HomeArticles on personal bankruptcyHow to borrow money: everything you need to know about receipts

Author of the article: Konstantin Milantiev

Last revised July 17, 2020

Reading time 9 minutes

When a friend or friend asks for financial help, you want to believe in the honesty of such people. However, when money comes into play, faith in human decency alone is not enough. Words are quickly forgotten, and even the lender may forget how much and for what period he lent.

In order to accurately remember the amount, date of provision and terms of repayment of borrowed funds, you should take a receipt from the debtor. Thanks to writing, you can accurately and specifically remember all the circumstances of the agreement between the parties.

Detailed information about the borrower, which includes passport details and registration address, in case of non-payment of the debt, will help, if necessary, file a claim in court.

What is a receipt?

If you want to loan a certain amount of money to another person, then such an agreement is confirmed by a corresponding document, which is equivalent to the terms of the microloan agreement.

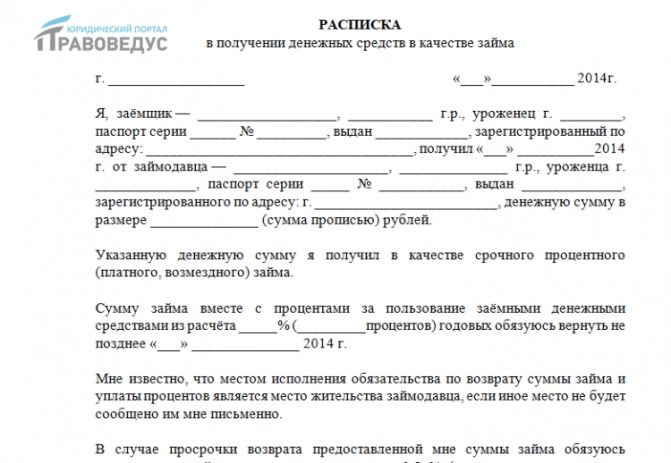

Sample receipt text

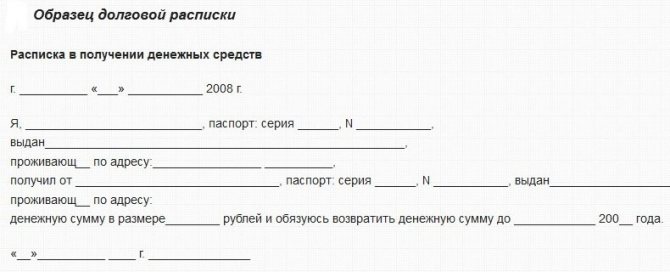

A sample receipt for receiving funds as a loan will help you correctly compose the text of the paper, which is characterized by a list of distinctive characteristics

:

- Both a printed and handwritten version of the receipt for borrowing money is used;

- It will help in clarifying a conflict situation between the parties in a court hearing and without notarization;

- The borrower's signature is required.

A receipt for borrowing money is drawn up based on a number of recommendations

:

- The Civil Code provides for the form of writing this paper by hand if the loan amount is above 10,000 rubles. This is a standard requirement, otherwise the paper has no legal basis. If the debt is smaller, you can agree on everything verbally, including repayment terms.

- The text of the receipt must include information about the parties to the transaction: full name, full date of birth, place of residence and identification document details.

- Next is information about the size of the loan and whether it was issued without interest or with interest. When using the currency of another country in a transaction, you will need to indicate the rate at which the debt should be repaid. This will help prevent further misunderstandings.

- One of the primary requirements for a loan receipt is an indication of the debt repayment period. It is recommended to specify a specific date.

Let’s summarize the topic of competent receipt preparation:

- The need to draw up a receipt may arise not only when transferring money for loans, but also in other situations when it is necessary to record something in a concise form.

- By drawing up a receipt, you can record the transfer of money, transfer of documents, payment of alimony, absence of claims, etc.

- A receipt has legal force if it is a correctly drawn up document. Only a receipt containing the necessary details can be presented in court as evidence.

- Other articles in this section

- What is commercial law: concept, sources, principles

- How decommunization took place in Ukraine, renaming streets

- About quarantine rules in Ukraine, fines for violating quarantine

- Civil process: cases when you can’t do without a lawyer

- What is an administrative case under the CAS of Ukraine

- What is the fine for traveling without a ticket on public transport?

How to get my money back?

When transferring a loan, you must immediately think about how to return your savings in the future. If the parties trust each other, and no unforeseen situations have occurred during the specified time, then problems usually do not arise. However, it is impossible to insure against force majeure for sure.

When issuing funds, it is advisable to limit their size to your capabilities, so that untimely repayment of the debt does not cause your bankruptcy. When compiling such a paper, carefully study all the information provided for errors. Particular attention should be paid to the correct spelling of personal information of partners, which should be checked using the passport, as well as the specified amount and period.

If the borrower does not repay the debt in a timely manner and violates the terms of the agreement, a claim is filed in court to collect the debt under the existing agreement.

Who fills out a receipt for receiving money?

The receipt is written by the one who borrows money . When a citizen who needs money cannot be present when it is issued, his representative comes instead. In such circumstances, the document must indicate that the loan was transferred to a representative, write down the date, place of transfer, banknote numbers, and other personal identifying parameters (passport details, signature, as in a passport). The more personal data you have, the easier it is to get the borrowed funds in the future .

Receipt with signatures of witnesses

In order to formalize collection in court in case of late payments, you must adhere to the main criterion - to put the signatures of witnesses on paper. The named persons must be legally capable and present a passport. The presence of witnesses is necessary in the process of drawing up the paper and obtaining funds in debt. According to the portal nalog.ru

, at least two certifying people are required who sign after the lender and the borrower.

If the amount in question exceeds 10,000 rubles, pay close attention to the rules for drawing up such paper. For smaller loans, it is enough to limit yourself to information about who gave the money to whom, and for what period.

How to borrow money against a receipt?

As judicial practice shows, quite often there are cases of incorrectly executed debt receipts, which make it difficult or even impossible to collect the amount of debt from the borrower. Let's list the main ones.

Error 1. The promissory note does not identify the person who received the sum of money. For example: “This receipt was given by me, Petrov Petrovich, that I received a sum of money in the amount of 25 thousand rubles as a loan from Marina Ivanovna Ivanova.” Often, such errors in promissory notes can be found in the case of a loan between persons who are in friendly or family relationships, and, as a rule, the attitude towards the document is a pure formality.

“This receipt is given by me, Petrov Petr Petrovich, born XXXXX, a native of the city of XXX, passport XXXXX No. XXXXXXX, issued by XXXXXXX, registered at the address XXXXX that on May 1, 2014 I received as a loan a sum of money in the amount of 25 000 rubles with a return period until May 1, 2020.

» The proposed wording of the text for the promissory note in the event of legal proceedings regarding the repayment of the debt may suggest that the debtor can submit to the court a completely different loan agreement, with a similar date and amount, but indicating other data about the borrower (for example, one of his relatives or friends).

Error 2. The promissory note was drawn up without indicating the fact that a certain amount of money had been received by a specific borrower. For example: “This receipt is given by me, Petrov Petrovich, born XXXX, a native of the city of XXX, passport XXXX No. XXXXXX, issued by XXXXXXX, registered at the address XXXXX that on May 1, 2014 I agreed with Ivan Ivanovich Ivanov on a loan a sum of money in the amount of 25,000 rubles.”

Such wording of the promissory note may lead to the fact that an unscrupulous borrower in the future, when the debt obligation to repay the sum of money is due, will claim that the loan was agreed upon, but not at all about its receipt. Based on Art. 812 of the Civil Code of the Russian Federation, the borrower has the right to challenge the loan agreement due to its lack of funds, presenting in court arguments proving the absence of the fact of transfer of money.

Error 3. When drawing up a promissory note, the purpose, term and conditions for repaying the amount of money received as a loan may not be indicated. For example: “This receipt is given by me, Petrov Petrovich, born XXXX, a native of the city of XXX, passport XXXX No. XXXXXX, issued by XXXXXXX, registered at the address XXXXX in that on May 1, 2014 I received from Ivan Ivanovich Ivanov XXXXX .R.

More on the topic How to pass your license without a driving school: is it possible without training in 2020

, a native of the city of XXX, passport XXXXX No. ХХХХХХ, issued by ХХХХХХ, registered at the address ХХХХХ in the amount of 25,000 rubles.” This wording of the promissory note fully allows the borrower, in the event of a dispute, to claim that the amount specified in the document was received as payment for some action (sale agreement, received as a gift, etc.), and subsequently become the main reason for the impossibility of repayment funds to the lender.

Error 4. When the terms of the loan are not noted in the promissory note, namely: whether the loan is targeted/non-targeted; debt repayment period; The interest rate or loan is interest-free. So, if the loan was provided to the borrower for some specific purposes, but they were not covered in the promissory note, the lender does not have the right to demand repayment of the amount ahead of schedule, even if these funds were spent for other purposes.

If the receipt does not contain a deadline for the return of funds, on the basis of Part 2 of Art. 314 of the Civil Code of the Russian Federation, the borrower is obliged to repay the loan within 7 days from the moment the lender submits demands for its repayment. If the borrower does not make contact and avoids meeting with the lender, it will be very difficult to prove the fact of filing demands for the return of funds and the existence of an overdue loan repayment period.

If there is no note in the debt receipt indicating the borrower’s obligation to pay a penalty if there is a delay in repaying the debt, the lender has no right to demand payment from the debtor, which is regulated by Art. 331 of the Civil Code of the Russian Federation, which states that, regardless of the form of the main debt obligation, the agreement of the parties to pay the penalty must be made only in writing.

Error 5: The promissory note was typed on a computer. This form of drawing up a document may lead to the borrower challenging the fact of signing with his own hand, and in the future, the need to conduct a handwriting examination. This error, accordingly, will entail a delay in debt collection and unnecessary financial expenses.

Error 6. There are corrections in the promissory note written in the borrower’s own handwriting. Remember that any corrections in documents relating to cash loans may subsequently negatively affect the proof of the reliability of information data, namely: the loan amount, the repayment period and the amount of interest.

As a rule, a promissory note does not have a set form of writing; the document can be drawn up either in simple written form or notarized. A correctly drawn up promissory note has full legal force and does not require certification by a notary. However, it is worth noting that in the event of disputes regarding the repayment of debt in court, a notarized document will significantly speed up the process, eliminating any claims by the borrower.

- information identifying the lender and borrower (full last name, first name, patronymic, date and place of birth, passport details, information about registration at place of residence, contact numbers);

- information indicating that a certain amount of money is transferred from the lender to the borrower as a loan; the amount of the amount must be indicated in numbers and words;

- the conditions on the basis of which the loan was issued, namely: targeted/non-targeted, repayment period, interest rate for the use of funds or interest-free loan.

More on the topic How to confirm receipt of goods on Yule

In addition to the above points, in order to reduce the risk of non-repayment of funds, it is recommended to include several important conditions in the promissory note, namely:

- Requirements for the borrower to pay a penalty in a certain amount in case of failure to repay funds on time.

- Requirements for the possibility of considering any disputes regarding the amount issued as a loan and receipts in the judicial authorities at the place of residence of the lender. This condition can have a positive effect in the event of disputes about debt repayment, if at the time of drawing up the debt receipt the borrower is registered in another city, or immediately after receiving the funds he changed his place of residence.

- Requiring the borrower to understand the legal consequences of issuing the promissory note. This condition must be written down in the borrower’s own handwriting, and in the event of a dispute, the lender has the right to refer to the fact that the borrower, when receiving funds, was fully aware of the consequences of his actions.

Despite the fact that the current legislation of the Russian Federation does not contain conditions confirming the need for witnesses when concluding a loan agreement, the presence of the latter when transferring money and receiving a promissory note is not prohibited. In cases of litigation, the presence of witnesses confirming the fact of transfer of money, as well as the conditions for their return, can play an important role.

Neighbor Lida is crying in my kitchen: my cousin borrowed 100 thousand rubles for two weeks and has not paid it back for a month, although he swore to return it on time. The amount is large for Lida: she planned to use this money to go on vacation with her daughter.

- Why didn’t you take the receipt? — I ask. “How can you take a receipt from a relative?” — Lida sincerely asks in response. - We are not strangers!

Often this is the calculation: today the debtor will lie to you that he is about to repay. He will take your money, spend it, and tomorrow he will come up with some new story. And you, they say, forgive him everything: they are not strangers.

Receipt with monthly payments

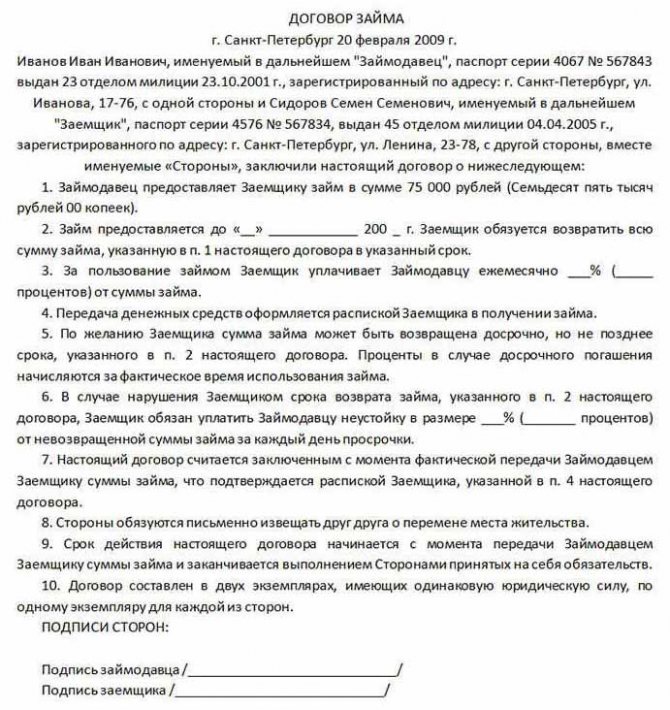

Sample loan agreement

This calculation presupposes the existence of a loan agreement, which is characterized by the following features:

- has significant legal force;

- expanded capabilities (calculation of fines, penalties);

- it is easier to prove that the debtor did not pay for a specific month.

The payment schedule is often drawn up in a promissory note, but in fact it will reflect the systematic nature of payments on certain days.

To be guaranteed to get your debt repaid, you should contact the insurance company and conclude an agreement. If the payer does not return the funds, all costs will be covered by insurance. The disadvantages of this method include financial waste.

— 54 KB

We will solve your debt problem. Free legal consultation.

Notarization

Notarization is provided in several cases:

- for situations specified in the law of the Russian Federation;

- with the agreement of both parties, although the law does not require this form of cooperation.

Only the loan agreement is subject to certification, and the receipt serves as an addition in this case. Therefore, to confirm the transaction, you will need to draw up an agreement. It should also be noted that the notary will certify the paper as an independent agreement.

Don't panic if the money has already been transferred. The receipt also serves as proof of the transaction, so if problems arise, you should go to court.

Receipt requirements

The main requirements when drawing up such a paper are:

- Indication of the place of its compilation (city or village).

- Correct document title.

- Full indication of the full names of all participants in the transaction, as well as their passport details. Abbreviations are not allowed, and the information must correspond to the passport data.

- The amount of the loan, which is written in rubles and kopecks. It is advisable to register it in digital and written form.

- Interest, if the agreement provides for it.

- If we are talking about currency, the exchange rate is prescribed at the time of transfer of funds to the borrower.

- Exact terms of money return.

- The date the debt was received in full.

At the end, the borrower's signature is required. If the paper is printed digitally, the borrower should handwrite his full name and signature at the bottom of the sheet.

Handwritten receipts have a special advantage, because if problems arise, it will be easier to prove the voluntary filling out of the document by a specific person.

Other requirements specified by agreement of the parties include:

- Specific return date (in parts or in whole). It is better to stick to the digital format to avoid confusion. If this point is not specified, the debt is expected to be repaid within 30 days from the deadline for issuing the lender’s terms;

- The interest rate indicated for the month, as well as penalties for late payments.

Purpose and types of receipts

The main purpose is to confirm in writing the fact of a loan that is given to one private person from another. Thus, a promissory note, regardless of its specific sample, serves as the main confirmation of the existing financial obligations of one citizen to another.

Lawyer's comment:

Along with this task, the receipt also performs several other functions:

- Confirmation of the fact of transfer of money directly (cash) or via bank transfer. In some cases, funds are transferred later than signing - then the receipt reflects the date and method of transfer of funds.

- Clarification of the deadline for a full refund.

- Reflection of information about the method of return - in whole or in part, in installments or with interest.

Essential conditions

It is important to note that the parties can choose any form that suits them. It is only important that it reflects all the essential conditions:

- description of legal relations (fact of loan);

- Date of preparation;

- indication of the full name and passport details of all parties (borrower and lender);

- exact indication of the amount;

- deadline for repayment of funds (if it is not specified, the lender can declare a repayment at any time, after which the payer becomes obligated to pay within 30 calendar days).

Thus, a promissory note is issued only between individuals. If we are talking about the interaction of companies, as well as the execution of an agreement between a legal entity and a private citizen, an appropriate civil agreement is drawn up (for example, a loan agreement, deposit agreement, etc.).

Types of document

There are several types of promissory notes. First of all, the subject of the receipt can be not only cash, but also other valuable objects that can also be loaned out. From this point of view, they can be divided into two groups:

- Cash.

- Property (including when jewelry and securities are transferred).

If precious items, securities and other funds are provided as a loan, then the receipt should describe in detail their essential characteristics - name, article number, details and other information.

In some cases, the creditor (aka lender) does not set out to receive interest on the debt. A person can simply borrow funds, but at the same time document this fact so that the amount (without interest) is returned in full and on time. Then we can distinguish 2 more types of documents:

- Receipt with interest.

- Interest-free IOU.

Finally, from the point of view of the return period, there is the following classification:

- Urgent document.

- Without specifying a deadline – i.e. return occurs at the request of the lender (no later than 30 days).

If there is a failure to pay a debt on a receipt, what should you do?

If the borrower misses the specified date for repayment of funds, then it is immediately clear why such a document is used. Its essence is to confirm the timely transfer of money. After all, the return of the amount provided is also formalized by a receipt. If such paper is missing, this indicates the presence of debt.

If the debt is not repaid on time, it is collected in court. For this purpose, write a corresponding statement of claim and attach the original receipt to it. If you have difficulties filing a claim, you can always seek legal help. A professional lawyer will clearly state the plaintiff’s position during the court hearing and help repay the debt.

When the court decision comes into force, debt collection will become the responsibility of bailiffs and is just a matter of time.

IOU of an individual

Required details:

- at the top there is the name “Receipt”, date of preparation and address (locality)

- date format - day as a number, month in words, year as a 4-digit number (for example, January 12, 2020)

- passport details - full name/when and by whom issued/No./series/address of residence and registration/date of birth of the lender and borrower

- amount and % in numbers and words, kopecks in numbers only

- characteristics of the property, if it appears

- loan repayment date - date with month and year

- borrower's signature

Nuances:

- The receipt is signed only by authorized persons. For example, when transferring collateral for a real estate transaction, only the owner of the apartment, and not his relatives

- If there is interest, you must enter the total amount

- It is necessary to indicate the consequences of non-payment of debt

- At the end of the document, the borrower must write in his own hand “Received the amount personally”

- The reason for the obligation must be indicated, which contains the phrase “On account” and is written on a separate line

For example, money in the amount of XX was transferred to pay:

- percent

- for repair work (apartment address)

- principal amount under the contract (name of the contract)

Recommended, but not required:

- Attract witnesses who, if necessary, agree to speak in court and confirm that the borrower was not under pressure. In this case, the passport details of the witnesses are entered in the receipt.

- Enter the telephone numbers of the parties

- When transferring significant amounts, additionally draw up a loan agreement

The original receipt remains with the lender. A copy that does not have legal force is transferred to the borrower. If the latter needs the original, the document is drawn up not as a carbon copy, but in two copies. When a receipt accompanies a loan agreement, this fact is indicated in the text.

What is the receipt used for?

This document serves as confirmation of the receipt of something - not just money. Usually the paper is drawn up in printed or handwritten form, where it is detailed who issued what and to whom. This is a one-sided document, signed by one person who received the item from another. After this, it is transferred for safekeeping to the person who lent it.

Most often, such papers are compiled as a confirming element of receipt of funds:

- under a completed purchase/sale agreement;

- sale of real estate;

- lease agreement, contract or provision of legal assistance;

- for alimony;

- payment of material damage;

- rental agreement for an apartment or house.

In all of the above cases, the receipt confirms the existence of relevant agreements and obliges the borrower to return a specific amount of money to the person who provided it.

Errors when preparing paper

Most often, errors in the preparation of any document arise due to inattention. To eliminate this possibility, it is necessary to double-check what is written. There are frequent mistakes in content, which include:

- Lack of date of writing the paper, debt repayment period and addresses of the parties.

- No witnesses were brought. Such an oversight leads to difficulties in the process of debt collection in court.

- Use of foreign currency. According to the current law, cash payments can only be issued in Russian rubles. If dollars or euros are considered, transfer through a bank account is possible. To borrow money to borrow money in foreign currency, you must indicate the ruble equivalent.

These problematic issues can be avoided if you promptly contact a competent lawyer for advice.