Current legislation cannot fully define and provide a general concept of liquidation of legal entities.

Legal science can only generalize the concept of liquidation, regulating it as a mandatory procedure under certain circumstances, as a result of which the activities of an organization completely cease. As a result, information about the liquidation of an organization can be found in special media and other publications.

Procedure for liquidation of a legal entity

Liquidation of a legal entity is no less complex a process than its creation. This process requires the collection of a significant number of documents, and in addition, it must be remembered that it must be recorded in the state registration authorities at the place of territorial affiliation of the company.

These requirements sometimes create quite difficulties for the founders of a legal entity who have decided to terminate their activities, since they require significant time and organizational resources from them. That is why managers of enterprises that decide to stop working often turn to specialized companies engaged in similar activities to organize all the necessary legal formalities. As a rule, they undertake most of all necessary contacts with government authorities, including registration authorities, tax inspectorates and others. Representatives of a liquidated legal entity in such a situation are usually assigned only the function of signing documents and some other simple procedures.

However, in general, the procedure for liquidating a legal entity is quite clearly stated in the current legislation. Therefore, if the organizers of the company have decided to independently carry out all the necessary procedures, it is not so difficult to do this after carefully studying the regulations governing this area. It is only important to carefully monitor compliance with all the rules governing this procedure in order to minimize the possible negative consequences of the liquidation of a legal entity.

Where to find information about the beginning of the liquidation process of legal entities

Where is information about the liquidation of a legal entity posted? Bulletin Information about the closure of an enterprise should be published in the periodical “Bulletin of State Registration”. The form submitted for printing on the official website of the publication must contain information about:

- abbreviated and full name of the organization;

- OGRN;

- TIN;

- the reason for termination of activity and the persons who made this decision;

- contact information for each representative of the liquidation commission to resolve general issues;

- time limits given to creditors to present their claims.

The application must be accompanied by all supporting documentation that confirms the liquidation, including relevant orders, a document appointing liquidators, information about the decision of management or judicial authorities.

Possible grounds for terminating the activities of an organization

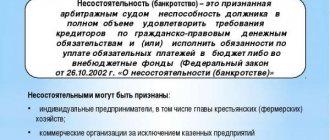

In general, the procedure for termination by a legal entity of its activities is prescribed in Articles 61, 62 and 63 of the Civil Code of the Russian Federation. Thus, Article 61 of this document establishes that the liquidation of an organization is a stoppage of its work, which does not imply a transfer of the scope of its rights and obligations to any other legal entity or individual. In addition, according to the content of this article, an enterprise can stop its work on two grounds: by a court decision if it commits any gross violations in the course of its activities, or by a decision of its creators. In addition, it must be borne in mind that an additional possible reason for terminating the operation of an enterprise may be its insolvency, that is, the inability to fulfill its obligations, which is called bankruptcy and, in accordance with Article 65 of the Civil Code of the Russian Federation, is the basis for the liquidation of the organization.

At the same time, the most organizationally complex process in this regard is the voluntary termination of a legal entity through liquidation by decision of its founders. Thus, the first step towards the implementation of the decision should be its written execution in the form of an order or other similar document and the immediate communication of this information to the registration authority. The latter, in turn, having received this information, must make an appropriate entry in the Unified State Register of Legal Entities, thereby recording that the organization is in the process of liquidation. For such companies, a special column is allocated in the register in which such enterprises are taken into account, so as not to take them into account when making some statistical calculations.

Bulletin of state registration of messages on liquidation of legal entities

From the moment of publication of the notice, the period for presenting claims of creditors begins, after which, and in the case of full settlement with creditors, the legal entity remains to wait for the entry on liquidation to be made in the Unified State Legal Entity. How and where a notice of liquidation is posted (useful links, general information) As regulated by Art. 63

Civil Code of the Russian Federation, the liquidator is obliged to publish a message in the media about the liquidation of a legal entity, about the procedure and deadlines for submitting applications from creditors with claims to the liquidated organization. As an authorized media body for submitting such messages in the Russian Federation, there is the “Bulletin of State Registration”.

This magazine is published in print form and is also available in an electronic version at (both options require a paid subscription).

The need to create a liquidation commission

After carrying out these actions, the founders of the company must appoint a liquidation commission, which will be entrusted with the bulk of the responsibilities associated with the implementation of the legal procedure for terminating the activities of the enterprise. As a rule, the composition of this commission is formed from among the organization’s employees and is formalized by an appropriate order. In addition to simply listing the members of this commission, this document should record which of them will serve as chairman. This person will be responsible for the timely preparation and provision of all documents necessary during the registration procedure, including the liquidation balance sheet of the enterprise.

Publication of information on the liquidation of a legal entity and the timing of its publication

The first step that the newly created liquidation commission must take in the course of its activities is the publication of a message about the termination of the enterprise’s activities in the print media.

This requirement, recorded in the Civil Code of the Russian Federation, is spelled out in more detail in the Order of the Federal Tax Service No. SAE-3-09 / [email protected] dated June 16, 2006 “On ensuring the publication and publication of information on state registration of legal entities in accordance with the legislation of the Russian Federation on state registration.” This document establishes that all information reflected in the Unified State Register of Legal Entities, which includes messages about the liquidation of an enterprise, must be published in the journal “Bulletin of State Registration”.

It is important to remember that the organization of such publication should be carried out as soon as possible after the decision is made to terminate the company. Since the journal “Bulletin of State Registration” is published weekly, the maximum period that can pass from the moment such a decision is made to the moment the corresponding message is published is actually no more than two weeks. At the same time, as follows from the information posted on the official website of the magazine, information is received daily, but it must be taken into account that only advertisements submitted before 14.00 on Wednesday will be included in the next issue. All publications submitted after this deadline will be published in the next issue.

What is the price?

How much does it cost to publish in the Liquidation Bulletin?

The issue price is 88 rubles. 50 kopecks for 1 sq.cm.

The individual specific cost can be found out only after the advertisement has been compiled and sent to the “Cost calculation” section on the official website of the magazine.

Practice shows that usually the amount for publication is no more than 1,800 rubles.

In this case, a bank commission is taken into account (if the method of depositing funds through a bank or bank card is selected).

Information that a record of termination of a legal entity’s activities should contain

In accordance with the requirements of the law, the journal “Bulletin of State Registration” establishes fairly clear requirements for the content of such publications. The general content of such requirements is defined in Order of the Federal Tax Service No. SAE-3-09 / [email protected] dated June 16, 2006 “On ensuring the publication and publication of information on state registration of legal entities in accordance with the legislation of the Russian Federation on state registration.” In addition, when preparing an announcement, members of the commission dealing with the termination of the organization’s activities should familiarize themselves with Letter of the Federal Tax Service No. 6-3-04 / [email protected] dated June 15, 2009 “On amendments to the application form and cover letter for publication of messages from legal entities in the journal “Bulletin of State Registration”. In particular, in accordance with these documents, the list of information that an announcement of the termination of an enterprise’s activities must contain includes the following mandatory information:

- full and abbreviated names of the company stopping its activities. Bringing both names is necessary so that all counterparties who have ever dealt with this organization can identify it and present their claims to it, if any;

- main state registration number (OGRN) of the organization. This figure, consisting of 13 characters, is the number of the entry under which information about this enterprise is entered into the Unified State Register of Legal Entities (USRLE);

- taxpayer identification number (TIN). This number is a 10-digit number that reflects the territorial affiliation of the company and its code in the Unified State Register of Taxpayers;

- information about the person, persons or body that made the decision to terminate the company’s activities. It is important that this information coincides with the name of the authority or information about the person who signed the order to stop the work of the enterprise. Most often, the founder or founders of the organization act in this capacity;

- contact details of members of the liquidation commission. This information is necessary so that a person or persons interested in obtaining additional information or having financial claims against this company can contact directly the representatives of the commission to resolve existing issues;

- information on the period allotted to creditors and other counterparties of the liquidated organization to present financial and other claims in relation to existing obligations. In accordance with paragraph 1 of Article 63 of the Civil Code of the Russian Federation, this period is determined by the members of the liquidation commission independently, taking into account the specific characteristics and circumstances of the process of terminating the activities of the enterprise. However, the same section of the legislation establishes that the duration of this period of time must be at least two months so that all possible creditors have time to receive information about the fact of liquidation of the company and present any claims against it. In addition, this section of the published announcement must contain information about the procedure for filing claims for such obligations.

On the official website of the journal “Bulletin of State Registration”, editorial representatives warn applicants that all information provided in the application for publication of information about the termination of the organization’s work undergoes an initial check against the Federal Tax Service database, which is publicly available. This operation is carried out by editorial staff in order to identify inconsistencies in the values of the digital codes of OGRN, TIN and other entries entered into the registers of the Federal Tax Service. If such inconsistencies are identified, publication of the material should be postponed until reliable information about the organization’s details is clarified. In particular, to find out this information, editorial staff have the right to demand the original or copy of the certificate of state registration of a legal entity or an extract from the Unified State Register of Legal Entities (USRLE) to identify the organization. It is important to remember that all these documents, including an extract from the register, must be valid as of the date of presentation.

Where?

Publication of information about the termination of activities is an important formality of the entire procedure.

. It acts as a guarantor of transparency and accessibility of information, while respecting the rights and legitimate interests of each creditor.

mass media

Publishing information in the media is a mandatory step during liquidation, but judicial practice has more than once encountered the question: is it possible to publish a message in other sources (except for the official publication)?

The court ruling refers to the Order of the Federal Tax Service of 2006, in accordance with which the source of publication of such information is established.

Consequently, the obligation to publish information is not fulfilled if it was presented in another publication. This is important not only from the formal side, but from the point of view of notifying creditors.

Identifying a specific publication for publication protects their legitimate interests because they will not need to:

- get acquainted with dubious sources;

- prove in court that they could not familiarize themselves with the publication, etc.

State Registration Bulletin

Order of the Federal Tax Service No. SAE-3-09/355 of 2006 establishes that information about the publication must be placed in the official source - the journal “Bulletin of State Registration”.

It is presented in both printed and electronic versions.

Additional documents submitted during the publication process

The list of additional documents that may be required by a representative of a legal entity when filling out an application for publication of information about its liquidation includes a copy of the organization’s order to terminate its activities and create a liquidation commission, certified by the signature of the originator and the seal of the enterprise, and an application for publication of the necessary information, signed the chairman of the said commission and the seal of the same enterprise. If the form of activity of the enterprise does not provide for the presence of a seal, it will be enough for the company representative to provide the same extract from the Unified State Register of Legal Entities (USRLE) to identify it, which is presented in case of detection of inconsistencies regarding the company identification codes. However, it should be remembered that in this case the presented extract from the register must be received by a representative of the institution no earlier than two weeks before the date of its presentation.

In addition, it will be necessary to present a payment document confirming payment for the services of this media outlet regarding the publication of the necessary information, since such a service, in accordance with current legislation, is paid.

A receipt from the bank where the payment was made, a payment order or another similar document can be used as payment documents.

To this package of documents, representatives of liquidated organizations, which are most often the chairmen of the liquidation commission, must attach a cover letter drawn up in accordance with the requirements of Letter of the Federal Tax Service of the Russian Federation No. 6-3-04 / [email protected] dated June 15, 2009 “ On amendments to the application form and cover letter for the publication of messages from legal entities in the journal “Bulletin of State Registration.”

Publication order

The procedure for publishing a message about the closure of a company takes place in several stages. Namely:

1) registration of a personal account on the official website of the State Registration Bulletin;

2) filling out an application to publish a message, following the prompts of the service. Here you can use the function of automatically generating a message about liquidation - you fill out the fields in the application, and the text is generated based on the data you entered. This text can be adjusted later. At this stage, you also indicate the need to re-print the application, the number of journals you want to receive, and information about the person for whom the accounting documentation will be drawn up;

3) choosing the method of submitting the message: with or without an electronic signature. If you have an electronic signature, all actions are carried out online; without it, you will have to select a regional office to which the application will have to be sent in printed form;

4) checking the application for publication. It takes up to several hours and, based on its results, issues an invoice for printing the message. Please note that the cost of publication is always determined individually, based on the volume of the message and the number of journals sent to the company;

5) payment of the invoice online or in any bank using a receipt printed from the website;

6) collection of documents and submission to the selected regional representative office of the Vestnik. For publication, the following are collected: an application and a covering letter in 2 copies, a copy of the decision on liquidation and the appointment of a liquidator, a receipt for payment for publication, a power of attorney if the applicant is an authorized person, an extract from the Unified State Register of Legal Entities (not more than 2 weeks old) ), if the legal entity does not have a seal.

Documents are submitted in person by the applicant or by mail. After they are received by the representative office, a publication on the liquidation of a legal entity is published in the nearest journal.

Do you need to liquidate your LLC? Contact the professionals. The Legal Center will take care of all the concerns regarding the liquidation of your company. More details on the page

Date of:

27.02.2017

Submit your application

This is interesting:

Changing the founder of an LLC in 2020: step-by-step instructions

Liquidation of an LLC: step-by-step instructions in 2018

Liquidation of an LLC with debts

Liquidation of LLC without debts

LLC reorganization

Change of LLC director 2020: step-by-step instructions

Types of bankruptcy

Bankruptcy of legal entities

Features and period of liquidation of LLC

Additional areas of work with creditors of a liquidated organization

Information about the termination of activities by a legal entity, which is published in specialized media, is intended to notify creditors and other counterparties of the organization about the fact of its liquidation so that they have the opportunity to make financial claims against it due to the presence of outstanding obligations on the part of this enterprise. At the same time, paragraph 1 of Article 63 of the Civil Code of the Russian Federation instructs members of the liquidation commission not to limit themselves to publishing such material for these purposes, using all other means available to it that may help establish the presence of such creditors.

In the event of receiving information about the presence of outstanding obligations on the part of a company that is ceasing its activities, as well as in a situation where members of the liquidation commission know for certain about the existence of creditors in respect of whom there are outstanding debts, the commission is obliged to notify such counterparties in writing about the fact that the company has stopped operating. As a rule, such written information is carried out by sending letters with acknowledgment of receipt.

This form of communicating information to creditors is usually chosen so that in the event of subsequent legal proceedings in relation to outstanding debt obligations, representatives of liquidated companies have in their hands evidence of the fact that creditors were promptly notified of the cessation of operations of the enterprises and had sufficient time to present their existing debts. them financial claims. At the same time, letters sent to creditors must also indicate a clear time limit allotted for appeals regarding outstanding debt obligations to members of the liquidation commission.

Subsequently, these requirements will be satisfied to the extent of the assets available to the company at the time of termination. After all calculations have been made, the liquidation commission will have to draw up a balance sheet confirming that payments have been made.

Necessary information

The obligation to publish a notice of termination of activity rests with the legal entity. Notice of liquidation must be published in the Gazette.

When a legal entity is closed, a commission is created to liquidate it, regardless of the circumstances. It includes several third-party people, the general founder. The commission must inform all creditors of the liquidation, so the information must be published to ensure publicity. It specifies the deadlines for carrying out financial settlements with a legal entity. The deadline is set by the person whose obligation it is to notify of liquidation.

It must be at least two months from the date of publication of the magazine in accordance with the provisions of the Civil Code, namely Article 63.

A special commission created to carry out measures to liquidate a legal entity:

- carries out assessment and sale of property;

- collects accounts receivable;

- makes settlements with creditors;

- draws up a liquidation balance sheet and a report on the work performed.

The prepared documents are submitted to the Unified State Register of Legal Entities to make changes. Next, an entry is made in the state register and the legal entity begins to be considered closed.

The database of legal entities is extensive. Find out how to use information from the Unified State Register of Legal Entities. Finding OKPO by TIN is easy. The methods are described in the article.

Mandatory company data

For publication, it is mandatory to provide information about the company and its economic activities, which contains information from:

- full and short, abbreviated name of the legal entity;

- OGRN, that is, the main state registration number;

- identification number under which it was registered as a taxpayer - TIN;

- information about the applicant, that is, the person signing the application and covering letter;

- legal address where the legal entity was located;

- information about the body that made the decision to liquidate the legal entity, the decision itself indicating the date of its adoption, the registration number of the decision;

- liquidation procedure, its terms, legal address, including electronic address, telephone number for satisfying applications with creditors' claims.

For claims

The obligations of the liquidation commission, whose actions are regulated by Art. 105 of the Civil Code, any claims from counterparties are subject to consideration, including issues related to the payment and collection of taxes, unified social contributions, and payment of insurance premiums.

Resolutions adopted by the commission are sent to counterparties within 30 days.

If the commission refuses to consider the claims made by the creditor, he has the right to demand fulfillment of obligations in accordance with the instructions of Article 112 of the Civil Code by a legal entity within a month, protesting the resolution.

The commission, having completed the receipt of claims, is engaged in drawing up an interim balance sheet, which is ascertained by the liquidation authority. It includes information about the property of a legal entity, a list of official statements on debt recovery.

Compensation for losses and payment of debts to creditors is carried out in accordance with the liquidation balance sheet, if the claims are recognized as legitimate by the commission or by a verdict rendered by the court.

Reimbursement of debts is carried out one by one. If any creditors present their claims after the established period has passed, then payments are made at the expense of the available property of the legal entity.

Claims settled include:

- official statement of displeasure without legal force;

- claims not contested in court;

- claims with complaints that were rejected by a court decision;

- unsatisfied requirements due to lack of available property.

Having completed the repayment of debt to creditors, the commission is engaged in drawing up a balance sheet of the economic activities of the legal entity. It must be approved by the commission, which deals with issues related to the functioning of the legal entity, and then transferred to the tax authorities.

If, after the actions taken, any property remains available, then it is transferred to the participants of the legal entity, if its transfer is provided for in the constituent documents or legislative acts.