Author of the article: Elena Petrenko Last modified: January 2020 8401

Dismissal in the event of bankruptcy of an enterprise has its own distinctive features and a step-by-step algorithm of actions for the employer, if we compare the process with the termination of employment contracts for other reasons. That is why it is important for managers to know how to carry out the procedure correctly: this will avoid many troubles and penalties in the future.

How does dismissal occur during bankruptcy of an enterprise?

The Constitution of the Russian Federation provides all citizens of the country with the right to paid work, its observance is strictly controlled by the state. An employer cannot simply fire an employee, but what if the company goes bankrupt? The dismissal of employees due to the bankruptcy of an organization is regulated by Article No. 81 of the Labor Law; it takes into account all the nuances of termination of a contract, which occurs at the initiative of the employer.

Liquidation of an enterprise due to bankruptcy

The insolvency of an enterprise and an increase in accounts payable leads to only one solution - liquidation due to the bankruptcy of the company. The decision on the insolvency of the organization is made by the leading collegial body. The final result is drawn up in the form of a protocol, signed by all persons entitled to vote.

After notification of the event to local authorities and notification of personnel, powers to manage the company are transferred to the hands of the liquidation commission, the final procedure is referred to as bankruptcy proceedings. The arbitration court appoints a manager if the financial condition of the enterprise is hopeless and is not subject to rehabilitation measures.

During bankruptcy proceedings, there is a mass dismissal of company personnel. In this case, the rights of employees in any decisions of the administration and founders of the company are protected by the Labor Code of the Russian Federation.

During bankruptcy proceedings, there is a mass dismissal of company personnel.

Having a problem? Call our lawyer:

Moscow and Moscow region (toll-free call) St. Petersburg and Leningrad region

Stages of dismissal of employees during bankruptcy

The cessation of all economic activities of an enterprise, which is associated with its bankruptcy, implies great responsibility for the personnel department. Personnel personnel must, within strict deadlines, prepare mandatory documentation and perform a number of certain actions for the natural dismissal of employees during the liquidation of the enterprise.

Mass dismissal procedure:

- Notification of the Employment Service about the bankruptcy of the company . which caused the layoff of the entire staff. The message is delivered in writing at least 3 months before the mass reduction of personnel.

- Notification of all employees of the enterprise (each individually) in writing at least two months before dismissal.

- Notifying staff about the possibility of early termination of the employment contract . If the response is positive, the employee who agrees to the offer receives additional compensation.

- Creation of an order for massive staff reduction in connection with the bankruptcy of an enterprise . Each employee must familiarize himself with the order personally and certify the document with his signature.

- Paperwork .

- Issuance of personal work books with relevant records.

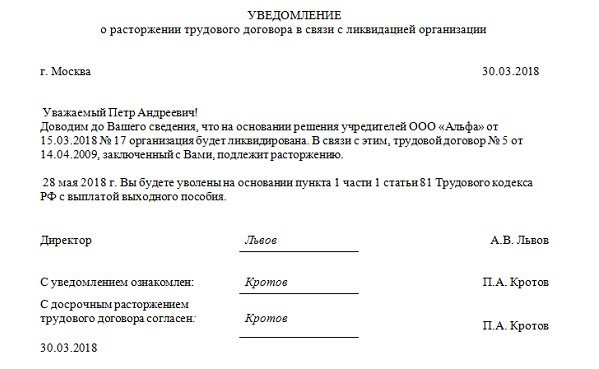

Notifying employees

Notifying staff is a mandatory condition for liquidating an enterprise; if the company administration does not notify employees of the upcoming changes, the action will be considered illegal. In addition, it should be understood that oral notice has no legal force. The written notice is certified by the signatures of both parties.

More information about notification periods for employees:

- 2 months – total time, applicable for full-time personnel, for employees who have been working for the company for more than two months.

- 3 days is the notification period for employees whose employment agreement is short-term and does not exceed two months.

- 1 week is the minimum notice period for the upcoming dismissal of seasonal workers.

To prevent possible controversial situations in the future, two copies of each notice must be drawn up. It is very important to put the date on documents so that it cannot be falsified.

The employee’s categorical refusal to study the official document does not relieve the employer of responsibility for carrying out this action. In such ambiguous cases, information about dismissal due to bankruptcy of the enterprise is conveyed to the employee orally in the presence of 2 or more witnesses.

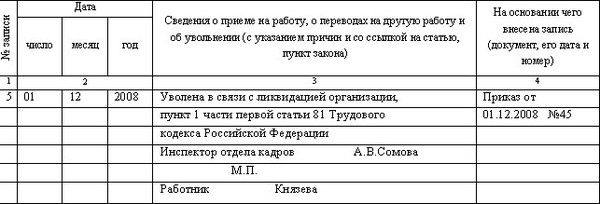

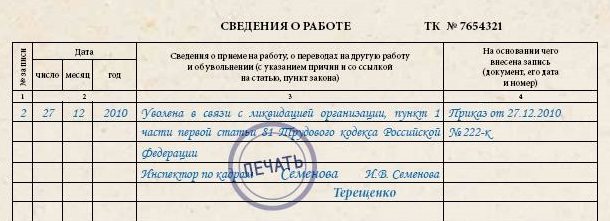

Issuance of work books

The document is issued on the last working day with the entries already made. The column about the reasons for dismissal should contain not only the relevant information, but also a link to the article of the Labor Code of the Russian Federation:

- If an employee took advantage of the early termination of employment and quits of his own free will, the column reads: “Dismissed of his own free will, clause 3 of part 1 of Article No. 77 of the Labor Code of the Russian Federation.”

- If the dismissal occurs due to bankruptcy, and the employee is at work until the last day.

Work books must be certified by the signatures of both parties and the company seal.

Issuance of a work book

This document is issued on the last working day with the records of dismissal included. It is worth remembering that the document must indicate not only the reason for dismissal, but also refer to the article of the Labor Code of the Russian Federation. If the employee took advantage of the early termination of the employment relationship, in the column about the reasons it is necessary to indicate: “Dismissed at his own request, clause 3, part 1, article No. 177 of the Labor Code of the Russian Federation,” supporting such a decision with a statement from the party, and in case of bankruptcy, this column is filled out as dismissal due to liquidation, referring to Article No. 81 of the Labor Code of the Russian Federation. This termination of the relationship also entails payment for 2 months in the amount of average monthly earnings.

Legislative guarantees

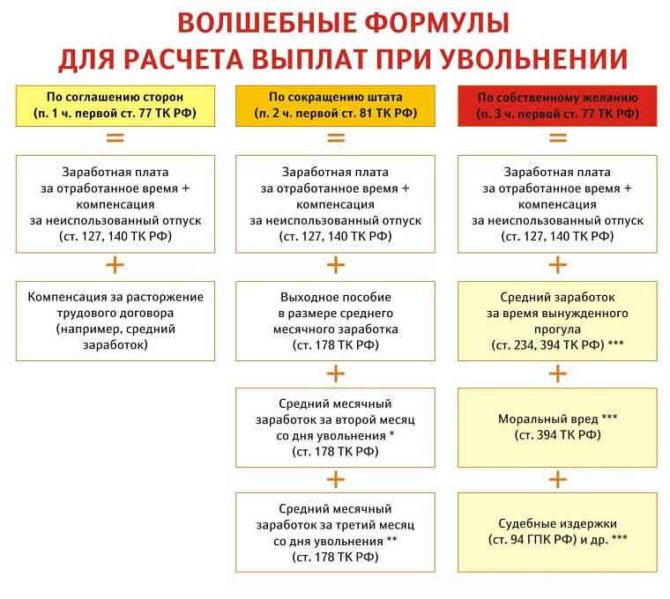

As a result of the bankruptcy of an enterprise, each employee loses his job, and with it his salary. Since the dismissal did not occur at the initiative of the worker, he has the right to receive guaranteed payments regulated by the Labor legislation of the Russian Federation.

What payments are due when dismissing employees due to the liquidation of an organization:

- Wage . calculation for the days actually worked in the last month before the layoff.

- Cash compensation instead of vacation . Since every citizen of the country has the right to basic and additional vacations, cash compensation is calculated as follows - the average daily earnings are multiplied by the number of free vacation days.

- Severance pay - its amount is equal to the average monthly salary, is retained for the period of employment and does not exceed two months; in rare cases, compensation is paid 3 months after dismissal.

Salaries and compensations are paid to the employee on the last working day, handed out along with the work book, and can also be transferred to a bank account/card.

If the employer does not fulfill its obligations, every employee dismissed due to the bankruptcy of the company has the right to appeal to law enforcement authorities to defend their interests.

Employees also retain the right to elect their representative. A representative of the labor collective is required to participate in the Arbitration Court in the event of a bankruptcy case of an organization, which led to the massive termination of employment contracts.

Required Notices

All employees must be notified of the planned dismissal at least 2 months before the date of termination of employment.

The following groups are exceptions:

- Seasonal employees - are notified no later than 1 week before the date of termination.

- Employees with short-term labor contracts are given three days' notice.

The manager issues an order to reduce staff in connection with the liquidation of the enterprise, copies of the document are issued to all personnel. All personnel of the organization sign for a copy of the order. If the employee refuses to sign, then the manager must draw up a statement of refusal.

If there is an existing trade union organization at the enterprise, the manager must send its representatives a message about upcoming layoffs. This is done no later than three months before the start of the first layoffs.

Dismissal in the event of bankruptcy of an enterprise also requires notification of the local employment center. The notice period depends on the number of people to be fired:

- If the number of employees is more than 15 people, then notification is sent 90 days in advance.

- If the staff number is less than 15 employees, notice must be given 60 days in advance.

On the last working day, a full settlement is made with all employees, they are given all the necessary documents confirming their work activity (work books, certificates, etc.).

Special categories

Hiring, as well as dismissal from an enterprise, is somewhat individual for certain groups of employees. Pregnant women and women on maternity leave, as well as general directors, do not always fall under the general norms of Russian labor legislation.

Dismissal of pregnant women

Liquidation of an enterprise, including due to its bankruptcy, is the only condition that allows dismissing a pregnant woman or depriving a woman of her job while on maternity leave to care for a child.

Although the entire dismissal procedure will take place on a general basis, and payments will not exceed the established ones, this category of citizens still has the opportunity to receive additional financial compensation, but not from the employer, but from the authorities, by filing an application for benefits. Read here about the procedure for laying off pregnant women during the liquidation of an enterprise.

Work books are certified by the signatures of both parties and the company seal.

Dismissal of the General Director

What additional conditions exist for the dismissal of a director during the liquidation of an LLC. The main person of the enterprise (CEO) may be subject to dismissal due to the bankruptcy of the company. Gene removal algorithm. director in this case complies with the current law defining the procedure for bankruptcy and layoffs of employees:

- Making a decision that the company is insolvent.

- Appointment of a commission and liquidation manager.

- Filing a petition to the Arbitration Court to dismiss the general director. Subsequent dismissal of the general director on grounds common to all.

Useful information for business managers about the reasons for bankruptcy of an organization:

The dismissal of employees of an enterprise against the background of its bankruptcy occurs according to the basic rules of Article No. 81 of the Labor Code of Russia, which regulates the procedure for dismissing personnel during the liquidation of an organization.

Free legal support by phone:

Moscow and Moscow region (toll-free call)

St. Petersburg and Leningrad region

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer will advise you free of charge.

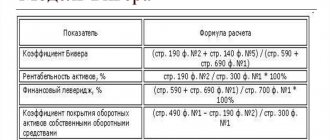

Amount of payments and compensations assigned to employees in bankruptcy

Dismissal in the event of bankruptcy of an enterprise entails the employer's obligation to pay monetary compensation to employees, the amount of which is determined by the current labor legislation:

- If the contract is terminated within the period established by the employer, the employee is paid compensation, the amount of which is equal to the average monthly salary. In addition, the employee retains the right to receive compensation payments in the amount of the average monthly salary for 2 months from the date of his dismissal, if during this time he does not find employment in another organization (Part 1 of Article 178 of the Labor Code of the Russian Federation).

- If within 2 weeks from the date of dismissal the employee applied to the territorial office of the employment service, but was not employed by him, the average salary can be paid for the third month of his stay in the status of unemployed (Part 2 of Article 178 of the Labor Code of the Russian Federation) .

- When terminating the contract by mutual agreement with the employee, the employer is obliged to pay him additional compensation, the amount of which is equal to the average earnings of the worker for the period remaining before the date of his intended dismissal (Part 3 of Article 180 of the Labor Code of the Russian Federation).

***

So, the termination of an employment contract with employees who are part of the staff of an enterprise declared bankrupt has a number of distinctive features, so even women who are on maternity leave can be fired during bankruptcy. All employees of the debtor company are entitled to receive compensation payments, the amount of which varies depending on how soon they find a new job.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Dismissal of employees in case of bankruptcy of an organization

Bankruptcy of a legal entity implies the eventual liquidation of the company, so it is necessary to fire employees. However, termination of employee contracts in the event of bankruptcy of an organization must be carried out in accordance with current legislation, otherwise it will be possible to go to court with a demand for reinstatement in the previous service and compensation for lost wages.

Notices upon dismissal based on bankruptcy

An employer who has not properly completed the documentation for the dismissal of its employees in the event of bankruptcy of the organization faces an additional fine. To comply with legal regulations, he is obliged to send official notices of the planned termination of employment to:

- all personnel 60 days before official dismissal (Part 2 of Article 180 of the Labor Code);

- to the territorial office of the Employment Center 60 days in advance, and if there is a mass layoff of personnel - 90 days in advance.

In the notification sent to the Employment Center, it is necessary to indicate information about each dismissed employee:

- position held;

- professions and specialties according to diploma;

- qualification requirements;

- wage parameters.

Employees' signature on the form serves as proof that employees have received the notification. All employees without exception should be notified of the planned termination of employment, including those absent from the workplace due to:

- leave (paid, unpaid, child care);

- temporary disability.

This is also important to know: What to do if you are not paid your salary upon dismissal and where to go

The law provides for categories of employees who may be notified of the upcoming termination of employment at a later date. These include:

- seasonal employees - they must be notified 7 days before termination of the contract;

- those working under a short-term contract - they are subject to 3 days notice.

The dismissal of employees in the event of bankruptcy of an enterprise is formalized by an appropriate order. Its copies are issued to everyone upon signature.

If there are those who do not want to sign, an act of refusal is drawn up.

Important

Please note! To avoid disagreements regarding compliance with legal regulations, it is worth sending notifications of the planned termination of employment to all employees by registered mail.

Procedure for informing employees about upcoming dismissal

Look, I fired you, but that doesn't mean I don't love you with all my heart. Stu Banks.

If the organization's bankruptcy procedure has already been initiated, employees should be informed about upcoming layoffs in advance, in accordance with the terms of the employment contract. The notice period for employees depends on the type of dismissal - regular or mass. By massive we mean a staff reduction of 15 or more employees at a time. In such a situation, it is necessary to notify employees three months before termination of the contract (with a normal dismissal, the employee is notified 2 months before terminating the contract unilaterally). In addition, you will need to report the mass layoff to your local employment office.

To comply with the terms of the contract and to avoid litigation with the organization’s employees, it is necessary to give each person a written notice that due to the liquidation of the legal entity, the employees will be dismissed. Employees who receive such a notice must sign in the appropriate register indicating that they have read the document. In this case, dismissal during bankruptcy of an enterprise will be completely legal and will not be a reason to go to court.

It is possible to dismiss employees before the 2-month period has passed from the date they receive the notice, but you will need to pay the employee compensation in the amount of the average monthly salary for the period remaining before the expiration of the established period. Dismissal by mutual consent is also possible - the employer and employee come to a compromise solution.

What does the Labor Code of the Russian Federation say?

The dismissal of employees in the event of bankruptcy of an enterprise is regulated not only by the Labor Code, but also by the Constitution, the Civil Code and the Insolvency Law.

The Labor Code does not provide for a separate article. It is possible to proceed to staff reduction only on the basis of a court ruling on the end of bankruptcy proceedings, which means the liquidation of the company. In this case, the company's employees are fired under Art. 81 Labor Code of the Russian Federation. The manager, who is obliged to deal with personnel issues at the company, has the right to dismiss personnel due to staff reduction (clause 3 of Article 129 of Law No. 127-FZ).

Employees must be notified of their layoff no later than 2 months before the event. Most often, until the moment of dismissal, the staff does not actually perform their duties, but the company is obliged to pay them for downtime until the date of their dismissal.

In order to reduce their costs, some managers try to reach an agreement with employees and convince them to take free leave for this period, or to terminate their employment contract at their own request or by agreement of the parties.

Cash compensation upon dismissal of employees

The liquidation of a company is considered a legitimate reason for the termination of the employment contract between the employee and the employer, however, this factor obliges the latter to pay some monetary compensation, since the termination of the contract was due to the fault of the employer.

First of all, dismissal of employees during bankruptcy of a company implies payment of severance pay, which is equal to one average monthly salary. In addition, the employer undertakes to pay the employee the same amount for two months as a guarantee of security for the duration of the job search. Finding a job earlier than this period eliminates the need for the previous employer to pay compensation.

Options for termination of employment

As already mentioned, in the general case, in case of bankruptcy of a company, the same algorithm of actions is used as in case of liquidation - implying advance notification of employees and payment of a fairly significant severance pay.

Instead, the management of the enterprise can offer the employee several other options that reduce the debt burden on the legal entity.

In total, within the framework of the current legislation, three ways of development of events are possible:

- Liquidation. The most honest option that excludes manipulation by the employee. In accordance with Article 178, paragraphs one and two of the Labor Code, the dismissed person receives severance pay, the amount of which is equal to the average monthly salary multiplied by two. In some cases, the multiplier may be equal to three - in particular, if the worker applied to the employment center and was unable to get a job. In addition, the employee receives a 100% salary for the time worked and payments for unused vacation time.

- The employee writes a statement of his own free will. In this case, in addition to wages for time worked and “vacation” compensation, the worker can only claim payment for downtime caused by the company, as well as, in court, compensation for moral damages and the costs of filing a claim.

- Dismissal occurs by agreement of the parties. The employee receives, in addition to the final salary and compensation for vacation days, severance pay provided for in the employment contract. For example, it may be equal to average monthly earnings.

The advantages of the second and third options for a company forced to pay off creditors and counterparties in parallel with its employees are obvious:

- less than the amount of compensation;

- The terms for terminating an employment contract are reduced.

An employee who wants to receive maximum payments from his former employer should not agree to such “simplified” methods - it is better to wait until the official order of dismissal due to liquidation is issued.

In turn, the employer does not have the right to force an employee to write a statement of his own free will - if there is evidence of involuntariness, such a document can be terminated in court.

Problems with payments or non-compliance with the terms of the contract

In some cases, there are employers who do not adhere to the terms of the contract, carrying out dismissal due to bankruptcy earlier than the established 2-month period from the date of sending notices. In such a situation, the employee can go to court, but there are some pitfalls here.

If employees demand monetary compensation, then it is worth considering that bankruptcy is characterized by the termination of the company’s activities and the sale of its property. The funds received from sales at the auction will be used to pay off all the organization’s debts, and often some debts cannot be covered. Inclusion of employees upon dismissal in the register of creditors does not guarantee that they will receive compensation.

Going to court to file a claim against an employer is not always cost-effective. On the one hand, declaring him bankrupt and conducting bankruptcy proceedings will not satisfy the interests of employees upon dismissal, since debt of this nature is written off in most cases. On the other hand, if the liquidation of a legal entity has already taken place, then the company against which the claim is brought, accordingly, does not exist. If there is no defendant, the court will close the procedure.

Useful tips

Both employers and employees are advised to contact qualified lawyers. who will help carry out this procedure in such a way that no one’s interests are harmed. The legislation has a lot of nuances that only competent specialists know about. Solving the issue on your own can lead to serious problems or a waste of your money.

The rights and obligations of employers and employees during the liquidation of a legal entity are regulated by the provisions of the Labor Code of the Russian Federation, therefore it will be useful to familiarize yourself with the main provisions of this regulatory framework.

Related publications

- Bankruptcy of Master Bank - why depositors still have not received their money

- Bankruptcy of an HOA with debts

- Definition of bankruptcy

- What you need to know about Federal Law 476, amending the Insolvency Law

Dismissal of employees in case of bankruptcy of an enterprise

The process of filing bankruptcy of a legal entity is accompanied by a number of procedures, without which the liquidation of the company will not be completed. We are talking about the dismissal of employees, for which it is very important to be guided by the current legislation. Violations in this matter may lead to legal proceedings by former employees for payment of wages or full reinstatement. How to avoid such risks? Is it possible to refer to the bankruptcy of a company when dismissing an employee?

Bankruptcy of legal entities will no longer be a problem if you seek help from the experienced lawyers of our company. Flexible prices, effective assistance in the most difficult situations.

It is not always the case that filing an application with a corresponding requirement can serve as a legal basis for dismissing a subordinate. The fact is that the liquidation of a company does not occur immediately, but is divided into several stages, and at all stages except the last two, the law does not allow unilateral dismissal of an employee. Only when the bankruptcy process enters the final stage will this indicate the impossibility of the company functioning as before, which will make the dismissal procedure legal. We are talking about the following:

- The first stages, and these are the stages of observation and financial recovery, leave a chance that the activities of the legal entity will not be stopped, so it will be impossible to fire the employee.

- When the current management loses its powers and the company goes into external management, then you can fire your employees, but only those who do not belong to the personnel department, since this department always works until the very end, right up to the liquidation of the entire enterprise.

The state can dissolve under any terms when the bankruptcy process comes to an end. This is if bankruptcy proceedings have begun, which will allow the company’s property to be sold at auction, the legal entity to be terminated and its employees to be fired.

Are there any exceptions? In addition to the indicated personnel service employees, there are a number of other categories of citizens who will remain at work until the decision to terminate the enterprise’s activities is made. Only at the very last stage can it be possible to fire disabled people, pregnant women who have not previously taken maternity leave, and it will also not be possible to fire an employee who has a child under three years old in the family.

What are the specifics of terminating an employment contract with an employee in the event of bankruptcy of an enterprise?

The basis for dismissal of employees in connection with the liquidation of the enterprise, that is, according to paragraph 1 of Art. 81 of the Labor Code of the Russian Federation must be a decision of the Arbitration Court that the organization has been liquidated. Since in this case the company ceases operations completely, all employees without exception are dismissed. The availability of benefits and the inclusion of an employee in a socially unprotected category of citizens does not matter.

Bankruptcy law obliges the bankruptcy trustee to notify the dismissal after the bankruptcy procedure is introduced. Art. 180 of the Labor Code of the Russian Federation specifies that this must be done 2 months before dismissal.

The head of an enterprise that has undergone bankruptcy proceedings is in a dual position: on the one hand, he is a director - he has the right to personally dismiss staff, and on the other hand, he is an employee, with whom the contract can also be terminated. In particular, after the introduction of an external management procedure, when he is actually replaced by an external manager, he may be fired; but the work book will not contain an article of the Labor Code of the Russian Federation, but the provisions of the bankruptcy law. In addition, the dismissal of a director in bankruptcy does not provide for the payment of severance pay.

The second category of citizens with whom questions may arise when terminating a contract in connection with the liquidation of an enterprise are pregnant women or citizens on maternity leave. Despite special legal protection, these employees are also subject to dismissal on a general basis, since the organization ceases its activities completely.

When an organization is liquidated as a result of bankruptcy, all employees cannot be fired at once, since some of them will be needed until the end of the liquidation procedure. In this case, there are 2 ways out of the situation:

- all employees are dismissed, but civil contracts for the provision of services are concluded with some;

- Notification of some employees occurs later and, accordingly, they are dismissed after the liquidation procedure.

The dismissal procedure itself in the event of bankruptcy of an organization consists of the following stages:

- notifications to employees in writing;

- payment of all funds;

- making an entry about dismissal in the work book;

- transferring to the employee all documents related to the work.

For reference! The employer is not obliged to assist in the employment of citizens dismissed during liquidation. The exceptions are orphans and children left without parental care.

Features of notifying employees about dismissal

When it is known for sure that bankruptcy is inevitable, and the corresponding procedure has already been initiated, then one should be guided by employment contracts, which stipulate the obligation to notify employees of dismissal in advance. The timing varies, and it all depends on the nature of the dismissal - regular or mass. In bankruptcy, entire staffs of more than 15 people are usually laid off, which falls under the definition of “mass layoffs.” In this case, employees should be notified of the impending reduction at least three months before the date of termination of the contract. For smaller layoffs, a notice period of two months should be adhered to before termination of the contract. In the event of a mass layoff, the employment service will also need to be notified.

Compensation for dismissal of employees due to bankruptcy

Termination of the activities of a legal entity makes unilateral termination of an employment contract legal; another thing is that this procedure requires the employer to pay compensation. The reason for the need for payments is the employer’s initiative in the matter of dismissal. If we are talking about bankruptcy and the dissolution of all employees except the HR department, then everyone will need to pay severance pay, which should be equal to the average salary, and over the next two months pay the same amount. If the dismissed employee finds a new job earlier than two months, the employer is automatically released from the obligation to pay benefits.

At some point, there may be no money available to pay benefits, and it is expected that employees will demand that all debts be repaid. You need to understand that the bankruptcy procedure is accompanied by the sale of the company’s property, and from the proceeds you can pay off all or part of the debts. If the amount is not enough to cover the debt, then employees may be included in the register of creditors, which is not a guarantee of receiving funds. As for going to court in case of non-payment of severance pay or arrears of wages, statistics say that this process is unprofitable. If the court declares an enterprise subject to liquidation bankrupt, then this will not help in the matter of paying monetary compensation, since in bankruptcy such debt must be written off, with the exception of very rare cases; accordingly, employees will only spend money on filing a lawsuit. If the filing of a claim occurs after the liquidation of the legal entity has been documented, then there will be no defendant in the form of a debtor enterprise. This will allow the court to close the procedure, which will also not bring money to the employee.

What types of compensation payments are due to employees upon dismissal?

At the same time, the person who is involved in carrying out all the necessary procedures related to the dismissal of employees of a bankrupt company on the basis of its liquidation must take care that the employees receive all the monetary payments that are due to them in this situation, based on the provisions of the current legislation.

Thus, the ordinary payment provided for in Article 178 of the Labor Code of the Russian Federation assumes that if an employee is dismissed due to the liquidation of the company, he is entitled to receive severance pay, the amount of which is one average monthly salary. In addition to all this, he also has the right to receive funds while looking for a new job in the amount of the average monthly salary for two months.

In this case, the employee must receive the specified funds at a time, on the day when the employment contract with him was terminated. It is worth keeping in mind that the main requirements for the provision of payments concern employees who were unable to find work within two months from the date of dismissal (although not only them).

If such an employee was registered with the employment service two weeks after the employment contract between him and the bankrupt company was terminated, and at the same time he was not employed within two months from the date of registration, the employee the right to payment of an additional amount of money in the amount of the average monthly salary appears.

Thus, in general, when a company is liquidated, depending on the specific conditions, the payment of funds to dismissed employees can be equal to three to four times the average monthly salary. These funds should help employees with financial support during a difficult period while they are looking for a new job.

Dismissal due to bankruptcy: controversial situations in judicial practice

As for the reasons that allow dismissed employees to go to court, there are not many of them. It is worth going to court if the company was not actually liquidated, which means there is no entry in the Unified State Register of Legal Entities, bankruptcy proceedings have just begun, or a new company has been formed that has assumed all the powers and obligations of the old company. The same applies to situations where the dismissal occurs due to the liquidation of not the entire enterprise, but one of the branches, or the dismissal was not formalized correctly from the point of view of law. Unlike ordinary liquidation, in bankruptcy the amendments indicated earlier are excluded, that is, all personnel must resign, including disabled people, those who are on maternity leave or have a child under three years old. At the same time, the staff of even a bankrupt enterprise has an advantage over other creditors, which obliges employees to repay all debts first. Violation of this order can also serve as a reason for legal recourse.

The head of an enterprise is not exempt from the dismissal procedure if the entity under his control is declared bankrupt. To do this, a decision is made on insolvency, then a liquidation commission is formed, and then a temporary manager is appointed. It is he who removes the general director from performing his duties by filing a petition with the Arbitration Court, and all further actions for dismissal occur on a general basis.

We will carry out bankruptcy of legal entities with maximum respect for the interests of the owners. In any difficult situation with debts, entrust bankruptcy management to professionals.

If during the bankruptcy procedure of a legal entity not all claims of creditors are fully satisfied, then an additional administrative and legal measure may occur, which is called subsidiary liability. It arises only when filing a bankruptcy petition with the Arbitration Court does not occur within the period established by law.

29 Sep 2020 439

How to “bankrupt” your company in difficult financial circumstances? Who needs this procedure? What are the consequences of bankruptcy of legal entities? Answers to these and other questions related to the bankruptcy of organizations will be given in this article.

15 Sep 2020 419

A legal entity, according to the law, is a subject of an organizational and legal form of business, registered on the territory of the Russian Federation and engaged in the production of goods (services). It is noteworthy that the status of an individual entrepreneur (IP) is still defined by law on the basis of an entity carrying out business activities without registering a legal entity.

19 Sep 2020 225

Dismissal due to bankruptcy of an enterprise

Advice from lawyers:

1. What payments are due upon dismissal due to bankruptcy of an enterprise.

1.1. Hello, in accordance with the norms of the current legislation of the Russian Federation and the established practice of its application, you are entitled to compensation for a reduction of up to three salaries.

Did the answer help you?YesNo

1.2. Good day. As a general rule, both in the event of staff reduction, liquidation and bankruptcy, the employee is entitled to compensatory severance pay in the amount of two months' earnings.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

2. Our company is a bankrupt OJSC, the last stage of bankruptcy, and they force me to write applications of my own free will and immediately write an application for admission to another organization LLC Management Company. Do I need to write applications for dismissal?

2.1. Lev Vladimirovich, good day. In fact, this decision depends on many factors. What specific procedure applies to your JSC. Does the OJSC have any debt to you regarding the salary? What is this new organization? Is this actually the same employer? Either way, you'll need to provide significantly more information if you want a pros and cons list.

Did the answer help you?YesNo

2.2. If you are transferred to another job in this way and you trust the employer, then you should agree. If not, then by law the arbitration manager must fire you and you should not write a statement yourself.

Did the answer help you?YesNo

3. The employer requires you to write a letter of resignation of your own free will in case of bankruptcy of the enterprise, how to be grateful.

3.1. Refuse, demand that you be fired due to layoffs in connection with the liquidation of the enterprise. Sincerely.

Did the answer help you?YesNo

3.2. Do not submit your resignation voluntarily. Lose the severance pay established by Art. 178 Labor Code of the Russian Federation.

Did the answer help you?YesNo

4. Our organization is undergoing a bankruptcy procedure and is currently being monitored. I wrote a letter of resignation, when should I be paid my salary, is there any priority? I know that the company owes taxes for two months. Thank you.

4.1. Hello Irina! Based on the Labor Code of the Russian Federation, Article 140. Payment terms for dismissal: Calculation for dismissal at one’s own request, as well as for other reasons, must be made on the day of dismissal, that is, on the last day of work. Calculation upon dismissal involves the payment of all amounts due to the employee: wages, compensation for unused vacations, payments provided for in the collective and employment agreement. If the dismissed employee used vacation in advance, the paid vacation pay is recalculated, and the corresponding amount is deducted from the salary upon final payment. If an employee was absent from work on the day of dismissal and was unable to receive a payment, he has the right to apply for it at any other time. The amount due to him must be paid no later than the next day after the application. According to Art. 65 of the Civil Code of the Russian Federation, an enterprise that is declared bankrupt by a court is subject to liquidation. And for employees of such an enterprise, this means that employment relations with them will be terminated on the basis of clause 1, part 1, art. 81 of the Labor Code of the Russian Federation. According to Ch. 27 Labor Code of the Russian Federation. which states that the employee is entitled to be paid wages for the time worked.

Did the answer help you?YesNo

5. Does the FORMER DIRECTOR of an enterprise fall under clause 3 of Article 136 of the Bankruptcy Law if there is a debt to him upon reduction of the director’s position at the time of dismissal, and according to the employment contract that was concluded on the day the enterprise opened, that is, 1.5 years in advance upon filing a bankruptcy application, due to the fact that 6 months after the reduction of the director’s position, the company was declared bankrupt, a monitoring procedure was introduced and the company had a NEW DIRECTOR at the time of filing the application.

5.1. — Hello, consultation on organizations and enterprises is a paid service. Choose a lawyer and we will provide you with this service for a fee, based on Article 779 of the Civil Code of the Russian Federation. Good luck to you and all the best.

Did the answer help you?YesNo

6. Liquidation of an enterprise due to bankruptcy. I am on maternity leave for up to 1.5 years. A month and a half ago they sent me a notice of further dismissal. They are delaying child benefits (partially with delays) What do I owe for this dismissal in terms of money, what payments, can I be fired retroactively without warning? Set the record straight (I want to register on time with the employment center within two weeks, if I get up on time, then there will be payments)

6.1. Good day. In accordance with labor legislation, in the event of an employee being dismissed due to liquidation and bankruptcy of an enterprise, they must pay two months' benefits in the amount of two months' average earnings; no one can fire you retroactively.

Did the answer help you?YesNo

6.2. Good day to you, you need to write an application to the same Arbitration Court addressed to the same judge to include your claims in the register of creditors.

Did the answer help you?YesNo

7. The wife is on maternity leave. The employer offers to write a letter of resignation at his own request due to the bankruptcy of the enterprise. How to proceed?

7.1. How to proceed? If she doesn't want to write this statement, she doesn't have to. Let them be fired due to the liquidation of the enterprise, paying all payments required by law.

Did the answer help you?YesNo

7.2. Hello. You shouldn’t write on your own; let him lay off or dismiss you due to the liquidation of the organization. Upon dismissal, you will be entitled to certain benefits. First of all, this is a severance pay in the amount of average monthly earnings. In addition, you retain your average earnings for the period of employment (no more than two months from the date of dismissal, including severance pay) Article 178 of the Labor Code of the Russian Federation. In addition to these payments, upon final payment on the day of dismissal, you receive wages and compensation for unused vacation.

Did the answer help you?YesNo

8. The company where I worked is bankrupt and is being fired under bankruptcy. If I immediately get another job officially with a work book within 14 days, am I entitled to compensation from the company (since upon dismissal they are required to pay compensation for 2 months)?

8.1. Yes, you must be notified of dismissal at least 2 months in advance and paid a benefit in the amount of 2 months of average earnings and compensation for unused vacation.

Did the answer help you?YesNo

9. What wording can there be in an order to dismiss an employee in this situation? Situation: a temporary manager is appointed at enterprise N (bankruptcy). Previously, the company entered into an agreement with a private security company (subsidiary), which essentially serves only enterprise N. Private security company employees have open-ended employment contracts. What awaits employees of private security companies in the event of bankruptcy of enterprise N: dismissal due to staff reduction or at the initiative of the employer... or is this a different wording?

9.1. It all depends on your employer, if there is no work, then you must be fired due to a reduction in the number and staff with the payment of severance pay, post. 178 of the Labor Code of the Russian Federation. They may offer dismissal by agreement of the parties with the payment of compensation.

Did the answer help you?YesNo

9.2. Your private security company is a separate legal entity. If it was created exclusively to serve a liquidated enterprise on the basis of a service contract, then in the event of liquidation of the main enterprise, the private security company is also liquidated and all employees are dismissed on this basis with the provision of guarantees and compensation in accordance with Art. 178 of the Labor Code of the Russian Federation, or the private security company enters into an agreement with other enterprises for the provision of services and the employees continue to work. If at another enterprise the volume of services is less, then at the private security company it is possible to reduce staff and corresponding layoffs on this basis.

Did the answer help you?YesNo

10. I am on parental leave to care for a child up to one and a half years old, the enterprise where I work is in the process of bankruptcy and will be sold in the near future, accordingly the enterprise will be liquidated. Actually, these are the questions: do they have the right to fire me (make me redundant) and what payments should I expect? Can I register with the CZN? and which institution should I contact after dismissal (downsizing) in order to receive benefits for up to one and a half years?

10.1. Hello! 1.Have the right to dismiss due to liquidation. Payments - in accordance with Article 178 of the Labor Code of the Russian Federation 2. You can register with the Central Tax Service 3. Contact social services. protection.

Did the answer help you?YesNo

11. The company is at the stage of bankruptcy, in 3 weeks it will be closed - I am on maternity leave for three months. They ask you to come and write a letter of resignation. Am I entitled to any payments in connection with bankruptcy and do I need to write a letter of resignation?

11.1. Hello! Don’t write anything, demand dismissal due to liquidation with all payments in accordance with Article 178 of the Labor Code of the Russian Federation.

Did the answer help you?YesNo

12. I quit the company. And a few days later the company launched bankruptcy proceedings. Of course, upon dismissal, they did not give me a paycheck. There is a salary debt. If I quit, will I get my loan back? Or, at the time of bankruptcy of an enterprise, is it necessary to be registered in this enterprise? Or now only through the court?

12.1. Hello. If the company is undergoing bankruptcy proceedings, you must contact the Manager and the court to include your claims in the register of claims of the debtor's creditors.

Did the answer help you?YesNo

12.2. You need to apply to be included in the register of creditors.

Did the answer help you?YesNo

13. Please help me, how to correctly issue a dismissal order in case of bankruptcy of an enterprise - (Grounds for termination)? I can’t make a mistake, everything must be spelled correctly. Hope is in you. Thank you.

13.1. The law does not provide such grounds for dismissing an employee.

Did the answer help you?YesNo

13.2. Hello, you can refer to the decision of the arbitration court on the introduction of bankruptcy proceedings. Under clause 2 of Article 129 of Federal Law No. 127 “On Insolvency,” the bankruptcy trustee is obliged to notify the debtor’s employees of the upcoming dismissal no later than within a month from the date of commencement of bankruptcy proceedings.

Did the answer help you?YesNo

Consultation on your issue

8

Calls from landlines and mobiles are free throughout Russia

14. The company where I work may in the near future be declared bankrupt by the court due to non-payment of accounts payable. Tell me, what do I, as an employee of such an enterprise, face in case of bankruptcy? Dismissal? Thank you.

14.1. Yes, your employment contract will be terminated on the basis of clause 1 of Art. 81 Labor Code of the Russian Federation. Your salary requirements. will be included in the second phase.

Did the answer help you?YesNo

15. My husband works at a municipal unitary enterprise, a passenger motor transport enterprise, and the business is heading towards bankruptcy and liquidation in the next 2-3 months. At the moment, the company’s policy is to dismiss the maximum number of employees at their own request; appropriate conditions are being created. My husband turned 58 on January 5th. Question: is it possible for him to retire before age 60? Is it possible to get laid off? How to behave optimally?

15.1. Don't write on your own. You can get laid off like everyone else (but in this case the payments will be good). You'll manage with your pension, Natalya Nikolaevna. Have a nice day.

Did the answer help you?YesNo

15.2. If you resign due to liquidation or layoff, the Central Employment Service may issue an early pension.

Did the answer help you?YesNo

16. I have a question. The management asked me to write a letter of resignation of my own free will without a date. Now the company is on the verge of bankruptcy, but they don’t want to lay us off due to reduction, can they fire me, because the date will not be written in my hand. Thank you in advance!

16.1. Sergey, if you are fired, you can safely go to court, the matter is promising.

Did the answer help you?YesNo

17. My name is Anna, I received a notice from the company about my upcoming dismissal due to bankruptcy, can I resign of my own free will without waiting for the deadline? And is compensation due?

17.1. On your own - you can. No compensation is due.

Did the answer help you?YesNo

18. In such a situation, it is necessary to file a claim with the court to change the wording of the reason for dismissal. If the company is currently at the stage of bankruptcy, then in the header of the application, who must be indicated as the defendant because the enterprise no longer has a legal address and bankruptcy proceedings have been introduced against it.

18.1. Hello! You indicate the employer, even if he is bankrupt.

Did the answer help you?YesNo

19. Dismissal due to the liquidation-bankruptcy of the enterprise; the salary was 70,000 rubles. They offer to write a statement of your own free will, what should you do?

19.1. You have the right not to write such a statement.

Did the answer help you?YesNo

19.2. If you resign of your own free will, you will lose 3 months of severance pay.

Did the answer help you?YesNo

20. I work as a manager in a department; we were told at a general meeting that there would be bankruptcy at the enterprise and offered to write a letter of resignation by agreement of the parties. By verbal agreement with the director of the enterprise, I wrote a statement by agreement of the parties, to which she imposed a resolution with a working period of two weeks. I haven’t been paid my salary for two months, I want to quit, but they don’t fire me.

20.1. Contact the labor inspectorate.

Did the answer help you?YesNo

20.2. Write a statement to your employer about the suspension of work and you don’t have to leave until you are fired or until your salary is paid.

Did the answer help you?YesNo

Where to go with a court decision on non-payment of wages upon dismissal? The company is in bankruptcy.

The following question arose: What payments are due to the general director upon dismissal by agreement of the parties during the bankruptcy of an enterprise and what law is this written in?

I am on maternity leave for up to 1.5 years. On January 13, the child will turn 1.5 years old.

I received a notice of upcoming dismissal due to the bankruptcy of the company.

We have this problem: we can’t pay off our salary debt (payments upon dismissal)

On August 30, 2020, I received a notice in writing against signature of the upcoming dismissal due to the bankruptcy of the enterprise,

The company where I worked has opened bankruptcy proceedings.

The company is undergoing bankruptcy proceedings; wages have not been paid since June.

In July 2020, I quit my job at Ishimbay Machine-Building Plant OJSC, since I had not been paid my salary since February 2020.

Enterprise bankruptcy. He was fired illegally at his own request, without a letter of resignation, the company did not pay.

At the company where I work there is a bankruptcy, we were offered to either write at our own request for dismissal or layoff,

Order of abbreviations

Dismissal of employees occurs in several stages, because they cannot be fired just like that at one moment. The procedure must be carried out in accordance with the law of the Russian Federation.

- The general meeting of participants or founders decides to declare the enterprise bankrupt. When an enterprise has one owner, the decision is made by him.

- The employment center at the place where the enterprise is located must receive information about the upcoming bankruptcy procedure, which will entail the dismissal of people. This must be done 3 months before the layoffs.

- Each employee must be informed in writing that he is leaving due to the bankruptcy of the enterprise. There is a separate, established procedure for notifying employees.

- The employer has the right to offer employees to resign early on their own, in which case they will receive additional compensation. Its size depends on the employee’s average monthly salary and the days remaining before the layoff.

- After employees are notified of dismissal, an order is created stating that the bankrupt enterprise breaks off labor relations with its employees. Each employee is familiarized with the order, who must sign it with his own hand.

- The procedure for carrying out layoffs includes the registration of personal files of employees, where information about their work activities is entered.

- A completed work book must be issued to each employee on the day of dismissal, which is the last working day.

Special situations

Liquidation of an enterprise involves the loss of a job for each employee. They are required to vacate the position by the date specified in the notice received. In case of early departure, termination of the employment contract is agreed upon with the new manager (not director).

Features of dismissal of specific categories of workers:

- those leaving early - compensation is paid instead of benefits (its amount is equal to the average monthly payment for the period from actual dismissal to the date specified in the notice);

- pensioners - receive all payments (not only benefits, but also compensation);

- Those on maternity leave or parental leave receive the required social benefits in addition to general benefits.

This is also important to know: The procedure for dismissal due to staff or headcount reduction

If a bankrupt enterprise does not have enough funds to fully repay debts to employees, they can resolve the issue in court.

Those on leave (maternity or child care), as well as those on sick leave, can submit an application to the Social Insurance Fund. In this case, due payments will be made within 10 days from the date of registration of the submitted application.