If there is no income, and banks refuse to refinance or restructure loans, get advice on what to do in your personal situation.

Our services

Submitting an application and documents to the Arbitration Court - 10,000 ₽

Participation in the first court hearing - 5,000 ₽

Sale of property or bankruptcy on a turnkey basis - from 7,990 ₽/month.

We tried to reveal the issue of bankruptcy and show the complexity of debt restructuring, which does not always entail liquidation and sale of assets.

You can find out how an entrepreneur can write off debts or reduce their credit load with minimal losses by contacting the lawyers of our company.

We will tell you everything about bankruptcy of individual entrepreneurs, provide comprehensive legal support on issues of declaring insolvency or maintaining a turnkey debt restructuring plan.