Standard situation: a person vouched for a friend when he took out a loan. Six months later, the friend was fired, he stopped paying the bank, and the debt was transferred to the guarantor. Sometimes the only way out of the situation is to declare bankruptcy.

An equally common situation is when an accountant acts as a guarantor for an organization’s loan. This is usually done with one call: “Lenochka, I’m on a business trip in Paris, and we need to take out a loan to fulfill the terms of the tender. Be kind, become a guarantor for the company, do a good deed!” And Lenochka, afraid of losing her warm place, agrees to the director’s request. Then the company goes bankrupt, and the accountant is left with a debt of 100,000 million rubles. And the only thing he can do in this situation is to legally recognize the insolvency of an individual.

In what cases will the guarantor not be liable for the debts of the principal debtors? What opportunities did the Federal Law on bankruptcy of an individual provide to guarantors?

What actions must a guarantor take in bankruptcy?

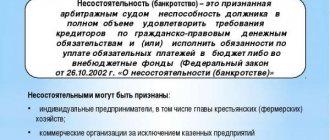

Bankruptcy of an individual is a situation when a person cannot pay off his obligations. In the event of bankruptcy of the main borrower, creditors have the right to demand payment from the guarantor. The basis for declaring a guarantor bankrupt will be the inability to fulfill obligations under the guarantee agreement (to repay someone else's loan).

To get a consultation

Ask any question about bankruptcy and receive a detailed answer. It's free.

What awaits the guarantor if the main debtor files for bankruptcy?

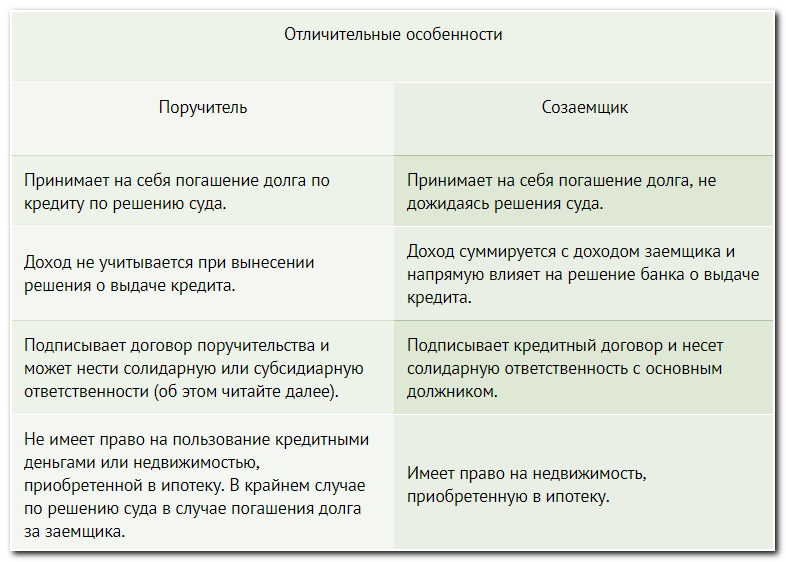

According to Art. 363 of the Civil Code of the Russian Federation, the liability of the guarantor can be subsidiary and joint. Let's consider in the table below what the guarantor's actions will be in the event of the borrower's bankruptcy.

| Vicarious liability | Joint responsibility |

| The guarantor pays part of the debt that the main debtor could not pay off | In accordance with the law (Article 322 of the Civil Code of the Russian Federation), the guarantor pays in full:

|

| First, a claim is made against the main borrower; if this is not possible, the debt is collected from the guarantor. | The creditor has the right to make claims simultaneously against both or any of them |

Judicial practice shows that in most cases, lending agreements provide for joint and several liability for guarantors. When concluding a guarantee agreement, pay attention to the type and terms of the guarantees issued.

Guarantor in case of bankruptcy of a company

The responsibility of the guarantor in the event of bankruptcy of a company is the fulfillment of the obligation to pay the debt for the organization after its liquidation. It would seem that what the problem is - the LLC/JSC was liquidated, which means that all debts and claims against the guarantors were settled.

No. In Art. 367 of the Civil Code of the Russian Federation expressly states that if the creditor managed to file a claim against the guarantor before the closure of the main debtor, even the liquidation of the borrower does not terminate the guarantee.

Another interesting nuance. If the guarantor complies with the banks' demands and pays off the debt, he will not be able to apply for recovery of money from a company that has already been liquidated.

But! If the guarantor pays off the loan obligations before the bankruptcy procedure is completed, he becomes a bankruptcy creditor instead of the bank, and can reimburse part of the money in settlements.

Banks are happy to accept guarantees for LLCs and individual entrepreneurs from individuals, including founders, relatives and even employees. If you don’t make money from it, you shouldn’t cover other people’s risks with your own money.

In the case of a small business, for example, when the husband is bankrupt and the wife acted as a guarantor for loans, she will have to answer for the debts of the company or individual entrepreneur. In such a situation, the option of joint bankruptcy, which we described in this article, is suitable for spouses.

What are the consequences of guaranteeing someone else’s loan?

02 October 2018

When a banking institution needs some additional guarantees to issue a loan, most often we are talking about collateral or a guarantee. If it is not possible to provide the bank with some property to secure your loan, it becomes necessary to look for persons who can vouch for the borrower.

Usually, they begin to look for these people among relatives, relatives or friends, turning to them with a request to nominally act as a guarantor for the loan.

However, if you are faced with a situation where someone close to you has asked to become his guarantor, you need to think very carefully about what consequences may await you in the future.

Vouch for a friend?

A guarantee is clearly a serious and responsible step, which may entail monetary obligations to a banking institution in exactly the amount that corresponds to the balance of the borrower’s debt. If the guarantor refuses or is unable to pay this debt, the entire burden of repaying the loan may fall on the shoulders of the guarantor, up to the confiscation of his property.

The guarantor may bear either partial or full financial responsibility. Most often, banking institutions hold the guarantor fully responsible for the borrower’s failure to fulfill loan obligations. Partial financial responsibility applies only if the borrower is unable to provide the required collateral, however, the income allows the borrower to fully service the loan. It is also necessary to emphasize that only liquid property that is not currently under arrest and is not collateral for any other loan can be accepted as collateral.

The financial responsibility of the guarantor and the borrower can be joint and several. The latter arises only when the main borrower is unable to repay his debt. And the first implies that the banking institution has the right to demand fulfillment of the conditions specified in the loan agreement from both the borrower and the guarantor. To clarify the type of responsibility that the guarantor bears, you need to carefully study the guarantee agreement.

The process of collecting loan debt is very complex and can be delayed for quite a long time. Very often, the amount of the original debt can increase sharply due to the lender applying penalties or fines for late payments. It is possible to seize property from the main borrower or the guarantor only after studying in detail all the intricacies of this case. There are options to minimize the negative consequences of mandatory loan collection and you can even save your property, but their effectiveness can vary significantly depending on each specific situation.

The guarantor is responsible for everything

The larger the loan amount, the higher the risks of the person who decides to become a guarantor. While the loan agreement is in effect, the guarantor risks his property and funds, and if he himself needs borrowed funds, he will most likely be refused due to obligations to the banking institution.

In what cases is the liability of the guarantor relieved?

The guarantor will be able to evade responsibility for paying debts in the following situations:

- The debt was transferred to another debtor.

- The main obligation has been fulfilled.

- The lender refused to accept the fulfilled loan obligation.

- The guarantee period specified in the contract has expired.

- Bankruptcy of the loan guarantor.

In other cases, the debt of the bankrupt (citizen or company) is transferred to the guarantors. The way out of the situation is to file for bankruptcy.

When retribution is inevitable

The guarantor’s property and income are at risk in the following cases:

- the borrower refused to pay, he has no official income;

- the borrower died and did not have a life insurance policy;

- the assessed value of the property is not sufficient to cover the debt.

In these cases, the guarantor will have to pay everything, from interest and the loan body to legal costs. An emergency way to get rid of bailiffs is to fake your own incapacity (in other words, pretend to be crazy). But few people want to live with such a stigma, so they have to look for other ways.

The mortgage guarantor is guaranteed not to have to pay for the borrower if he does not have any regular income and property. At the same time, a person without income and real estate cannot become a guarantor: the bank requires confirmation of income when applying for a loan. If the guarantor is threatened with paying off other people’s bills, you can quit your job and transfer movable and immovable property to your immediate relatives. These steps will delay the need to pay, but will not eliminate it completely. The bank will wait until the guarantor has a regular income and will demand their money back.

Important: if the case goes to court, and the guarantor and the borrower are registered in different cities, the plaintiff bank chooses the court at the location of one of the defendants. As a rule, this is the court at the location of the banking organization. From whom the bank will demand a refund first depends on the type of liability specified in the agreement.

How does the bankruptcy procedure for individuals proceed with guarantors?

In fact, the bankruptcy case of a guarantor does not have any special features; the procedure follows the general procedure. Let's look at how this works.

- An application for bankruptcy of the guarantor is drawn up. The document indicates the amount of debt, creditors, the reasons that prompted you to file for bankruptcy, as well as the SRO from which the financial manager will be selected.

- Applications are collected - evidence of the circumstances stated in the application. In particular, court decisions, claims from banks, surety agreements, payments under it.

- A state fee of 300 rubles is paid. and an advance payment for the manager’s services of 25 thousand rubles, receipts must be attached to the application.

- The first court hearing, the application is considered and the procedure is introduced. Practice shows that in most cases, courts recognize bankruptcy and order the sale of property. The basis for the occurrence of debt is not important - whether it is your own loans or someone else’s. If the demand cannot be fulfilled, the court will recognize the bankruptcy of the guarantor.

- The financial manager carries out the necessary procedures and then prepares a report for the court. The remaining debts are written off.

Judicial practice of bankruptcies and guarantors for loan obligations

A guarantee actually entails serious consequences, and this is confirmed by the evidence - the Decision in case 2-1387/2015, adopted on October 13, 2020 in Ryazan. We are talking about collecting a debt from a guarantor, and joint and several liability played an important role in the decision.

If we consider the Determination of March 16, 2012 in case No. A76-19770/2009, adopted by the Autonomous Court of the Chelyabinsk Region, we learn that the rights of the guarantors, as well as their obligations, do not cease even within the framework of the bankruptcy of the debtor. The accrual of interest and various commissions under the loan agreement continues all the time. And here a lot depends on the guarantor:

- if he does not act, then upon completion of the insolvency procedure of the main debtor he will be faced with an increased debt;

- if he pays off the debt and joins the process as a bankruptcy creditor, he will have the opportunity to recover at least part of the money.

At the same time, the court decision in case 2-207/2017 ~ M-137/2017, adopted on November 22, 2020 in the Trans-Baikal Territory, establishes that after the death of the borrower, banks cannot demand repayment of obligations from guarantors

. Creditors have the right to appeal to the heirs of the debtor if they enter into inheritance rights.

Note that an analysis of the fictitiousness of bankruptcy is also carried out in relation to the guarantor, and the financial manager checks the withdrawal of property. There is also a practice of challenging the guarantor’s transactions, so selling for next to nothing and donating assets (real estate, cars) on the eve of bankruptcy is pointless. The manager will challenge unequal contracts; read a detailed review about this.

So, the bank has the right to present financial claims to the guarantor in case of bankruptcy of the debtor. Sometimes it is more profitable for a guarantor not to pay off someone else’s debts, but to admit insolvency. For large loans, this is the right decision.

Judicial practice in the bankruptcy of ordinary citizens, which has developed over the past 4 years, has shown that the courts are more loyal to guarantors.

If you have become a guarantor, and now banks require that you pay off the debt, contact professional lawyers in Moscow. We will help you file for bankruptcy, file a lawsuit and write off debts, without losing personal property!

To get a consultation

Ask any question about bankruptcy and receive a detailed answer. It's free.

Rights and obligations of the guarantor

If you have already gotten involved in this, then you should not be nervous in advance. First, I will tell you what the guarantor must do:

- The guarantor's responsibilities include covering the borrower's financial debts. That is, if a friend does not make a monthly payment, it falls on your shoulders.

- You must also comply with all the terms of the contract that was signed by him.

Now let's move on to the rights of the guarantor. If you thought the situation was hopeless, it is not.

The guarantor can challenge the actions of the creditors at any time. It is possible to obtain cancellation of the contract and removal of obligations from you.

Comments and questions

- Sofia 11/14/2018 at 14:43

Which of you, competent lawyers, can explain in detail how the further bankruptcy procedure will develop IF the sale of the property of the main bankrupt at the onset of 6 months (it would seem that the procedure is completed), the bank requests an extension for another six months, citing that the sale did not take place, the court naturally supported the petition, and the bankrupt guarantor’s bankruptcy should also end soon, but! Will he also be given an extension for these six months? he has no property, only a salary, or there is the possibility of completing bankruptcy with the writing off of his debts and sureties.Answer

- Alexander, bankruptcy lawyer 11/16/2018 at 15:39

Hello Sofia! In this case, most likely, the guarantor will also have the procedure extended, since, as far as I understand, the guarantor was included in the register of claims of creditors of the main debtor. This means that his case involves accounts receivable, and the financial manager is also interested in collecting them.

Answer