Summary

- How to buy back your debt from a bank under an assignment agreement? And what you need to do?

- Redemption of debts under an assignment agreement

- How to redeem a debt under an assignment agreement

Questions

1. How to buy back your debt from the bank under an assignment agreement?

And what you need to do? 1.1. First of all, you need to contact the bank and clarify all the conditions. Each bank sets its own conditions on this matter, unless, of course, your bank makes such offers at all.

1.2. Contact the bank where you received your loan directly. If the bank agrees to sell you your debt under an assignment agreement, then complete it. In general, I very much doubt such actions of the bank; it is not profitable for it. But you can try, of course, in case he agrees. Your issue can only be successfully resolved with legal assistance. Always happy to help you!

2. A PKB employee came and convinced me to sign an agreement to pay off part of the debt under the loan agreement, which was originally concluded with Vostochny Bank. those. According to the assignment agreement, the debt was transferred to collectors. bought it cheap. I signed an agreement with a collection agency, which indicates the amount of forgiveness is quite significant. Please tell me, have I been scammed or could this be true? I have an agreement with the collection agency, and a repayment schedule too. you need to deposit 1000 rubles. per month.

2.1. If the contract was officially signed, then most likely not.

2.2. Once you have signed it, you can try to prove through the court that the transaction was made under duress. If it doesn’t work out, just don’t pay, let them go to court themselves and indicate there that the transaction was made under duress. And in general, it is no good to pay to scammers and extortionists, which are what the so-called “collectors” are.

3. I had a loan from a bank, the bank filed a lawsuit for 240,000 rubles (including fines and penalties), then the court decision on collection went to the bailiffs, and a couple of months later the bank filed my debt under the assignment agreement, the amount indicated in the agreement was 159,000 rubles (amount of principal) debt. The assignment of rights was obtained through the court. Now the organization that bought my debt (159,000 rubles) wants to collect 240,000 rubles from me based on a lawsuit previously filed with the bank. Is this legal? How much can they charge me?

3.1. Hello. You need to read the documents. There are mandatory requirements of the law.

3.2. It all depends on what is written in the court decision and writ of execution.

4. Through a friend, I bought out my debt from the bank under an assignment agreement. What kind of agreement should my friend and I draw up in order to forgive the debt and not be subject to personal income tax?

4.1. Hello! You will not have a debt forgiveness agreement. You need to go through the process of paying off your debt. In more detail, I will answer in a personal message.

5. I found out that the bank has the right to file a lawsuit to charge interest for using the loan for the entire period that I am paying off the debt. Allegedly, I am still “using” the loan; the debt has long been with the bailiffs. They offered to buy out the debt under the assignment agreement. The question is, is there any guarantee that if I pay off the debt, the bank will fall behind and there will be no surprises in the future in the form of another enforcement proceeding? I don’t know, maybe they can arrange something with the bank that they have no complaints or something else.

5.1. It is possible through a settlement agreement and everything can be spelled out in it.

6. Collectors from RSV LLC write to me about the existence of a debt from Online Loan LLC. I definitely didn’t take any money there. They work under an agency agreement with a Cypriot fund that purchased debt from banks and microfinance organizations in the Russian Federation. Now they are writing that they will file a court order if payment is not made. Because They have an agency agreement and not an assignment agreement, can they do this? What should I do?

6.1. They can. Cancel the order.

6.2. So that collectors do not bother you, write an application to refuse to interact with the creditor, then, if they go to court, cancel the court order in accordance with the Code of Civil Procedure of the Russian Federation. Sincerely!

6.3. If you receive a court order, apply for its cancellation within the prescribed period and in the prescribed manner.

7. My ex-husband has debts on loans from VTB Bank and Post Bank. Hasn't paid for 2 years now. The banks have not yet filed a lawsuit. He doesn't work, he has no property. I want to buy out his debts from the bank, but when I called the bank, they told me the amount of his total debt. Tell me how I can do it in order to buy out his debts under the assignment agreement, is it possible to somehow make such an offer to the banks, how to make such an offer correctly. Thank you.

7.1. Hello. If the debts are small, then write to the bank in writing an offer to conclude an agreement for the assignment of the right of claim. Invite your version of the assignment agreement. That's all.

8. I want to buy out a friend’s debt from the bank under an assignment agreement. The bank requires me to indicate the reason why I want to repurchase the debt. What should I indicate?

8.1. The best reason is homosexuality!

Banks or private lenders are commercial entities whose purpose is to make a profit by issuing loans at interest. Also, do not forget that fines, commissions and penalties are also of commercial interest and can generate profit. And the entire debt business as a whole is very profitable.

Therefore, the borrower’s acquisition of his own debt is a good deal for both parties, but under clear margin conditions. For example, a bank analyzed a problematic contract and came to the conclusion that it would make a profit upon sale.

In general, the concept of profitability for credit institutions in this matter is vague. This is due to the Central Bank’s resolution on restrictions on the issuance of new funds until old debts are written off from the balance sheet.

Important!

Problems related to loans fall into the category of complex cases.

Consult for free

with the specialists of our “Legal Center”

How it works:

- The Central Bank takes money at 2-3% from the government or other states and distributes it among bankers.

- Each bank is allocated a certain amount (quota). That is, the amount of money issued is strictly limited.

- Next, the bank issues loans to people or companies at its own interest and distributes the amount received from the Central Bank among the borrowers.

- If the borrower stops paying and his debt hangs on the lender’s balance sheet, then the next time the tranche is distributed, the bank will not receive funds in the amount specified in the agreement.

An interesting situation is emerging - it is beneficial for the bank to quickly get rid of the problematic agreement. In principle, he does not lose anything, but only earns. So feel free to negotiate the purchase of personal debt.

Who has the right to redeem the debt:

- an individual representing the interests of the borrower;

- commercial organization (collectors);

- lawyers;

- non-profit structures.

Transaction objects

The activities of banks are based on the turnover of funds, obtaining benefits from commission fees, interest on loans, borrowings, loans. The institution's policy establishes a certain standard for debt collection from unscrupulous borrowers, while the lender will take the maximum possible measures and actions to fully satisfy its requirements. The financial well-being and business reputation of the bank depend on the volume of funds collected from debtors.

The creditor considers the option of repaying obligations by signing an assignment only in exceptional situations, when a set of measures has been taken to work with an insolvent client, and conclusions have been drawn about the impossibility of fulfilling the debt.

Transfer of debt on consumer loans is allowed, but the lender is reluctant to enter into a transaction if, under the terms of the agreement, there is security for the obligations.

For example, on a car loan from Sberbank, a citizen has a debt equal to half the cost of the vehicle, then the bank will most likely refuse the assignment. The tactic is based on the fact that the collateral actually has a higher price than the amount of the obligation. The transport can be seized from the defaulter, sold, and the funds will be used to pay off the arrears. The creditor will then receive not only the principal and interest, but also the amount of penalties, fines, and penalties.

A credit institution will proactively consider proposals for the assignment of claims on overdue loans, obligations not secured by collateral or a guarantee. Debt with an expiring statute of limitations is also at risk. The likelihood of debt repayment under such agreements is minimized, and the judicial collection procedure is associated with certain risks, financial and time costs for the creditor.

Various persons may be chosen as debt buyers

Grounds for ransom

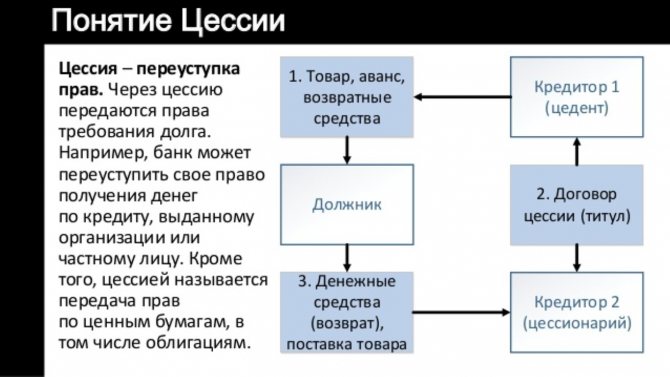

The purchase is formalized by an assignment agreement - an agreement under which the rights of the creditor are transferred to another person (Article 382 of the Civil Code).

The buyer, when concluding an agreement, must be sure that the seller (creditor) has the right to demand payment of the debt.

- receipt;

- loan agreement;

- executive document;

- resolution to initiate enforcement proceedings;

- papers indicating that the debtor is undergoing bankruptcy proceedings.

Receipt

Debts on receipt are redeemed reluctantly. Typically, the amount of money borrowed is small. Often the paper is drawn up in violation of the requirements of Art. 808 Civil Code:

- is printed on a computer, but must be written by the debtor exclusively by hand;

- there is no information about the borrower, which makes identification difficult (full name, passport details, registration);

- the loan amount is written in numbers, it is more correct to decipher it in words;

- there is no date of receipt, repayment period, type of loan (interest-bearing or non-interest-bearing);

- there is no phrase “the money was received by me personally.”

Considering that money on a receipt is given to relatives or acquaintances, the lender rarely notarizes it.

As a result, it is difficult to legally demand a refund based on an incorrectly drawn up document. Collectors will not risk their finances if the chance of receiving income is minimal.

Loan agreement

Most often, an assignment agreement is concluded on the basis of a loan agreement. It is beneficial for the bank to get rid of the debt if repayment will entail large legal costs.

When the cost of repayment exceeds the required amount, the debt is more profitable and easier to assign.

Financial institutions sell such agreements in bulk at a low price. Therefore, collectors are more willing to enter into an agreement for the assignment of the right of claim on the basis of a loan agreement.

Executive document

The writ of execution is issued after the court decision enters into legal force (10 days after its issuance). On its basis, the creditor has the right to independently collect funds or entrust this to the bailiffs by initiating enforcement proceedings.

A debt claim based on a writ of execution has a greater chance of being satisfied. The buyer will not have to spend money on legal proceedings. As a result, the price of such an offer turns out to be higher than the wholesale price.

The benefit to the acquirer is obvious. The seller will be able to return 10-50% of the required amount and return the finances as soon as possible.

Resolution on initiation of enforcement proceedings

The resolution indicates that compulsory measures are already being taken against the debtor. The person who has redeemed the debt can only provide the assignment agreement at the place where enforcement actions are carried out, monitor the progress of the case, provide all possible assistance and wait for the result.

Documents on the financial insolvency procedure

The financial affairs of a debtor undergoing bankruptcy proceedings are handled by a bankruptcy trustee. He carries out an inventory, inventory and valuation of property. Tries to even out the situation with the client's debt. The person who entered into the assignment agreement contacts the manager and jointly solves the problem of repaying the debt.

Redemption procedure

Let's look at the redemption procedure using a real example: the borrower took out a consumer loan from VTB in the amount of 250,000 rubles for a period of 12 months. The monthly payment is 26 thousand rubles. To make payments, the borrower sells the car, but he still manages to pay only half of this amount.

To avoid a legal dispute, after a few months the debtor turns for help to an anti-collection organization, where the corresponding agreement is concluded. Starting from this moment, the borrower transfers 13 thousand rubles not to the VTB account, but to the account of anti-collectors. In the meantime, lawyers conduct oral and written negotiations with the financial institution in order to persuade them to resolve the problem before enforcement proceedings reach the court.

After some time, the lawyers still manage to achieve their goal and come to an agreement with VTB Bank. During this time, 78 thousand rubles were credited to the company’s account. The agency receives 10,000 rubles as payment for its services, the rest of this amount is used as payment for the transferred debt to VTB.

At the bank

Redemption of debts from a bank is a complex process, since there are many applicants for the acquisition, and the procedure is complicated due to bureaucratic delays.

If delays occur, the financial institution will analyze the prospect of getting rid of the contract. And if the credit commission thinks that the debt can be repaid, then all methods will be tried and only then a final decision will be made.

If the bank goes to court and wins the case, the Central Bank will write off this agreement from its balance sheet and provide new funds. The same applies to bankruptcy or initiation of criminal proceedings against the borrower.

Why is it profitable for a bank to sell a borrower’s debt?

The credit institution also benefits from the sale:

- Receives real money that can be immediately spent on development.

- Improves statistics that affect the flow of new funds from the Central Bank fund.

- Saves on costs associated with debt collection. No debt - no costs for lawyers, state fees, or additional work for employees.

- Maintains a positive reputation.

What debts can be redeemed?

- Unpromising - the client lacks property and official income. Even if you win the trial, the bailiffs will complete the enforcement proceedings on the basis of Art. 46 part 4 of Federal Law No. 229.

- Paid – Most of the loan has been paid off. That is, the bank wants to receive only the expected profit in the form of interest or fines.

- Controversial - the borrower has found violations in the contract and is trying to terminate it in accordance with Art. 451 Civil Code.

- With the statute of limitations expired, the bank has no choice but to sell the debt to collectors or a representative of the borrower.

The principle that guides the creditor when selling debt is profit. If the debt is bad, collection will require significant costs, the bank will try to get rid of the “bad” loan as soon as possible. But if there is a chance to return the money, the financial institution will not make the deal.

For example, if the loan was issued against collateral, the purchase of a mortgage, or a car loan, it is more profitable for the bank to seize the collateral and sell it.

If the debtor has a solvent guarantor, the creditor will not back down and will recover the money from the latter through the court.

Most often, the bank assigns loans for consumer loans when it becomes obvious that repayment is impossible or unprofitable.

Required documents

Since the borrower does not have the right to redeem his own debt, representatives must do this, but documents are collected by all parties to the transaction, including the lender.

- loan agreement;

- account statement;

- the bank's claim indicating the final requirement (hereinafter referred to as the CT);

- property documents;

- income certificates.

- application for debt redemption;

- evidence of the borrower's insolvency;

- documents confirming the benefit of the bank, for example, providing other debt obligations of the client, proving that selling the problem loan would be the best option.

- contract analysis;

- monetary demand;

- providing a report that shows how the debt was formed.

For each specific transaction, a separate package of documents is generated.

Assignment agreement

Based on the assignment agreement, the rights of claim are assigned. This provision is regulated by the Civil Code, Art. 388-390.

The debtor is obliged to agree to the sale, but if the agreement is a banking one, then this point was indicated. Therefore, the presence of the borrower at the conclusion of the transaction is not necessary.

If there was no agreement initially, then the debtor is obliged to agree to the sale of the debt.

Redemption of loan debt from VTB Bank at a 90% discount

What debts can the bank sell? If the financial institution has done everything possible to collect the debt from the debtor, but he has not repaid the loan, then the debt is assigned the status of bad debt.

The bank can sell any debts recognized as bad. Let's take a closer look at the question of how to buy back your overdue debt from VTB 24 Bank.

Is it legally possible to sell a debt to repay it further? For those who decide to buy back the rights to a loan, it is important to understand that this is an absolutely legal process that occurs due to various circumstances on both sides of the contract.

Why banks try to sell debt According to statistics

Through a third party

The concept of “third party” is not reflected in the legislation, but is used everywhere in the legal field. Therefore, these persons can be anyone:

Therefore, anyone can contact the bank and offer to buy out the debt. The wife has the legal right to purchase her husband's loan under an assignment agreement.

Since the borrower cannot negotiate with the lender, he is obliged to turn to a third party.

If the borrower has offered the bank to buy out his agreement, the participation of a representative is a prerequisite. The main thing in such relationships is trust. Otherwise, the debt will remain in the hands of the assignee.

Who can act as a buyer of an overdue loan?

Redemption of your loan debt from the bank by the borrower himself

It often happens that VTB offers the debtor to enter into an assignment agreement and buy out the debt.

It is important to understand that you personally have no right to this. It can only be redeemed with the help of a third party.

How a debt is redeemed by a third party from a bank

The redemption procedure is quite simple and resembles applying for a loan. A third party enters into an assignment agreement with VTB and buys out the debt.

An assignment is the transfer of debt rights to another person who has agreed to buy it back - which is discussed in Article 382 of the Civil Code of the Russian Federation.

Who can become a third party?

The most important rule is that the person chosen by the debtor as a third party should not be closely related to him. That is why it is necessary to contact an anti-collection agency or a specialist lawyer who will help you get out of this situation correctly and repay the loan.

Offer from the creditor to the debtor

Often, moneylenders try to negotiate with debtors to buy out the debt. Banks may also offer this, but with rare exceptions. Typically, the borrower independently seeks approaches to financial organizations by sending a proposal to the organization’s head office or sending a representative to an appointment. Let's assume the bankers are satisfied with the terms and agree to the deal, let's see how this happens.

Redemption procedure

There are two options for the development of events:

- A court decision has been made regarding the debt.

- The creditor did not go to court.

On the second point, everything is simple - they paid a fee and entered into an assignment agreement.

If there was a trial, the process becomes more complicated. The buyer must submit an application for succession, and after the court makes a ruling, submit it to the bailiffs. Next, you need to pick up the writ of execution, thereby ending the proceedings.

The bank will never take away the writ of execution. This carries a significant risk for him.

Application to the bank for debt redemption

The document represents the usual standard form.

I, ___F. AND ABOUT._______________

Debt buyout offer

I, (F. I. O.), propose to (name of the bank) conclude an agreement for the assignment of claims for debt collection from (F. I. O. debtor) in the total amount (amount).

The amount of debt was confirmed (case number) by a court decision. With the value of the assigned right in the amount (indicate the amount for which you are willing to redeem the debt) and the payment period within 7 calendar days from the date of conclusion of the assignment agreement.

Classic: debtor bank

The classic sales scheme is to assign the contract directly to the borrower’s representative (relative).

Typically, lenders ask for at least 50% of the gross amount

. But this market does not adhere to clear prices, so in practice it is possible to reduce the cost to 40-30%.

It is worth noting that the agreement is sold to a collection agency for only 10% of the total cost.

Multi-step: bank-collectors-debtor

The bank does not always agree to the debtor's proposal. In some cases, the debt will be sold in a general portfolio to debt collectors.

Here you need to negotiate with representatives of the agency and understand the price for which they bought the debt.

The agency's conditions for repurchase are much more loyal than those of the bank. The explanation is simple: there are a lot of debts, but they pay little. The percentage of closed contracts is only 5% (according to NAPCA) of the total. Therefore, it is much easier to agree.

Why do banks try to sell debt?

A normal person realizes that if the creditor files an appeal to the court, then there is nothing to count on reducing the debt. I would like to once again emphasize that the debtor who agreed to buy back his own debt receives good benefits.

As for banking organizations, it is absolutely not beneficial for them to have such agreements, this is due to the fact that the Central Bank requires accessible ways to be exempt from such loans. Among other things, the presence of such debtors significantly reduces the rating of organizations providing loans. All these facts force credit institutions to literally sell loans for pennies.

If you cannot pay off your debt, you need to agree with the bank on a deferred payment; in most cases, the bank makes concessions, and the person will have time to find money. And it’s better, of course, not to borrow money at all. Today this is very dangerous due to the difficult situation in the country, so you need to reasonably assess your capabilities before taking out a loan.

How you can buy back your debts from the bank is discussed in this video:

How can an organization buy back debt?

A legal entity can also fall into a debt trap, but with a larger number of creditors than a physicist. For example, business partners who provided a delay in receiving goods. This debt is called debit.

Debit Accounts (DA)

We have already told you how to use debit debt to get rid of debts to an individual, now let’s look at whether a company can buy back such a debt.

The procedure will be similar to the acquisition of any debt. Everything is done through representatives. The only difference is that a court decision must be made on this debt.

Making a deal

There are two potential methods for repurchasing debt from a bank: directly or through intermediaries.

Agreement with a third party

The borrower can contact the collection company independently, discuss possible options for resolving the problem, and find a compromise. Then the collectors draw up an assignment agreement with the bank, repay the debt to it, and then sell the obligation directly to their client.

The transaction is mutually beneficial for all participants: the bank achieves debt closure, the collection service receives a reward, and the citizen reduces the amount of potential risks and expenses, and is freed from debt encumbrance.

Similar actions can be committed with the participation of relatives and other persons. In such cases, it is important to interest the bank in a specific offer for sale, and to convince the new creditor to take on someone else’s debt.

For example, the client will provide Alfa Bank with documentary evidence of insolvency, lack of work, sources of income, property. And the collector, in turn, will offer the lender to sell the debt on favorable terms in the shortest possible time. Much depends on the creditor, but there is a high probability that the profit from the assignment will be greater for him than the difference in the amount of enforcement and legal costs.

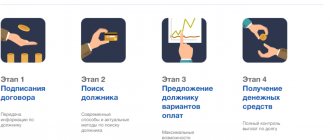

Separately, we should consider how a citizen can redeem his debt from a bank under an assignment agreement:

- Finding a new lender.

- Negotiating the terms of the deal.

- Discussion of the event with the bank.

- Conclusion of the assignment.

- Signing a contract for the transfer of debt to an individual.

Resolving the issue directly with the creditor

In practice, it is very difficult to reach an agreement with the lender on the assignment of the right to claim debt on a loan, since such transactions can lead to negative consequences in the form of a decrease in the flow of clients, income, deterioration of business reputation, and the status of the organization.

With the right approach, the debtor can negotiate with the bank himself

Therefore, the most optimal option would be to wait for the moment when the lender himself takes the initiative and offers the borrower to repurchase the debt. If the defaulter is the first to express a desire to repay the debt using this method, the bank will have doubts about the citizen’s insolvency, which confirms the likelihood of full satisfaction of the requirements within the current transaction.

The debtor may provide information indicating a deterioration in his financial situation or the absence of other sources of debt repayment. This policy will be especially effective when the statute of limitations is coming to an end, the amount of obligations is insignificant for the bank and the procedure for forced collection through collectors or the court is inappropriate.

The borrower may offer the organization terms that are more favorable than those offered by other potential assignees. For example, a collection agency is ready to buy a bad debt on a citizen’s consumer loan from Alfa Bank for 20%, and the client will offer 25%. Additionally, the debtor can initiate the opening of a debit card or account in this institution, thereby increasing the likelihood of the creditor making a positive decision.

It is important for the borrower not to waste time, not to wait for the moment when the bank offers to buy the debt through a third party, to negotiate with the creditor, to study the market segment, the economic situation in the country independently or with the involvement of a specialist. Then it is possible to identify the optimal conditions for achieving the goal and determine a favorable rate for the assignment.

Today, many law firms and anti-collection agencies, for a reasonable fee, are ready to formulate defense tactics for the debtor, prepare an action plan, and even act as a legal representative in negotiations on the basis of a power of attorney.

Loans

Loans for organizations are much larger in amount than for individuals. There are also more ways to collect. For example, blocking and seizure of accounts without which legal entities. the person ceases to operate.

But securing loans is much more serious. Banks lend funds only to trusted organizations that, in their opinion, are able to repay everything on time.

Directors of enterprises are subject to criminal liability for non-repayment of loans. Therefore, companies take such problems seriously and try to resolve the issue as quickly as possible.

An ordinary person can pay or turn off the phone and disappear. This won’t work with organizations. Before issuing money, they are checked by security officers and pulled out all the ins and outs. In fact, companies provide information about all income, even those they try to hide. After all, it is in their interests. It's simple: the higher the income, the larger the loan.

The debt is repurchased either at the negotiation stage - with the help of a reduction in the debt, or after the trial, the debt is repurchased for 30-50% of the nominal value. Provided that there is no bankruptcy procedure.

Credit line

This financial product is provided in portioned tranches. That is, the bank controls a large amount, dividing it into separate payments. When debt arises, not the entire loan is lost, but only a part.

It is possible to buy back this debt, but only if there is a serious delay. Typically, creditors make concessions and are willing to wait quite a long time for funds to arrive. A striking example is the agricultural industry, in which the receipt of payments is delayed for seven to eight months, from the time of sowing the crop until the moment of sale.

Leasing

Typically, enterprises buy special equipment, industrial equipment or commercial real estate on lease. Since this product is highly liquid, the bank takes it first.

It is not practical to buy out such debts, but the company does this to preserve its reputation. Typically, the sale of the collateral covers all expenses and the amount owed is not significant.

Mortgaged property

The company can buy the collateral from the bank on a first-come, first-served basis. But it is necessary to understand that such a turn is undesirable for the organization. As a rule, a company that owes money begins bankruptcy proceedings.

The debt, like the property, is sold by the bankruptcy trustee, but as a result of bankruptcy, such debt is not collectible, and its purchase by any of the parties does not make sense.

How to buy back your or someone else's debt from a bank?

Any bank is a purely commercial organization.

Expired cards and consumer loans are subject to sale. The rights of the original creditor are acquired by the new creditor to the extent that existed at the time of transfer. Thus, the rights to unpaid interest and mortgage on the real estate are transferred to a third party.

His task is to make a profit. One of the main products of any bank is issuing loans. Loans are issued on payment terms. That is, interest is charged on them for use. Inevitably, a certain percentage of loans are problematic for the bank. That is, they have overdue debt with low prospects for repayment.

In addition to issues of profit, banks, as credit institutions, have certain obligations to the Central Bank of Russia.

Some obligations include requirements for indicators of overdue debt in the loan portfolio. A high level of problem debt carries the risk of losing a license. Therefore, loan debts are often sold.

In civil law this procedure is called cession. The assignment is regulated by Articles 388 – 390 of the Civil Code of the Russian Federation.

The Supreme Court of the Russian Federation clarified

Where are debts bought and sold?

- Auctions are specialized online platforms where lenders announce the starting price of an overdue loan. The person who offers the highest price will be able to purchase it. Usually, bad debts (which have been abandoned by collectors) end up at auctions. Their cost is 2-3 times less than the amount of the debt itself.

- Register of banks. Today, every bank publishes information about overdue debts that it is ready to assign. A special Internet page of a financial organization contains information about the amount, date of arrears, the region of the Russian Federation where it exists, and the price for which the debt is repaid. Contacts are indicated.

- Ads. Most collection agencies make their intentions known on the company's website or on social media.

How did your debt end up with collectors?

First, let's figure out how debts get to collection services.

- The possibility of debt repayment was considered unpromising by the bank.

- The debtor client has no property that could be recovered.

- The debtor has a reputation as a defaulter with many other banks.

- When issuing the loan, no guarantors were involved who could guarantee the repayment of the overdue payment.

- The borrower refuses to repay the debt for more than a year.

- The loan has already expired.

- Considering the size of penalties and fines, the loan debt will reach such a size that it will be extremely difficult to collect.

Having been freed from the outstanding debt, the bank loses the right to demand repayment of the debt. Now this will be handled by a collection agency. Moreover, according to Russian laws, a debt from a bank can be redeemed by both a legal entity and an individual.

How do debt collectors buy debts from a bank? When transferring debt to collectors, the bank enters into an assignment agreement with them, which is an agreement on the assignment of the right of claim. Under this agreement, the right to claim the debt passes from the bank to third parties - assignees.

In the banking environment, there is a widespread practice of transferring debts to collectors in a “package” way: the bank immediately sells a large number of debts at a reduced price. This approach is due to the bank’s reluctance to incur reputational costs, since large amounts of debt negatively affect the reporting and overall rating of banks. Typically, the price at which collectors purchase an overdue loan is only 1-2 percent of the debt amount.

Benefits of Buying Your Own Debt

- stops the accrual of penalties and penalties;

- repays debt with a discount of 10-50%;

- closes a loan in a short time (from two weeks to a couple of months, depending on the region and bank);

- improves credit history;

- termination of enforcement proceedings;

- lifting restrictions on travel and registration activities;

- reducing the burden on the family budget.

Debt redemption allows you to control your financial situation. This is a smart move for the debtor. It is important to understand the procedure and choose a representative you can trust.

If you have any questions about the topic of this article or require legal advice, please leave a comment or contact the site specialist on duty in the form of a pop-up window. Also call the numbers provided. We will definitely answer and help.

Debt obligations to various banks are a rather unpleasant situation for many people. We are talking about the stage of debt when a court has already been appointed and bailiffs can come. If all these actions do not affect the borrower, the next step of the creditor bank will be to sell the debt to a collection company.

Are there options to solve the problem without much loss? Many borrowers are looking for an answer to this question, and there really is one.

In order to somehow recoup the bank's expenses, the debt is purchased from the bank by a third party for a truly small amount - 1% of the total debt. Of course, at such moments a person has an idea - to buy his own debt from a banking organization, but everything is not as simple as some people think.

A simple procedure for repurchasing debt from a bank

According to statistics, only about two percent of debtors know that they have the opportunity to buy back their debt from the bank.

But almost no one knows about the details of such a procedure. In the meantime, it is like two peas in a pod similar to the procedure for assigning (selling) a debt obligation to collectors. What is necessary for this? It's simple. You need to find a dummy third party who will agree to buy your debt for 10 - 25% of the amount of the loan you received.

The best option is to find a legal entity for this role. At the same time, it will save you from the need to pay endless penalties, fines, etc.

You should also take into account that people who are related to you will not be suitable for this role.

It's simply illegal. It would be ideal if you contact an experienced lawyer for detailed consultation on all issues. He will also collect the entire package of necessary papers for you.

How a debt is redeemed by a third party from a bank

I would like to immediately note that the debt is redeemed quite simply, somewhat similar to the sale of loans to collectors. A significant drawback is that the debtor himself cannot redeem his own debt from the bank.

Dear readers! Our articles talk about typical ways to resolve legal issues with debts, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call . It's fast and free!

But if thoughts about this do not leave you, then you need to find an outsider who will sign an assignment agreement with the bank. If you manage to pull off such a deal, the borrower will not pay a penalty on the debt.

In reality, this procedure is extremely simple; the only drawback is the search for a third party. In such a situation, a person will have to turn to a lawyer for help, and then naturally he will have to pay a lot of money if the specialist is a good one. But, in any case, these expenses will seem like nothing compared to the debt.

Is it legal to sell a debt to pay it off?

Third parties are those who were not involved in the subject of the contract from the very beginning. And only the banking structure, the guarantor and the borrower himself can be in it. Now in modern banks, when completing such a transaction, they immediately warn the potential client that if the debt is not repaid, all rights will be transferred to collection companies.

What kind of debt can actually be bought from the bank?

Banking structures naturally agree to repay not all debts. They sell, as a rule, those loans for which no payments have been received for more than six months. At the same time, I would like to say that not a single banking organization will sell debt under a mortgage agreement or other loan where property is pledged.

As a rule, many banks agree to assign rights where there are no guarantors.

Who is allowed to offer to buy debts from a bank?

A bad situation may arise if the bank refuses to sell the debt; this usually happens when the debtor has “good collateral”; this happens extremely rarely, but it still happens. It is often easier for a bank to resell debts, and sometimes they do this without the knowledge of the debtor himself.

A simple procedure for repurchasing debt from a bank

According to statistics, only about two percent of debtors know that they have the opportunity to buy back their debt from the bank.

But almost no one knows about the details of such a procedure. In the meantime, it is like two peas in a pod similar to the procedure for assigning (selling) a debt obligation to collectors. What does that require? It's simple. You need to find a dummy third party who will agree to buy your debt for 10 - 25% of the amount of the loan you received.

The best option is to find a legal entity for this role.

At the same time, it will save you from the need to pay endless penalties, fines, etc. You should also take into account that people who are related to you will not be suitable for this role.

It's simply illegal. It would be ideal if you contact an experienced lawyer for detailed consultation on all issues. He will also collect the entire package of necessary papers for you.

Some people turn to so-called “anti-collection organizations” for this purpose.

How does the redemption of an individual’s debt work?

As mentioned above, banking structures are very fond of turning to collectors, this applies to the most hopeless creditors. When a person does not make his payments for more than two years, the bank collects such debts “in bulk.” Then they choose the most advantageous offers for themselves and offer to buy out the debts of individuals.

If the bank has found a suitable reseller, an assignment agreement is concluded. After which all rights under debt obligations are transferred to resellers, and the original agreement with the borrower, in general, loses its force.

As mentioned earlier, the borrower will not be required to consent to this procedure, but the bank, according to the legislation of the Russian Federation, is obliged to warn the defaulter about this transaction a month in advance. If this does not happen, and the debtor comes to his senses and returns the money to the first creditor, all obligations are considered to be fully fulfilled.

The bank offers to buy back the debt

- VTB 24 Bank offers to buy back the debt for 30% - what's the catch?

- The bank offers to buy back the debt of 244,000 for 103,000 - this is a catch.

- VTB Bank offers to buy out a debt of 670 tons for 150 tons, is this to be believed or is it a hoax.

- for 50% cost?

What is this procedure? - The bank is offering me to buy out the debt, is it worth it?

If you find it difficult to formulate a question, call, a lawyer will help you: Free from mobile and landline Free multi-channel phone If you find it difficult to formulate a question, call a free multi-channel phone, a lawyer will help you

Galina, g.

Alzamay for 50% cost? What is this procedure?

lawyer Sharipov Alfat Fanisovich,