Until what time do they have the right to call from the bank?

This article will tell you at what time collectors can call the debtor, and how often they have the right to do this. Few people know that as of January 1, 2014, provisions of the law on consumer credit came into force, limiting the time when collectors or the bank collection service can call the debtor and remind them about the debt. So, calls at night on weekdays are limited.

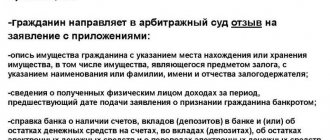

The application is suspended for 2 months after the court decision regarding debt collection comes into force, but then automatically resumes. When making telephone calls, collectors are prohibited from using numbers that are not official (registered to the collector), and they are also prohibited from hiding the phone number. You cannot call if this method of interaction with the debtor is not provided for in the agreement between the creditor and the collector.

Blocking phone calls

Yes, there are restrictions. The standards according to which calls should be made were adopted in the Federal Law “On the Protection of the Rights and Legitimate Interests of Individuals.” It deals specifically with situations where activities are carried out to repay overdue debts. The law applies not only specifically to collectors, for example, but to persons acting in the interests of the creditor. That is, the bank’s security service also falls under it. The set times for calls are as follows:

- On weekdays from 8-00 to 22-00;

- On weekends and holidays, this schedule shifts slightly to the period from 9-00 to 20-00.

In addition, the number of calls made is also established there. Collectors or bank security officers may eventually call you no more often than:

- 1 per day;

- 2 times per week;

- 8 times a month.

What to do if a debt collector calls you at work, read this article.

A debt collector constantly calling is a typical situation in Russian reality.

The Law on Collectors, adopted in July 2020, states the frequency and time when calls from collectors are permissible. So:

- On weekdays, collectors can call from 8 a.m. to 10 p.m.;

- On weekends, collectors can call debtors from 9 a.m. to 8 p.m.;

As for the frequency of collection calls, according to the new Law, they should arrive no more than twice a week.

If the collection service cannot contact the debtor for a long time, the next in line are his close relatives (whose telephone numbers, as a rule, are written down in loan agreements just in case).

Read about whether debt collectors have the right to call relatives of the debtor here.

The law on collectors talks about loved ones and relatives who are prohibited from calling. These include:

- Women are “in position”;

- Mothers who have children under 1.5 years old;

- Relatives who are over seventy years old;

- Relatives who are in the hospital;

- Relatives with 1st group of disability;

In other cases, calls from collectors are legal only if the borrower's debt period is more than one month.

Phone calls are a method of interaction that the debtor can easily block himself. Changing the number (SIM card), temporarily disconnecting the phone and installing a blocking program on the mobile device - these three options are the most widespread. Of course, avoiding negotiations with a creditor or collector can seriously speed up filing a claim in court to collect the debt, but it does not entail any other negative consequences for the debtor.

If there are violations by debt collectors, the debtor has many opportunities to file a complaint. The prosecutor's office and the police are universal authorities for complaints. Special - FSSP, and on site - the territorial division of the bailiff service. In the first months of the new law, which tightens the requirements for collectors and their activities, according to FSSP statistics, the number of complaints increased 10 times. The number of administrative cases against debt collectors has also increased. Therefore, this method works quite effectively in practice.

In addition, MFOs refer to the provisions of Article 15 of the current edition of the Federal Law “On Consumer Credit (Loan)”, which regulates the collection of loan debt. There is no mention of third parties in this article, that is, the law does not directly allow interaction with third parties, nor does it prohibit it. Therefore, the MFO will appeal the decision of the court of first instance and await decisions on similar claims filed in other courts.

What rights does a collection agency have?

Acting as an agent, the debt collector is nothing more than an intermediary whose entire role is to provide debt collection services to the creditor. If we turn to the provisions of the Law on Consumer Credit (Loan), then all the rights of the collector in relation to the borrower can be reduced to a short but succinct definition - he can only politely and politely ask to repay the debt.

- Require fulfillment of obligations earlier than the period established by the loan agreement or law.

- Call, conduct personal meetings, send SMS from 22:00 to 08:00 on weekdays and from 20:00 to 09:00 on non-working holidays and weekends.

- Perform any action with the intent to cause any harm.

- Abuse the right in any form.

Allowed time for calls from the bank

Time frame. How to protect yourself? The law clearly states not only how many times a day collectors can call, but also to what period of time communication is limited. The interval varies depending on the day of the week.

On weekdays, you can disturb the borrower with calls only from eight in the morning to ten in the evening. These time frames are also reserved for personal meetings and sending messages. Let's look at the innovations In the new law, in addition,

- Visit the bank management with a demand to stop calls from 22:00 to 8:00.

- Contact the prosecutor's office with a statement about violation of the law.

- If the callers do not identify themselves, the borrower can write a statement indicating the fact of extortion.

I suggest you familiarize yourself with them.

Article 15. Features of taking actions aimed at repaying debt under a consumer credit (loan) agreement 1) personal meetings, telephone conversations (hereinafter referred to as direct interaction); 3. The following actions are not allowed on the initiative of the creditor and (or) the person carrying out debt collection activities: For additional clarification, you can contact me by writing a personal message September 23, 2020, 21:04 Vladimir,

- On weekends and holidays, this schedule shifts slightly to the period from 9-00 to 20-00.

- On weekdays from 8-00 to 22-00;

In addition, the number of calls made is also established there.

— It is necessary to register a legal entity with assets of more than 10 million.

If employees involved in collecting a problem loan cannot contact the debtor, they begin calling his relatives.

How many times a day can collectors call by law: rights, features and requirements How many times a day can collectors call by law: rights, features and requirements Let's take a closer look at the powers of employees of such agencies.

That is, any threats are prohibited, and even more so, damage to property (this also applies to offensive inscriptions, which collectors often use as a way to influence non-payers). Agencies cannot contact a bank client who is behind on payments if the loan agreement does not contain a corresponding clause allowing the involvement of third parties.

In addition, the financial institution is obliged to notify the debtor that his debt has been transferred to a collection company.

When making calls to the debtor, the telephone numbers of collection agencies and collection services must be determined by cellular operators, and email addresses must not be hidden. The use of physical force against the debtor, threats to life, and causing harm to health and property is prohibited.

Of course, this point only works in cases where the creditor did not go to court or the judge ruled in favor of the defaulter.

Internet reception of the Prosecutor General's Office

- Federal Bailiff Service of the Russian Federation.

How many times a day can debt collectors call by law in 2019? Hire a lawyer and instruct him to communicate with debt collectors about the debt. Code of Civil Procedure of the Russian Federation Article 434. Postponement or installment plan for the execution of a court decision, changing the method and procedure for its execution, indexation of awarded sums of money. The only gap in the law is the lack of information about punishments for violations committed by debt collectors.

The only point that touches on this issue is the instruction on full compensation for damage caused by illegal actions. Who can demand repayment of a debt?

Features of communication with debt collectors that you should know about The law not only determines how often employees of collection agencies can call citizens and communicate with them, but also sets a time frame. Taking into account the current provisions of the federal act, debt collectors have the right to call a person who has a loan debt only if the person initially gave consent to the processing of personal data.

Let me remind you that these are not collectors, but a bank.

The solution to your question depends on the date of conclusion of the loan agreement and the purposes for which it was drawn up.

Let's take a closer look at the powers of employees of such agencies.

Sending notifications in various forms (e-mail and address letters, SMS messages) is allowed no more than 16 times a month. Their number cannot exceed two per day.

- The law clearly states the limit on the number of calls that debt collectors can make. The norm is one call within 24 hours.

- Sending notifications in various forms (e-mail and address letters, SMS messages) is allowed no more than 16 times a month. Their number cannot exceed two per day.

- Employees of agencies involved in the repayment of overdue loans can schedule personal meetings no more than once a week.

- Clear time limits on communication. On weekdays, collectors have the right to contact the borrower in the morning from eight o'clock until ten in the evening, and on holidays and weekends - from 9:00 to 20:00.

Let's look at the innovations In the new law, in addition to the number of times collectors have the right to call the borrower, we are also talking about streamlining the activities of these agencies.

And not anyhow - but notify by special registered letter with acknowledgment of delivery.

3. Stories from the series “X is calling you” should, in theory, sink into oblivion.

And nothing will happen to them for this. Therefore, the war continues and victory depends entirely on you (so to speak, saving a drowning person is the work of the drowning people themselves).

3. The following actions are not allowed at the initiative of the creditor and (or) the person carrying out debt collection activities: 2) direct interaction or interaction through short text messages sent using mobile radiotelephone networks on weekdays from 10 p.m. to 8 a.m. local time and on weekends and non-working holidays from 20:00 to 9:00 local time at the place of residence of the borrower or the person who provided security under the consumer loan (loan) agreement, which is specified when concluding the consumer loan agreement (agreement securing the execution of the consumer loan agreement (loan) or about which the lender was notified in the manner established by the consumer loan (loan) agreement.

We suggest you read: Is it possible to return cable products?

The guarantor is jointly and severally liable, along with the borrower, so bailiffs will have the right to seize your property, seize your accounts, ban you from traveling abroad, withhold part of your wages and take other measures to collect bank debt in full.

Also indicate there that you are paying, that you were honestly warned about the problems.

And late calls do not help you get your refund.

Threaten to appeal to the Central Bank and the prosecutor's office.

10 Jun 2013, 11:02

11 Jun 2013, 20:01

Internet reception of the Central Bank• To the Prosecutor General of the Russian Federation, complaints and written requests are accepted by mail at the address: GSP-3 125993 Moscow, st. Bolshaya Dmitrovka, 15a.

How many times a day can debt collectors call by law in 2019? Hire a lawyer and instruct him to communicate with debt collectors about the debt. 3. If the debtor is granted an installment plan for the execution of a judicial act, an act of another body or official, the executive document is executed in that part and within the time limits established in the act on granting the installment plan.

Code of Civil Procedure of the Russian Federation Article 434. Postponement or installment plan for the execution of a court decision, changing the method and procedure for its execution, indexation of awarded sums of money. Limitations established by law on the total amount of interest on the debt will also be important for borrowers.

The only gap in the law is the lack of information about punishments for violations committed by debt collectors. The only point that touches on this issue is the instruction on full compensation for damage caused by illegal actions.

Who can demand repayment of a debt?

Who do debt collectors not have the right to call? If employees involved in collecting a problem loan cannot contact the debtor, they begin calling his relatives.

How many times a day can collectors call by law: rights, features and requirements How many times a day can collectors call by law: rights, features and requirements Let's take a closer look at the powers of employees of such agencies. Therefore, this method works quite effectively in practice.

The rights of collectors under the new law are limited. Officially, companies are allowed to take actions to collect debts from citizens of the Russian Federation. However, the methods used must not contradict existing legislation.

Remember that the creditor's representative is obliged to state his position and surname, indicate the exact name of the company he represents and leave the debtor with a contact phone number. This prohibition also applies to hiding the numbers from which collectors call the borrower. Accordingly, there can be no talk of any repayment of exorbitant interest rates (which debt collectors often try to impose).

They can only assign payment of penalties in accordance with the loan agreement.

- pregnant women;

- minors;

- patients undergoing inpatient treatment;

- bankrupt.

- people with disabilities of the first group;

We will discuss certain details that are appropriate for non-payers to know about.

We will talk about the concern of relatives, friends and neighbors of the debtor.

If there are violations by debt collectors, the debtor has many opportunities to file a complaint.

The prosecutor's office and the police are universal authorities for complaints.

Special - FSSP, and on site - the territorial division of the bailiff service. In the first months of the new law, which tightens the requirements for collectors and their activities, according to FSSP statistics, the number of complaints increased 10 times. The number of administrative cases against debt collectors has also increased.

- patients undergoing inpatient treatment;

- bankrupt.

- pregnant women;

- minors;

- people with disabilities of the first group;

Law on collectors from January 1, 2020 - what collectors can and cannot do

- make phone calls - no more than 1 time a day, 2 times a week and 8 times a month,

- call only from 8:00 to 22:00 on weekdays and from 9:00 to 20:00 on weekends and holidays,

- send messages in the form of SMS, instant messenger messages, etc. no more than 2 times a day, 4 times a week and 16 times a month, while the same time of day restrictions apply as for calls

- communicate in person - no more than once a week.

Collection companies appeared in Russia around the same time that the rapid growth of consumer lending began in the country, which means that many debtors on such loans appeared to banks. The collectors' methods became more and more harsh, and in many cases - downright gangster. Collectors literally extorted debts, and the number of high-profile cases that went beyond the methods of working with debtors on loans became too large. As a result, a law was passed that imposed rather strict requirements on collection agencies and limited collectors in their methods of influencing debtors. What does the law on collectors and collection activities look like from January 1, 2020, what methods can collectors use and which cannot.

We recommend reading: Sheet e 1 in personal income tax declaration 3 for 2020

Law on calls from the bank 2020 to relatives

Good afternoon.

I'm in arrears on my bank loan, and now they're constantly calling me about it. I do not refuse payment in any case, and I will pay off all debt with penalties and fines, but as soon as the money appears. Now they are completely gone. The problem is that the calls are simply boring, and I would like to clarify at what time do they have the right to call me from the bank on this issue? Hello! Temporary restrictions on making contacts with the borrower for debt collection by a bank or any other person authorized in this matter (mainly collection agencies) are regulated by paragraph 3 of Article 15 of Federal Law No. 353-FZ. According to this standard, on weekdays they can contact you only from 8-00 to 22-00.

On weekends and holidays, this period is reduced by three hours - the connection can be made from 9-00 to 20-00.

The rights and obligations of the parties under a loan agreement are stipulated in the federal law on consumer lending. And this law clearly states that employees of banks and collection agencies have the right to remind the debtor about the debt through telephone conversations or personal meetings.

Important

But they can do this only from 6:00 am to 10:00 pm. At night from 22-00 to 6-00, calling and visiting debtors is prohibited.

There are no other restrictions. But in the fall, a bill is being prepared for consideration to limit the number of telephone calls per day, as well as to prohibit bank employees and debt collectors from putting pressure on the debtor or his relatives; it is planned to fully spell out all actions that will be prohibited, including raising one’s voice.

In the application, indicate the exact date and time of the call, as well as the phone number from which the call came and inform that further communication between bank employees and you is possible only through postal or electronic correspondence. Send the application to the bank by letter with notification, and keep a copy of the application for yourself.

And live in peace. But what happens if the debtor did not do this on time, or never answered calls, or simply changed his number. Believe me, the debtor will not face anything for this. Of course, it’s better to play it safe and send a letter to the bank saying that, for example, your phone is broken, and there is no way to buy new millet, so contact with you is only possible by mail, but that you do not refuse to pay the debt and will pay everything right away, as soon as possible.

When making calls to the debtor, the telephone numbers of collection agencies and collection services must be determined by cellular operators, and email addresses must not be hidden. The use of physical force against the debtor, threats to life, and causing harm to health and property is prohibited. How often and how many times a day can debt collectors call?

Please note that in situations where the statute of limitations on the loan taken has expired, the client’s concern is unacceptable. Of course, this point only works in cases where the creditor did not go to court or the judge ruled in favor of the defaulter.

- 3. The following actions are not allowed at the initiative of the creditor and (or) the person carrying out debt collection activities: 2) direct interaction or interaction through short text messages sent using mobile radiotelephone networks on weekdays from 10 p.m. to 8 a.m. local time and on weekends and non-working holidays from 20:00 to 9:00 local time at the place of residence of the borrower or the person who provided security under the consumer loan (loan) agreement, which is specified when concluding the consumer loan agreement (agreement securing the execution of the consumer loan agreement (loan) or about which the lender was notified in the manner established by the consumer loan (loan) agreement.

- In no case is it allowed to harm the health of the borrower.

- Collectors do not have the authority to damage or take away the debtor's property.

- It is prohibited to threaten or be rude during conversations on the phone or during meetings.

- According to the new law, debt collectors cannot exert psychological pressure.

- It is not allowed to disparage the borrower's personality.

- It is unacceptable to use weapons or other objects to make threats.

- Information about the borrower should not be passed on to third parties.

- Demanding the repayment of debt from relatives of the defaulter (if they are not guarantors or heirs) or using threats against them is strictly prohibited.

Who do debt collectors not have the right to call? If employees involved in collecting a problem loan cannot contact the debtor, they begin calling his relatives.

Attention

Now there are clear restrictions: in 30 days only eight times, no more than a call per day, only two conversations per week. Very good frequency. And everything would be fine. But some collection agencies may call from different mobile devices, and if a complaint or statement is filed against them, it is very difficult to prove that these calls came from this particular collection organization.

Info

However, the situation in the foreclosure market has now changed dramatically. Which way? Of course in a positive way. Firstly, a law was passed regulating the relationship between debt collectors and debtors.

Secondly, now the debtors themselves have become much more literate, there is a lot of information on this issue on the Internet and most people know their rights and are beginning to defend them. There is also an innovation in 2020 regarding the inclusion of collection agencies in the official register.

We invite you to read: What to do in the event of an accident - the driver’s procedure for compulsory motor liability insurance in 2020, responsibilities, rules of conduct

Pay for the response Continue the dialogue Sincerely, Vladimir Valentinovich Kalashnikov. Payment for the response in any amount is welcome. Click the payment button. Additional questions - in a personal message. Thanks for the answer!

- Now, the law only allows reminding the debtor about the overdue payment, nothing more.

But since it is not clearly stated how exactly reminders can be made, employees of banks and collection agencies use the opportunity of telephone conversations not just to remind the borrower about the debt, but also to threaten and morally pressure the debtor. This is already a violation of the law and you can safely demand that the bank stop calling. In addition, the debtor has every right to appeal to the relevant authorities to protect his rights and interests, and the debtor also has every right not to answer calls from banks and collection agencies after the first conversation in which they violated the law.

Most often, they do not stand on ceremony with the borrower and begin to flood them with messages and calls. Many people even complain about the threats that come from them. How many times a day can debt collectors call according to the law adopted in 2020? Do they have the right to disturb at night or on holidays? How to protect yourself from the actions of debt collectors?

It is quite difficult even for an experienced lawyer to prove the fact of threats and other illegal actions. Thanks to the new law, everything should change dramatically in 2020.

The latest edition of Federal Law 230 was adopted on January 1. It talks not only about how many times collectors can call, but also how often to visit the borrower. If communication becomes very intrusive, then each debtor has the right:

- Contact the prosecutor's office with a statement about violation of the law.

- Visit the bank management with a demand to stop calls from 22:00 to 8:00.

- If the callers do not identify themselves, the borrower can write a statement indicating the fact of extortion.

It is recommended that the debtor make a formal request to the bank in order to find out whether calls are allowed at night, as well as in what quantity they should be received. The organization is required to respond to these issues with written notice. This document will help protect the borrower's rights.

What do collectors have the right to? Rights and obligations of collectors from 2019 under the new law If we open Russian legislation, we will find an article that directly limits the actions of collectors and creditors. For example, these persons do not have the right to disseminate information about the debtor without his personal consent. In addition, they are also prohibited from: Using physical force to achieve the desired result. But the question arises: is it possible to call the debtor on weekends and non-working holidays?

Yes, debt collectors have the right to call on weekends, except for the following time period. Calls on weekends are limited from 20.00 to 09.00 hours. Important! Since our country is quite large and there are different time zones, the indicated hours must be determined by local time.

Important! If you yourself are dealing with your own case related to calls from debt collectors, then you should remember that: Each case is unique and individual.

She told the bank that they have the right to call from 8 a.m. to 10 p.m., to which the girl rudely said that according to Art.

No. 37 has the right to call whenever he wants and everything is spelled out there - the Civil Code of the Russian Federation. 16 January 2020, 13:41 Answers from lawyers (5)

The funny thing is that such restrictions are established by law for collectors - call from 8.00 to 22.00 no more than 2 times.

- third parties who receive a call refuse to interact (conversate) with the bank (its representative).

- the debtor did not give written consent to this (main condition);

Regardless of the consent of the debtor, the bank is prohibited from providing information about the borrower, his debt and collection at the debtor’s place of work.

Such actions of the bank assume that the information will become available to an unlimited number of persons.

Unfortunately, the new law was on the side of the creditor.

They can choose any day of the week for communication, the only thing is that employees of collection agencies must adhere to a certain time period. How many times a week can debt collectors call?

The new law on debt collectors, which will come into force on January 1, seems to protect borrowers. In fact, this period is much shorter - from 8 a.m. to 10 p.m., and no more than twice a day. And call time is limited from 8 a.m. to 10 p.m. 22-00 on weekdays and from 9-00 to 20-00 on weekends.

- minors;

- patients undergoing inpatient treatment;

- people with disabilities of the first group;

- bankrupt.

- pregnant women;

- Is there a certain regulation on how many times bank representatives can call?

- The new Law will limit collectors from calls and meetings with debtors

- How often and how many times a day can debt collectors call?

- Elena, if someone calling you on the phone was silent on the phone, how do you know that this is a bank employee? Wouldn't it be easier for you to turn off your phone to prevent unwanted calls from coming in?

- on weekdays from 22.00 to 8.00;

- on weekends and holidays from 20.00 to 9.00.

We invite you to familiarize yourself with: Documents for registration under a social tenancy agreement

How many times can debt collectors call?

Typically, debt collectors will do everything in their power to get the money back. After all, their earnings directly depend on this. If they cannot find the debtor, they call his relatives. Federal Law 230 defines at the legislative level a list of people with whom they are prohibited from communicating in any circumstances. You can't call:

- it is necessary to clarify information regarding whether the borrower is currently working there;

- you need to find out whether the debtor provided the correct information about the length of service and position;

- the collector wants to convey, with the help of the employer, a request to contact him. However, they do not have the right to indicate the amount of debt or disclose other information. Typically, this method of communication is used when collection agencies cannot establish the location of the debtor or contact him in another way.

“Stop calling us!”

It is incorrect to say that debt collectors do not have the right to disturb the relatives of the debtor. Such actions are legal if the loan agreement contains a clause on the possible disclosure of the terms of the agreement to third parties and consent is given to the processing of personal data. Debt collection agencies can inform those relatives who have agreed to become guarantors for the loan about the debt. It must be remembered that the debtor’s spouse bears the same responsibility for the loan as the borrower himself, but only after an appropriate court decision. When entering into an inheritance, the successor receives not only the property, but also the debts of the deceased person.

New law on bank cards from July 1, 2020

The service then checks this information. If a person does not have evidence confirming that he makes contributions to the State Treasury, he will have to pay a fine of up to 20 percent of the amount accrued for rental housing. This initiative concerns absolutely all residents of the Russian Federation.

This version, although it looks threatening, also contains many weak points. There are not many employees working in the tax service, and when crowds of people pour into the offices of the Federal Tax Service, who begin to prove the legal origin of the money transferred to them and ask for the return of income taxes, these offices will simply be overwhelmed by the influx of visitors. Moreover, everyone can prove the legality of money, because nothing prevents you from drawing up a loan agreement between the customer of certain services and their performer, especially since such an agreement is written by hand and does not require any certification from a notary, which means it costs only the paper on which is printed.

Why do scammers need SNILS?

Answer : Hello, Grigory Nikolaevich. According to the latest changes in legislation in 2020, the investor must be notified with a corresponding notice about the fact of transfer of funds from fund to fund. The letter is compiled by Pension Fund employees. It is sent to the address of the insured person. It is possible to duplicate the document using the payer's email address.

- Never, under any circumstances, enter into a dialogue over the phone with supposedly employees of the Pension Fund of Russia . Remember that Pension Fund employees never call anyone on the phone , moreover, they do not transfer or offer money to anyone. If they call you and introduce themselves as employees of a pension fund and offer to receive money, just hang up and do not continue the conversation.

- Never tell anyone your card number unless absolutely necessary.

- The secret code on the card, which is displayed on the back of the card, is strictly not recommended to be disclosed to anyone.

- Do not leave or fill out your personal data of your passport, SNILS, phone, card on dubious sites on the Internet that offer to pay you mythical amounts that fell on you from the sky.

- You can carry out all operations on your pension either at the nearest Pension Fund branch or in your personal account on the official website es.pfrf.ru

- Do not store your card PIN with your card.

- Be vigilant and attentive, if you encounter such a case, remain calm and end the conversation on the phone.

We recommend reading: Amounts of Subsidies for Large Families in 2020

Law on collectors from January 1, 2020 No. 230

If you are being harassed by debt collectors, and even threatened, you should go to court. First, collect evidence of violations (audio, video recordings), which you will provide to law enforcement agencies. Initially, you should contact the police or prosecutor's office with a description of the conflict situation.

The law does not limit the number of calls, but you can use a legal loophole. If you receive calls more than 20 times a day, this is considered an invasion of privacy and you have the right to take legal action. Also, employees of organizations are prohibited from calling relatives or friends of the debtor.

Don't call mom

Termination of a government contract under the new law in 2020 Contents:

- Do banks have the right to call the debtor’s relatives?

- What time can debt collectors call by hour?

- How many times a day to call from the bank

- How many times and when can banks call by law?

- What to do if debt collectors call and threaten the debtor and his relatives?

- What rights do debt collectors have?

- How many calls are banks entitled to make to debtors?

Do banks have the right to call the debtor’s relatives? Such actions fall under the article of the law on non-disclosure of personal data and may serve as grounds for contacting law enforcement agencies. It is recommended to immediately remind collectors of this if such cases occur.

They call from the bank about someone else's loan

If people get calls from the bank about someone else's loans, and they don't know what to do, then they should turn to professionals for help. Currently, many lawyers specialize in the credit field and provide legal support to people who find themselves in difficult situations. By contacting a law office, people will receive comprehensive advice and will be taught how to behave with bank employees and debt collectors.

The easiest way to get rid of annoying calls regarding someone else’s loan is to install special software called “anti-collector” on your mobile phone. If bank employees or collectors start calling from other numbers, people should record their threats on any technical devices. Such recordings will be considered by law enforcement agencies as evidence.

What to do if banks keep calling

If there are continuous threatening calls from the bank or collectors, the debtor and his relatives can contact the authorities to protect their interests.

There is no need to succumb to provocations from collectors or make excuses to them. To avoid this, you can submit a statement to the bank stating that in phone calls bank employees do not just remind you about the debt, but use an elevated tone and are rude, which is considered unacceptable.

It is necessary to record all data about the call, namely date, time, phone number. It will be even better if you attach a recording of a telephone conversation with the collector to your application. Please ask for further interaction with the bank via email and regular mail.

It is not necessary to submit the application to the bank in person; you can send it by registered mail with notification, and keep a copy for yourself.

What if bank employees demand that relatives repay the debt? The bank can demand payment of the loan debt only from persons who are guarantors. Relatives who are not guarantors often wonder where the bank got their contact phone number.

When applying for a loan, the borrower leaves the contact information of his relatives or friends. In case of late payments on a loan, the bank, first of all, should call the debtor himself. If it is impossible to reach the borrower by phone, collection service employees will call all specified contacts.

How not to pay a loan to banks legally is detailed in this article.

What is the method of legal regulation of business law is indicated in detail in this article.

What is the subject and method of business law can be understood from this article: https://ruleconsult.ru/grazhdanskoe/korporativnoe/predmet-metod-predprinimatelskogo-prava.html

You may also be interested in learning about the types of sources of business law.

But this is not done with the aim of demanding payment, but in order to ask relatives to remind the borrower about the delay and ask the debtor to contact the bank. The amount of debt should not be disclosed to family and friends; this information is a bank secret.

Relatives and friends of the debtor have the right to give the borrower's address, his contact phone number and demand that the bank not bother them in the future.

What are collectors entitled to in 2020?

After all, collection agencies do not provide loans to the population, and all the contracts they work with are purchased from banks and other credit organizations. Plus, it is important to know that the bank sells problem debt only in exceptional cases when repayment seems impossible. And collectors do not buy everything, but only what can bring profit.

Let's consider the situation: the bank was unable to repay the debt from a problem client and put the contract up for sale. After some time, one of the collection agencies buys the debt and becomes the legal creditor. But it was not possible to collect the amount from the debtor.

Do banks have such authority - can they call relatives and friends of the loan debtor?

The Federal Law on Consumer Lending regulates the basic rights and obligations of the parties in relation to the loan agreement. The bank and debt collection services have the right to call the client to remind them about overdue payments, as well as to pay a visit. But there is a small clause in the law regarding the timing of calls and visits. It is limited to 6 am and 10 pm. There is a ban on calling and visiting debtors at night.

In the future, the government plans to introduce restrictions on the number of calls per day, putting pressure on the debtor and his relatives, and even the tone in the collector’s voice will be controlled.

Before the adoption of these innovations, collection service employees are allowed to remind the client about the debt that has arisen and the need to repay it as soon as possible. But in addition to simple reminders, debt collectors often use threats that have a moral impact on the psyche of the debtor and his relatives.

On video: Do collectors have the right to call the debtor’s relatives:

Since such actions on the part of the bank and collection agencies may be regarded as a violation of the law, the client has the right not to answer threatening phone calls after the first incident.

A client who, due to circumstances beyond his control, has become a debtor will be right before the law if he warned the bank in writing about temporary financial difficulties. Upon application from the debtor, the bank can provide credit holidays, that is, time during which the debt can not be repaid.

How often can they call from the bank according to the law 2020

Citizens living in the regions of the North, Far North or equivalent areas can count on receiving northern pension payments. The state guarantees early registration of pensions, as well as the possibility of receiving increased benefits. Let’s look at the procedure for registering pensions for northerners in 2020 in Russia, and we’ll tell you about all the important nuances related to the issue of accrual, calculation and receipt of payments.

The beginning of 2020 was marked by the entry into force of the Russian law increasing VAT to 20 percent. Information about this event has been discussed in society for a long time, and many people are worried about how the VAT increase will affect their well-being. Entrepreneurs are concerned about how their business will develop, while the average person is interested in the issue of increasing prices. Let's take a closer look at what the VAT increase to 20 percent in 2020 is all about.

We recommend reading: What benefits does a labor veteran have in St. Petersburg in 2020?

What rights does a collection agency have under the new law?

When all of the above norms are violated, or at least one of them, the debtor or another person who has suffered from the unprofessionalism of a collection organization can safely contact the police or directly go to court. Before this, we recommend that you contact a lawyer who will help you draw up a statement of claim describing what rights were violated and what you demand in relation to the creditor, or the persons to whom the right to deal with your debt was transferred.

- Voice recorder recordings of telephone calls.

- History (extract) of telephone calls, allowing you to see that the interaction was carried out from a hidden number, at night or during a period prohibited by law for communication with the debtor.

- Postal letters, telegrams, various kinds of paper notices, including those addressed to your relatives, regarding someone else's debt.

- Photos of advertisements, inscriptions.

- Screenshots from the Internet showing violation of your rights and disclosure of confidential information.

- Video filming and audio recording of personal meetings.

Whose number was it that called and offered a credit card?

Do not answer such a call or call this number back to ensure your financial security! The information that was able to be established is small. It is known which operator the number +7 958 709 04 16 is and which region. Accordingly, this is OAO “MTT” (“Interregional TransitTelecom”, not the most famous operator), and the region is Moscow and the Moscow region.

- in any controversial and doubtful situation, you need to show attentiveness, common sense and a critical assessment of the situation;

- You cannot transfer your passport and other personal data to unknown people over the phone or on the Internet. Bank employees do not have the right to receive such information remotely: first, the client must personally sign a consent to the processing of personal data at the organization. Therefore, the most logical action is to offer to stop by a bank branch or call its official number and clarify whether the call really came from bank employees;

- Sometimes you shouldn’t transmit information remotely to familiar people. Cases of hacking of pages on social networks and email accounts have become more frequent. Fraudsters can send a message allegedly from a friend or relative with a request to send a password, take a screenshot of a received message, send money, PIN code, or provide passport or bank card details. If you had to face such a request, you should make sure whether it comes from a person you know and for what purposes he is asking to do it;

- If write-offs, theft of funds or other damage are detected, you must contact your bank within 24 hours to block the card and the police. Even if the amount of harm is small, timely reporting and reporting of details will help law enforcement officers identify a criminal scheme and prevent harm to other citizens;

- You should be wary of all calls from unknown and especially hidden numbers.

22 Feb 2020 juristsib 1127

Share this post

- Related Posts

- What documents are needed to apply for a social scholarship in 2020?

- Social Services and Social Support Measures for Labor Veterans in the Republic of Kazakhstan

- Prices in Military Sanatoriums of the Russian Federation in 2020 for Military Pensioners

Until what time do banks have the right to call by law?

Collection activity is a type of activity of a group of people (services, agencies) aimed at collecting debts from citizens who have bound themselves with debt obligations to banking organizations. In other words, collection specialists ensure that the debt incurred by citizens to the bank is repaid by them as soon as possible.

These interaction schemes are defined by Chapter 24 of the Civil Code of the Russian Federation.

At this stage, debt specialists use measures to collect debts from borrowers, such as calls, messages to a mobile phone number, and letters by mail.

According to the Law that came into force in 2020, collection specialists should not call the debtor more than twice a week. As for the time of calls, they should be made from eight o'clock in the morning to ten in the evening on weekdays and from nine to twenty o'clock on weekends.

If the debtor does not respond to calls, and the debt continues to hang, the collection specialist can take measures such as a personal visit by the collector to his home or work.

However, according to the Law “On Collection Activities” that came into force in 2020, debt specialists cannot appear in person to the debtor more than once a week.

If neither calls nor personal meetings work for the debtor, the collection specialist has the right to turn to court for help, where the issue of collecting the debtor’s existing debt will be dealt with by a judge.

If you receive calls from a debt collector more often than required by law and are harassing or threatening in nature, you should contact one of the following authorities:

- The banking institution in which the debtor incurred a debt;

If you want to get rid of incessant calls from collectors, then first of all you need to contact the bank where you have a loan and fill out an application for non-disclosure of personal data. After that, in most cases, the flow of calls stops.

- Collection servicefrom which you receive collection calls;

We suggest you familiarize yourself with: Is an expert’s opinion mandatory for the court?

The details of the collection service, as well as the data of the debt specialist harassing you, must be provided by the collector himself at your personal request. After visiting the collection service, you need to contact the bank again and submit an application for non-disclosure of personal data.

Calls from the bank do not stop and are already going beyond what is permitted? When debt collectors forget about the rules about when they can call and when they can’t, it makes sense to complain. Initially, the bank itself can resolve the situation with its employees if they exceed their own authority.

Info

Loan debt is not only a damaged credit reputation and not always communication with bailiffs.

In recent years, problems for borrowers with debts have been caused by so-called debt collectors.

Agencies began to appear everywhere immediately after the financial situation of Russians worsened and large loan debts began to form.

Banks do not have the ability to resolve situations on their own and, as a result, transfer the debt to collection agencies for collection.

Unfortunately, the actions of employees of such companies leave much to be desired and very often citizens suffer from psychological pressure, and in some cases from physical pressure.

Important

In our article, we will pay attention to issues related to how many times a day collectors can call, how legislation regulates this issue, and how to deal with collectors if they continue to behave boorishly.

According to the new law, the time of calls from collection banks Internet reception of the Central Bank • to the Prosecutor General of the Russian Federation, complaints and written requests are accepted by mail at the address: GSP-3 125993.

Attention

Moscow, st. Bolshaya Dmitrovka, 15a. Internet reception of the General Prosecutor's Office Federal Bailiff Service of the Russian Federation.

How many times a day can debt collectors call by law in 2018? Hire a lawyer and instruct him to communicate with debt collectors about the debt.

In addition, after the death of the defaulter, his heirs, who have assumed rights, will also be obliged to repay the debt, so calls from collectors are quite legitimate.

Time frame. How to protect yourself? The law clearly states not only how many times a day collectors can call, but also to what period of time communication is limited.

The interval varies depending on the day of the week. On weekdays, you can disturb the borrower with calls only from eight in the morning to ten in the evening.

These time frames are also reserved for personal meetings and sending messages.

If debt collectors violate the law, the borrower has the right to file a demand to verify their actions. To do this, you will need to record late calls or SIM messages and contact law enforcement agencies. What is prohibited? The law prohibits not only how many times a day debt collectors can call, but also other actions. Let's look at them.

Let's look at the innovations In the new law, in addition to the number of times collectors have the right to call the borrower, we are also talking about streamlining the activities of these agencies.

How many times a day and during what period of time are banks allowed to communicate with me? How many times a day and during what period of time are banks allowed to communicate with me? I give you a general direction on credit debt and an acceptable way out of the situation with the least losses.

Federal Law “On Enforcement Proceedings” Article 37. Providing a deferment or installment plan for the execution of judicial acts, acts of other bodies and officials, changing the method and procedure for their execution Do banks have the right to call on weekends and holidays? Are banks allowed on weekends and holidays?

I think that there is no such direct prohibition. Starting from January last year, representatives of the creditor have the right to call a citizen no more than twice a week or no more than eight times a month. Some rules are set regarding time frames. A standard has been established according to which one call should be received no more than once a day.

A certain procedure applies to time frames.

Collectors cannot call on weekdays - from 20 to 8 o'clock, and on holidays and weekends - from 20 to 9 o'clock.

If these rules are violated, serious administrative measures will be applied to the collection agency. Postponement or installment plan for the execution of a court order, changing the method and procedure for its execution, indexation of awarded amounts of money Law on collection activities from January 1, 2020 - news for today Important for borrowers will also be Limits set by law on the total amount of interest owed.

The only gap in the law is the lack of information about punishments for violations committed by debt collectors.

The only point that touches on this issue is the instruction on full compensation for damage caused by illegal actions. Who can demand repayment of a debt? When analyzing the features of the law on collection activities, the first thing you need to focus on is who exactly has the right to demand the repayment of loans and debts.

How long can collectors call? How long can collectors call? Few people know that as of January 1, 2014, provisions of the law on consumer credit came into force, limiting the time when collectors or the bank collection service can call the debtor and remind them of the debt.

We suggest you read: What amount of property tax deduction is returned when buying an apartment in cash and how much interest can be returned from the mortgage {q}

So, calls at night on weekdays are limited.

This time is considered on a working day from 22.00 to 08.00, i.e.

no one has the right to disturb the debtor during the specified hours on working days. But the question arises: is it possible to call the debtor on weekends and non-working holidays? How many times a day can collectors call by law: rights, features and requirements How many times a day can collectors call by law: rights, features and requirements Let's take a closer look at the powers of employees of such agencies.

For example, we are talking about people who find themselves in difficult life and financial situations, as well as Russians who are minors, declared bankrupt, disabled people, sick people and pregnant women. According to the law, in 2020, violation of established rules threatens the collection agency with serious scrutiny and certain legal consequences.

Features of communication with debt collectors that you should know about The law not only determines how often employees of collection agencies can call citizens and communicate with them, but also sets a time frame. Taking into account the current provisions of the federal act, collectors have the right to call a person who has a loan debt only if the person initially gave consent to the processing of personal data. Federal Law 230 clearly states the list of people whom collectors do not have the right to disturb under any circumstances .

- It is prohibited to make calls to pregnant women, as well as those who have children under the age of one and a half years.

- It is not permitted to communicate with persons undergoing treatment in a hospital inpatient unit.

- Relatives over 70 years of age should not be disturbed even with informational calls.

- It is prohibited to send notifications or communicate by phone with people with the first group of disabilities.

What to do if calls continue? Having figured out how many times a day collectors can call, at what time and days, the borrower can feel protected.

Attention

There are situations when the borrower develops overdue debt. The circumstances may be very different, but one of the results will be guaranteed - calls from the bank.

And this is a mandatory procedure, because the bank needs not only to notify the client about the debt, but also to find out the details. As a rule, some banks make concessions and do not pester you with their intrusiveness, but this does not always happen.

Important

Of course, when a bank employee actually raised his voice or threatened you. But don’t be afraid to answer calls from the bank, because possible threats are only threats.