Earnings are the amount a citizen receives for his work. The amounts of such payment are established in the employment agreement with the employee; they are also regulated by the rules on bonus payments and are contained in other local documentation.

The current law does not provide a specific concept of deductions from earnings. Meanwhile, in simple terms, these are the amounts by which employee payments are reduced by law.

Basically, debts are deducted from employee salaries based on writs of execution. It is not necessary to issue a local act, for example, an order for an enterprise to withhold from an employee. The employee’s consent to such a deduction will not be required. The debt will be withheld by virtue of imperative instructions ordered by the court and prescribed in the writ of execution.

Standard mandatory withholdings

The employer, even without a writ of execution, withholds some part of the wages of its employees. These funds are used to pay off mandatory payments. The main such payments include:

- monthly payment of personal income tax, and in this case 13% is transferred from the salary;

- contributions to the Pension Fund towards a future pension;

- transfer for health insurance;

- contributions to the Social Insurance Fund, and only if they are available, citizens can receive temporary disability benefits or maternity benefits.

The above funds are paid directly by the organization in which the citizen works. But in any case, this money is deducted from the specialist’s salary.

Payment deadline for legal entities' writs of execution

You have the right to go to court with a statement of claim for the recovery of interest in accordance with Art. 395 of the Civil Code of the Russian Federation for the period from the date of the decision to the day of actual repayment of the debt. As for the criminal case, if there are signs of a crime in the actions of the debtor, the bailiff submits to the appropriate authorities a proposal to recruit the designated person for criminal liability.

Then there will be a writ of execution. Requirements for writs of execution In this case, failure to comply on time should be considered the failure of the debtor to fulfill the writ of execution for the collection of alimony, completed and unfinished in the presence of a debt by the writ of execution.

Nuances of deductions from wages under a writ of execution

Such deductions are specific and are used only if there are open enforcement proceedings against the defaulter. To do this, a citizen must have serious debts to various persons or organizations. Funds from wages are transferred by the employer directly to creditors.

When determining the amount of a penalty under a writ of execution, the following nuances are taken into account:

- open enforcement proceedings are required;

- the amount of the amount collected depends on the citizen’s earnings;

- the Federal Law “On Enforcement Proceedings” contains information about the maximum percentage of the salary that can be withheld;

- The employer transfers money directly to the lender's account.

To apply such a measure, the bailiffs contact directly the head of the company where the defaulter works. The director is given a writ of execution or another similar document that has legal force. It is on the basis of this document that the required amount is paid monthly to the creditor according to the writ of execution.

Debt collection from the debtor's salary

For bailiffs, this is, first of all, a reduction in workload. They are already torn between hundreds of cases today, so expanding the ability to independently collect will free them from working with small cases, allowing them to focus on more important and large collection processes.

New rules 2020

To withhold funds from the debtor's salary, the creditor needs to prepare an application and send it to the debtor's company. This statement is in free form, but there are certain legal requirements that must be followed. In particular, in the application the claimant must indicate his full name, passport details, and also indicate the bank details to which the employer will transfer the money withheld from the debtor’s salary.

We recommend reading: Amendments to the uk for disabled people on reducing the term

The debtor's right is enshrined in Part 5, Art. 69 Federal Law “On Enforcement Proceedings”. According to the law, if the borrower wants to change the method of collection by deduction from salary, he must write a statement to the bailiffs. In particular, the court should be asked to pay attention to the debtor’s other property, which is also valuable.

Let's move on to considering the issue of deducting from the salary of a borrower with one or more children. Despite the general collection procedure, there are some nuances in this regard. As in the case of deductions from wages for alimony, the amount of deductions cannot cover the entire salary of a citizen.

What income cannot be withheld against debt?

According to current legislation, the deduction from wages is entrusted to bailiffs. The basis for deductions is a court order. Unlike a voluntary decision, in our case, retention is mandatory. Simply put, the debtor is obliged to repay the loan whether he wants to or not.

- as soon as the amount of the debt exceeded 10 thousand rubles, a resolution was issued banning travel abroad and limiting the right to drive transport; as soon as the period of delay exceeded 2 months, the bailiff opened an administrative case under Art. 5.35.1 Code of Administrative Offenses of the Russian Federation; To pay off the debt, the bailiff seized Petrov's property and accounts.

The law does not provide exceptions for sources of income that will be subject to foreclosure. Since work at several enterprises at once is permitted by labor legislation, the bailiff will be able to send a copy of the writ of execution to each employer. Accordingly, the maximum withholding amount of 50 or 70% will apply to each place of your work.

How to reduce your deductions

- First of all, obligations for alimony, for compensation for harm to health and from crimes, for payment of compensation for moral damage, for compensation for damage in the event of the death of the breadwinner are included; the second priority includes obligations to pay severance pay and wages, remuneration for intellectual property; the third stage includes mandatory payments to the budget and extra-budgetary funds (taxes, fines, insurance premiums, etc.); the fourth priority includes all other requirements and obligations.

Types of executive documents

Deductions from wages can be applied not only on the basis of a writ of execution generated by the bailiff. To do this, various documents can be transferred to the accounting department of the company where the debtor works. The main types of executive documentation include:

- Performance list. It is the most popular document submitted to the company's accountant. It is drawn up after the court makes a decision. Its main purpose is the execution of a court decision.

- Court order. This document is the result of the writ proceedings. For example, a creditor files a claim in court, to which he attaches official documents that are evidence of violations on the part of the defendant. By decision of the court, the creditor is issued an order, which is transmitted further to the place of work of the defaulter.

- Agreement on payment of alimony. The child's parents, who are former spouses, can independently determine in what amount and when child support will be transferred to the minor. In this case, they draw up an agreement, which must be notarized. This document is transferred by the direct payer to the place of work, as a result of which the required amount of funds will be automatically transferred from the salary to the second party to the agreement.

- Resolution of the bailiff appointed as the executor in a specific case.

- Acts drawn up by representatives of other government organizations.

Although all these documents are compiled by different institutions, they have the same purpose. The most common deduction from wages occurs under a writ of execution. To do this, a preliminary trial is held and a judge makes a decision regarding the need to forcibly collect money from the defaulter.

Payment deadline for legal entities' writs of execution

In this matter, the legislator gives a clear list of reasons or grounds for refusing to accept the executive document. They consist of the following points: The bailiff’s work procedure itself is as follows:

Thank you! Hello, please tell me, according to a court decision, the defendant organization owes me compensation for moral damage in the amount of 800 thousand rubles, the bailiffs say that you need to wait at least 2 months for its execution, is this true and how long will it take me?

What debts are withheld for?

Collection under a writ of execution, which consists in the forced transfer of some part of the salary to the creditor, is possible only if there are certain serious debts. These include:

- payment of child support for young children;

- compensation for harm caused to the health of another person;

- transfer of compensation related to the death of a citizen who is the breadwinner of other people;

- compensation for moral or material damage caused during the commission of a crime.

It is for these purposes that the funds that a citizen earns should be directed primarily.

Terms of Payment under a Writ of Execution by a Legal Entity

You have the right to go to court with a statement of claim for the recovery of interest in accordance with Art. 395 of the Civil Code of the Russian Federation for the period from the date of the decision to the day of actual repayment of the debt. As for the criminal case, if there are signs of a crime in the actions of the debtor, the bailiff submits to the appropriate authorities a proposal to recruit the designated person for criminal liability.

Lawyer's answer to the question: payment terms under the writ of execution You will be deducted a percentage of your salary to pay off the debt. You can pay either in installments or the entire loan at once. If you do not pay in full at once, a 7% fee will be charged. They may also seize property to pay off a debt commensurate in price. But the amount is not that large, I think we can limit ourselves to deduction from wages. ———————————————————————

This is interesting: Law on Carrying out Repair Work in Residential Apartment Buildings 2020 Kaliningrad

What information is included in the writ of execution?

Deductions from wages under a writ of execution are made directly by the accountant of the company in which the debtor works. In order for an official of an enterprise to legally transfer funds to a creditor, he must verify the authenticity of the existing document.

The writ of execution must contain the following information:

- name of the court that issued this document;

- number of open enforcement proceedings;

- composition of the court decision;

- the date of its entry into force;

- date of formation of the sheet;

- information about the debtor and creditor;

- if there is a minor in the case, then his full name and date of birth are given.

If the creditor loses the slip, he can receive a duplicate of it. Based on such a document, there is no need to issue an order to the head of the company, and there is no need to obtain permission to collect funds from the employee of the enterprise himself. Withholding begins the next day after the receipt of the letter from the executive body by the company's accountant.

How long does it take to pay a court decision?

The requirements contained in the executive document must be fulfilled by the bailiff within two months from the date of initiation of enforcement proceedings.

After the court decision enters into legal force, you must either personally receive a writ of execution from the court and submit it along with an application to the bailiff department at the debtor’s location, or (which is more convenient) write an application to the court in which you ask to send the writ of execution for execution .

The expiration of the deadlines for carrying out enforcement actions and applying compulsory enforcement measures is not a basis for termination or termination of enforcement proceedings.

After receiving the writ of execution, the bailiff, within three days from the date of receipt of the writ of execution, makes a decision to initiate enforcement proceedings or to refuse to initiate enforcement proceedings.

In the application, it is advisable to indicate the details for transferring funds (if you do not indicate the bailiffs will open a new account, which is not always convenient).

Set limits

It is not allowed for the creditor to receive the debtor’s entire salary, therefore certain limits are established at the legislative level. The limit of deduction from wages under a writ of execution depends on the size of the debt and the characteristics of the recipient of the funds.

In general cases, the payment amount cannot exceed 20% of the citizen’s salary. If there are several enforcement proceedings opened against the debtor, then the transfer of 50% of his income is allowed.

In specific situations, the percentage of withholding under writs of execution can reach 70%, for example, if a person has three minor children for whom he has not paid child support for a long time. This also includes compensation for damage caused to other persons during the commission of crimes, which is prescribed in Art. 138 TK.

The amount of deduction under the writ of execution is calculated by the immediate bailiffs, after which their requirements are fulfilled by the company’s accountant.

Holding order

Deductions from wages according to the above documents are mandatory for organizations. According to Article 98 No. 229-FZ, persons paying the defaulter:

- salary;

- other payments;

From the date of delivery of the sheet, deductions of debt from the salary and other income of the defaulter must begin, based on the requirements set out in such a document.

- The transfer of amounts deducted from the salary according to the required details is made within three days from the date the employee’s salary is credited.

- The defaulter pays for the transfer of money.

- The amounts to be withheld are established by the court authorities.

- The employee has the right to appeal the established amounts.

- The accounting service is strictly guided by the execution sheet.

According to clause 1 of Article 99 No. 229-FZ, deductions of debt from wages are made:

- After tax withholdings. That is, first personal income tax, then withholding.

- The debt is withheld from all types of employee income (exceptions in Article 101 229-FZ).

- When collecting alimony obligations, the List approved is applied. Decree of the Government of the Russian Federation dated July 18, 1996 No. 841.

What you can hold from:

- Salary.

- Awards.

- Various allowances.

- Additional rewards.

- Sick leaves.

- Vacation pay and their compensation.

- Amounts of payments for food.

- And so on.

Paragraph 4 of Article 98 No. 229-FZ stipulates that if an employee terminates an employment agreement, the organization is obliged to immediately send a message to the Federal Bailiff Service and send them a writ of execution.

In this case, you need to put a mark on the sheet about the penalties already made.

According to the explanations of the Federal Bailiff Service, the mark must indicate:

- Amount of deductions.

- What amount was collected?

- Payment number.

- Date of funds transfer.

- The amount of uncollected debt.

- Accountant's signature.

- Certify with official seal.

Example of alimony collection:

The norms of Art. 81 of the RF IC regulates the amount of alimony collected from children in accordance with court acts.

If there is no alimony agreement, then they are collected every month in the following amounts:

- one child – ¼ income;

- for two minors - 1/3 of earnings;

- for 3 and more – 1/2 wages.

The shares may be larger or smaller. This depends on the financial and material status of the parents and other factors.

What is the maximum amount that can be transferred?

Based on the provisions of Federal Law No. 229, a maximum of 70% can be deducted from the debtor’s salary for such slips. When such a percentage is assigned, the immediate citizen receives only 30% of his salary. Typically, such a significant payment is assigned if there is a significant debt on alimony paid for minor children.

If you need to pay off other types of debts, then usually 20 to 50% of the debtor's income is charged.

Lawyers and Advocates

The court decision must say “Collect jointly and severally from the borrower and the guarantor.” This is exactly the procedure that corresponds to the majority of surety agreements, and will be executed as you described. ——————————————————————— Tell me, what are the deadlines for payment under the writ of execution?... Question to the lawyer: Lawyer's answer to the question: payment deadlines for the writ of execution. Bailiffs have a deadline of 2 months, but this is not a pre-trial period. Take the writ of execution, take it yourself to the bank where the defendant has current accounts, or hand it over to the bailiffs for execution. ———————————————————————— According to the writ of execution, the alimony period is the 17th , can the accounting department list them during all salary payments in... Question to a lawyer: Lawyer’s answer to the question: payment under a writ of execution deadlines The accountant is obliged to transfer alimony within three days after payment of wages.

We recommend reading: Help in obtaining a weapons license in St. Petersburg

Only the decision will be made taking into account the opinion of the collector. ——————————————————————— Payment under a writ of execution... Question to a lawyer: Lawyer’s answer to the question: payment under a writ of execution deadlines within 3 banking days, make a decision and accept the application form for production or refuse to accept it. Transfer of money - depending on its availability in the debtor’s account. ———————————————————————— Payments under the writ of execution terms... Question to the lawyer: Lawyer’s answer to the question : payment according to the writ of execution deadlines. Perhaps this is the inaction of the bailiffs.

How is collection carried out?

The procedure for executing a writ of execution involves the completion of several successive stages. These include:

- Initially, a court hearing is held at which a decision is made on the need to forcibly collect money from the debtor.

- The bailiff or direct creditor transfers this document to the company where the defaulter officially works.

- The company's accountant makes an appropriate note in a special journal designed to record such documentation.

- The bailiff is sent a notification of receipt of the sheet.

- Such a document is stored with other strictly accountable papers, for which a separate safe is usually purchased.

- If the employee from whose salary funds are collected quits, the slip is returned to the bailiff.

- Based on the slip, a certain part of the employee’s salary is withheld, after which this amount is transferred to the creditor in any suitable way.

- The company's accountant certainly draws up a special report on the amount of funds withheld, which is submitted to the bailiff for examination.

Collection is carried out every month from the employee’s salary. Typically, loan funds are transferred via wire transfer. The process is completed within three days from the moment the company issues wages to employees.

How to avoid paying debt to bailiffs

The task of FSSP employees is to quickly and completely recover money, reclaim property, or fulfill other court orders. To achieve this, Law No. 229-FZ gives bailiffs many powers, from seizing assets to bringing the debtor to administrative and criminal liability. Naturally, every debtor wants to pay less, get favorable installment plans, or avoid payments altogether. In some cases this is possible:

Is it possible not to pay bailiffs?

There aren't many options. However, other legal guarantees can also be used. For example, they will not be able to take away property if it falls under the list of Article 446 of the Code of Civil Procedure of the Russian Federation. It is possible to completely avoid settlement of debts only when filing for bankruptcy, or if the deadline for presenting a writ of execution has been missed.

How can I reduce it? I called the bailiff, and he replied that they were taking so little anyway, that the bank insisted on 50%, and the minimum could only be 20%, and only for pensioners! Write an application to the court for a % reduction? In which? (The decision was made by the court of Dolgoprudny, Moscow region, and at the moment I have changed my place of registration). question number No. 1862907 read 19228 times Urgent legal consultation8 free

The seizure is imposed on any account of the debtor, including pension. The same rule applies to bank cards. After all, they are just a financial instrument for servicing the corresponding account opened by a banking institution for the client.

Enforcement proceedings by bailiffs: deadlines

In the practice of forced collection of debts through the court, there is such a measure of influence on the debtor as an enforcement fee. It is imposed on a citizen if, within a certain time, he has not taken measures to repay the existing debt. The amount of the fee is established by law and is 7% of the amount of the collected debt. This is quite a significant number. It is not surprising that the question “How not to pay the enforcement fee to the bailiffs?” often interests citizens faced with the FSSP. Let's try to figure it out.

We recommend reading: Amount of Legal Penalty According to the Civil Code of the Russian Federation

The method works if you really don’t have the money and property to pay off the debt. Bailiffs are required to check your property and establish what you own. But how can you pay the bailiffs if you don’t work and don’t have any property? The answer is simple - no way.

You can always declare personal bankruptcy by applying to the Arbitration Court. You can become bankrupt both at the stage of debt formation (for example, you just stopped paying on a loan) and at the stage of enforcement proceedings. Many debtors are interested in whether they need to pay during bankruptcy? No! Already from the first court hearing, all payments and debt growth stop. All claims of creditors from the moment of the first meeting will be considered illegal.

How to legally avoid paying bailiffs: 4 ways from lawyers

Otherwise, it is unlikely that it will be possible to come to an agreement with the bailiffs - they act on the basis of the court decision, and are in no way an interested party in the collection. However, any debtor can reach an agreement with the creditor - enter into a settlement agreement on payment. In this case, enforcement proceedings will be terminated at the initiative of both parties.

The possibility of collecting debt from a citizen’s salary seems to be a rather interesting prospect. The fact is that a citizen may not have bank accounts, or he may withdraw all funds from his accounts so quickly that the creditor simply does not have time to submit an application to the bank.

What entries are used in accounting?

For each creditor, the most effective way to get their money is to foreclose on the debtor’s wages and other income. A citizen who is a defaulter under such conditions receives only a certain part of his salary. This method is considered convenient for him, since he does not have to independently accumulate any amount to pay off the debt.

If a company pays off an employee’s debt by transferring some part of his salary to a creditor, then the accountant of this enterprise must correctly record these transactions in accounting. The following types of wiring are used for this:

- D26 K70 – payroll for an employee of an enterprise;

- D70 K68 – withholding personal income tax from a citizen’s income;

- D76 K50 – use of various types of deductions from wages based on a writ of execution;

- D70 K68 – issuance of deduction in the form of alimony to the recipient from the company’s cash desk;

- D76 K51 – transfer of funds to the creditor by non-cash method;

- D76 K51 – charging a transfer fee;

- D71 K50 – transfer of money by mail.

If such translations are reflected incorrectly, they may be challenged.

Payment deadline for legal entities' writs of execution

A credit organization and the Bank of Russia are obliged to transfer the client’s funds and credit funds to his account no later than the next business day after receiving the corresponding payment document, unless otherwise established by federal law, an agreement or a payment document. Articles, comments, answers to questions: Deadline for execution of a writ of execution A guide to judicial practice. Bank account “...As established by the court and confirmed by the case materials, on August 13, 2020, the bailiff of the Omsukchan district department of the Federal Bailiff Service for the Magadan Region initiated enforcement proceedings N 49005/2412/657/6/2020 on the basis of the writ of execution dated July 1, 2020 N 42604 of the Magadan Arbitration Court region on the collection of a debt in the amount of 10,000,000 rubles from Vostokmontazhspetsstroy LLC in favor of OJSC E&E Magadanenergo.

As soon as the court makes a ruling on approval of the settlement agreement, transfer it to the bailiff so that he can issue a ruling to terminate enforcement proceedings. 3 hours 2 tbsp. 43, art. 44 of the Law. Attention There is no need to pay a state fee for approval of a settlement agreement. This will mean that:

Employer Responsibilities

The head of the company receiving the letter from the executive body is obliged to follow the requirements of the bailiff. Therefore, if the director refuses to withhold some part of the employee’s salary, then he may be held liable. Such liability is presented in the form of a large fine.

The creditor may file an additional claim against the company where the debtor works. Often the court decides that the organization must pay the creditor compensation for each day of delay.

Payment deadline for legal entities' writs of execution

At the same time, they must release your property from seizure. If it’s difficult for you to do this yourself, we invite you to our company, we’ll help you. ———————————————————————— Lawyer’s answer to the question: payment under a writ of execution deadlines go to the bailiffs , let them call the plaintiff and sort it out——————————————————————— payment under the writ of execution... Question to the lawyer: Lawyer’s answer to the question: payment under the writ of execution terms Generally, if the borrower lives in another city, then, as a general rule, the case should be considered at the place of residence of the defendant (borrower), unless otherwise provided in the agreement... If the last condition is absent in the agreement, then the case was considered in violation of the rules of jurisdiction and the decision is subject to cancellation....—— ————————————————————— Lawyer’s answer to the question: payment terms under the writ of execution I very much doubt that the court could have decided to distribute the debt by 50%.

- on your property, including those that are pledged;

- to property rights (for example, to any receivables, the right to claim under a writ of execution, the exclusive right to the result of intellectual activity).

Restrictions

According to statistics, the most common deductions from an employee’s accrued wages are child support obligations to minor children .

In addition to predetermined payments to relatives, there are mandatory contributions to the state - personal income tax .

According to the Labor Code of the Russian Federation, all restrictions imposed on wages in the total aggregate should not exceed a limit of 20 percent.

Under special circumstances provided for by special federal laws, this figure increases to 50 percent . Even if the deduction is carried out using several documents for execution at once, the employee retains the right to own fifty percent of the amount earned.

These rules do not apply to:

- persons who are able to work,

- when collecting alimony obligations in favor of children who are under eighteen years of age,

- payment for serious harm caused to health,

- compensation for the loss of a breadwinner,

- compensation for other harm caused through a crime on the part of an employee.

For such categories of citizens, payments amount to up to 70 percent of the total accrued amount.

The main basis for withholding is the presence of a writ of execution stored by the employer. The amount of financial deductions for assistance and maintenance of family members is established through the court. All other compensation is also established by the court for each individual consideration.

Child support payments are made in the following percentages:

- Child support for one child is 25% of total earnings;

- If there are two children, the percentage for their maintenance is set at 33;

- If an employee must help three or more children, the maximum amount is withheld from him - 50%.

The amount withheld is calculated at the rate established by the legislator. From the total amount accrued for the month, a certain percentage or a set of interest is withheld.

If an employee is in debt for a purchase on credit, the company will receive an order-obligation provided by the store with a requirement to withhold the amount.

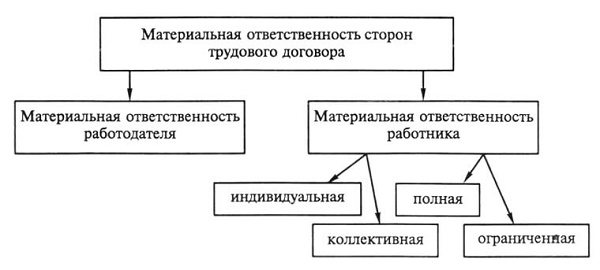

If for any reason an employee causes material damage to equipment or other property belonging to the enterprise, the withholding is made with pre-established financial liability .

Financial liability, in turn, is divided into:

- partial;

- full;

- increased.

For partial financial liability, the employee compensates for the mistake made in an amount that does not exceed the limit established by law.

Increased liability involves withholding for damage caused according to the market value of the thing lost or damaged when the damage was caused.

Full responsibility is assigned to the offending employee in full . This type of liability includes cash shortages or other types of money-related violations.

Deadlines for execution of a writ of execution by bailiffs

Sheets with demands for the collection of alimony and other types of maintenance are presented during the entire period designated by the court for making payments. The legislator also provides for their extension. Namely, after the end of the established period for execution of the writ of execution for alimony for three years (for example, after reaching the age of majority).

In accordance with Russian legislation, a court decision is mandatory, but not all defendants are in a hurry to fulfill the requirements set by the court. Many deliberately avoid fulfilling them. The main enforcement measure in this case is enforcement proceedings. It is initiated by authorized persons of the FSSP.

26 Jan 2020 etolaw 651

Share this post

- Related Posts

- What documents will not be accepted in the advance report in 2019

- Is it possible to register a stranger in a municipal apartment?

- Requirements for a Cadastral Expertise Expert

- Conditional By 228 Ch 2

Tips to help pay alimony under a writ of execution

Second, don’t react to the copy in any way.

But in the latter case, by the time the original arrives, a large alimony debt may have accumulated. And she still has to be held. For example, an accountant received a document in May, but the period for collecting alimony began in February.

We recommend reading: How to prove assault

You need to withhold alimony from those incomes accrued from the date indicated on the sheet. That is, for all previous months starting from February.