Recently, the services of anti-collector companies have become very popular. They are in demand due to the inability of collection organizations to communicate correctly with borrowers. Another reason for the development of such services is that banks charge interest and penalties to collect the maximum from the debtor.

Often potential borrowers sign a loan agreement without reading it carefully. And then it turns out that you need to pay additional interest, hidden literally between the lines. It is very difficult to repay such a loan, especially during a crisis, when you can easily lose your job.

To start working with collectors, you only need to be late with your payment a couple of times. The reason for the delay in payment may be the illness or family difficulties of the borrower. Also, the contract may contain subtleties that are incomprehensible to the average person and require clarification from a lawyer.

Collectors in most cases exert psychological pressure on people, intimidate them by all means, trying to extract funds to repay the loan. Of course, it is illegal to use violence, but a borrower, as a rule, cannot resist debt collectors due to ignorance of the laws. Banks very rarely refer cases to the courts, because

because this delays the process of loan repayments. At the same time, people who are trying to take away what they have acquired through backbreaking labor, who have lost peace and sleep, have only one way out - turning to anti-collectors.

The purpose of anti-collection agencies

Of course, the main goal is to help borrowers cope with a difficult situation without losing money, strength and nerves. This includes pacifying the principles of operation of collectors. A competent anti-collection company employs experienced lawyers, lawyers specializing in disputes with banks and debt collectors.

The name “anti-collection” was not chosen by chance. If a person is bothered by a collector, then of course he will turn to an anti-collector. Although lawyers have a much broader specialization, a competent idea with a name only benefits such agencies. Borrowers often want to use a service specifically related to the tactless performance of debt collectors in their work.

[custom_ads_shortcode1]

How to become a collector

Getting a job at a collection company is not difficult if the applicant exactly meets the requirements of this profession.

These include:

- higher education in a suitable field, so economic or legal specialization is required;

- ability to speak competently;

- presence of certain knowledge in the field of psychology;

- composure and resistance to stress;

- the opportunity to correctly argue your opinion and position.

How to avoid paying collection agencies? Tips in the video:

Important! Debtors often have a negative attitude towards debt collectors, so when they meet in person, they are often the first to attack them with their fists, so it is advisable to have men who are physically strong working in the agency.

Often even women get such jobs, but it is advisable that they only call debtors, while personal meetings are scheduled by men.

Anti-collector operating strategy

Banks rarely take the case to court, because... with increased amounts of penalties, the debt soars significantly. The court usually decides such claims in favor of the borrower. The bank is delaying court hearings, trying to exhaust the debtor and get the amount paid with all the markups.

Anti-collectors aim to bring the case to court, reducing the amount of debt as much as possible legally, and therefore are engaged in drawing up statements and complaints. Going to court usually ends in favor of the borrower, helping to remove hidden interest on payments. Many agencies talk about the possibility of completely canceling the debt, but often this is simply impossible.

Let's look at whether anti-collectors can really help solve the problem? It is important to look at reality calmly and unbiasedly. Many people believe that collectors and anti-collectors are two sides of the same coin, i.e. first they work on the bank’s side, and then on the borrower’s side for his money. Of course, after such work by the anti-collector, calls for collection may stop, but not for long.

[custom_ads_shortcode2]

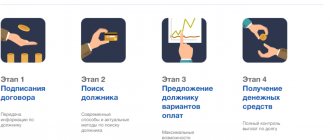

Anti-collector action algorithm

The whole process includes several stages:

- The debtor contacts a specialized agency, where he describes the problem to a specialist, who, in turn, will talk about the prospects for solving it.

- After discussing the nuances, an agreement is concluded and payment is collected. This can be a fixed amount or a percentage of the loan amount.

- The next step is to issue a power of attorney to a company representative, that is, forward the creditor’s claims to this authorized person. Now calls will be sent to him, and regular paper letters will still be sent to the debtor himself. There is no escape from this.

A lawyer from an anti-collection firm helps resolve disputes with banks and debt collectors through negotiations. He draws up statements, letters, petitions to apply to the bank, court and collection company. If necessary, he can fight a case in court, seeking a reduction in the loan rate, refinancing, changing the monthly payment amount or payment period. This usually occurs within 2–6 months.

A competent lawyer will help you recover the loan commission, illegally imposed insurance, as well as penalties. He will probably be able to combine several loans into one and go through the refinancing procedure. In general, it can either speed up the process in court or delay it to achieve the optimal result for the borrower. The experience of a specialist plays a big role here.

To sign and quickly issue certificates in a variety of authorities, the anti-collector uses a lot of acquaintances and connections, which, of course, is reflected in the cost of the service of the specialized agency. But such a specialist can help in the fight against annoying calls from collectors. Usually the issue is resolved by writing one or two statements.

[custom_ads_shortcode3]

Who can work as a collector?

“A collector is, first of all, a psychologist. He must look for an approach to a person, feel which strings to pull, and place the accents correctly,” says Leonid. Our hero believes that there are no universally effective phrases or rhetoric. What resonates in one person will not necessarily affect another.

Leonid explains that his agency’s employees must strictly adhere to instructions, work strategy and the law. He says that none of his charges call people at night, make threats or use moral pressure. “We have a standardized working day with its own routine and peculiarities.” As Leonid says, usually people either immediately get involved and start making good money, or quickly burn out and become disappointed. “Not everyone is capable of handling these types of calls eight hours a day. Morally it’s quite difficult,” the expert notes.

The collector can call the debtor, send him SMS, emails, and official notifications about the debt. That is, he carries out comprehensive work with the debtor in order, firstly, to understand the circumstances, and secondly, to convince him to repay the debt.

“My specialty as a psychologist partly helped me in my work. I love communicating with people, I understand them and see that they understand me. This greatly affects efficiency and results,” explains the expert. He says that a collector must be hardworking and stress-resistant. “We don’t talk to people about the weather and don’t sell anything. We usually encounter objections, refusals, and rejection. In the first months, a young specialist spends much more time at work. He studies and understands the specifics. Doing this if your soul is not at all inclined to work will not work,” Leonid is convinced.

Increase your financial productivity by creating

Personal financial plan: 5 steps to realizing your dreams

He says that at first glance it is impossible to understand how effective an employee will be. He says that one day a sweet, fragile girl, small in stature and with a thin voice, got a job on their staff. “No one thought then that she would become the best employee. She was able to negotiate with difficult clients and repay large amounts of debt,” the expert recalls.

How to understand that the anti-collector cannot help you?

A competent specialist will take the following steps:

- He will thoroughly study the credit history and the contract to find inconsistencies.

- Will highlight the problems and prospects of the business.

- He will show how he himself sees a way out of this situation. The solution to the dispute may be to reduce the rate, cut the inflated interest, and commissions.

Remember! A competent specialist acts only within the framework of the law. Promises to completely remove the loan should alert the borrower. If a lawyer has not thoroughly studied the problem, but is already talking about prospects, drawing a bright future, most likely, you are dealing with a non-professional. A good sign is if the anti-collector is keenly interested in all the details. Of course, such specialists will not rush to your first call. They usually have a lot of orders, so you will have to wait for your turn.

[custom_ads_shortcode1]

When should you use the services of an anti-collector?

It is best to contact the agency when the case has not yet reached the court. Then the lawyer will familiarize the borrower with his rights, help him draw up an application to the bank and collect the necessary documents. A power of attorney is issued to a representative of such a company, according to which the bank and collectors will now speak directly with him. In practice, of course, few people turn to anti-collectors at such an early stage.

At the judicial stage, specialists can already represent interests in court. The enforcement stage means that the trial has already taken place, but the borrower is not satisfied with the result. In this case, the defense attorney may file an appeal. But the process is lengthy and expensive.

[custom_ads_shortcode2]

How to talk to debt collectors correctly

Statistics show that debt collectors manage to force every second borrower to repay their debts.

But some agencies tend to use frankly “gangster” methods of their work: threats, blackmail, psychological influence. There are also cases when debt collectors threaten physical harm.

The debtor must clearly understand for himself: if he is not dealing with outright criminals, then any threats from collectors are unfounded.

It is worth understanding that if you are going to respond to demanding letters from debt collectors, then you need to write them in the most legal manner possible. This will indicate that you have serious intentions and legal literacy. Often they turn to credit lawyers for help in drafting such answers.

The most important!

As a rule, if collectors see that you have a good and experienced lawyer behind you, they will stop putting pressure on you and the debt will be transferred back to the bank. Send registered letters with acknowledgment of delivery and a description of the contents.

If the case goes to court, this can prove that you tried to resolve the conflict peacefully.

How to talk to collectors if they are going to visit you personally? The answer is no.

IMPORTANT: they have no right to enter your house without your consent. If subjects who introduce themselves as either debt collectors or bank employees knock on the door, first calmly and politely ask them to leave. Tell him that otherwise you will call the police.

Remember that only a bailiff can come to your house and take an inventory of your property. And then on the basis of a court order, or a writ of execution. If the collectors do not calm down, call your neighbors and make noise, then feel free to call the police and say that unknown persons are trying to break into your place.

You can use the following algorithm of actions:

- The debtor has the right to know that a collector is really calling him. You need to find out from him the name of the agency, his own full name, the basis on which he works with the bank.

- Check the amount of debt and whether it is calculated correctly. If they refuse to provide this data, then just hang up. It would be better to record the number from which they called.

- If an employee of a collection agency comes to the house, you don’t even have to talk to him.

- Always maintain restraint, calm and confidence when communicating with debt collectors. Collectors are very good at sensing the debtor’s fear and uncertainty.

- Collectors cannot enter your home without permission or seize your property. They carry

What promises from anti-collectors should you not believe?

There are agencies that want to attract the maximum number of clients by making unrealistic promises. You should be wary of the following:

- a promise to correct the loan history along with late payments;

- abolition of interest. The bank may require their payment;

- cancellation of the penalty amount. This is possible with full repayment of the debt amount along with interest;

- carrying out debt restructuring in the same bank;

- complete cancellation of the loan.

[custom_ads_shortcode3]

Service cost

The price list for these services is high. Starts from 1000 rubles. per consultation and reaches 10–20 thousand.

per month with a large amount of debt. The higher the amount of debt, the higher the cost of the service.

If the amount of debt is small, up to 50 thousand rubles. , then usually collectors do not undertake such work.

You can save as much here as you would pay for an anti-collector service. Therefore, this is a pointless waste of money and time, unless the issue is important to you.

[custom_ads_shortcode1]

What to do if you fall into debt?

You can try to figure it out yourself by searching for information about laws regarding the rights of banks and debt collectors on the Internet. Of course, you will need the help of a good lawyer. You also need to be able to write statements and claims.

You can find courses on the Internet on how to get out of a hole. They are usually called like this: “Get rid of debts”, “Freedom from loans” and something similar. In some manuals you can find examples of writing statements and letters. They tell you how not to overpay interest and describe how to deal with debt collectors.

Anti-collector correspondents are called upon to help only real people who find themselves in difficult situations. They will quickly expose scammers. However, there are scammers among anti-collection agencies.

For a fee, they can help you change your name, surname, become disabled, or “die.” Banks blacklist such companies.

[custom_ads_shortcode2]

Illegal methods

Collection companies often change their names, registration and location addresses, computer center addresses, and also re-register the legal entities from which they work. Their illegal actions lead to this.

1) They call allegedly as law enforcement officers and threaten that they will open a criminal case. A true judicial and law enforcement officer will never extort the fulfillment of financial obligations to a creditor. And you shouldn’t be afraid of criminal liability for late payment of debt, because there is no crime.

2) Disseminate information about debt. They go around to neighbors, relatives, and employers, throwing mud at the debtor, and write about him on social networks. People begin to fear that intermediaries will again post personal data online, and they pay the fine in full. For such actions, collectors may incur administrative liability, because this is a direct violation of legislation in the field of personal data protection. In this case, you need to write a statement to the police.

3) They send a copy of an alleged statement to the police, fake court summonses , letters on blood-colored paper that they will come to you to sue for your property. The court does not send SMS. Only summonses to the place of registration from banks and the executive service can be received. Therefore, it is necessary to control postal correspondence at the place where you are registered.

3) They go to the apartment, threaten or even show violence . For practical reasons, they most often arrive in the morning or evening. They threaten that they will take away my property, and also that they will ban me from traveling abroad. Only the executive service can seize property, accounts, or ban travel by court decision. Here again you need to call the police. Threats are extortion and a crime under Articles 129, 189 and 355 of the Criminal Code.

5) But, there are cases of even more arrogant behavior on the part of representatives of creditors, when supposedly “by invitation” they enter your home , describe the property, take photographs and film it on video. The home of every person is inviolable in accordance with Article 182 of the Criminal Code. Again, you need to call the police, in response, remove all actions of the collectors and file a counterclaim.

How to find a competent specialist?

On the Internet you can find many promotional offers from various companies. If you are looking for a competent specialist, pay attention to the clarity and detail of the consultation. The company must have its own detailed website, email and telephone number for contact.

You can look for reviews about working with this company - and only then schedule a personal meeting with a company representative, where it is important to be especially attentive.

Anti-collectors always warn that under no circumstances should you tell collectors your place of work, telephone numbers, or disclose information about where the property is currently located. Also, you don’t need to explain to them why you can’t pay the loan now. They listen to such stories every day; they don’t need details.

[custom_ads_shortcode3]

How to talk to debt collectors on the phone

Many people don't know how to talk to debt collectors over the phone. Negotiating over overdue debts is a special skill that such specialists develop. An unpaid loan can cause endless calls and long conversations. In order for collectors to stop bothering a person, it is necessary to act in a certain way.

How to talk to a debt collector

If a citizen does not know how to behave with a debt collector over the phone, then a number of simple rules should be followed:

- speak politely, even if they are rude;

- always clarify who is calling and for what reason;

- don't hang up;

- do not give your interlocutor new contact details, information about property, or places of residence of relatives;

- do not try to pity the collector;

- answer seriously, do not troll or deceive your interlocutor.

Debt collectors call because their job is to communicate about defaulted loans. If the debtor answers calls, but wants to enter into a conversation regarding the fulfillment of his obligations, then the specialists will continue to interact until they find the right line of action.

If you did not take out a loan, you should immediately inform the caller about this . Even if it is not possible to turn away the specialists the first time, after several fruitless conversations the collectors will be convinced that the person they need does not answer the specified number. And the conversations will stop.

Some citizens believe that having a tough conversation will help get rid of annoying calls. In case of aggressive behavior of the debtor, the case will be transferred to another specialist, and communication will take place according to the appropriate scenario: the citizen will be spoken to in a boorish and offensive manner.

History of the creation of these services

Anti-collection agencies began to appear 10 years ago. The first company was called “The First Anti-Collection Agency.” The name “anti-collection” was brought to life by the founder Sergei Kapustin.

As a rule, such services are in demand during a crisis, with massive non-payment of wages and layoffs. The main thing is to choose a reliable, responsible specialist who will keep his promises and will not talk about canceling the debt in full.

None

Russians pay on average 10% of their income for loans, and for some, payments “eat up” most of their income. Hence the constant increase in overdue loans and the demand for debt collector services. But in recent years, so-called anti-collectors have appeared, which promise to save you from banks and debts. Should I trust them and spend my last money?

Anti-collectors, debt collectors, credit lawyers - this is what those who deal with problems with bank loans on the side of borrowers

. Considering how high the debt load of the population is now, such services remain in demand.

The clients of such specialists or firms are borrowers who can no longer make payments on their loans. Usually people turn to anti-collectors in a completely hopeless situation.

.

Banks try to recover problem loans sequentially:

- first, the debtor is offered refinancing or loan restructuring;

- if there are no payments, the bank will try to resolve the problem through pre-trial methods - write off the debt from other accounts or contact the bailiffs directly;

- when these measures do not help, the bank has two options - sue the client or sell the debt to collectors.

The borrowers themselves drag out payments until the last minute - when they come to collect the debt from a collection agency. The legislation is gradually changing, now their methods are greatly limited. But still, persistence and the ability to persuade scares many clients.

Then the debtor tries to solve this problem and turns to anti-collectors. They advertise themselves on the Internet, and in some cities they are not shy about hanging advertisements right on the streets.

The problem here is that the debtor is not trying to solve the problem with the debt itself.

, but only fights off the “seekers”. Accordingly, even if they no longer bother the debtor, the debt does not go away. This will become clear when the debtor tries to travel abroad.

In general, it is worth dividing anti-collectors into those who act completely within the law and those who bypass this law in every possible way. The first ones work with documents, looking for legal opportunities to delay or cancel payments. “Shadow” anti-collectors work according to their own principles.

[custom_ads_shortcode1]

Check the collector in the state registry

If you hide or persist in not paying, the creditor may turn to a debt collector. In this case, the creditor - be it a bank, microfinance organization, credit union or private individual - is obliged to inform you within 30 working days that he has hired a debt collector. If the creditor sold your debt to a debt collector, you should receive notice of the assignment.

A creditor can only use one collection agency.

If a debt collector calls you and you haven’t received an official letter yet, the first thing to do is check to see if it’s a scammer.

By law, only a representative of a collection agency included in the state register can communicate with you about overdue debts.

But you can also refuse to communicate with him until you receive official notification.

Learn the rules by which collectors must work

Until recently, collectors used almost any measure of psychological pressure against debtors, and sometimes it even went as far as physical. Their behavior was not regulated in any way. But since January 2017, a law came into force that clearly describes what they can do and what they cannot do. Now collectors must be extremely correct and polite.

The main rule: collectors cannot be intrusive, much less cause you any harm. If you feel excessive pressure, this is a clear sign that the collector is going too far.

What do legitimate companies offer?

When asking for help with debts, you need to understand that the chosen company is acting legally. It should have an office, official details (individual entrepreneur or legal entity), preferably have a website, and it wouldn’t hurt to look for reviews. The main thing is that such a company must position its services as completely legal (it is not a fact that this will turn out to be true, but it is worth clarifying).

not many methods of work available to legal anti-collectors.

. They divide the whole process into 3 stages:

- pre-trial stage. This is the protection of the client from collectors and debt collectors on the part of the bank (the client forwards their claims to a specialist); studying all the intricacies and features of the loan agreement; attempts to resolve claims directly with the bank;

- court. The firm helps to draw up a statement of claim against the bank or a counter-statement; analyzes the case materials and challenges everything that can be “removed” from the claims (fines, penalties, commissions);

- work after trial

. Anti-collectors will work with bailiffs - they will agree on phased repayment of the debt and draw up a convenient debt repayment plan.

Futures are an unusual and profitable financial instrument. One of the companies sets a price of 20,000 rubles for the entire range of services and assures that all stages can be completed in 3 months. Someone offers to work for a “subscription fee” of 6-10 thousand rubles per month.

Whether to use such services or not is everyone’s business. There is nothing complicated in the listed actions; most of this could be done by the debtor himself. Considering how the loan agreement is drawn up, it is almost impossible to win a lawsuit against the bank.

Why then turn to anti-collectors? There are several reasons:

- reluctance to communicate directly with collectors

and the bank. All their claims can be forwarded to the anti-collector, as the official representative of the debtor. If a debt collector somehow violates the law (and now it’s easy to break it, it’s enough to come to the debtor twice a week), then the anti-collector will help bring him to justice; - impossibility or inability to independently agree

on a more convenient debt repayment schedule. You can reach an agreement with the collection agency and the bailiffs. All of them are interested in repaying the debt, even gradually. It will be easier for a specialist to do this than for an ordinary person; - in the most extreme case, the anti-collector will help organize and carry out the bankruptcy procedure for an individual

. This will cost not 20 thousand, but 100-150 thousand rubles, but in a really difficult situation, this option is the only possible one.

In essence, a legal anti-collector is just a lawyer who understands banking law

and knows the procedure for conducting court cases. Therefore, in small towns it is not necessary to look for a “profile” specialist; you can contact any law firm.

[custom_ads_shortcode2]

What rights do debt collectors have?

Do collectors have the right to come to your home, call or write? The reason for the development of the new Law No. 230 was a huge number of complaints about the unlawful behavior of employees of collection agencies: threats, reprisals, beating of debtors, damage to their property, etc. In fact, collectors have practically no rights, they only have permission for the following types of interaction:

| Working method | Description |

| A personal meeting | No more than 1 time per week |

| Telephone call | No more than 1 time per day, no more than 2 times per week and 8 times per month |

| Sending SMS messages, emails, postal notifications | No more than 2 times a day, 4 times a week, 16 times a month |

Now the following questions arise: do collectors have the right to call at work and do collectors have the right to call relatives? There is only one answer - no, they don’t. Collectors are not allowed to transmit information about the debtor to other persons (talk about the amount of debt, the amount of fines, etc.), including employers, neighbors, relatives of debtors. An exception may be if, for example, a friend or relative of the debtor is tied to the processing of an overdue loan - a guarantee. Or the borrower himself died, and his loan became part of the inheritance of his relative.

On weekdays from 10 pm to 8 am, telephone calls from debt collectors are strictly prohibited. And then you ask whether collectors have the right to call on weekends, we answer that they have, but this cannot be done between 20:00 pm and 9:00 am.

Personal meetings involve the collector coming to the debtor’s home and setting up an “audience” in another territory. But, revealing the question of whether collectors have the right to come home, it is worth noting that the owner of the home may not allow collectors into his house and not even open the door for them, especially in cases where the agency representative threatens with arrest, inventory, seizure of property (unacceptable actions).

Upon arrival at the debtor’s home, the collector must introduce himself, indicate his full name, position, and the name of the organization he represents. In a conversation, raising the tone on the part of the visitor is unacceptable. The same rule applies to telephone calls. It is unacceptable to hide return contact information from the debtor.

Debtor on the other side of the law

You can distinguish a “shadow” anti-collector by his promises to clients. They usually offer to “legally not pay the loan.” Of course, there are practically no legislative provisions for this, which means that such offers are obviously untrue (either everything will turn out to be illegal, or you will still have to pay).

Working methods of not entirely legal

different anticollectors:

- forwarding calls and visits. For a certain amount, the debtor promises to save the client from intrusive calls from collectors or the bank. But unlike the “legal” scheme, it will simply ignore calls. The client will not be disturbed, but interest and fines continue to accrue;

- writing off a debt for paying some of it. A fairly common scheme is when the anti-collector offers to pay him a certain amount for which he will settle the debt to the bank; a bill of exchange often appears here. Most likely, after some time, the bank’s requirements will resume, and interest will be accrued for the entire period. In the worst case scenario, the “specialist” will simply appropriate this money for himself;

- investments in profitable instruments. A fairly “innovative” scheme almost always indicates fraud. The debtor offers to invest a certain amount of the client’s money in some very profitable business, and pay off the debt for the interest received. It is clear that the client will no longer see either the “specialist” or his money

, and the interest on the loan continues to accrue. - legal action against the bank due to force majeure in the state. Anti-collectors are seriously filing lawsuits in court, asking to write off the debt due to “the state’s failure to fulfill its function of maintaining the national currency.” Naturally, the court's decision will be in favor of the defendant;

- They offer to re-register property in the name of relatives, or change their place of residence and name. Legally, this makes no sense: if there is already a debt, the re-registration of property can be challenged. The same is true with a name change - all changes are monitored by government agencies.

At best, the actions of such companies will allow the debtor to delay the process of paying off the debt - courts and claims can last a very long time. But it is worth remembering that while there is no court decision, interest and penalties from the bank continue to accrue. Conclusion - if possible, you need to choose an anti-collector who operates entirely within the legal framework.

[custom_ads_shortcode3]

How effective are collectors and agencies?

Statistics report that half of debtors repay the loan after communicating with debt collectors.

But this is not at all because visiting a debt collector is so scary for debtors. They just really act convincingly and professionally.

Typically, communication with collectors begins with calls, in which psychological pressure is exerted on the borrower, and then visits to the debtor may follow. The goal is the same - to put emotional pressure in order to force you to repay the debt, or at least part of it.

A negligent borrower, when communicating with collectors, must remember that in their work they must strictly comply with the law on collectors and their activities.

This means that they do not have the right to call later than 10 pm or earlier than 6 am, they must not violate public order, act on behalf of the court or the police, or act contrary to the law.

If collectors commit illegal actions, for example, making phone calls at night, or breaking into an apartment without permission, the only correct action is to contact the supervisory authorities and the prosecutor's office.

We should not forget about the three-year debt collection period : if it has passed, collectors can no longer demand repayment of the debt by law.

But collection agencies often exceed their powers, which is why they complain about them quite often.

Reviews about the work of anti-collectors

A considerable part of representatives of this business work “in the shadows” and are not particularly keen to comply with the law. That’s why there aren’t many reviews about their work (not everyone wants to talk about how they broke the law

).

Reviews about legal anti-collectors are all similar. It is difficult to trust them, since representatives of these companies themselves can write good reviews if they wish. Most often in reviews they indicate

like this:

- Collectors called several dozen times a day, demanding payment of an overdue debt. I contacted, signed an agreement, and after 4 days the calls stopped. The client also writes that he subsequently entered into an agreement with the firm for pre-trial and trial representation;

- After non-payment of the loan, the bank sued and demanded an amount several times more than the original amount. The firm represented interests in court under a contract for the provision of legal services. As a result, the client’s debt amount was reduced to a normal (i.e. proportionate) amount;

- for representation in court, an ordinary law firm (with experience in dealing with debt) asked for 30 thousand rubles. This man did not become their client; in the end he conducted the business himself.

Indeed, if you understand the terms of the contract and some laws, you don’t have to seek the services of anti-collectors

. Many people write about this, including clients of companies.

It is difficult to find reviews about the work of “shadow” anti-collectors. We managed to find a story about how such “specialists” took advantage of a client’s advanced age

and actually deceived her:

- accepted payment at their rates, promising to solve the problem with the loan;

- as proof of the work done, they issued an extract from the BKI (at that time it was paid and cost 3,000 rubles), where the debt was supposedly “closed.” In fact, the debt was transferred under an assignment agreement, that is, sold to collectors;

- They also provided a court decision by which the debt was allegedly declared non-existent. In reality, the court decision (very voluminous) states that there are no grounds for satisfying the requirements. It is obvious that the claim concerned the writing off of a debt, and the lack of grounds is the court’s refusal to write off the debt;

- All this time, interest continued to accrue on the loan.

This is obviously a vivid example of the work of “black” anti-collectors who take advantage of legal illiteracy

the majority of Russians.

The conclusion can be drawn as follows: it is best to solve your problems with debts on your own, and, as a last resort, contact a proven and reliable law firm.

[custom_ads_shortcode1]

When it comes to court

The victim of debt collectors, Lyudmila, has been proving her case in court for several years now. She took out a car loan, the car was collateral. In fact, the debt was repaid, and they decided to sell the car with the permission of the bank.

“I live calmly, don’t worry about anything, and suddenly several different collection companies contact me. I was threatened with serious bodily harm, which forced me to move into rented apartments twice. They even made some appointments. I was very afraid. They were scared that I wouldn’t be able to go abroad.”

The bank from which Lyudmila took out a loan was in a state of liquidation. Then she found out that he was holding auctions for the sale of debts to collectors. But no one notified the woman in writing about the transfer of her debt. The police did not react at all. They didn’t even want to open a criminal case, and had to go through the courts.

At the same time, the initial amount of debt grew to absurd proportions: from 100 thousand to 480. When the lawyer asked the collectors to give written explanations, they did not respond and did not appear in court.

“We opened a case under Article 189 of the Criminal Code - extortion, and under Article 129 - threats to life and health. But the peculiarity is that we were simultaneously suing the bank. We have no corresponding confirmation that the bank transferred this debt at all. The bank did not inform the debtor about anything and demanded an amount several times higher,”

How to avoid becoming a victim of scammers

The easiest way not to lose your money is not to contact anti-collectors. Although, there is an even simpler way, not to take out a loan at all. Unfortunately, often the loan has already been taken out, there is nothing to pay it off, and it was not possible to figure it out on your own. Then you should listen to the recommendations:

- Think again about whether it’s worth turning to anti-collectors. Banks are not against settling the debt directly with the debtor, restructuring the loan or offering credit holidays. A normal collection agency will also be ready to accommodate the client and draw up a convenient debt repayment schedule;

- do not believe that the debt will disappear. The debt will not disappear: both collectors and banks are interested in getting at least something from the problem loan. Even if demands to repay the loan no longer come, the debt still exists and spoils the debtor’s credit history. Cases when a bank closes a loan after receiving a certain portion of the debt are extremely rare;

- You need to carefully read the contract with a lawyer. First of all, there must be such an agreement; without it, you should not transfer money to anyone. It must also indicate the name of the company and its details. And most importantly - the rights and obligations of the parties;

- do not contact dubious companies. Their hallmark is bright, flashy advertising (often illegal), big promises, including guarantees of debt forgiveness. It is best to contact a normal, serious law firm.

Unfortunately, there are more scammers in Russia every year, and among anti-collectors they are almost the majority. Therefore, all that remains is to advise:

- first of all, do not take loans (especially microloans);

- if there is a loan, pay it on time;

- if you can’t pay, resolve the problem directly with the bank;

- if negotiations with the bank fail, try to solve the problem through the court yourself (this is not so difficult, the Internet is full of sample statements of claim and instructions);

- If you cannot solve the problem yourself, contact a specialist, but only a legal and trusted one.

Are you interested in the services offered by so-called anti-collection agencies, but are you afraid that this is another useless waste of money? From our article you will find out whether it is worth contacting anti-collectors and how they work.

Discussion: anti-collectors - help or new loss of money?

[custom_ads_shortcode2]

Who are collectors?

Collectors are specialists who provide debt collection.

They usually work with lenders from large banks or work in support of microfinance organizations. Their goal is to force the defaulter to return the money at almost any cost. In the USA, collectors appeared in the 60s of the 20th century. In the 80s, such companies began to open in Europe. In Russia, the first debt collection agencies were first created as subsidiaries of banks. The first autonomous collection agency, FASP CJSC, was registered on August 9, 2004.

Now collectors in Russia work according to two schemes:

- Collectors buy the debt from the credit institution at an incomplete price. The bank writes off the difference in payments as a loss, and the agency tries to extract the entire amount from the debtor.

- The agreement between the lender and the bank has not been cancelled. The collector simply stimulates the receipt of regular payments.

Rights of collectors and rights of debtors under the new law

The rights of collectors are comprehensively set out in Part 1 of Art. 4 Federal Law No. 230. It contains only 3 points allowing:

- phone calls and SMS notifications;

- postal, telegraphic and voice mail sent to the debtor;

- personal meetings.

The law allows the use of other methods of interaction only on condition that they are specified in the contract and the debtor has not refused to use them within the period established by law.

Among the rights of the debtor introduced by the new law are the right to refuse interaction, which can be used after 4 months from the date of termination of loan payments, as well as refusal of any methods of interaction provided for in the contract if they violate the rights of the debtor.

Who are “black” and “gray” collectors?

With the adoption of the law, the concept of “black” and “gray” is gradually losing relevance. From now on, there are strict requirements for registration of collection agencies. Their activities are supervised by the FSSP of the Russian Federation. If someone violates the law at his own peril and risk, then this is considered unambiguously - in accordance with Art. 163 of the Criminal Code of the Russian Federation, as extortion or Art. 159 of the Criminal Code of the Russian Federation, as fraud.

To avoid contacts with scammers posing as debt collectors, you need to take a number of simple steps:

- Demand to introduce yourself and present a certificate of registration of the agency in the FSSP Register;

- Check the name with the name contained in the register. Information is available via this link.

- The registry information contains the agency's addresses and telephone numbers. Demand to inform them.

- Call one of the telephone numbers listed in the registry and find out whether there is an employee on staff making claims on behalf of the agency.

Who are anti-collectors?

An anti-collector is a lawyer who protects debtors from collection agencies. It should be immediately clarified that there are several types of anti-collectors:

- Real anti-collectors. These are lawyers who have serious experience in litigation with banks and collection agencies related to the collection of loan debts. They never promise the client that for a certain amount they will save him from any problems from collection agencies and bailiffs - at most they can reduce penalties and fines, extend the collection process and in every possible way improve the client’s lot.

- Fraudulent anti-collection agencies. Unfortunately, most of them are those advertisements that you can see at bus stops and advertising poles, where they offer to relieve you of any loan debts - these are scammers pretending to be anti-collectors. Not a single lawyer will undertake to promise a positive resolution of the trial without even familiarizing himself in detail with the case materials.

[custom_ads_shortcode3]

Negotiate with the creditor directly - then you won’t have to meet with the collector

In life, of course, anything can happen. Due to a late paycheck, illness, or simply forgetfulness, you may miss your loan payment deadline. If you understand that for objective reasons you will not be able to repay the debt on time, contact your lender.

Ideally, in advance, before you fall behind on payments and thus ruin your credit history. You can, for example, ask for a deferment or restructuring of the loan - change the terms and amounts of payments.

The bank, of course, is not obliged to do this, but can accommodate you.

If you are still late with your payment and representatives of a bank, microfinance organization (MFO) or consumer credit cooperative (CCC) are already calling you to find out the reason for the delay and warn you about penalties, honestly explain your situation.

Don’t be afraid to resolve issues directly—it’s more profitable for both you and the lender to sort things out without involving specially trained people. You will avoid unnecessary penalties and fines that accrue for each day of delay, as well as stress from psychological pressure.

How do anticollectors work?

It is necessary to clearly distinguish which functions the anticollector can perform and which tasks are beyond its control. Services or what an anti-collector can really do:

- Legal advice on your situation with non-repayment of loan debt. After studying all loan agreements and other documents, a real anti-collector will be able to make a verdict on what the client should expect, how serious the consequences of his actions are and what can be done to mitigate them.

- After consultation, if the client agrees, the anti-collector begins work:

- conducts negotiations with the bank and/or collection agency, protects the client from threats from collectors

- contributes in every possible way to speeding up (or slowing down, depending on the circumstances) court proceedings by preparing and submitting applications, petitions and complaints to the court and other legal authorities

- represents the client's interests in court proceedings and files complaints against court decisions

- accompanies enforcement proceedings in the interests of the client

What an anti-collector cannot do or how to recognize scammers:

- Clear your credit history by erasing all records of late loan payments.

- Cancel interest on the loan (not to be confused with fines and penalties).

- Completely relieve the client of the need to repay the debt and cancel all penalties before the trial.

[custom_ads_shortcode1]

Who are collectors? Should we be afraid of them?

If in the evenings a rude voice on the phone demands that you return a certain amount of money to the bank from which you took out a loan, but forgot to repay the next interest, then you should know that you have fallen into the sphere of influence of the so-called collectors.

Who are collectors? This is an organization or individuals who are engaged in collecting from bank debtors overdue interest on loans and other non-payments. As the debtors themselves call them, they are racketeers of the 21st century. Those bank clients who have encountered them know how difficult it is to resist them. But is the situation as hopeless as it seems? Let's try to figure it out.

Cost of services of anti-collection agencies

The cost of anti-collection services varies among different companies. Some anti-collectors charge a fixed amount monthly - for example, it can be 1% of the debt amount for cooperation lasting up to six months. Other anti-collectors require one-time payment upon initial application.

Be careful and contact only trusted anti-collection agencies, otherwise there is a risk of not only not improving your situation, but even worsening it: incompetent lawyers can ruin your credit history and the attitude of the creditor, even accusing you of fraud, since all actions of anti-collection agencies are under investigation under your responsibility.

[custom_ads_shortcode2]

Is it worth contacting anti-collectors?

It is impossible to give an unambiguous answer to the question of whether anti-collectors are a help or just a new loss of money; everything is individual. We will list some points that are recommended to be taken into account when choosing an anti-collector:

- You must trust your anti-collector. To do this, before contacting, you should read reviews and other information about its activities. During the process, the debt collector will interact with all of your loan documents containing personal information. In addition, there is often a need to provide the anti-collector with the necessary powers through a notary to represent the client’s interests in court.

- Professional quality. Naturally, you cannot trust a person without a legal education. You should also pay attention to the specialization in which the lawyer studied. An ideal combination of a specialty in civil law and procedure, as well as additional financial education in the specialty “Finance and Credit”.

To summarize the article , it is worth saying that the debtor can solve any problems with loan debts independently by studying the articles of the Civil Code of the Russian Federation and examples of court proceedings. The essence of the activity of anti-collectors is that they take over the entire process and save the client’s time for a very reasonable fee. Another question is that it is very difficult to find a really good anti-collector.

Sources:

- credits-on-line.ru

- bankstoday.net

- baikalinvestbank-24.ru