The financial crisis and the resulting increase in overdue payments on bank loans have a number of consequences. Today, many debtors know about Sberbank’s mobile collection group firsthand. Let's figure out what kind of group this is, what its responsibilities are and whether this entity has a legal basis.

Basic methods of pre-trial collection

Pre-trial methods of debt collection are generally divided into several types:

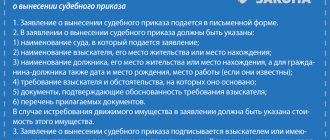

- drawing up and sending a claim to the debtor - the creditor or, if it is an organization, its employees (representatives) correspond with the borrower, without this stage it is impossible to file a claim in the future;

- using an agreement to assign rights to a debt - this measure is also called the sale of debt, this is an extreme measure, which for the debtor only means that he will have another creditor, and all other “nuances” for returning the money will remain the same;

- foreclosure is possible if a loan was issued with collateral, while the pledged property, if the agreements are violated, changes the owner and is sold at auction.

In practice, the first method has become widespread, which in the vast majority of cases is called pre-trial debt collection. The creditor, protected by the Law, notarized documents, credit agreements, has every right to claim the loan, and the debtor gets the opportunity to resolve the issue “amicably”, receive some concessions and preferences, or, if he disagrees with the position of the other party, send him an objection.

Consequences after filing a complaint

- no response will be received and you can file a claim in court

- the debtor will pay off the debt

- the debtor acknowledges but does not pay the debt, in this case the lawsuit will be considered in a simplified manner without calling the parties to a meeting

- the first claim turned out to be incorrect, the claim was left without consideration and another claim must be submitted

The Intellectual law firm, after developing an effective strategy for dealing with the existing debt, will carry out pre-trial collection in such a way as to return the money before the trial, or will facilitate and simplify it.

0

0

0

0

How is pre-trial debt collection regulated?

Pre-trial collection does not mean the immediate transfer of all borrowed funds - there are many legal mechanisms for their return. The updated provisions of the legal acts of the Russian Federation stipulate that the parties have the right to reconsider the terms of the agreements. For example, you can set other deadlines for paying off the debt, restructure it, cancel a fine or penalty, or ask for an installment plan (this is often provided by utility service providers). This flexibility is convenient when collecting debts on bank loans - in accordance with legislative innovations, they can also be returned without trial.

If a delay occurs, it is not necessary to contact the judge and wait until the case is considered and the decision is appealed. To “launch” the return procedure, it is enough to make a notarial execution record on a document confirming the fact of the debt (loan agreement or other register) and notify the borrower 14 days before the visit to the notary. This right is vested in banks, but not microfinance credit organizations. The mechanism of pre-trial notarization is not available to them.

If the agreements that were drawn up in writing when issuing funds on loan included a clause on the possibility of collection using notarial records, individual creditors also have the right to take advantage of this opportunity. To implement the mechanism, you need to have the contract certified by a notary when it is drawn up. Collection of transactions is possible without this. The lender only needs to contact a notary office and pay for its services at the current rate.

The debtor, in turn, has the right to appeal the claim as follows:

- within seven days from the date of receipt of the notice of pre-trial collection, he sends to the notary who sent the document objections - that he does not agree with the principle of calculation, and so on;

- the notary refuses to affix the inscription to the creditor bank;

- the creditor submits the case to the court, which will consider it in the standard way.

The debtor can also appeal the decision after the issuance of the writ of execution. To do this, no later than 10 days later he submits an application to the court to declare the actions illegal, supporting them with justifications. In this case, the defendant will be the notary who affixed the inscription.

Validity period of interim measures

Before July 12, 2020, the period for mandatory pre-trial settlement was usually 30 days, and the period for which the arbitration court could take interim measures was limited to 15 days. Therefore, creditors had to apply for interim measures 2 weeks after sending the claim, and debtors could already re-register and withdraw their assets during this time.

Part 5 of Article 99 of the Arbitration Procedure Code now provides for 2 types of deadlines:

- no more than 15 days to send a claim to the debtor

- no more than 5 working days from the date of expiration of the waiting period for a response to the claim for filing a statement of claim

Part 7 of Article 99 of the Arbitration Procedure Code also obliged the creditor to inform the court that took the interim measures about the direction of the claim and the filing of the claim in another court.

Why pre-trial collection is convenient for the parties

Despite the possibility of turning to a judge, parties to debt relations are increasingly choosing to resolve the situation without a lawsuit. This is convenient for everyone - it saves energy, time and money. Pre-trial practice makes it possible for the lender to receive the loaned funds on time, and for the borrower to avoid having to be a defendant in the courts (although there is less room for maneuver).

A significant advantage of recovery without court for the creditor is the speed of implementation. The mechanism is clearly regulated, takes literally a couple of weeks, and the debtor will not be able to take protective measures - declare bankruptcy, sell expensive property, including through a fictitious transaction. During court proceedings, the borrower has time (they last for months) and the opportunity to file an appeal, challenge the outcome of the case, challenge or “delay” the claim.

The second advantage, important for both parties, is saving money. When recovering debt through the court, creditors spend money on fees (up to 5% of the total debt amount), verification of signatures, and so on. The borrower bears the costs of appealing and filing appeals. Pre-trial settlement does not involve these costs.

It is important that without resorting to lawsuits, the parties maintain normal relations and prove to each other their integrity and ability to negotiate. A complaint is not necessarily a strict requirement; it is a correct and effective mechanism for resolving a complex issue, which helps not to waste your nerves on a conflict, but to move it into a constructive direction. The parties can enter into an agreement, additional agreements and calmly discuss the terms, demonstrating a willingness to negotiate rather than aggression.

Delivery procedure

Russian legislation defines only two forms of expressing claims:

- Claim (pre-disc)

- Judicial.

Both of them are closely interconnected. If the primary one does not give the proper result, i.e. the debtor does not pay the bills, then they resort to the second one.

Most often, the procedure for filing a claim is reflected in the contract. He should be followed. If this is not the case, then the document should either be taken to the office of the company that has the debt and handed it over, taking a receipt with the seal of the manager. You can also use postal services and send a claim by registered mail with a list of attachments to the legal address of the debtor. It would be a good idea to follow it up with an email.

If the answer received from the debtor is not satisfactory, then the next step is to collect the debt through the court by filing a statement of claim. It should also be accompanied by a copy of the claim for debt payment and a number of the following documents (if available):

- The main agreement with the defendant for the provision of services (for example, an agreement for the lease of non-residential premises or purchase and sale).

- Certificates of examination and verification of the quality of services received.

- Reconciliation Act.

The submitter must ensure that all documents submitted along with the claim are certified by the signatures of both parties and must be stamped.

Next, find out where to apply. If the plaintiff is a legal entity, then it is necessary to apply to the Arbitration Court, for individuals - to the Court of General Jurisdiction. This should be done at the defendant’s registered address. The only exceptions will be cases when a different procedure was prescribed in the main agreement.

Debt collection can be done through court

To make a decision on the case, the judge will check the following points:

- The fact of concluding an agreement for the provision of services on a reimbursable basis, i.e. the presence of the document itself: a contract, letters of guarantee, etc.

- Proof that the agreed services were actually provided (invoices will be needed, etc.).

- Cost of services provided.

- The time frame within which the performer must meet.

- The deadline has arrived when cash payments must be made.

- The fact of a real delay in payments.

As soon as the court decision comes into force, the plaintiff must take a writ of execution from the office and apply with it to the Bailiff Service, where a case will be opened for the return of the resulting debt.

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer can advise you free of charge - write your question in the form below:

Free consultation with a lawyer

Request a call back

Still have questions?

Call the number and our lawyer will answer all your questions for FREE

To protect himself in a possible trial, the creditor must have strong evidence that he tried to correct everything in the claim procedure. For these purposes, there is a special procedure for sending claims to the borrower.

In court, the creditor will take the side if the claim is served in one of the two ways presented:

- delivery of the document in person, signed by the recipient;

- postage;

But in each of these cases there are nuances that need to be paid attention to. If the claim will be served in person, then for this you need to have several copies of the document. The first is given to the second party to the conflict, and the second must be signed by the debtor with the obligatory indication of the time and date of delivery.

This copy must remain with the creditor, and it will serve as evidence in court if the situation develops negatively. The date indicated on the document plays a decisive role, since it is from this date that the countdown begins for both the debtor and the creditor.

If you need to serve a claim on a legal entity, then it is necessary to accurately determine the person responsible for receiving the correspondence. Usually this is the secretary, but no one guarantees timely delivery of the letter to the manager. Therefore, if the company or company is small, then it is worth trying to present it in person.

But the most reliable evidence is the presence of a postmark confirming delivery. In this case, the court almost never supports the defendant’s claim that the claim was not received on the basis that an incompetent person signed for the documentation.

In 90% of cases, the court sides with the creditor. If the debtor by all means avoids serving the claim, then a claim is filed in court with envelopes that should have been handed to the defendant.

Further identification of the location will be carried out in court.

How pre-trial collection is implemented in practice

The pre-trial debt recovery mechanism involves a phased implementation:

- the debtor is sent a written notification that he has an overdue debt - if the fault is due to hassle or forgetfulness, the situation will be quickly resolved;

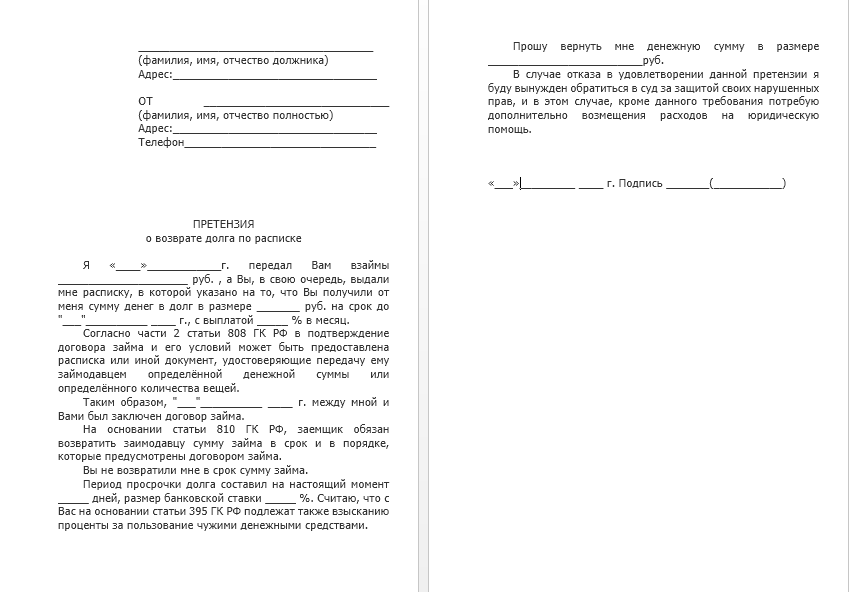

- if the debt is not repaid, the lender sends a demand to the borrower - in a standard form, officially, in writing (the document will later be needed if the proceedings go to court), keeping a copy;

- the creditor collects materials proving his case: receipts confirming the existence of the debt, correspondence, including electronically and via SMS, witness statements, and other information;

- the debtor, who decides to repay the debt voluntarily, participates in negotiations, the parties discuss the mechanism, features of payment, set deadlines and fix the conditions in a written agreement;

- the creditor receives the funds - in whole or in part (if the parties agreed on installment plans or other conditions).

The written claim must indicate under what circumstances and on what conditions the funds were issued, the period for their return, and the measures that the creditor will take if the debtor refuses to cooperate. The document must be drawn up correctly, taking into account legal requirements, therefore it is recommended to contact professional lawyers to write it. They also provide representative support in the settlement process, act as a mediation service and help quickly and efficiently reach a peaceful agreement on the debt. If an agreement cannot be reached, the creditor resorts to other measures.

Pre-trial settlement of overdue debts

It is beneficial for both parties to the conflict not to bring the matter to court, because otherwise you can lose both time and money, so you need to know how all this happens in practice.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

It's fast and free!

The claim sent to the debtor is the most common and convincing document forcing the repayment of the debt. Therefore, it must be drawn up according to all the rules and be able to maximally inform the other party to the conflict about its possible losses in the event of a trial in court.

The procedure for pre-trial settlement of financial disputes includes the following actions:

- Drawing up a letter with a full calculation of the debt and a demand for its repayment.

- Sending the claim directly to the debtor.

- Signing a mutual agreement, which specifies the responsibilities of each party to the conflict to effectively resolve the dispute.

The basis for filing a claim is most often a cooperation agreement signed by both entities. It may stipulate an obligation to perform any action by one party to the conflict.

Moreover, all deadlines for fulfilling these conditions must be clearly indicated in the contract, so that it can be relied upon when drawing up a claim.

The basis for sending a document to the debtor is the occurrence of a debt under the contract and ignoring oral demands for the return of the required amount.

Field team of a bank or collection agency. Myths and reality. Part one.

Loans What is the Sberbank mobile collection team: when does it arrive and what to do? Many citizens take consumer loans lightly, often without thinking about the fact that the borrowed funds will have to be repaid. An irresponsible approach to financial issues leads to late payments and debt formation. If there are no payments within three months, a Sberbank on-site collection team may visit the borrower. What is it Savings Bank employees begin working with the debtor if funds to repay the loan are not deposited within three days after the agreed date. Initially, only telephone conversations are conducted with the borrower, during which an employee of the financial institution tries to find out the reason for the delay. If the payment on the Sberbank loan is not received within ninety days, then an on-site collection team is sent to the debtor. Initially, it is this unit that is trying to get the fee paid. The Savings Bank postpones contacting collection services until the last minute. Their services are resorted to if payments cannot be achieved throughout the year.

Consumer protection Field team of a bank or collection agency.

According to the bank’s criteria, the following are considered serious reasons for changing the terms of the loan agreement: loss of job, sharp decrease in income; conscription into the army; decree; loss of ability to work. All circumstances must be confirmed by relevant documents.

What it is

The Federal Law does not provide for situations in which a credit institution would have the right to pursue a policy of intimidation in relation to insolvent clients. However, this is what bank representatives do during on-site collection. This activity is similar to the practice of collection agencies, with the difference that the work is carried out by the bank's security service.

The actions of the collection team are limited to interaction with the client during telephone communication or direct contact. Can psychological pressure be exerted on the client through threats, harsh demands and rude behavior? Let's look further.

Work process

- Mobile groups receive to work a register of debtors that have already been worked out by employees of office teams, but are suitable for the conditions described above.

- The contract has been in effect for one month.

- The first thing that employees of mobile groups do, before going to the debtor, is to print out personal data, his photograph, comments from the employees of the delinquency and collection department, and a pre-trial claim (what this is, see here).

- Then they travel to the registration address, sometimes at the actual address.

- Establish contacts with the client, relatives, acquaintances, colleagues.

- Negotiating the closing of a loan agreement by the client.

If the debt is closed, then the agreement is sent to the archive, if not, then the office team members return to work, who, using the established telephone numbers (if any), call the client and his immediate circle.

We will answer your question in 5 minutes!

We will answer your question in 5 minutes!

What is the Sberbank mobile collection group, and should you be afraid of it?

Visiting team Do collectors have the right to come to the debtor’s home? Some people who took out a loan and for one reason or another cannot repay the debt to the bank have already encountered debt collectors. Collection agencies are engaged in the collection of problem debts, and their specialization is out-of-court collections. Banks that do not want to deal with a problem client transfer or sell the debt to collectors. The duties of debt collectors include collecting debts in almost any legal way, which they often take literally and bombard the borrower with a huge number of calls.

When does a borrower get on the “problem” list?

The payer will be classified as “unscrupulous” if the loan payment is overdue from 7 to 90 days. Having recorded a long-term delay in payment, the credit manager transfers the case to the overdue debt department, and the client is automatically transferred to the rank of problem ones .

At first, OPRsPZ specialists independently call the defaulter and remind them of the need to make a monthly payment in accordance with the drawn up payment schedule. Additionally, SMS notifications are sent to your mobile phone every day with a similar call and the stated amount of the accumulated debt.

If after a couple of weeks there is no reaction from the borrower, employees begin processing the debtor’s friends and relatives. They find profiles of friends and parents on social networks and send letters to them. The messages indicate the amount of debt and emphasize the unpleasant consequences that will arise if the loan is not repaid.

The tactics of department specialists may be different. Some problem clients received messages like this: “Your loan has been transferred to the On-Site Collection Team for review. We strongly ask you not to leave the city and to be at home after six in the evening.” But judging by the reviews, not a single debtor had the honor of meeting representatives of this “group.”

If the defaulter is unemployed, he may receive letters with a different text. For example, that the highest court will oblige him to get any position, from a janitor to an orderly, and to give 50% of his earnings to pay off his debt.

In most cases, employees working with unscrupulous borrowers prefer to communicate at a distance, without organizing a personal meeting. However, judging by customer reviews, there are still exceptions. According to one girl, the collectors visited the apartment during working hours. There was no one at home, and bank representatives began knocking on neighbors' doors and telling unpleasant information about the young woman. If Sberbank persistently collects overdue debt, what should the debtor do?

- Try to deposit at least some amount into your credit account to pay off the debt and interest.

- Make every effort to get the loan restructuring approved.

- Take a second loan from a third-party financial institution, on more favorable terms, and cover the overdue debt.

- Delete pages from all social networks, or hide your social circle there. This will help get rid of the excessive intrusiveness of Sberbank.

- Blacklist the numbers of the employees who attack the phone. This way, calls will not interfere with your normal life.

In the case where friends and family are called, it is necessary to complain to the bank’s technical support on their behalf. After such a request, calls to persons not directly related to the loan agreement are stopped.

If employees try to contact you after 10 p.m., you can safely file a complaint, with reference to the Federal Law “On Consumer Credit,” and send it to the Central Bank.

The law prohibits calling clients and sending them messages from 10 pm to 8 am on weekdays, and from 20.00 to 09.00 on weekends and holidays.

Bank collection department

If contact with the debtor is established, then the personal data is verified, the amount of the debt is summed up on the day of the call, and they are invited to the collection department. If contact is made with his relatives, acquaintances, neighbors, contacts or work colleagues, they are asked to pass on information regarding the debt.

If the client comes to negotiations, he is offered several options for solving the problem: Important!

Re-accreditation must be approached very carefully.

Because this is fraught with a new debt trap. This issue can be studied in detail here.

If the borrower is satisfied with everything, he pays the debt and his agreement is sent to the archives. Next, he is given a certificate confirming the closure of his personal account.

After six months, he will again be able to take out a loan from this bank if the conditions suit him. A certificate of account closure is a legal document and serves as proof that you have no debt to the bank.