How do bailiffs collect debts from citizens? Read the information in the article.

Every car owner may encounter such a situation, in which they have to ignore the rules of the road. In some cases this happens consciously, but in most cases it does not.

- Often, due to such situations, the car owner receives fines. But he does not always know about the penalties imposed. This may happen due to the fact that the person does not live where he is registered or the debt notice was accidentally sent to the wrong address by the wrong recipient.

- If the fine is not paid on time, the case is sent to court, and the judge, after rendering a verdict, gives the case to the bailiffs.

- They must look for the debtor and collect the necessary amount from him.

- Is it possible to find out debt from bailiffs via the Internet, and how? How does the collection process work and how can the debt be paid? You will find answers to these and other questions in the following article.

How to pay a debt from bailiffs: methods

Paying fines and alimony debts is easy. There are several ways to do this. If you know that you have a debt through the bailiffs website, then you need to pay it urgently. Here are the ways you can use:

Pay with a button on the service itself.

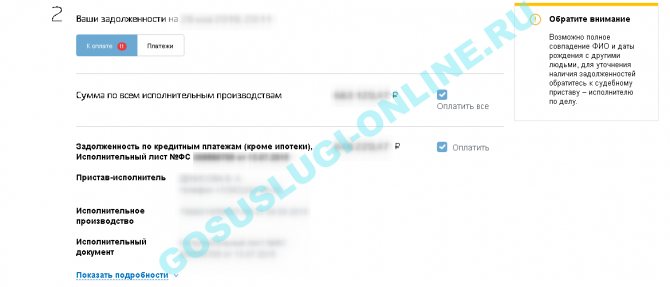

The system found your debt in the database of enforcement proceedings. The information appeared in the form of a table. In one of the columns there is a yellow “ Pay ” button. Click on it.

How to pay a debt from bailiffs: methods

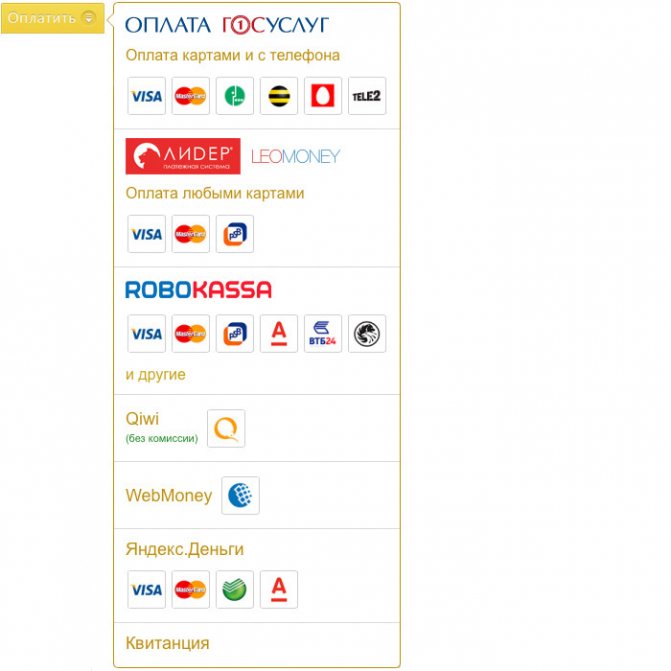

You will be offered several payment options from different payment systems and banks. Choose a convenient method and click on the icon with an active link.

How to pay a debt from bailiffs?

Important: For the transfer you will have to pay a commission of 2.5 to 3.5%, except for Qiwi. Using the Qiwi system you can pay fines and other debts without commission.

If you have a Sberbank card, then use the option of paying via Internet banking. Go to your Personal Account and find the line with payment of fines in the “ Payments and Transfers ” tab.

Via a mobile application.

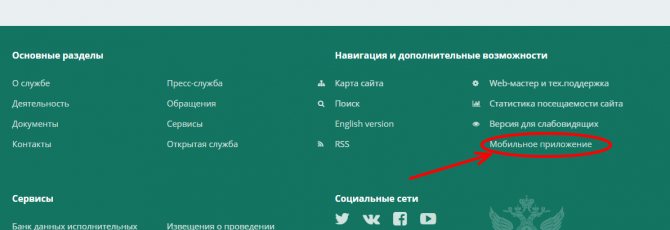

You can download it on the FSSP website. On any page of the site, move the slider down and find the “ Mobile application ” tab. Click on it.

How to pay debts from bailiffs through a mobile application

You will see a description of this application and three versions for downloading. Select and start downloading and installing.

How to pay a debt from bailiffs: installing the application

After installing the program on your phone, make payments in two clicks through electronic payment systems - quickly and conveniently.

Payment via terminal.

There are terminals in banks, airports, on the streets and even in the territorial departments of the FSSP. Click the “ Pay fines ” tab, indicate the number of the enforcement proceeding and the amount including the commission, and deposit the money into the bill acceptor of the machine.

Payment at a banking institution using a receipt.

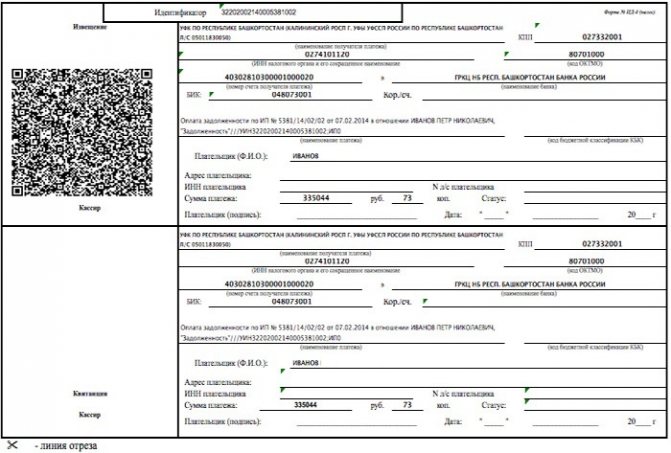

On the FSSP website there is a “ Receipt ” option. You will see it when information about the presence of debt appears. Print it out and pay at any bank.

How to pay a debt from bailiffs: receipt for payment

You can also pay debts in person to the bailiff in his office. But, if you don’t want to go to the joint venture department, then choose any method described above and pay your debts.

Unified State Register of Enforcement Proceedings

The Unified Register of Debtors of the Russian Federation is a list of persons who are indebted to individual entrepreneurs, posted on an online resource. This database was created by the FSSP in order to systematize information about non-payers. Most of the information is open. The list includes both individuals and legal entities who have failed to meet debt or other financial obligations.

The list of debtors is posted publicly on the FSSP website. But a person can get there only if the court initiates enforcement proceedings. That is, people and companies officially recognized as malicious debtors will be able to add their names to the list of debtors.

The reasons for creating a register where all individuals who “forgot” about their debts were collected are very simple:

- Solving problems with identifying defaulters in the Russian Federation;

- Help in finding defaulters when they try to travel abroad;

- Search for debtors when applying for loans.

The regulatory framework that regulates the register of debtors is Federal Law Act No. 229 of October 2, 2007. In addition, regulatory regulation is carried out by:

- Constitution of the Russian Federation;

- Norms of international treaties;

- FSSP Order No. 248 of May 12, 2012.

The main goal of the registry is to reduce the number of debtors and stop the growth of debt, which will gradually be achieved.

Open information in the bank of enforcement proceedings

The public status of the register does not mean that the information in it is open to everyone. Defaulters indicate personal information in the register, but it is not available to everyone. To obtain information, you need key details of the debtor. The register allows you to clarify information about tax debts, alimony arrears, fines, etc. as well as debts to financial institutions. In addition to the debtor himself, information about the debt is seen by creditors who control the collection of money.

To find a debtor, you need to know:

- Initials;

- Region of residence;

- Date of birth.

Among the publicly available data, the automated information AIS OIP contains:

- The date of execution of the court verdict, which led to the fact that the debtor was entered into the register;

- Information about the executive document (type and number);

- The name of the department that issued the execution document;

- Date of initiation of the IP;

- Amount of outstanding debt;

- Address and name of the bailiff service that initiated the IP;

- Information that the person has been put on the wanted list (if necessary).

To obtain the listed data, you need access to the World Wide Web.

Information about individuals

Information on debt of individuals:

- Full name of the debtor;

- Date and address of birth;

- Amount of debt;

- Number of the resolution and date of its issuance;

- Details of the document that led to the initiation of the IP, and details of the body that issued this document;

- The name and contact telephone number of the bailiff under whose control the individual entrepreneur is located.

A debtor who is on the list does not have to worry about the information provided. They only motivate to quickly pay off the debt.

Information about legal entities and organizations

Entry into the register of debtors of organizations and legal entities occurs even more often than individuals. In the business world, one wrong move can lead to bankruptcy, so it is important for companies to find out whether their partners have debts before entering into business relations with them. In addition, being included in the register imposes some restrictions on debtors, one of which is the inability to travel abroad, which can also harm the business.

Legal entities and organizations represent:

- Company name;

- Her legal address;

- Amount of debt, etc.

The list of information is almost the same as in the case of individuals. There are several options for those who would be interested in information about the bankruptcy of a company:

- To the debtor's creditors.

- Persons planning to participate in bidding for the debtor's property. Bankrupt enterprises greatly reduce the prices of their property, and this is a profitable opportunity to save money.

- Employees of the organization and business partners. If a company hasn't notified anyone of its plight, it could be an unpleasant surprise for everyone who depends on it. To prevent this from happening, the Register was invented.

The consequences of being included in the register for legal entities and organizations are much more complicated than for individuals, since they seriously affect not only their financial well-being, but also their reputation.

If you don’t want to lose your status in business circles, you need to monitor your financial situation and pay off your debts on time

Who is included in the register of debtors

Non-repayment of debt is one of the common problems of domestic society. Usually, the presence of debts is associated with the low economic culture of the population, the situation in the country, etc. With the help of the Unified Register of Debtors, they are trying to minimize this problem.

Debtors are distinguished according to several criteria:

- Intentions regarding debt repayment. There are debtors who intend to repay the debt, but due to various objective reasons, are unable to do so. But there are debtors who have no intention of repaying their debts. In the second case, the debtor’s chances of adding his name to the Register increase significantly.

- Legal and financial literacy. Debtors who understand the law understand the consequences of not paying a debt and look for a way to compensate for the debt. Individuals who do not have the necessary knowledge base are usually in no hurry to get rid of debt, hoping that nothing will happen to them for it.

- Financial opportunities. Often debtors do not pay their debts due to the fact that they do not have the financial ability to do so.

Despite different reasons, all of the listed categories of persons have a chance of being included in the Register. The list includes persons who do not fulfill debt obligations:

- For payment of bank loans;

- Due to the termination of payments on a consumer loan;

- Due to delays in payments for compensation for personal injury or property damage;

- Non-payment of compensation for moral damage caused;

- Due to non-payment of mandatory taxes;

- In case of non-payment of fines;

- Non-payment of fees, utility bills, etc.;

- Due to non-payment of alimony, etc.

Bailiffs can enter information only if an individual entrepreneur has been filed against the debtor, recognizing the person as a willful defaulter.

Information about the case will not be entered into the database until it comes under the jurisdiction of the FSSP service, therefore, due to a small utility debt, the chances of getting on the list are zero. Although it is not recommended to delay repayment of debt.

Consequences of entering a debtor into the register

Once on the list of defaulters, a person or organization immediately feels the consequences:

- You cannot get loans from banks;

- You cannot carry out transactions related to personal property (it can be seized as payment of a debt);

- It is prohibited to travel abroad;

- It is not allowed to use bank cards or funds stored in accounts;

- You cannot get loans from a bank.

But most importantly, the debtor’s property and money can be seized and sold for next to nothing in order to quickly repay the debt. Bailiffs and witnesses must seize the property by entering it into the deed. The items are transferred for storage, and copies of the seizure order are forwarded to interested persons and organizations.

How do bailiffs collect debts from individuals?

Bailiffs take measures against debtors described in the Law “On Enforcement Proceedings”. There are many of these measures, but several are the most common. Here are examples of debt collection from individuals:

- From salary . The debtor must be officially employed, then it will not be difficult for bailiffs to find a person in the database.

- Collection of property, money and securities. The bailiff has the right to evict the debtor from the living space. But this measure takes place if the amount of debt is large.

- Ban on traveling abroad . This measure is also often used, although many people think that bailiffs do not have the right to impose such bans.

Advice: Bailiffs can resort to different penalties, and all of them are within the framework of the Law. Therefore, keep an eye on your debt and pay it on time.

What can the FSSP collect?

Debt obligations may arise due to non-payment:

- fines imposed by government services (sanitary and epidemiological station, fire department, traffic police, etc.);

- regular mortgage payments;

- loans and any types of loans;

- utilities;

- alimony;

- fees and tax payments.

It is worth noting that the existence of debt is not a direct reason for taking harsh measures against a person. In a forced format, debt repayment is possible only if there is:

- a valid court decision;

- a resolution of one of the authorities, which was not duly challenged.

As a rule, the existence of a particular debt is not a surprise to citizens. Any late payment immediately goes through the collection procedure in court, of which the debtor or his representative is always notified. Fines imposed by the traffic police, fire department or other government services are most often issued on the spot, in the presence of the offender, or sent by mail for review. If it comes to enforcement proceedings, then a postal notification must be sent to the debtor. If a person has already fulfilled his obligations under a court decision, he can write to the bailiffs an application to suspend enforcement proceedings and send it along with documents confirming the execution of the court decision.

Can bailiffs deprive a driver's license?

Since January 2020, bailiffs have the right to suspend a driver’s license. This punishment may follow if you have a debt of more than 10 thousand rubles. Bailiffs deprive a driver's license until the debtor repays the debt.

Register of debtors

The register of debtors whose travel outside the Republic of Kazakhstan is restricted is formed on the basis of electronic notices of travel restrictions transmitted to the Border Service of the National Security Committee of the Republic of Kazakhstan. An electronic notice is sent by the bailiff after he has issued the relevant decision and it has been sanctioned by the judge. A copy of the resolution is sent to the debtor. The resolution can be made both in relation to citizens of the Republic of Kazakhstan and in relation to foreigners and stateless persons, as well as in relation to the heads of legal entities - debtors.

If the executive document is not a judicial act and was not issued on the basis of a judicial act (for example, writs of execution or protocols), then the claimant or the state bailiff has the right to apply to the court with a request to establish a temporary restriction on leaving the Republic of Kazakhstan for the debtor. But in this case, it is worth considering that a decision may be made without your presence, so it is better to always pay off debts, fines, fees and utility bills on time so as not to bring the matter to court.

Bailiffs: how to check the ban on traveling abroad?

A ban on traveling abroad is the most unpleasant incident, especially during the holidays. Bailiffs impose a ban if the amount of debt exceeds 10 thousand rubles. If this amount is less, no one has the right to prohibit you from going on vacation.

How to check the ban on traveling abroad? This will be available using several methods:

- On the FSSP website . Go to the registry database, enter your last name and start searching. If a green line appears saying that you have no debts, then everything is fine. If the executive number appears, hurry up and pay the fine. You can also personally visit the FSSP office with your passport and find out the necessary information from the bailiff.

- On the website of the Federal Tax Service . To do this, create a Personal Account with a login and password issued by the Federal Tax Service. Your Personal Account displays all the necessary information.

- On the government services website . On this resource you also need to go through the procedure of creating a Personal Account. Then go to the Ministry of Internal Affairs page using the appropriate tab. Find the line “ Issued fines ”, enter the driver’s license number, car number and click “ Search ”. On the next page you will see all unpaid fines.

Pay your fines on time so as not to bring your debt to court proceedings, and then you will not have bans on traveling abroad, and you will preserve your savings.

Database Search

The database developers provide a convenient and easy-to-use search for the necessary information, depending on what data is known to the interested party.

If we talk about the individual entrepreneur database, the most popular is to search for individuals by first and last name. To eliminate a large number of unnecessary results, it is recommended to also fill in other lines.

To search for organizations, you must use the “Search for Legal Entities” tab and enter the available data.

If you know the IP number, then it is most convenient to search through the “Search by IP number” tab.

You can find the information of interest in the search register for individual entrepreneurs by the last name, first name and patronymic of the wanted person.

Search instructions

To perform a search you need:

- Access the Internet through a user-friendly browser.

- Enter the address www.fssprus.ru into the address bar.

- In the upper left part of the page that opens on the official website of the FSSP of Russia, select the “Information Systems” section, and then – “Data Bank of Enforcement Proceedings” or “Detected Register for Enforcement Proceedings.”

- Be sure to fill out the lines marked with an asterisk, the rest are optional.

- Enter the highlighted set of letters and numbers.

- View the result.

It should be noted that the IP database and the Search Register for enforcement proceedings can be useful not only for debtors, but also, for example, for potential employers or employees, since these services help to find out whether the organization is held liable for non-payment of wages and whether the future employee is a willful defaulter.

What is the unified federal register of information on bankruptcy of individuals and legal entities?

Bankruptcy is a term used in economics to define the inability of individuals and businesses to pay their bills.

The Unified Federal Register of Bankruptcy Information is a state resource that contains up-to-date information about individuals and legal entities declared insolvent, from filing a lawsuit to selling property. The official website is located at this address.

The regulatory authority of the resource is the Ministry of Economic Development. Its competence includes the appointment of an operator and rules for maintaining the register. The basics of the functioning of the service are reflected in Article 28 of Federal Law No. 127 of October 26, 2002 “On Insolvency (Bankruptcy)”.

Features of management

CJSC Interfax has been appointed as the registry operator. This is the largest information group in the CIS, including 36 companies. The operator deals with the technical side of the portal.

It receives information from users authorized to enter data, verifies its accuracy and enters it into the register.

All messages received are duplicated in the official source approved by the Government of the Russian Federation - the Kommersant newspaper.

The following have the right to enter data:

- arbitration managers;

- state and municipal bodies;

- operators of electronic platforms;

- auction organizers;

- self-regulatory organizations, notaries.

An arbitration manager is a citizen of the Russian Federation authorized by an arbitration court to conduct bankruptcy proceedings and maintain a balance of interests of all parties. His responsibilities include preparation and implementation of activities at each stage, he convenes and conducts meetings of creditors, and also stores original documents until the completion of the case.

We suggest you read: How to show production waste on account 20

Information about decisions made and ongoing activities must be submitted for publication in the register within 10 days. Verified data appears on the website after 3 days, in the Kommersant newspaper - after 10 days.

All information about the stages of the bankruptcy procedure is added to the debtor’s card:

- Observation. At this stage, an assessment of the debtor's existing assets is carried out. The first meeting of creditors takes place. A register of claims against the debtor is compiled.

- Financial recovery. Members of the meeting determine the order of repayment of debts. The debtor fulfills obligations by refinancing, obtaining a new loan to repay the current one, or the debt is repaid by third parties.

- External control. If the management of the company is recognized as incompetent, a decision is made at the meeting to introduce control over the activities of the enterprise. The debtor can also use the moratorium to put things in order.

- Competition proceedings. If none of the remedies are effective, the debtor's property and assets are sold at auction.

In fed. The bankruptcy register displays information about current trades and auctions.

The application for information must include the name, address and details of the debtor, as well as information about the procedure.

Every three months, Interfax transmits to the executive authorities reports on past activities, the amount of debt, what part of the debt was repaid during the implementation of measures, the costs of procedures, as well as an assessment of the work of the arbitration manager and signs of fictitious or deliberate bankruptcy.