Definition

Accounts receivable turnover

(receivable turnover ratio) measures the speed of repayment of an organization's receivables, how quickly the organization receives payment for goods sold (work, services) from its customers.

The accounts receivable turnover ratio shows how many times during a period (year) the organization received payment from customers in the amount of the average balance of unpaid debt. The indicator measures the effectiveness of working with customers in terms of collecting receivables, and also reflects the organization's policy regarding credit sales.

Calculation (formula)

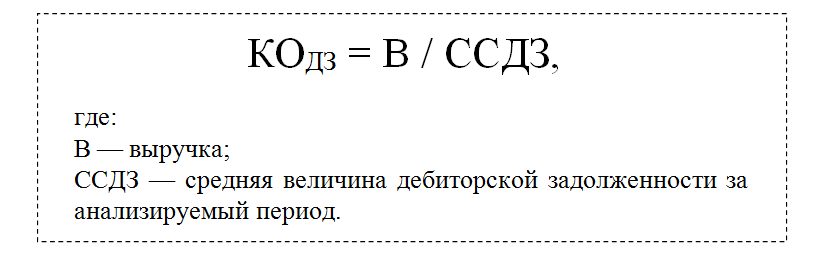

Accounts receivable turnover (ratio) = Revenue / Average accounts receivable balance

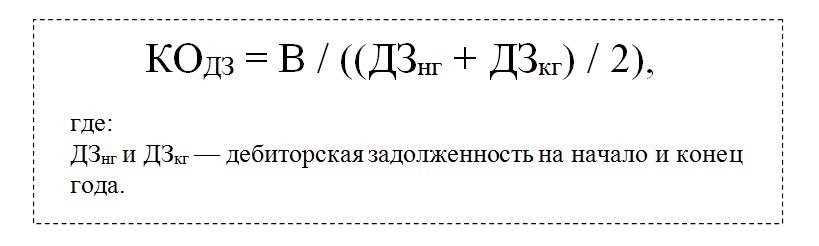

The average balance of accounts receivable is calculated as the amount of accounts receivable from customers according to the balance sheet at the beginning and end of the analyzed period, divided by 2.

It is also common to calculate the indicator not in the form of a coefficient, but in the form of the number of days during which the receivables remain unpaid:

Accounts receivable turnover in days = 365 / Accounts receivable turnover ratio

Normal value

For accounts receivable turnover, as well as for other turnover indicators, there are no clear standards, since they strongly depend on industry characteristics and the technology of the enterprise. But in any case, the higher the coefficient, i.e. The faster customers pay off their debt, the better for the organization. At the same time, effective activity is not necessarily accompanied by high turnover. For example, when selling on credit, the accounts receivable balance will be high, and the turnover ratio will be correspondingly low.

About accounts receivable turnover in English, read the article “Receivable Turnover Ratio”.

The state of an organization's economic indicators is determined by various factors. Moreover, the key component of the balance sheet here is the duration of the receivables turnover. This value shows how successful the company’s management policy is and indicates to financiers the dynamics of the enterprise’s development. Let's talk more about this issue.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please contact the online consultant form on the left or call

+7 It's fast and free!

Let's start with terminology

To understand the content of financial analysis, we invite readers to master basic knowledge. Accounts receivable turnover is defined as the ratio of the enterprise's profit to the average debt of debtors .

In other words, this value indicates an increase or decrease in current assets in the course of the organization’s activities. That is, such an indicator is an indicator of the effectiveness of management.

Moreover, in such cases, the duration of the receivables turnover is also important for economists. The final analysis of the work done shows the real productivity of the enterprise. Here, financial analysts use turnover calculation formulas to study the current situation in detail. Here they take the indicators of income and losses of the enterprise for a certain period.

Note that the turnover period of receivables becomes a component of such calculations. What does this definition mean? For ordinary people, this term shows the speed of repayment of loans by debtors.

Thus, this component of the formula tells us when the counterparties pay their bills. In addition, such a value is important for analyzing how the time of loan repayment corresponds to the planned payment terms and indicates trends in the growth or decline of the company’s solvency. This indicator is calculated based on real accounting data.

Read more: Documents for tax deductions for life insurance

Business activity assessment

Labor productivity

Labor productivity (LabourProductivity, RevenuesPerWorker), den. units/person:

RPW = Revenue (sales revenue) / Average headcount

Labor productivity is an indicator of the efficiency of using labor resources (labor factor). The growth of this indicator indicates a positive trend in the company's development.

Analyzed together with all indicators of labor efficiency:

— Labor productivity

— Profit per employee

— Capital-labor ratio

— Capital productivity

Another name for the coefficient: Sales volume per employee, den. units/person

Profit per worker Profit per worker (Earnings Per Worker), den. units/person:

EPW = Net profit / Average headcount

This indicator shows how efficiently and profitably the company conducts its activities. The growth of this indicator indicates a positive trend in the company's development.

Analyzed together with all indicators of labor efficiency:

— Labor productivity

— Profit per employee

— Capital-labor ratio

— Capital productivity

An increase in profit per worker must be accompanied by an increase in labor productivity. At the same time, the growth rate of labor productivity must be higher than the growth rate of profit per worker.

Capital-labor ratio

Fixed Capital Per Worker, den. units/person:

FCPW = Average cost of fixed assets / Average headcount

An economic indicator characterizing the equipment of workers of enterprises in the sphere of material production with fixed production assets (facilities).

Analyzed together with all indicators of labor efficiency:

— Labor productivity

— Profit per employee

— Capital-labor ratio

— Capital productivity

An increase in the capital-labor ratio must be accompanied by an increase in labor productivity. At the same time, the growth rate of labor productivity should be higher than the growth rate of the capital-labor ratio.

Capital productivity

Capital productivity (fixed asset turnover), Fixed Assets Turnover

FAT = Revenue (sales revenue) / Average cost of fixed assets

Characterizes the efficiency of the enterprise's use of the fixed assets at its disposal. The higher the ratio, the more efficiently the company uses fixed assets. A low level of capital productivity indicates insufficient sales or too high a level of capital investment. However, the values of this coefficient differ greatly from each other in different industries. Also, the value of this coefficient greatly depends on the methods of calculating depreciation and the practice of assessing the value of assets. Thus, a situation may arise when the fixed asset turnover rate will be higher in an enterprise that has worn-out fixed assets.

Inventory turnover ratio

Inventory Turnover Ratio (IT)

IT = Production costs / Inventories (in turnover)

IT = Inventory * 365 / Cost of production (in days)

Inventory turnover ratio reflects the efficiency of the production process. It grows with the optimization of production and, as a result, a reduction in the need for working capital for its organization.

Accounts payable turnover ratio

Accounts payable turnover ratio, Payables Turnover (PT)

PT = Production costs / Accounts payable (in turnover)

PT = Accounts payable *365 / Production costs (in days)

The accounts payable turnover ratio reflects the speed at which a company settles payments with its suppliers. A decrease in the indicator may mean both problems with paying bills and the deliberate use of accounts payable as a cheap source of financial resources.

Asset turnover ratio

Asset turnover ratio, Assets Turnover (AT)

AT = Sales proceeds / Total assets (in turnover)

AT = Total assets * 365 / Sales revenue (in days)

The asset turnover ratio reflects the intensity of use of all available company resources, and grows with increasing efficiency of the business as a whole.

Equity Turnover Ratio Equity Turnover (ET)

ET = Sales Revenue / Equity (in turnover)

ET = Equity * 365 / Sales Revenue (in days)

Shows the rate of turnover of the company's equity capital for the billing period (number of turnovers per period). This indicator characterizes various aspects of activity: from a commercial point of view, it reflects either excess sales or their shortcomings; from financial – the rate of turnover of invested capital; from the economic side - the activity of funds at risk of the shareholder

Accounts receivable turnover ratio

Accounts receivables turnover ratio, Receivables Turnover (RT)

RT = Sales revenue / Accounts receivable (in turnover)

RT = Accounts receivable * 365 / Sales revenue (in days)

The accounts receivable turnover ratio characterizes the organization of the company's work in collecting payment for its products. The lower this indicator, the higher the company's need for working capital to expand sales.

Operating cycle

Operating Cycle - the average time between the acquisition of materials or services used in the production process and the receipt of revenue from the sale of finished products.

Operating cycle = Accounts receivable turnover period + Inventory turnover period

Reducing the operating cycle over time is considered a positive trend and is one of the tasks of the company’s financial management

Financial cycle

The financial cycle is the period of turnover of funds invested in the working capital of an enterprise.

Financial cycle = Inventory turnover period + Accounts receivable turnover period – Accounts payable turnover period

Shortening the financial cycle over time is considered a positive trend and is one of the tasks of the company’s financial management.

Receivables to payables ratio

Ratio of receivables and payables (Receivables - Payables Ratio)

RPR = Receivables / Accounts Payable

Allows you to determine how many accounts receivable there are per unit of accounts payable, and the optimal value of this ratio varies from 0.9 to 1.0, i.e. accounts payable should be no more than 10% higher than accounts receivable.

Accounts receivable collection ratio

Kdeb = Average accounts receivable / Sales revenue

Inverse receivables turnover ratio. It is calculated as the ratio of average accounts receivable for core activities (settlements with debtors for goods, works and services; settlements on bills received; advances issued to suppliers and contractors) to sales revenue. The value of this indicator depends on the type of contracts prevailing at a given enterprise: for example, if the main standard contract provides for payment within two weeks from the date of shipment of the goods, then the critical value of the coefficient is 1/26. Thus, if the calculated value of the ratio exceeds 1/26, we can conclude that the company has problems with its debtors.

Economic growth sustainability coefficient

To assess the business activity of joint stock companies (or enterprises paying dividends on securities), the economic growth sustainability coefficient is used:

Kstab = (Net profit - dividends - contributions to the reserve fund) / Average equity capital for the period

The numerator of this ratio is net income minus dividends paid to shareholders. If dividends are not paid, this indicator is the same in value as the return on equity.

Shows the average rate at which an enterprise can develop in the future, without changing the already established relationship between various sources of financing, capital productivity, profitability of production, etc.

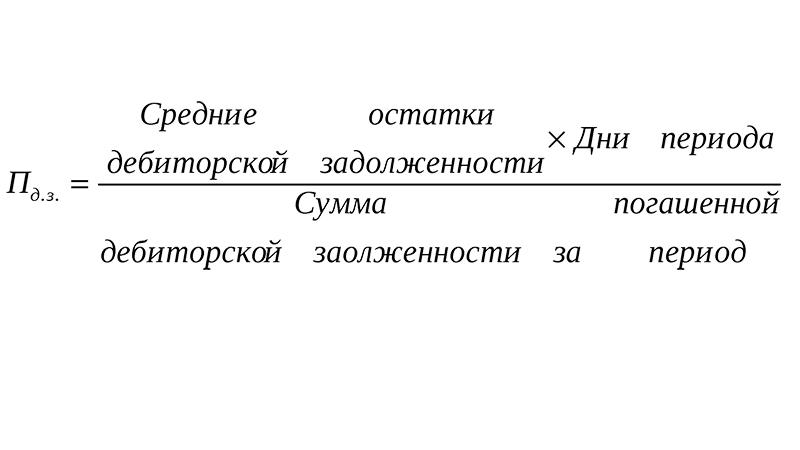

Carrying out calculations

Let's consider how the average turnover period of receivables is determined. Here, economists divide the number of days in a year by the turnover ratio to get the capital return period. This formula looks like this: P=365/K . Note that the result here is indicated in days. The value “365” corresponds to the number of days in a year. For quarterly reports, this value is replaced by a number that corresponds to the number of days of the period under consideration.

In turn, economists calculate the coefficient by determining how the average amount of accounts receivable relates to the company’s revenue using the formula: K = Svdz/V . Moreover, the average amount of debt is determined by obtaining the arithmetic average between the difference in the amount at the beginning and end of the time interval under consideration.

Then the calculations are carried out according to the formula: Ksobdz = P/K, where “P” is the period in days, and “K” is a constant showing the turnover of the enterprise.

Note that there is no single criterion for indicators of this magnitude. Remember, here financiers take into account the specific terms of the transaction, based on the capabilities of the counterparties. However, we note that in this situation, a reduction in the loan repayment period is a good signal indicating the growing potential of the company. The turnover rate of accounts receivable indicates the effectiveness of the policy of control and collection of debts.

Duration and turnover rate

Let's talk in more detail about what the speed with which assets are returned by counterparties means in such situations. Here the key indicator is the dynamics of this value. Considering that economists prefer to summarize such results quarterly, throughout the year it is clearly visible how quickly and on time counterparties fulfill financial obligations.

As already mentioned, the receivables turnover in days shows the feasibility of cooperation with a specific legal entity or individual. Moreover, a reduction in this value indicates a conscientious attitude of partners and a competent collection policy at the enterprise . After all, the speed with which capital returns to the company allows the disposal of available funds without increasing the current asset.

Loans that are not repaid on time go into the category of overdue debt, which, in turn, provokes unnecessary expenses and even leads to bankruptcy of the company if a critical mass of such debtors accumulates.

For these reasons, timely control and tracking of accounts receivable is an important task for the organization’s management. Here it is advisable to control the development of both the creditor enterprise and the company that has become a debtor. To improve this indicator, it is appropriate to systematize the asset return period , increase the volume of direct deliveries and use economical raw materials or materials for the production of goods.

The value is rising or falling

Now let's look at the details about specific turnover indicators and determine what the fluctuation of this component means. Financiers say that the value of the period ideally becomes inversely proportional to the turnover ratio . In other words, an increase in the value of “K” and a decrease in the value of “P” indicates the prosperity of the enterprise and the correct direction of management policy.

Read more: How to choose a taxation system when registering an individual entrepreneur

However, a combination of various combinations is likely here, and it will be possible to make a specific verdict on the real state of affairs only after a comprehensive and in-depth study of the financial condition of the organization. Note that when determining the value of the period during which debtors returned funds for using the company’s asset, financiers recommend comparing this value with the turnover ratio.

The indicator is decreasing

When the value of the turnover period falls, this trend indicates that the company's management has chosen the right course of credit policy, and debtors are repaying debts on time. Moreover, a stable decrease in this value indicates the independence of the enterprise from external investments and an increase in current assets.

True, such situations sometimes signal an overly strict collection policy of the lender. The consequence here is the loss of customers and a reduction in sales of products on credit. Therefore, objectively assess the current situation in order to avoid a lack of clientele in the future.

The value increases

If, during a detailed quarterly analysis, the value grows, economists consider this a warning sign for management . There are many reasons why a company's working capital falls. However, carelessness in choosing counterparties and lack of verification of the solvency of partners is a consequence of deteriorating economic indicators. Financiers also include a soft collection policy here.

An increase in accounts receivable turnover indicates the need to control settlements with customers and change the debt collection system when it comes to deadlines. After all, a stable increase in the turnover period is a signal of the insolvency of partners or the uncompetitiveness of the lender’s products. In both cases, it is recommended to review the management policies of the company.

An increasing turnover period indicates an ill-conceived sales strategy - in this case, sales volumes are growing too quickly, and the pace of market coverage does not correspond to real demand.

As a rule, in such a situation there is a decrease in the turnover ratio. Low accounts receivable turnover indicates the need to revise management, control and collection systems - after all, ignoring such a problem leads to bankruptcy of the company .

However, there are also cases when the turnover period is stable, but the company’s revenue is falling. Here it is important to check whether the real terms of return of capital correspond to the appropriate time intervals. For example, if, after the calculations are carried out, it turns out that the turnover period for the quarter is over 90 days, this indicator signals problems in debt collection.

Consequences of increasing return periods

Finally, we’ll talk about how dangerous the growth in the turnover of debtors’ debts is for the company’s work and we’ll briefly outline the ways out of the crisis. If we talk about risks, it is appropriate to remind you about investing finances in a dubious transaction, instead of using such an asset for the needs of the company. In addition, it is advisable not to forget about inflation here - accordingly, the currency depreciates over time , and the revenue will not live up to expectations and calculations.

Thus, the company missed the chance to gain benefits by issuing loans to unverified or insolvent counterparties. This indicator becomes especially critical when the company accumulates significant amounts of overdue debts that have to be written off. And with limited current assets, this path leads to the enterprise obtaining loans and, as a consequence, paying interest, which already becomes a direct loss.

To improve turnover indicators, it is appropriate to introduce the practice of reducing payment terms by counterparties to the minimum possible intervals. In addition, in such situations, financiers say that it is appropriate to give preference to large wholesalers with an impeccable business reputation.

As you can see, a comprehensive analysis of the company’s accounting department and responsibility when choosing trading partners can lead to the prosperity of the enterprise. The main thing is to constantly monitor the financial condition of your partners and competently pursue a debt collection policy. Note that here it is appropriate to give preference to short-term loans rather than long-term loans. This article talks about the difference between these two types.

Read more: Committee for Security and Law and Order of St. Petersburg

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Accounts receivable management in an organization implies not only complete and timely accounting of receivables, but also the calculation of various kinds of indicators that characterize them. One of the main indicators determined on the basis of data on the amount of receivables of an organization is the turnover ratio. We will tell you what it shows and how it is calculated in our consultation.

Accounts receivable is

Accounts receivable is the amount of debts due to an enterprise, firm, company from other enterprises, firms, companies, as well as citizens who are their debtors.

Simply put, receivables are all the money that, according to documents, already belongs to the company, but in reality is held by other people or companies.

The main source of accounts receivable is deferred payments. It's no secret that postpayment is accepted in the business world. First, goods are supplied or services are provided, then an invoice is issued to the buyer, and then payment occurs. From the accountant's point of view, the company received income at the time the invoice was issued. This time difference leads to cash gaps - a discrepancy between accounting income and actual cash flow. Profitable firms may have ongoing problems with current payments if they do not have good accounts receivable management.

Example: let’s say I’m an individual entrepreneur making websites. In December I receive an order for 100 thousand rubles, complete the work and issue an invoice to the buyer. From the point of view of an accountant (and most importantly, the tax office), I have already received income. The customer delays payment, but the tax office demands to pay income tax. I still have nothing to pay, and penalties are charged on the amount of unpaid tax... To avoid fines, I have to borrow money. Exactly the same situations can occur with payment of office rent, payment of salaries to employees, etc.

What does the accounts receivable turnover ratio show?

For any type of asset, the turnover ratio shows the efficiency of their use. In relation to accounts receivable, the turnover ratio (TR) is calculated as the quotient of dividing sales revenue for the period (B) by the average amount of accounts receivable for this period (AR):

The ratio shows how many rubles of revenue are per 1 ruble of receivables and, in fact, characterizes the rate of conversion of receivables into cash. Therefore, an increase in the accounts receivable turnover ratio is considered a positive trend. The turnover ratio is analyzed by the organization in dynamics, as well as in comparison with the indicators of competitors.

According to the financial statements of the organization, the turnover ratio can be determined as follows (Order of the Ministry of Finance dated July 2, 2010 No. 66n):

ODZ = Line 2110 / [(Line 1230N + Line 1230K) / 2]

where line 2110 is the amount reflected in line 2110 “Revenue” of the income statement for the reporting period;

line 1230Н – indicator of line 1230 “Accounts receivable” of the balance sheet at the beginning of the reporting period;

line 1230K – indicator of line 1230 of the balance sheet at the end of the reporting period.

However, given that line 1230 reflects all receivables (including, for example, advances issued and overpayments to the budget), to calculate the receivables turnover ratio, it is advisable to “clear” the line 1230 indicator. That is, take into account only the debt of buyers and customers.

However, this does not reduce the conventionality of the turnover ratio, because the numerator still reflects net revenue, i.e., excluding VAT, while the balance sheet shows customer debt in full.

Formula for calculating the coefficient: general view and individual clarifications

To calculate the accounts receivable turnover ratio, the formula is used:

To achieve greater reliability of the calculated coefficient, it is necessary to take into account three nuances:

- Revenue for purposes of calculating the ratio should not be “cleared” of VAT and excise taxes, since accounts receivable, as a rule, include these taxes.

- The volume of receivables includes exclusively the debts of buyers and customers - from the entire set of receivables, it is necessary to exclude such elements as advances issued, taxes overpaid to the budget, etc.

- When calculating the SSR, data can be used not only at the beginning and end of the year, but also analytical information about accounts receivable broken down by shorter periods (days, decades, months, quarters, etc.).

If, when calculating the ratio, data on accounts receivable only from the annual balance sheet is used, the formula takes the following form:

Our materials will help you take into account the subtleties and nuances in different life situations:

- “What nuances and pitfalls can there be when buying an apartment”;

- “What are the nuances when leasing agricultural land”;

- “How to make early repayment of a mortgage: instructions and nuances.”