Representation of interests in court in a bankruptcy case by proxy

It is not always possible for an individual or legal entity that has declared itself bankrupt to represent its interests in courts and other authorities. In this case, he delegates his powers to the attorney.

The first paragraph of Article 36 of Federal Law No. 127-FZ of October 26, 2002 states that any capable citizen whose powers are duly formalized can be a representative of a bankrupt.

A power of attorney to conduct a bankruptcy case serves as a document certifying the rights of the person conducting the bankruptcy case. It is issued in writing and is considered valid only if the date of its issue is indicated. The validity period of the document is also important. In case of its absence, the power of attorney will be considered valid for a year after signing.

If a legal entity acts as a principal, then the power of attorney is issued by its director or other authorized person. If there is a seal, the power of attorney must contain it. The document specifies the main powers that the principal grants to his representative. The attorney has the right to carry out only prescribed actions.

One of the main rights that a power of attorney grants to an attorney to conduct a bankruptcy case is representation in court. This right can be vested in both the representative of the debtor and the creditor.

Usually, both parties prefer to entrust the conduct of legal proceedings to a third party. This is due to the fact that attorneys will be able to competently approach the problem and resolve it to the benefit of the client. Representation of interests in court by proxy involves the implementation of all necessary actions: from drawing up complaints to filing a petition.

Among other things, this document allows creditors to vest the attorney with the following powers:

- voting during the meeting of creditors;

- filing complaints against the manager;

- approval of a candidate nominated during a meeting of creditors, etc.

The document allows you to represent the interests of the principal in the arbitration court.

How to properly issue a power of attorney to the court

The text of the power of attorney provides a list of actions that the attorney must carry out, as well as a list of his rights.

In practice, the principal issues a power of attorney with the following powers:

- presentation and signature of statements of claim;

- appealing court decisions;

- participation in a meeting of creditors;

- filing complaints and petitions;

- representation in state and non-state bodies, appealing their decisions in court;

- implementation of representation in the notary office, as well as in local government bodies.

The above powers can only be handled by a qualified lawyer who has experience in the field of bankruptcy.

Access to cases

The representative receives access to the bankruptcy case only in cases where the power of attorney is issued in accordance with legal requirements.

In other cases, the power of attorney is issued in simple written form. But in practice, many people prefer to have a power of attorney certified by a notary, even if this is not mandatory.

In fact, notarization of a power of attorney is correct, since the notary will draw up its text in accordance with all legal requirements, taking into account all the wishes of the principal. This reduces the likelihood that the arbitration court will not accept the representative’s power of attorney and will not allow him to participate in the bankruptcy case.

Examples of bankruptcy of individuals will help you evaluate all the pros and cons of this process and decide for yourself the feasibility of using this method.

We will explain what are the differences between bankruptcy of non-profit organizations.

If a representative acts on behalf of a company, the power of attorney must be signed by its director or a person with appropriate authority. A power of attorney for bankruptcy of an individual is signed by that individual.

The legislation provides participants in legal proceedings and their representatives with a fairly wide list of various rights and opportunities, but they cannot abuse them and violate the rights of other participants: for this they can be held accountable

Applicants declaring their critical financial situation do not need a sample power of attorney for bankruptcy of individuals, since its execution is still carried out by a notary.

But you need to clarify in advance what powers should be specified and make sure that the necessary “options” are specified. Otherwise, you may encounter a situation where the trustee needs to take some action, but he is not allowed to do so.

The document usually states:

- date and city (locality);

- information about the person issuing the power of attorney - that is, the person involved in the bankruptcy case;

- information about the trusted person - that is, the one who will actually speak in court;

- the name of the company and its details, if the document is issued on behalf of a legal entity;

- list of powers assigned to the trustee;

- case number and information about the parties, if legal proceedings have already begun;

- You can specify any period for which the power of attorney is issued (if not specified, the period will be valid for 1 year).

We suggest you read: How to check a person for bankruptcy status?

At the end of the document, the signatures of both parties are placed, as well as the signature and seal of the notary. Without these required elements, the paper will not be considered valid.

In general, a bankruptcy power of attorney is a very convenient tool that allows citizens to protect their interests by involving professional lawyers in the case, as well as in cases where they cannot appear in court for objective reasons. As for legal entities and individual entrepreneurs, they usually always issue a power of attorney, since they are busy liquidating the enterprise.

Document form

When it becomes necessary to draw up such a power of attorney, the question arises of choosing the appropriate form. You need to know that in this regard, the legislation does not put forward any restrictions. You can compose a document in a free style. Although many prefer a simpler option. To do this, just find an existing form online, which already contains all the most necessary information. The filler can only enter the information in the appropriate lines.

Types of powers of attorney

As you know, there are three types of powers of attorney:

- one-time;

- special;

- general

But here you need to understand that one-time and special powers of attorney have significant limitations on their powers. As a rule, such documents are drawn up when the representative only partially participates in the process. This happens extremely rarely, but still the principal has the opportunity to hire an assistant in this way. We can say that such powers of attorney in this case are an exception. In most cases, a general power of attorney is issued, with which you can transfer all powers. Only the holder of such a power of attorney can collect creditors, have the right to vote, and perform any actions related to this issue.

How to correctly draw up a power of attorney to handle bankruptcy cases

If we compare this power of attorney with other similar documents, there are no serious differences. When registering, you should adhere to standard rules. The document must contain a “header”, main and final parts. If we are talking about a power of attorney, which is drawn up on behalf of a legal entity, it must be signed by the director. If the company uses a seal, its imprint is also affixed here.

The powers of the representative must be clearly defined. It should be remembered that if some action is not specified, the authorized person will not be able to perform it. Accordingly, in this case the attorney will not be able to fully fulfill his duties regarding the conduct of this case.

What is written in the text

The document must contain important information, which includes:

- date and place of execution of the power of attorney;

- the name of the company on behalf of which the document is issued;

- details of the bankrupt company;

- information about the manager;

- an indication that the attorney is vested with certain powers;

- a list of actions that a representative can perform;

- full information about the authorized person, if this is an employee, his position is indicated;

- signatures of responsible persons.

If necessary, you can enter any additional information here. Here the principal himself decides. In general, the more information is specified in the document, the greater the likelihood that there will be no claims against the power of attorney.

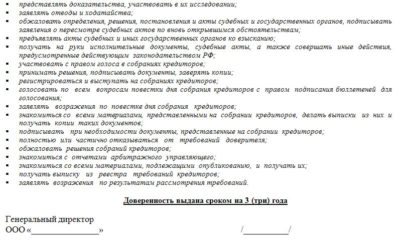

Sample power of attorney for representation of interests in bankruptcy from a legal entity

Many people read what is written on the Internet and often do not read the letters of the law, thereby misleading themselves and others. The price of services does not depend on the number of creditors and the amount of debt. Citizens may be prohibited from traveling abroad until the court makes a ruling on the completion or termination of insolvency and bankruptcy proceedings. Thus, the court can prohibit the debtor from traveling abroad until the completion of the procedure for the sale of his property. How long does the bankruptcy procedure for an individual last?

As for other persons: “involve other persons to ensure the exercise of their powers on a contractual basis with payment for their activities at the expense of the debtor, unless otherwise established by this Federal Law, a meeting of creditors or an agreement of creditors;” those. can attract but only precisely to ENSURING IMPLEMENTATION, but not in any other way.

The specified list of powers is minimal. When compiling it, it is necessary to take into account all possible situations and supplement the list at your own discretion.

General power of attorney to conduct bankruptcy proceedings

The bankruptcy procedure requires mandatory provisions that must be reflected in the general power of attorney. Otherwise, the representative will not be able to participate in the meeting of creditors.

Thus, a general power of attorney to conduct bankruptcy proceedings must include the following items:

- representation of interests in arbitration court;

- drawing up and filing statements of claim (especially statements of insolvency (bankruptcy));

- writing responses to petitions from the other party;

- challenging court decisions related to determining the financial insolvency of a company;

- conclusion of a settlement agreement;

- recognition of claims by the plaintiff;

- signing, filing and receiving other documents within the competence of the attorney.

If we are talking about the participation of an attorney in a meeting of creditors, then the document must also contain provisions giving the latter the right to attend and vote in all matters considered at the meeting.

Power of attorney for representation in court on declaring an individual bankrupt

Most often, powers are transferred by: the debtor and/or his creditors. Full transfer of powers occurs only through a general power of attorney.

Both forms must contain basic details required for all types of trust documentation.

This form requires entering specific names, indicating the locality where they are located.

Power of attorney to conduct bankruptcy cases of legal entities

A power of attorney to conduct business bankruptcy cases is issued in writing.

The powers will depend on the legal status of the participants in the financial insolvency of the enterprise: the document must include paragraphs relating to issues of the bankruptcy case: A power of attorney for participation in a meeting of creditors requires details on the conduct of business and must contain the following provisions:

- participation in the meeting of creditors and participation;

- appealing the actions of the arbitration manager;

- signing of ballots when voting;

- approval of the candidate in the creditors' committee;

- signing other documents.

Thus, the bankruptcy procedure itself requires the inclusion of mandatory provisions, without which the participation of a representative at a meeting of creditors will be impossible.

The document must contain: Thus, a power of attorney for the participation of a professional specialist represented by a lawyer facilitates the actions of the creditor or debtor in the legal process.

Sample power of attorney for participation in a bankruptcy case in an arbitration court

Representatives of one of the parties cannot be: The paper does not have a set form and can be written arbitrarily. But for it to be legally valid, compliance with certain drafting rules described in the Arbitration Procedure Code of the Russian Federation is required.

A power of attorney for bankruptcy in court must have the following points: An example of drafting can be found on the Internet in the public domain. For clarity, here is a sample of how to write a document. Power of attorney for representation of interests in arbitration court.

The fifth of May two thousand and seventeen.

Power of attorney to conduct civil cases in courts, with the right to conclude a settlement agreement

The bankruptcy power of attorney must indicate the date of its issue to the representative, otherwise it is considered invalid.

In addition, it is necessary to indicate the validity period of the power of attorney for the conduct of bankruptcy cases. If this is not indicated, the power of attorney will be valid for one year from the date of its signing (clause

1 tbsp. 186 of the Civil Code of the Russian Federation). The right of delegation may be provided (the ability for a representative to transfer his powers to another person).

A power of attorney on behalf of a legal entity must be signed by its head (director) or another person who has the right to do so and sealed (if any) (clause 5 of Article 61 of the Arbitration Procedure Code of the Russian Federation).

, INN, OGRN, checkpoint, location: , registered, person, year of birth, gender, passport, issued, department code

Sample power of attorney for bankruptcy of an individual

.doc Thus, the content of a power of attorney for the bankruptcy of an individual should be structured according to the following scheme: A power of attorney can be issued both for the entire process of conducting a bankruptcy case and for its individual procedures.

For example, to participate in a meeting of creditors, for representation in a specific court hearing, etc.

Powers can be granted in one power of attorney to either a single person or several at once. Powers of attorney from individuals for representation in court must be certified either by a notary or in another way provided for in paragraph.

Source: https://credit-helper.ru/doverennost-na-predstavitelstvo-v-sude-o-priznanii-bankrotom-fizicheskogo-lica-25741/

Powers in a power of attorney for bankruptcy

Typically, a power of attorney to conduct a bankruptcy case contains a wide range of powers, which depend on the legal status of the participants in the bankruptcy procedure.

The authority must not in any way be infringed upon by other parties to the litigation. Otherwise, the trustee may be held liable.

Among the powers vested in an attorney are his right to:

- representation;

- signing statements;

- presentation of evidence to a judicial authority;

- obtaining court decisions;

- familiarization with the case materials, making copies of it, etc.

The rights specified in the document must be limited by the legislation of the Russian Federation.

Special powers of a creditor's representative in a bankruptcy case

In addition to the established powers, the creditor's attorney in a bankruptcy case may also be granted special rights. Among which:

- partial or complete waiver of claims;

- changing the grounds of claim;

- transfer of authority to another person;

- signing an application for review of judicial acts in connection with newly discovered circumstances;

- receipt of awarded funds and property.

Power of attorney from a physicist in case of bankruptcy

Therefore, the external manager has the right and obligation to issue judicial powers of attorney to protect the interests of the debtor on behalf of the organization - the debtor, with his signature, confirmed by the seal of the debtor. Participate in the bankruptcy case and in the arbitration process in the bankruptcy case with all the rights provided for by the Arbitration Procedure Code of the Russian Federation and the Bankruptcy Legislation, including acting on behalf of Kolos LLC, making statements, giving explanations, receiving and issuing documents, with the right to receive , filing and signing applications, petitions, complaints within the framework of bankruptcy proceedings in an arbitration court.

Fulfill in full and in monetary form the debtor's obligations to bankruptcy creditors or provide the debtor with the funds necessary to satisfy the requirements of the authorized bodies, including for payment of interest accrued in accordance with the Federal Law “On Insolvency (Bankruptcy)”, as well as amounts of penalties (fines, penalties).

To draw up a power of attorney, an identification document is required (usually a passport of a citizen of the Russian Federation). The document is drawn up in accordance with the requirements of the law and a certain range of powers for conducting bankruptcy proceedings. The head of the enterprise also has the right, within the powers determined by the title documents, to conduct a bankruptcy case.

Who needs the document and why?

A power of attorney is issued if it is impossible for a participant in a bankruptcy case to personally participate in the process of recognizing financial insolvency.

It can be issued to any person who, on behalf of the principal, will submit petitions, provide evidence, receive court decisions, participate in court hearings, etc.

Any participant in the bankruptcy case can act as a principal. Based on the provisions of Art. 34 127-FZ the participants in the process are:

- Debtor.

- Bankruptcy creditors.

- Arbitration manager.

- Authorized bodies.

- The person who provided security in the financial recovery procedure.

Typically, the principals are the debtor and his creditors. The manager does not have the right to delegate his powers.

Based on the provisions of paragraph 1 of Art. 36 127-FZ in a bankruptcy case, representation of the interests of participants in the process is allowed. According to this provision, any capable citizens with duly formalized powers can represent the interests of citizens, individual entrepreneurs and legal entities who participate in a bankruptcy case.

In paragraph 4 of Art. 36 127-FZ emphasizes that a power of attorney issued and executed in accordance with the norms of Russian legislation serves as proper formalization of powers.

Based on these legal norms, the list of powers of the trustee must be listed in the power of attorney. A power of attorney to conduct a case in an arbitration court without a separate indication of certain powers does not provide these powers. But taking into account the provisions of Art. 71, 100 127-FZ, claims of creditors can be signed by a person with a general power of attorney to conduct a case in an arbitration court with the right to sign applications (under Part 2 of Article 62 of the Arbitration Procedure Code).

Subject to para. 2 p. 1 art. 37, paragraph 2, art. 40 and para. 2 p. 2 art. 150 127-FZ, the power of attorney should additionally stipulate such powers as signing an application to declare the debtor bankrupt, the right to participate in voting on the issue of concluding a settlement agreement.

If a bankruptcy case received a document from a person who did not have the authority to conduct the case, then the person who was vested with such authority may approve the procedural actions previously performed by the unauthorized person.

My own lawyer

Tweet

POWER OF ATTORNEY № 234/14

Moscow, September twentieth, two thousand and fourteen

This power of attorney was issued to Mikhailov Peter Alekseevich, passport: 60 08 No. 128345 issued on 17.08.2008 of the Moscow Ministry of Internal Affairs of Russia ”, the code of unit 134-500, for the interests of the Limited Liability Company“ Chamomile ”(TIN 3016027648, OGRN 1036780309519) .

In accordance with this power of attorney, Mikhailov P.A. on behalf of Kolos LLC has the right:

In the arbitration court, at all stages of the judicial process, appeal, cassation and supervisory instances, with the right to perform all procedural actions provided for in Article 62 of the Arbitration Procedure Code of the Russian Federation, including signing a statement of claim and a response to the statement of claim, applications for securing a claim, transfer of the case to an arbitration court , complete or partial waiver of claims and recognition of the claim, changing the subject or basis of the claim, concluding a settlement agreement and agreement on factual circumstances, as well as the right to sign an application for review of judicial acts based on newly discovered circumstances, appealing judicial acts of the arbitration court, receiving awards cash or other property, performing other actions related to this order.

In a bankruptcy case and in arbitration proceedings in a bankruptcy case, represent the interests of the principal with all the rights provided for by the Arbitration Procedure Code of the Russian Federation and the Bankruptcy Legislation, including authorizing participation in a meeting of creditors and in a meeting of the committee of creditors with voting rights, and also grants: the right filing and signing the debtor's application for recognition as insolvent (bankrupt); applications from the creditor for recognition as insolvent (bankrupt); grants the right to receive, submit and sign applications, petitions, complaints within the framework of bankruptcy proceedings in an arbitration court; the right to convene a meeting of creditors; the right to demand the provision of a report from the arbitration manager; the right to challenge candidates for arbitration managers; the right to perform other actions related to this instruction:

Participate in the bankruptcy case and in the arbitration process in the bankruptcy case with all the rights provided for by the Arbitration Procedure Code of the Russian Federation and the Bankruptcy Legislation, including acting on behalf of Kolos LLC, making statements, giving explanations, receiving and issuing documents, with the right to receive , filing and signing applications, petitions, complaints within the framework of bankruptcy proceedings in an arbitration court.

Participate in meetings of creditors (including the first meeting of creditors) with the right to vote on all issues on the agenda, receive voting ballots, vote with them or in another established manner on all issues on the agenda.

Make the necessary decisions (vote): on introducing and changing the deadline for financial rehabilitation, external management and filing a corresponding petition with the arbitration court;

on approval and amendment of the external management plan and approval of the financial recovery plan and debt repayment schedule;

on approval (determination) of requirements for candidates for an administrative manager, external manager, or bankruptcy trustee;

on the selection of a self-regulatory organization to submit to the arbitration court candidates for an administrative manager, an external manager, or a bankruptcy trustee;

on the selection of a registrar from among those accredited by a self-regulatory organization;

on concluding a settlement agreement;

on applying to the arbitration court with a petition to declare the debtor bankrupt and to open bankruptcy proceedings;

on the formation of a creditors’ committee, determination of the quantitative composition, election of members of the creditors’ committee, on the early termination of the powers of the creditors’ committee and on the election of a new composition of the creditors’ committee;

on the assignment to the competence of the committee of creditors of making decisions that, in accordance with the Federal Law “On Insolvency (Bankruptcy)”, are adopted by a meeting of creditors or a committee of creditors;

on the election of a representative of the meeting of creditors;

on filing a petition with the arbitration court to remove the arbitration manager;

on the inclusion of additional issues and decisions taken on them on the agenda of the creditors’ meeting;

as otherwise provided by the Federal Law “On Insolvency (Bankruptcy)”

questions.

Demand the convening of a meeting of creditors, and if the meeting of creditors is not held by the arbitration manager within the time limits established by the Federal Law “On Insolvency (Bankruptcy)”, hold a meeting of creditors.

Require the inclusion of issues on the agenda of the meeting of creditors and formulate issues to be included on the agenda of the meeting of creditors. Prepare, sign and submit applications, petitions and complaints, including about disagreements, violations of rights and legitimate interests, complaints against the actions of the arbitration manager, decisions of the meeting of creditors and committee of creditors, to invalidate the decision of the meeting of creditors, transactions concluded or completed by the debtor .

Request the issuance of an extract from the register of creditors' claims on the amount, composition and order of satisfaction of his claims or a copy of the register of creditors' claims.

Reject candidates for arbitration managers indicated in the list of candidates and petition for the removal of the debtor's head in the financial rehabilitation procedure.

Demand the provision of reports from the arbitration manager and foreclosure on the debtor’s property illegally obtained by third parties in the amount of claims remaining unpaid in the bankruptcy case, or recovery of the corresponding amount without foreclosure on the debtor’s property.

Fulfill in full and in monetary form the debtor's obligations to bankruptcy creditors or provide the debtor with the funds necessary to satisfy the requirements of the authorized bodies, including for payment of interest accrued in accordance with the Federal Law “On Insolvency (Bankruptcy)”, as well as amounts of penalties (fines, penalties).

Represent the interests of the meeting of creditors and the committee of creditors, exercise control on their behalf over the actions of the arbitration manager, as well as exercise other powers granted by the meeting of creditors in the manner prescribed by this Federal Law “On Insolvency (Bankruptcy)”, including: demand from the arbitration manager or the debtor's manager provide information about the financial condition of the debtor and the progress of bankruptcy procedures;

appeal to the arbitration court the actions of the arbitration manager;

make decisions on convening a meeting of creditors and on addressing the meeting of creditors with a recommendation to remove the insolvency practitioner from performing his duties;

make other decisions, as well as perform other actions if the meeting of creditors grants such powers in the manner established by the Federal Law “On Insolvency (Bankruptcy)”.

Perform other actions related to this instruction.

Signature of Petrov I.F. ___________________________ I certify.

The powers under this power of attorney cannot be transferred to other persons.

The validity period of this power of attorney is 1 (one) year.

CEO

Kolos LLC _______________ A.S. Gubarev

Related topics:

- Application to appeal the actions (inaction) of the bankruptcy trustee Application of the bankruptcy creditor to declare a citizen bankrupt sample Application for recovery of damages from the arbitration manager Petition to exclude property from the bankruptcy estate of the debtor THE PLEDGOR PAID THE DEBT OF THE BANKRUPTCY BORROWER

Who makes up

The power of attorney is prepared by the principal and his representative. Typically, the representative is a professional lawyer from the staff of the company or organization specializing in bankruptcy.

A power of attorney to represent the interests of a legal entity may not be executed by a notary. The transfer of authority is confirmed by the manager’s signature and seal (if any). But if the head of the company is removed from business and his powers are transferred to the manager, the power of attorney loses its legal force.

As for the power of attorney from individuals for their representation in court, such a power of attorney is certified by a notary or otherwise in accordance with paragraph 2 of Art. 185.1 Civil Code. For example, powers of attorney from persons undergoing treatment in specialized institutions are certified by the head physician (in his absence, by the senior or duty doctor); powers of attorney from persons living in stationary service organizations can be certified by the head of social security.

In most cases, when a power of attorney is issued on behalf of an individual, it is drawn up by a notary.

What does a power of attorney provide for bankruptcy?

Participate in meetings of creditors (including the first meeting of creditors) with the right to vote on all issues on the agenda, receive voting ballots, vote with them or in another established manner on all issues on the agenda.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website. In the case under consideration, maximum attention should be paid to the list of powers vested in the representative of an individual (we have included a detailed list of them in a sample power of attorney, which can be downloaded from the link below).

The text of the power of attorney must indicate the place and date of its issue. It is also necessary to indicate the validity period of the power of attorney. The maximum period provided for by current legislation is 3 years. If the validity period of the power of attorney is not provided, then it is considered that it was issued for 1 year.

All issues related to bankruptcy are regulated by Federal Law No. 127. In accordance with paragraph 1 of Article 36 of the said regulatory act, a power of attorney to represent interests in a bankruptcy case can be issued to any legally capable person, regardless of who the witness is: debtor or creditor.

But there are also certain limitations. Namely: a power of attorney from a financial manager in a bankruptcy case cannot be issued. Only one member of a self-regulatory organization selected by the court has the right to occupy this position. If the arbitration manager is unable to fulfill his duties, he is removed from this position and his place is taken by a new person who meets the requirements of Russian legislation.

Participating in a bankruptcy case are:

- debtor;

- creditors (the bank that previously issued a loan to the bankrupt, organizations that supplied goods, and others);

- authorized bodies from among government agencies (most often the Federal Tax Service);

- arbitration manager.

In practice, there are very often cases when a power of attorney is issued to a representative in the presence of legal proceedings. In this case, the representative can carry out insolvency representation only in cases where he is given the opportunity to familiarize himself with the case materials. Accordingly, such authority must be indicated in the text of the power of attorney.

The power of attorney was signed by citizen Artem Pavlovich Razumovsky in my presence after reading the text of the power of attorney out loud. Our website will help you draw up such a document correctly, without contacting a notary. Dzerzhinsky, house 14, apartment 38 Power of attorney issued for a period of one year. Participation by a representative upon oral request is allowed.

In practice, there are very often cases when a power of attorney is issued to a representative in the presence of legal proceedings. In this case, the representative can carry out insolvency representation only in cases where he is given the opportunity to familiarize himself with the case materials. Accordingly, such authority must be indicated in the text of the power of attorney.

According to existing legislation, the financial manager must conduct the bankruptcy procedure in any case, which means that the constant presence of the debtor at meetings does not make much sense. Is personal bankruptcy right for you? Don't rush!

In Russian and foreign organizations of any form of ownership, with the rights to negotiate, approve documents, consider complaints, claims within the framework of transactions, one of the parties to which is the Enterprise.

Drawing up a power of attorney for different situations

Depending on who is the party to the bankruptcy case, the features of participation have some of their own nuances. However, the structure of the document giving the representative the right to act on behalf of the bankrupt or creditor, as well as to influence the case during its consideration, is always the same. It consists of:

- title of the document;

- dates and places of compilation;

- passport details of the principal and representative;

- text with a list of powers;

- the duration of these powers;

- personal signature of the principal;

- block, which is filled out by the notary.

At the end of the document, before the signatures, you can indicate the presence or absence of the possibility of entrusting the listed powers to another person.

For bankruptcy of an individual

Often issued to an experienced lawyer or any other person, including a civilian. A deed of trust for the bankruptcy of an individual is a standard document when transferring powers to a representative, therefore it does not have any significant features.

The main point here is passport information about the identity of the representative and restrictions on rights by clearly stating the powers and the limited validity period of the document.

For bankruptcy of a legal entity

There are several key features:

- The seal of the company, enterprise, organization of the principal with the personal signature of the head, general director is required;

- recording the available evidence with the attachment of such, on the basis of which a legal entity applies to the arbitration court;

- All details of the company are required, including TIN, OGRP, Charter.

For legal entities, a general power of attorney is often issued.

For bankruptcy of individual entrepreneurs

The document is practically no different in design when compared with a power of attorney for individuals, since that is what an individual entrepreneur is. That is, the individual entrepreneur transfers to the representative the right to act in his interests precisely as an individual.

The registration number of an individual entrepreneur must be indicated.

Registration procedure

Federal Law No. 127-FZ gives citizens, organizations and entrepreneurs the opportunity to attract representatives to protect their interests in court - proxies. They act both in courts of general jurisdiction and in arbitration.

Often a power of attorney is issued for the participation in the process of a lawyer who knows the specifics of conducting the proceedings and can achieve favorable conditions for the bankrupt.

The document can also be issued by the creditor if he cannot come to the court in person, which is important for large companies and banks. In this case, the interests of the legal entity are usually represented by a full-time or hired lawyer, to whom a power of attorney has been issued to the bankruptcy court for the individual. Its goal is to recover the maximum amount of funds received from the sale of the debtor’s property in case of bankruptcy of the borrower.

Similarly, a power of attorney can be issued on behalf of third parties involved in the case.

We invite you to familiarize yourself with: Power of attorney to receive an extract from the Unified State Register of Legal Entities

The document will be useful for speaking in court. Its owner, in accordance with the legislation of the Russian Federation, can:

- file claims, including counterclaims;

- appeal the decision of the bankruptcy court;

- seek restructuring instead of bankruptcy;

- oppose the stated demands and recognition of the claim, petition to change the subject of the proceedings;

- admit the claim in full or only in part;

- amend the bankruptcy petition;

- file complaints and petitions;

- challenge judges or juries;

- enter into a settlement agreement.

A power of attorney gives the right to protect the interests of the principal in government agencies, and not just in court. For example, if it is necessary to contact the tax office or other institutions as part of the proceedings.

In the event of bankruptcy, it is difficult for an ordinary person who has never encountered anything like this to understand all the vicissitudes of legal proceedings. Therefore, a lawyer usually acts as a trustee.

The specific algorithm for issuing a power of attorney and the “set” of permissible operations are determined by who exactly carries out the bankruptcy. So, for an individual the registration procedure will be one, and for a legal entity it will be different.

It is important to take into account the validity period of the document. If the power of attorney does not contain the date of issue, the document will be invalid. Any period can be specified. By default, this is 1 year from the date of discharge.

If a legal entity goes bankrupt, the procedure for issuing a power of attorney to conduct a bankruptcy case is different:

- the participation of a notary is not required, the document is certified by the head of the company or a person replacing him (acting, acting or bankruptcy trustee);

- the power of attorney is issued on behalf of the entire organization, and not its director;

- The document must be affixed with the company's seal and the manager's signature.

If the director of the company was removed from the management of the organization (and in bankruptcy this is not a rare procedure) and an arbitration manager was appointed instead, then the power of attorney in the name of the former person is considered revoked. And you won’t be able to use it in court.

Therefore, the lawyer protecting the interests of the company, in the event of the removal of the previous management, needs to update the documentation of the new director.

Often, the purpose of drawing up a power of attorney for a professional lawyer is to avoid vicarious liability. The trustee is faced with the task of proving in court that the company’s bankruptcy was not intentional and that management is not to blame.

The law has given individuals the formal right to declare bankruptcy, but many debtors have no idea where to start, let alone defend themselves in court.

Therefore, a qualified lawyer will help in a bankruptcy case, who will receive a power of attorney and represent the interests of his client in court. But any other person, even a relative, can be a confidant.

A power of attorney is issued on the basis of the passports of both persons: the principal himself and the authorized representative. The paper is drawn up by a notary. The cost of the service is from 1.5 thousand to 5 thousand rubles, depending on the complexity of the documentation and notary fees.

To avoid potential problems, it is better to list in the document the specific powers of the trustee during the bankruptcy meeting. Or even issue a general power of attorney to him. Then the owner of this document will be able to participate in bankruptcy proceedings and dispose of the debtor’s property.

When closing his company, an individual entrepreneur risks not only the company’s property, but also his own.

Taking this into account, many individual entrepreneurs in case of bankruptcy prefer to play it safe and issue a power of attorney to speak in court to a professional or a person who understands legal issues better than himself.

The status of an individual entrepreneur is intermediate between a private individual and a “real” company. Therefore, the procedure for issuing a power of attorney for him is similar to the algorithm for an individual. He needs:

- take your passport and a copy of the passport of the future authorized representative;

- contact a notary;

- declare your desire to issue a power of attorney for representation in a bankruptcy case;

- clarify what powers should be specified in the document;

- pay the cost of the service according to the tariff;

- receive the paper in your hands.

We suggest you read: Check the company for debt

Even if the individual entrepreneur himself defends his interests in court, a power of attorney will not hurt. He will be able to use the help of a trusted person, for example, if he needs to pick up documents from a court or government organization.

Bankruptcy and sale of property are not always the only way out of the situation. It happens that the court, seeing the potential bankrupt’s ability to repay the debt, orders a restructuring of his obligations on favorable terms.

And also the parties can come to an amicable agreement - that is, agree on repayment of the loan in a convenient manner. Lenders agree to forgive the borrower the accrued interest and penalties if they understand that he does not have property to cover the debts, or that the process may be delayed.

The signed settlement agreement is an official document, and it leads to the termination of legal proceedings on the issue of bankruptcy of the citizen. Therefore, if the principal can agree to a settlement with the creditors, this will be a good achievement. Thus, the borrower will have a real chance to pay off debts without extreme measures.