How to cancel a writ of execution through court

The abolition of a writ of execution by the Arbitration Procedure Code of the Russian Federation is not provided for; the court’s obligation to request a writ of execution from a participant in the process is also not established by law.

According to the meaning of the law, in the event of the cancellation of the judicial act in pursuance of which it was issued, the executive document loses its force, and this prevents its enforcement by the territorial bodies of the FSSP. Here, a non-state method of execution of the canceled decision has been chosen. I believe that the only way out is to appeal to the court that examined the case in the first instance, with a statement prohibiting the filing of an invalid writ of execution for execution in any way. Proof of the collector’s intention to use the invalid writ of execution will be required. And not only that. The claimant will be able to re-submit the writ of execution for proceedings at any time if the deadline for its submission has not expired. Blog and Practice Important Contents

- Refusal

- Revocation of the writ of execution

- Temporary termination of enforcement proceedings

- Application for revocation of a writ of execution

The powers of the FSPP include the collection of arrears of alimony, unpaid loans, and debts for utility bills. Therefore, the work of bailiffs has recently increased. It is this procedure that causes many difficulties for most creditors.

Paying off alimony debt

If the debtor has property that can be sold, as well as a car license, funds in accounts in banks and other credit institutions, he has something to lose. repay the resulting debt in full as quickly as possible in order to avoid seizure of bank accounts, driver's license reinstatement procedures, and other measures to induce debt repayment. Moreover, it is unlikely that it will be possible to lift restrictions of various kinds in one day.

If the claimant has not applied to the bailiff service, the payer must also understand that the failure to initiate enforcement proceedings does not relieve him of the obligation to pay the due funds from the date the claimant submits an application for their assignment. Although the recipient of the funds himself will not be able to apply any sanctions to the debtor for non-payment of alimony, he has the right at any time (not limited by deadlines) to contact the bailiffs with an application to initiate proceedings and a petition to collect the debt.

We recommend reading: Court decision on division of a mortgaged apartment

How to cancel a writ of execution

In this case, the bailiff must issue a ruling that the enforcement proceedings are completed. The claimant cannot be forced to revoke the writ of execution. Once the statute of limitations for the specified document has expired, it is no longer possible to present it for re-execution.

Important: Two parties can enter into a settlement agreement, indicating in it the encumbrances for the debtor. Not everyone knows that this agreement must be approved by the court. In this case, the withdrawal of the writ of execution will mean that the claims of the claimant will not be satisfied by compulsory measures. A sample notification of the debtor about the assignment of the right of claim can be found on our website. Sample form for notifying the debtor of the assignment of the right of claim Application for revocation of the writ of execution In order for the claimant to be able to revoke the writ of execution, it is necessary to write a corresponding application.

Suspension of enforcement proceedings occurs in the following situations:

- participation of the debtor in hostilities;

- untimely death of the debtor;

- the debtor is in a medical institution.

That is, the reasons for suspending enforcement proceedings are situations that do not allow the debtor to fulfill his obligations. The decision to temporarily terminate enforcement proceedings is made by the bailiff. When the basis for starting enforcement proceedings was not a court decision, but an act of state power, the withdrawal of the writ of execution for the temporary termination of proceedings is carried out by a state authority.

Read more about how to obtain a debt under a writ of execution here. The writ of execution is sometimes returned without any intentions of the claimant. But in order to refuse to collect sums of money from the defendant, freeze accounts and recover valuable property, the following grounds must be present:

- The debtor fulfilled his obligations to the debtor or paid the full amount of the debt.

- The debtor does not have the ability to fulfill his obligations to the creditor or does not have the funds to repay the debt in whole or in part.

- The claimant and the debtor signed an agreement for the voluntary return of funds or the fulfillment of obligations by the debtor.

- Untimely death of the debtor.

Other reasons for refusing enforcement proceedings are personal in nature, but must necessarily have documentary evidence. The procedure for refusing enforcement proceedings is regulated by Art. 43 Federal Law “On Enforcement Proceedings”.

Attention: It is important that the text of the application does not contain information about coercion to withdraw the specified document. The application must be drawn up in the name of the bailiff who opened the proceedings in the plaintiff’s case. You can submit an application at any stage of enforcement proceedings. When it is reviewed by bailiffs, a positive decision is always made. In the event that the claimant does not have any grounds for revoking the enforcement document, he has the opportunity to write a statement that the enforcement proceedings be suspended. A sample of revoking a writ of execution from bailiffs can be found on our website. How to cancel a writ of execution through the court Suspension of enforcement proceedings occurs in the following situations:

- participation of the debtor in hostilities;

- untimely death of the debtor;

- the debtor is in a medical institution.

That is, the reasons for suspending enforcement proceedings are situations that do not allow the debtor to fulfill his obligations. The decision to temporarily terminate enforcement proceedings is made by the bailiff. When the basis for starting enforcement proceedings was not a court decision, but an act of state power, the withdrawal of the writ of execution for the temporary termination of proceedings is carried out by a state authority.

Read more about how to obtain a debt under a writ of execution here.

Why did the bailiff stop collecting from the card if the debt is not repaid?

To find out the reason for the withdrawal of money by bailiffs, you should contact the bank to obtain an extract. This can be done by visiting a Sberbank branch in person, or by calling the hotline number listed on the financial institution’s website.

The salary is stored in the personal account until the card owner withdraws money through an ATM using the PIN code. But sometimes situations arise when the money on the card is withdrawn, and the owner does not even know where his hard-earned funds went? And if it turns out that the money was withdrawn by bailiffs, is it time to start an independent investigation and find out why the amount of money disappeared from the savings book? Let's look into this issue.

How to close a writ of execution through court

It is important that the text of the application does not contain information about coercion to withdraw the specified document. The application must be drawn up in the name of the bailiff who opened the proceedings in the plaintiff’s case. You can submit an application at any stage of enforcement proceedings. When it is reviewed by bailiffs, a positive decision is always made. In the event that the claimant does not have any grounds for revoking the enforcement document, he has the opportunity to write a statement that the enforcement proceedings be suspended. A sample of revoking a writ of execution from bailiffs can be found on our website. Moskomprivatbank turned to the magistrate of another court district (at my place of registration) and received a court decision in its favor in an open court hearing (collection of credit card debt). I was not informed in any way about the meeting or the decision. Now the bailiffs have initiated enforcement proceedings. Question: in what order and how to proceed to cancel the court decision and suspend the proceedings? Thank you in advance! Collapse Victoria Dymova Support employee Pravoved.ru Similar questions have already been considered, try looking here:

- What articles do you need to rely on for the judge to cancel the writs of execution?

- Where should I go to cancel the writ of execution?

Lawyers' answers (2)

- All legal services in Moscow Challenging the right to an apartment in Moscow from 20,000 rubles. Examination of contracts Moscow from 15,000 rubles.

A year ago, the Constitutional Court of the Russian Federation declared the existing procedure for calculating time limits when a writ of execution is revoked by a claimant to be contrary to the Constitution (Resolution No. 7-P of March 10, 2016). In May 2020, amendments to the Federal Law “On Enforcement Proceedings” were adopted, which finally confirmed the court’s position. We have previously talked about the current practice of recalling sheets. In terms of timing, it was as follows. As a general rule, the claimant has three years from the date of entry into force of the court decision to submit a writ of execution for execution. Most often, the sheet is handed over to the bailiff. If you come to the bailiff for the first time after the trial, for example, after three years and one month, enforcement proceedings will not be initiated, and the court decision will forever remain unexecuted.

After the bailiffs write off the money from the card, the debt is considered repaid

- you can call the institution’s hotline, the contact number must be indicated on the card;

- go directly to the bank branch and clarify the information with the employee, asking them to make a statement of the recent movement of money in your account;

- check the statement online on the official Sberbank page. To do this, you need to go to your “Personal Account” on the page; if the write-off was carried out by the bailiff service, this information will be displayed.

- The bailiff service receives a decision, a writ of execution, a copy of which is sent to the debtor. From the moment the citizen receives the letter, enforcement proceedings gain legal force;

- the next step is collecting data on the citizen’s property: real estate, deposits in banking institutions, vehicles, finances, and other valuables;

- Based on the writ of execution, the bailiff has the right to request information not only about salary accounts, but also about open credit and deposit lines.

26 Jan 2020 etolaw 5302

Share this post

- Related Posts

- What is due to the widow and child of a military serviceman in Chernobyl?

- Bailiffs postal transfer

- Can bailiffs seize a computer with personal information?

When is a writ of execution returned to bailiffs?

A writ of execution is a document drawn up by the bailiff service (FSSP) and containing information on the procedure for collecting debts based on a court decision. FSSP employees send a writ of execution to the defendant’s employer, after which the employer acquires obligations to collect the debt from the employee’s salary in the manner prescribed by the federal law on enforcement proceedings (FZ-229).

The writ of execution must be returned to the bailiffs in the following cases:

- The debt under the writ of execution has been repaid in full. The employer returns the writ of execution to the FSSP in the case when the funds to be recovered from the employee’s salary have been paid in full (for example, the amount of compensation for material damage has been fully repaid). Also, the writ of execution must be returned upon expiration of the collection period (for example, when a child reaches 18 years of age when alimony is withheld). In each case, when returning the writ of execution, the employer makes a corresponding inscription (covering letter) on the back page of the document, indicating that the writ of execution has been repaid.

- The employee changed his job. Based on Art. 111 of the RF IC, when dismissing an employee who pays alimony, the employer is obliged to notify the FSSP within 3 days from the date of dismissal by issuing a corresponding notice (a sample can be downloaded here). Along with the notification, the employer submits to the bailiffs a writ of execution, on the basis of which the debtor’s new employer will make deductions.

- The debtor's location is unknown. There may be cases when the employment contract with an employee is not terminated, but the employer cannot make deductions on the basis of a writ of execution, since the location of the employee is unknown. In such a situation, the employer must return the writ of execution to the FSSP, supplementing the document with an appropriate covering letter.

- There are no means to collect the debt. If an employee is on vacation at his own expense for a long time, or there are other reasons why the employer cannot withhold the debt, the writ of execution must be returned to the bailiffs.

Submission deadlines

The deadline for submitting enforcement documents to the bailiffs depends on the subject of the dispute on the basis of which it arose and the corresponding decision of the judicial authority (in Article 21 of Federal Law No. 229):

- Court orders and writs of execution must be satisfied within 3 years from the date of issue.

- When collecting periodic payments - during the entire period of validity of these payments and 3 years after their expiration.

- Decisions on labor disputes – within 3 months.

- Administrative offenses – for 2 years.

- Documents based on decisions of arbitration courts (when reinstating missed deadlines for presenting IL) - within 3 months.

In a situation where the writ of execution is returned to the claimant due to the impossibility of implementation, the period for a new presentation to fulfill the requirements is calculated from the day the sheet is returned to the claimant, in accordance with Art. 22 clause 3 of Federal Law No. 229. It is equal to the initial deadline, which is established for each decision in accordance with the previously mentioned Article 21 of Federal Law No. 229.

How to restore deadlines?

Article 23 of Federal Law No. 229, which regulates the deadlines for the execution of decisions on judicial acts, indicates the possibility of restoring missed deadlines. There must be a valid reason for this, which the plaintiff can document.

A similar right is also enshrined in Art. 432 Code of Civil Procedure of the Russian Federation. Restoring the deadlines begins with filing an application with the court that originally made the decision.

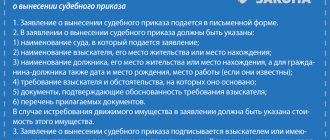

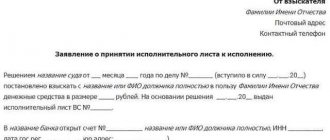

How to file an application to revoke a writ of execution

Enforcement proceedings may be suspended at the initiative of the claimant. In this case, the claimant must withdraw the writ of execution by filing a corresponding application.

The current legislation does not approve the form in accordance with which the application must be drawn up, so the document can be drawn up in free form indicating the following mandatory details:

- full name of the FSSP, address;

- information about the applicant who is the claimant under the writ of execution (full name, residential address, passport details);

- name of the document (Application for withdrawal of the writ of execution);

- Date of preparation.

The text of the document should indicate:

- grounds for returning the writ of execution at the initiative of the claimant (Article 46 of the Federal Law No. 229 dated October 2, 2007);

- number and date of the writ of execution;

- amount of claim.

The application form for revocation of a writ of execution can be downloaded here ⇒ Application for revocation of a writ of execution.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

First of all, the claimant needs to fill out an application for revocation of the writ of execution in 2 copies, and then contact the FSSP body that issued the writ of execution.

The applicant may contact the FSSP to revoke the writ of execution at any time, regardless of the collection period and the amount of the debt.

To revoke the writ of execution, the claimant must pay an enforcement fee in the amount provided for in clause 3 of Art. 112 FZ-229 (7% of the collection amount, but not less than 1,000 rubles).

An application to revoke the writ of execution, submitted by the claimant along with a receipt for payment of the enforcement fee, is the basis for the FSSP to suspend enforcement proceedings. Within 5 working days from the date of the claimant's application, the bailiffs issue a resolution to terminate the proceedings, after which they transfer the document to the employer, who collects the debt.

From the moment the FSSP resolution comes into force, enforcement proceedings are considered terminated, and the defendant is released from paying the funds provided for by the enforcement document.

After receiving the decision, the employer returns the writ of execution to the FSSP, and the bailiff, in turn, transfers the document to the claimant.

Writing off debts from a bailiff and the procedure for carrying out the procedure

The permissible presentation period shall not exceed three years upon satisfaction of lump sum payment claims and a similar time after the expiration of the periodic payments awarded. The execution procedure according to Art. 36 Federal Law No. 229 dated October 2, 2007 cannot exceed a two-month period.

We recommend reading: Low-income status for how long

Based on a judicial act, the creditor receives the right to compulsorily collect the loan debt from individuals and organizations by contacting the bailiffs. The service provides the debtor with a period for voluntary fulfillment of the plaintiff’s demands, then a forced collection procedure is launched with recourse to wages, as well as to property.

Peculiarities of revoking a writ of execution for alimony

As practice shows, the bulk of reviews are related to writs of execution for alimony, which are canceled due to the conclusion of a voluntary agreement.

Below are step-by-step instructions that will help the reader understand the features of revoking a writ of execution for alimony.

Step 1. Conclusion of a voluntary agreement.

Before revoking the writ of execution, the claimant and the defendant must enter into a voluntary agreement on the payment of alimony, which will approve the amount of collection (a fixed amount or a percentage of income) and the procedure for its payment. The text of the document should indicate that the agreement comes into force from the moment the writ of execution is cancelled.

After signing, the agreement must be submitted to a notary for certification.

Step-2. Payment of the performance fee.

To revoke a writ of execution, the claimant must pay an enforcement fee in the amount of 7% of the debt amount, but not less than 1,000 rubles. When paying the fee, you should keep the receipt for later presentation to the FSSP.

Step-3. Revocation of the writ of execution.

After paying the enforcement fee, the claimant must appear at the FSSP with the following documents:

- identification;

- application for revocation of the writ of execution;

- receipt for payment of the execution fee;

- a voluntary agreement on the payment of alimony, certified by a notary.

Within 5 days from the date of application, bailiffs issue a resolution to terminate enforcement proceedings on the basis of a writ of execution and begin collection in accordance with the requirements of a voluntary agreement.

Step-4. Collection of alimony by voluntary agreement.

FSSP employees send the following documents to the employer who collects alimony:

- a resolution to terminate the collection of alimony under a writ of execution;

- voluntary agreement to pay alimony.

Based on the resolution, the employer returns the writ of execution to the FSSP, after which the bailiffs hand over the document to the claimant.

Why did the bailiff stop collecting from the card if the debt is not repaid?

For example, sometime 6-12 months ago, enforcement proceedings were initiated against you, for example, let’s take an unpaid fine in the amount of, say, 5,000 rubles. According to the usual scheme, after receiving a writ of execution against you, the bailiffs issued a decision to initiate enforcement proceedings and then either wrote off this amount of money from your account, or you yourself voluntarily paid it. The bailiffs issued a resolution to terminate the enforcement proceedings and this means that they don’t need anything else from you, you have fulfilled all your obligations. In theory, after this decision to terminate enforcement proceedings, you should be removed from the debtor database, but there are also delays, and it happens that you are not removed from there at all not after 10 days. Not in half a year and you are hanging there and hanging. But you say, how can this be?

I paid the debt and honestly fulfilled my obligations, why didn’t they remove me, and what if they won’t let me go abroad because of this? Let's act like this! We make a copy of the decision to terminate enforcement proceedings against you. We are writing a request to remove information about you as a debtor under terminated enforcement proceedings (indicate the number) from the electronic database of enforcement proceedings.

How to resume collection after revocation of the writ of execution

The revocation of the writ of execution is the basis for the temporary suspension of the defendant’s enforcement actions, but does not completely terminate the enforcement proceedings.

A claimant who has withdrawn a writ of execution on the basis of an application has the right to resume enforcement actions within 3 years from the date of approval of the relevant resolution of the FSSP.

If, within 3 years from the date of revocation of the writ of execution, the claimant expresses a desire to resume enforcement proceedings, then he will need:

- fill out an application, the form of which can be downloaded here ⇒ Application for the resumption of enforcement proceedings on alimony;

- pay the enforcement fee;

- contact the FSSP to resume enforcement proceedings on alimony.

If there are compelling arguments that are the basis for resuming enforcement proceedings, the bailiff, within 1 day, issues decisions according to which the defendant is again recognized as a debtor and acquires obligations to pay alimony in the prescribed manner.

Enforcement proceedings were closed by the bailiff, what will happen next?

The termination of enforcement proceedings in itself for the reason you mentioned (lack of property on which collection could be imposed) is not a basis for recognizing the debt as uncollectible. Therefore, there is no reason to write him off either. And the category “forgive a debt” is not provided for in the law at all.

The bank itself does not have the right to make any write-offs on its own initiative - no one has given such powers to any bank, even a state-owned one. By law, the bank can only comply with a court decision by order of a bailiff. There is no such thing now - therefore, the bank itself cannot write off your earnings to pay off the debt.

We recommend reading: Law on Repair Work in Apartment Buildings 2020

Options for waivers

The legislation of the Russian Federation provides for three options when a creditor can suspend the collection procedure or terminate the proceedings:

- Completely abandon production.

- Recall IL.

- Temporarily suspend collection.

Refusal

Article No. 43 FZ-229. The injured party has the right to refuse to collect the debt now and in the future. However, for this you need to have good reasons:

- the debtor has fully fulfilled his obligations to the creditor;

- the defendant is unable to fulfill obligations or cannot repay the debt in whole or in part - that is, the debtor does not have funds or liquid property;

- the parties entered into a settlement agreement;

- death of the defendant.

The reasons for refusing the procedure for executing a court decision are exclusively personal in nature, but must be justified documented.

Important! According to Art. 43 FZ-229, the consequences of revoking the writ of execution are that the creditor will not be able to resume the proceedings again.

Review

The difference between refusal of revocation is that the collection process can be resumed, since this action only suspends the work of the bailiffs.

In Art. 21 Federal Law-229 specifies the time period when the plaintiff can apply to the FSSP again with a request to resume execution of the proceedings (3 years). In this case, only the validity of the paper is suspended, while the period continues to accrue.

In accordance with Art. 46 FZ-229, the claimant can revoke a document on the basis of a written statement, which becomes an indisputable reason to suspend the proceedings. From this moment on, the deed is at the disposal of the creditor.

Important! A sample application to the FSSP can be downloaded.

Temporary suspension

The document is returned to the plaintiff from the FSSP. The procedure is regulated in Art. 40 FZ-229 and is feasible in the following cases:

- the debtor takes part in hostilities;

- untimely death;

- the debtor's stay in the hospital.

You can hand over the sheet to the creditor in cases where the defendant is unable to repay the debt.

Important! Both parties can conclude a settlement with prescribed obligations for the debtor, as well as approved in court. In this situation, revocation means that the creditor's demands will not be enforced.

Revocation of a writ of execution by a court

According to Art. 47 FZ-229, revocation of the writ of execution by the court becomes possible in circumstances where the original decision was decided on illegality.

The case is returned for further investigation if disputes arise or the decision of the first court is annulled.

When the revocation occurred during the ongoing proceedings and part of the funds or property was recovered in favor of the plaintiff, the material assets are returned to the owner.

Revocation of the writ of execution on alimony

Here it is necessary to make a reservation that the withdrawal of the IL for alimony is not a refusal of monthly payments to minor children. The decision made by the judicial authority remains inviolable.

In this case, this is the replacement of forced penalties with voluntary payments. The payer voluntarily continues to contribute funds, within the same terms and from the same income, as established by the court.

The presence of alimony debt is not canceled with the revocation of the decision, but the increase stops. In case of lack of integrity of the debtor (evasion of voluntary payments), the total amount will not increase.

Important! To exclude the appearance of debt during the period of suspension of proceedings, it is necessary to support the fact of voluntary payments with documents - bank statements, receipts confirming the transfer of finances with a note of the purpose of payments, receipts from the ex-wife.

Alimony payers make a deal with their ex-wife, explaining that voluntary payment will significantly increase the amount of monthly contributions, since the gray salary is several times higher than the official salary.

Perhaps so, but where is the guarantee that the debtor will voluntarily pay a larger amount if he does not want to forcibly part with a less impressive contribution?

It’s another matter when the debtor, due to the presence of a writ of execution, cannot receive, for example, parole (parole).

Having ceased production, the claimant can resume it, for example, after 2 years. In this case, the debtor pays alimony that has accumulated for 3 years from the date of filing the application for revocation.

It is possible to revoke a document obliging you to pay alimony:

- Submit an application to the bailiff.

- After waiting for the decision to end the case (according to the law, 5 days).

- Receive a writ of execution with a copy of the decision to terminate payments.

Important! Termination of alimony payments comes into force from the moment the application is submitted, and not when the bailiff issues a ruling or the injured party receives the papers.

Return of a writ of execution from a financial institution (bank)

It is advisable to revoke a writ of execution from a bank in two cases:

- When the debtor has several accounts in different financial structures.

- When it is discovered that there is not enough money in one of the accounts to pay off the debt, that is, take the decision from one bank and send it to another.

The lender needs to draw up an application, a sample of which can be found, and send it to the bank.

The management of the organization is obliged to return the paper within the next 24 hours following the date of receipt of the application - and not a day later.

The return goes like this:

| On the back of the document, the reasons for the return and, in the case of partial repayment of the debt, the amount collected are indicated. | These notes must be certified by the signatures of the chief accountant, banker, as well as the official seal. |

| In the book of accounting and storage of writs of execution, a note is made about the reasons for the return and the exact date is set. | The transfer of the sheet is carried out through a receipt from the recipient or using a registered letter, which provides for the issuance of a notification to the sender. |

Important! Having received the IL, the creditor can send it to a branch of another bank or directly to the FSSP.

Conclusion

A few words about the consequences of the revocation of the writ of execution by the claimant. By following the debtor's lead - by agreeing to reasonable arguments in favor of voluntary payments, the creditor risks the following:

- Stopping debt accumulation. By negotiating a settlement agreement, the debtor is trying to avoid paying off the debt accumulated during the period of non-payment.

- Receive irregular payments.

- Stopping any payments at all.

- Understatement of the amount of contributions established by the decision of the judicial panel.

Of course, these negative consequences can be corrected by again turning to the court and, as a result, going through all the proceedings again in the legislative body. While the debtor will simply change his old place of work, for example, to a higher paying position.

As a result, the writ of execution will not follow him, since the accounting department, without legal grounds, stopped collecting the necessary monthly amounts from the debtor. At a new job, the draft dodger earns many times more, but pays the creditor, according to the settlement agreement, contributions in the amount established by the court, based on the payer’s previous income.

Moreover, collecting debt for the period when the IL is suspended is very problematic in terms of collecting evidence. Therefore, by carrying out a revocation, the lender creates a lot of problems for itself. It's worth thinking about this.

Similar articles:

- Return of the writ of execution to the claimant Termination of enforcement proceedings 1. Conversion of the writ of execution to the proceedings - termination of proceedings without fulfillment of the claims of the claimant...

- Application for suspension of enforcement proceedings Sample application for suspension of enforcement proceedings, taking into account recent changes in legislation. Enforcement proceedings are initiated by a bailiff...

- Writ of execution after the trial To whom is the writ of execution issued after the trial? The writ of execution must be issued to: The plaintiff personally in the hands or to an authorized...

- Liability for failure to execute a writ of execution Criminal liability for failure to execute a writ of execution You want to say that banks are subject to Article 46 of the Constitution, article...

How to legally write off debts from bailiffs

Writing off money is a procedure that worries all defaulters. According to the law, the FSSP does not have the right to repay the debt without a court decision, that is, the bailiffs will not be able to cancel it. If the borrower is unable to pay, he does not have property or work, then the enforcement proceedings against him can be stopped, but this is not their responsibility, but only the opportunity to receive relief.

- issuance by a judge of an order to cancel the enforcement proceedings - if the decision was made with violations, the court has the authority to suspend the enforcement proceedings;

- the lender personally requests to stop the forced collection of funds from the debtor;

- conclusion of a peace agreement between the parties to the conflict - the debtor promises in writing to the lender to pay the entire amount or part of the funds on a new date, or offers a mutually beneficial deal;

- The court ruled that the creditor's claims were unlawful.

When will enforcement proceedings be closed?

Upon completion of enforcement proceedings for the collection of periodic payments, the bailiff has the right to carry out enforcement actions provided for in paragraph 16 of part 1 of Article 64 of this Federal Law, independently or in the manner established by Part 6 of Article 33 of this Federal Law.

In the future, agreements are violated and the person or legal entity again makes claims. Remember, nothing prevents you from presenting the sheet again; this can be done immediately, but you will have to prove that the debtor’s financial situation has changed. If you decide to reconcile, then do it correctly, through the court!

Judicial proceedings can also be completely terminated under current legislation, which is regulated by the conditions under article number 52 of the Federal Law. Here there is the fact of the death of a person who owes a certain amount of money.

The countdown of the validity period of enforcement proceedings for debt collection can begin with:

- Delivery of a writ of execution by bailiffs.

- Failure to receive a writ of execution.

The bailiff can tell you anything, but to an official request, he is obliged to officially respond. The bailiff does not have the authority to evaluate the property damages - he is not an appraiser.

At the same time, bailiffs can transfer the existing monetary debt to his official relatives. This kind of action can occur when receiving an inheritance, as well as when official spouses have common property. This is regulated by the legislation in force in our country under article number 45 of the Civil Code of the Russian Federation. In possible cases, when the borrower of funds does not return the loan taken within the time period specified in the agreement or receipt, then a statement of claim is filed with the judicial authorities of our country.

If the bailiffs don’t bother you, then it’s better not to bother them either. You should not run to their appointment and write any statements. There is a high probability that your case will not be returned again. This is due to the huge number of cases with which collection officers are overwhelmed.

Sample application for cancellation of a court order on utility bills

To achieve cancellation of the court order to collect the mortgage from you in favor of the housing and communal services company, properly draw up and file an objection to it within ten days.

In your objection, please include the following information:

- details of the court order to which the objection was drawn up, including the date when it was issued;

- information about which magistrate issued the court order to which the objection was drawn up;

- the reasons for your objection;

- requirement for the court to accept your objection.

The objection must be signed with your own hand and indicate the exact date of its signing.

According to a court decision, debts for utility bills are collected by bailiffs using the entire arsenal of means available to them, from warnings to seizure of property, arrest of accounts, ban on traveling abroad, and so on.

It is impossible to seize the only home from the owner for utility debts.

Court order for debt collection for housing and communal services: cancellation, what it is, application for debt collection

The notice can include a clause stating that if the amount is not repaid within the specified time frame, measures will be taken against the person in the form of suspension or disconnection of utility services.

A court order is both a decision of a judicial authority and an executive document. This is stipulated in Article 121 of the Code of Civil Procedure of the Russian Federation. Based on this document, the services have the right to contact bailiffs to collect the debt.

I received this SMS. What does it mean?

This means that you have a loan or credit card debt that the court will collect from you. On the Sberbank website it is written that it independently determines the amount that it will write off, but in most cases, it is 50% of the salary.

Especially for you: Why checks didn’t go through the online cash register: what to do