If there is a risk of bankruptcy in the activities of an enterprise, this may primarily be due to financial and legal issues that may lead to the exclusion of the enterprise from the Unified State Register of Legal Entities.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

To avoid bankruptcy you must:

- first understand the methods of preventing the insolvency of a legal entity;

- maintain reporting documentation correctly.

This suggests that the risk of bankruptcy implies, first of all, a crisis in the activity of the enterprise, a way out of which is possible only with the help of special financial management methods.

What is this?

Risk should be understood as the occurrence of negative circumstances for the enterprise, as a result of which the legal entity is unable to fulfill its obligations to the creditor.

This means that the consequence of bankruptcy is a difficult financial condition, which is expressed in the insolvency of such a person.

Signs

The Federal Law “On Insolvency” enshrines the signs of bankruptcy, which are as follows (Article 3 of Federal Law No. 127):

- inability to satisfy the creditor's demands;

- inability to make mandatory payments;

- impossibility of fulfilling the obligations imposed on a legal entity within three months from the moment when they actually must be fulfilled;

- growth of accounts receivable;

- no sales.

Causes

The reasons that lead to the risk of becoming bankrupt are as follows:

- unprofitable activities of the enterprise;

- increase in loan debts;

- use of loans to pay off debt obligations to creditors;

- low liquidity;

- lack of leadership;

- previously concluded agreements have become ineffective;

- stock prices plummet.

The legislative framework

The main legislative act is the Federal Law “On Insolvency” No. 127.

There are regulations that regulate the activities of certain business entities, namely:

- Federal Law “On Limited Liability Companies”;

- Federal Law “On Joint Stock Companies”.

Registration of the activities of a legal entity is carried out on the basis of a special law, namely “On State Registration of Legal Entities and Individual Entrepreneurs”.

Risks in the field of finance

Concept

Financial risk is the probability of losses or incomplete receipt of income relative to the predicted amount. According to another definition, financial risk is any event as a result of which the financial results of the project will be lower than expected.

The extreme degree of manifestation (realization) of financial risk is the initiation of bankruptcy proceedings for an organization - a situation in which a legal entity is not able to repay debts and transfer the necessary payments to the budget and extra-budgetary funds. In this regard, the concepts of “bankruptcy risk” and “financial risk” are often identified.

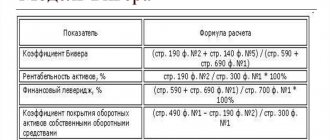

The assessment of bankruptcy risk is carried out on the basis of calculating a number of financial indicators of bankruptcy, comparing the obtained values with standard values and analyzing their dynamics.

There are many methods and models for predicting it: Altman, Taffer, Beaver, Belikov-Davydova (Irkutsk model), Kazan University. Read more about the use of enterprise bankruptcy forecasting models here. In the end, it all comes down to determining the ratio of the amount of debt and the income of the enterprise, from which the specified debt can be repaid.

Often the concepts of “bankruptcy risk” and “financial risk” are identified.

Reasons for bankruptcy of an enterprise

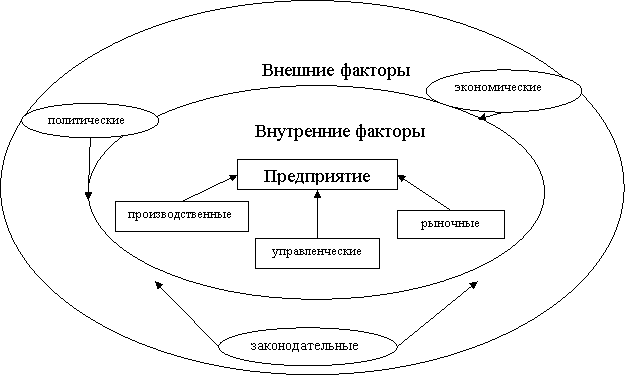

The risk of bankruptcy can be caused by both external reasons, which the enterprise cannot influence with the proper effect, and internal ones.

The first includes:

- political or economic instability;

- changes in legislation (economic, tax, financial, regulating the industry of the company);

- exchange rate fluctuations;

- behavior of counterparties;

- income of the population (consumers);

- industry risks;

- level of competition;

- lack of administrative resources and social importance of the company (for example, for a city-forming enterprise, support measures will most likely be developed and adopted by authorities and local self-government), etc.

Among the internal (related to the economic activities of the enterprise itself) causes of bankruptcy are all factors that reduce income or increase costs:

- Ineffective management , including poor financial management; the tendency of the company's management to make risky decisions in the hope of high income compared to other projects; unsuccessful pricing or overall marketing policy, etc.

- Low quality products , lack of demand for manufactured goods.

- Unsuccessful organization of production , including the distribution of production of individual goods (or product elements) among enterprise branches located over long distances; logistics; organization of supply and sales of products; cooperation and specialization; energy supply systems; organization of repairs; quality control, novelty of the technologies used, etc.);

- Lack of labor organization and clear personnel policy : including such components as work shifts; organization of workplaces; sanitary and hygienic conditions, minimizing hazards; discipline; rationing; placement and effective use of personnel; system of training specialists and attracting professionals; labor incentives and others.

Bankruptcy risks

Bankruptcy risks, in turn, are divided into several types:

- industry;

- financial;

- taking place at the macroeconomic level.

Financial

Financial risks include, first of all, risks associated with the inability to timely pay obligations to creditors, as well as the risk of lost profits.

Other

Industry risks should be understood as an increase or sharp drop in market prices for heat and water supply, as well as electricity prices.

Negative consequences include the lack of demand for manufactured products.

If we talk about macroeconomic risks, they are related:

- with an imperfect taxation system;

- with a lack of guarantees from the state.

Do not forget about periodic increases in loan rates, inflation and the unstable situation regarding exchange rates.

Enterprises

The risks of an enterprise may be associated with economic losses that arise in the process of carrying out economic activities, namely in the production of certain services or products.

Risk reduction

When choosing a specific risk minimization method, it is recommended to consider the following rules:

- always predict the amount of losses (consequences of risk);

- don’t risk a lot for a little;

- do not take more risks than your own capital “allows”.

You always need to determine the maximum possible losses for a specific risk factor (type), compare them with the volume of invested funds, and then with the volume of your own funds. After this, you can understand whether the risk will lead to bankruptcy.

Simple ways to reduce risks

This is the minimization of risks “with the organization’s own resources” without attracting third-party financial assistance or reorganizing the enterprise. These include the following:

- Avoidance of risk – refusal of operations and projects for which the risk is high; refusal of expensive borrowed capital.

- Diversification . It represents the distribution of financial investments between different assets or projects that are not related to each other. Thus, if a negative result is obtained in one area of investment, it can be compensated by the profit on another project or asset. This will increase the financial stability of the enterprise.

- Limitation is the establishment of all kinds of limits (limits), exceeding which should be avoided, for example, on financial expenses, the level of receivables, the size of loans or their ratio to assets, the size of investments in one project, etc.

- Creating reserves to cover unplanned (unforeseen) expenses . This method is usually used when implementing a new project in order to finance sudden additional work, compensate for unplanned changes in costs, etc. In addition, reserves of raw materials and products in the warehouse can be created.

- Obtaining more information about the upcoming project (operation) and possible results . Since risks arise in conditions of uncertainty, the surest way to make a high-quality forecast is to collect as much information as possible.

- Financial methods - reducing unproductive expenses; abandonment of unprofitable projects and production; sale of part of unused property to reduce debt and others.

Complex ways

- Insurance is the transfer of “financial responsibility” in the event of a risk to the insurance company. In this case, the principle “it is better to sacrifice a little so as not to lose a lot” applies. You can insure property, liability, loss of funds.

- Hedging is insurance of the price of a product against a fall that is unnecessary for its manufacturer or against an increase that is undesirable for the consumer. It is carried out by concluding contracts for future purchases at a fixed favorable price. Widely used in stock trading.

- Risk distribution is its division between several project participants, including those involved in its management.

- Obtaining control over related industries or a company operating in related activities.

- Enterprise restructuring (merger, division, accession, spin-off, transformation). Separation (sale) of non-production units, for example, transfer of social sphere objects to federal, regional or municipal ownership.

- Rehabilitation is financial assistance received from the founders of a legal entity, its creditors or other persons associated with the enterprise.

Thus, financial risks, and especially the risks of bankruptcy, can be predicted, minimized or prevented. There are many ways to do this, depending on the situation. The key to success in this case can be professional assistance from lawyers and financial advisors.

Success and no major financial losses!

How to reduce?

It is impossible to reduce the risk; the main thing is to begin health measures at the enterprise on time, i.e. immediately after identifying the first signs of bankruptcy.

To do this, you will need to assess the financial capabilities of the enterprise, using the most common methods of protection against insolvency risks:

- insure activities;

- redistribute risks;

- apply financial liability to the enterprise;

- use of security;

- creation of a reserve fund.

The bankruptcy procedure of an OJSC is carried out in accordance with the requirements of Federal legislation. What is a settlement agreement in bankruptcy proceedings? Details in this article.

Financial risk: essence and their classification

Financial risks arise in connection with the movement of financial flows and manifest themselves mainly in financial risk markets. These risks are characterized by great diversity, and in order to effectively manage them, it is advisable to classify them according to various criteria.

If insurance is possible, financial risks are divided into two large groups in accordance with the possibility of insurance : insurable and uninsurable.

An insurable risk is a probable event or set of events against which insurance is provided. The insurer is obliged to compensate for loss of income in full or in part upon the occurrence of the following events: - stoppage of production and reduction in production volume as a result of specified events; — bankruptcy; - Unexpected expenses; — failure to fulfill contractual obligations by the counterparty of the insured person, who is the creditor of the transaction; — legal expenses incurred by the insured person; - other events.

The task of the enterprise is to take prudent risks, without crossing the line beyond which bankruptcy is possible.

The next sign of risk is based on the level of financial losses : acceptable risk, critical risk, catastrophic risk. Acceptable risk is the threat of complete or partial loss of profit from the implementation of a particular financial project. In this case, losses are possible, but their size is less than the expected profit. Critical risk is associated with the danger of losses in the amount of costs incurred to carry out a specific financial transaction. Catastrophic risk is characterized by the fact that financial losses are determined by the partial or complete loss of the property status of the enterprise. This risk leads the company to bankruptcy.

According to the area of occurrence, financial risks should be divided into external and internal. The source of external risks is the external environment in relation to the enterprise, i.e. This is a risk that does not depend on the activities of the enterprise. An enterprise cannot influence external financial risks; it can only anticipate and take them into account in its activities.

Internal risks are risks that depend on the activities of a particular enterprise, i.e. their source is the enterprise itself. These risks may be caused by: - unqualified financial management at the enterprise; — inefficient structure of the enterprise’s assets; — incorrect assessment of business partners; — excessive commitment of the enterprise management to risky financial transactions; — unstable financial position of the enterprise and other similar factors.

If foreseeable, financial risks are divided into the following groups: predictable and unpredictable. Predicted financial risks are risks the occurrence of which is a consequence of the cyclical development of the economy, changing stages of financial market conditions, predictable development of competition, etc.

by time into permanent risk and temporary risk. Constant financial risk is characteristic for the entire period of a financial transaction or financial activity and is associated with the action of constant factors. Temporary financial risk is temporary in nature; an enterprise encounters this type of risk only at certain stages of a financial transaction. These risks consist of two groups: short-term and long-term risks. The first risks arise from credit and investment risks, and long-term risks arise from inflation risks.

According to possible consequences, financial risks are divided into three groups: - risk, as a result of which the enterprise does not receive a certain amount of income; — a risk as a result of which the enterprise incurs economic losses; - a risk as a result of which an enterprise can count on both receiving additional income and incurring losses.

Based on the object of risk occurrence , three groups of financial risks can also be distinguished, these are: - risks of an individual financial transaction, which collectively characterize all the financial risks that an enterprise may encounter when carrying out any financial transaction; — risks of various types of financial activities that may arise during the implementation of any type of financial activity; — the risks of the financial activity of an enterprise as a whole include a complex of various financial risks that may arise when the enterprise carries out financial activities.

If possible, further classification distinguishes between simple and complex financial risks.

Complex financial risks are risks that include a complex of its various subtypes. This includes investment risk.

Inflation risk is a type of financial risk that consists in the possibility of depreciation of the real value of capital, as well as the expected income and profit of an enterprise from financial transactions or operations due to rising inflation. This type of risk is permanent and accompanies all financial transactions of an enterprise in an inflationary economy.

Tax risk should be understood as the probability of losses that an enterprise may incur as a result of opportunistic changes in tax legislation or as a result of errors made by the enterprise when calculating tax payments.

Credit risk is the likelihood that partners participating in a contract will be unable to fulfill contractual obligations, both in general and for individual positions.

There are trade credit risk and bank credit risk. For the supplier of goods, this risk lies in the client’s ability to pay for them in accordance with contractual obligations.

The level of credit risk increases with the amount of the loan and the period for which it is taken out. It may be caused by the following reasons: - industry decline; demand for products produced by the enterprise; — failure to fulfill contractual relations by the partners of the enterprise; — transformation of enterprise assets; — force majeure circumstances.

Deposit risk is the probability of losses as a result of non-repayment of an enterprise's deposits with banks. This risk arises rarely and, as a rule, is due to an incorrect assessment and unsuccessful choice of a bank for carrying out deposit operations of the enterprise. It should be noted that this risk is universal. It is inherent in the conditions of a market economy.

Currency risk is the risk of losses as a result of unfavorable short-term or long-term exchange rate fluctuations in international financial markets. Currency risks are divided into the following risks: — translation risk; — operational risk or transaction risk; — economic risk, which in turn is divided into direct risk and indirect risk.

Translational currency risk arises when the accounts of foreign subsidiaries are consolidated with the financial statements of the parent companies. Operational currency risk arises in the course of a business transaction, the specifics of which determine the payment or receipt of funds in foreign currency not at the time of the transaction, but after some time. Economic currency risk is the likelihood of a reduction in revenue or the possibility of making a profit due to changes in exchange rates. This risk is long-term in nature and is associated with the fact that the company makes expenses in one currency and receives income in another. As a result, any changes in exchange rates may affect the financial position of the enterprise.

Investment risk is the probability of financial losses occurring in the process of carrying out the investment activities of an enterprise. There are two types of this risk: financial investment risk and real investment risk. This type is classified according to the level of assessment, causes of occurrence, and type of loss.

The next type of financial risk is interest rate risk. This type of risk arises due to unforeseen changes in interest rates in the financial market. This risk causes interest costs or investment returns to change and therefore changes the rate of return on equity and on investment capital relative to expected rates of return.

The cause of interest rate risk is changes in financial market conditions under the influence of the external business environment, growth or decline in the supply of free monetary resources, government regulation of the economy and other factors.

Banks and investment companies primarily face interest rate risk, but this financial risk corresponds to enterprises that use bank loans to finance their activities, as well as invest temporarily free funds in assets that generate interest income.

Enterprises carry out a significant amount of loans and capital investments on floating interest rate terms. In this case, the interest payable or receivable during the term of the contract is periodically reviewed and adjusted to the current market rate.

Business risk is one of the types of financial risks that are primarily characteristic of joint-stock companies. It is the impossibility of a joint stock company to maintain the level of earnings per share at a non-decreasing level. Business risk arises, as a rule, in cases where the economic activity of an enterprise is, for certain reasons, less successful than what was planned.

How to predict?

It is possible to predict the insolvency of an enterprise using several scientific approaches:

- the first is based on the study of financial data, the calculation of which is carried out on the basis of economic ratios, as well as the ability to read the “balance sheet” of the enterprise;

- the second forecasting approach is based on comparing a certain company with bankrupt companies; this approach makes it possible to study errors based on a comparison of data from the enterprise under study.

Comparing these approaches, the first one is more effective, but has several disadvantages:

- a company that is in financial difficulties typically fails to provide reports on time, resulting in some data being unavailable;

- if the report contains far from the results that need to be provided, they are most often simply “painted on”.

Diagnostics

To avoid the threat of bankruptcy, it is necessary to assign diagnostics to the company, i.e. evaluate activities.

By correctly assessing the risks that affect the financial viability of the company, you can find the most suitable way to bring the company out of bankruptcy.

The main reasons for the insolvency of companies are external and internal factors.

External factors are influenced by the unstable economic and political situation in the state.

Internal factors are influenced by the development and direction of the company itself, namely:

- insufficient management qualifications;

- lack of sufficient capital for development;

- irrational use of income;

- lack of development in the enterprise.

In order to avoid bankruptcy, it is necessary to periodically analyze both the products produced and the income of the enterprise, and assess the circumstances that may lead to insolvency.

As a rule, it is internal factors that influence the negative consequences of a company.

It must be remembered that the analysis of circumstances must end with an assessment of the impact of such circumstances on the company’s activities.

Grade

There are several schools of thought regarding the conduct of an insolvency risk assessment.

Thus, one point of view is that when conducting an assessment, it is necessary to use as a basis factors that can directly affect the further development of the company, arranging them in a certain hierarchy.

Based on such an assessment, it will be possible to develop a “recovery” plan for all factors.

Using a comprehensive analysis of financial viability, it is necessary to use the company’s financial indicators also in a hierarchical order, i.e. assign criteria and indicators, working them out in order of importance for risk assessment.

The risk of bankruptcy as a threat to the economic security of an enterprise

Bibliographic description:

Dmitrieva, I.V. The risk of bankruptcy as a threat to the economic security of an enterprise / I.V. Dmitrieva, A.R. Ivanova. — Text: direct // Current issues of economics and management: materials of the V International. scientific conf. (Moscow, June 2020). — Moscow: Buki-Vedi, 2020. — pp. 114-117. — URL: https://moluch.ru/conf/econ/archive/222/12608/ (access date: 09.09.2020).

In modern conditions, the problem of economic security is relevant, since enterprises operate under conditions of various external and internal risks, and the competitive economic environment hides numerous threats. One of these risks is the risk of bankruptcy of an enterprise, since in a market economy an integral part is the phenomenon of bankruptcy of enterprises that are unable to compete in the market, this makes it important to understand the essence of bankruptcy and develop actions to improve the financial condition of the enterprise.

The threat of bankruptcy has recently become real for many enterprises, for example, according to the Unified Federal Register of Bankruptcy Information for the period 2009–2016, the growth of enterprises declared bankrupt remains at a fairly high level (Fig. 1)

Rice. 1. Number of enterprises declared bankrupt for the period 2009–2016.

World practice shows that bankruptcy is an inevitable phenomenon of any modern market, which uses insolvency as a market instrument for the redistribution of capital and reflects the objective processes of structural restructuring of the economy.

However, any risk, and bankruptcy is undoubtedly a risk for the economic security of an enterprise, can be predetermined and efforts can be made to minimize the consequences of its occurrence.

So, what is corporate bankruptcy? And how does it affect the economic security of the enterprise? It is these two questions that were considered by the author.

As an analysis of scientific literature has shown [1...], bankruptcy is a company’s refusal to pay its obligations; from a legal point of view, bankruptcy is the recognition by an arbitration court of the absolute insolvency of the debtor and the inability, in connection with this, to carry out its economic activities aimed at repaying debts.

According to the author, bankruptcy is a crisis situation, and all the attention of the enterprise’s economic security system should be focused on solving or finding a so-called “exit” from it.

To determine the presence of signs of bankruptcy of the debtor, the following are taken into account:

- amount of debt for transferred goods;

- completed work;

- services provided;

- the loan amount, taking into account interest payable by the debtor;

‒ the amount of debt arising as a result of unjust enrichment;

‒ the amount of debt arising as a result of damage to the property of creditors (with the exception of obligations to citizens to whom the debtor is liable for causing harm to life or health);

‒ obligations to pay severance pay and wages to persons working under an employment contract;

‒ obligations to pay remuneration under copyright agreements;

- obligations to the founders (participants) of the debtor arising from such participation [2].

An important component in the system of economic security of an enterprise should be diagnosing the state of the enterprise, identifying strengths and weaknesses, as well as timely overcoming and preventing crisis situations.

Bankruptcy diagnostics is a set of measures to identify the parameters of the crisis development of an enterprise and the possibility of its bankruptcy in the future.

Undoubtedly, the activity of an enterprise should be considered as an interaction of external and internal factors.

Factors influencing the occurrence of a crisis in an enterprise are shown in Figure 2.

Rice. 2. Factors influencing the occurrence of a crisis in an enterprise.

Protection against the impact of internal and external threats is the enterprise’s economic security system, which is a set of measures that ensure the economic security of the organization.

Economic security is the state of an enterprise in which it can function normally to achieve its strategic goals, under existing external conditions and their changes within certain limits [4].

The result of ensuring the economic security of an enterprise is the stability (sustainability) of its functioning, the efficiency of financial and economic activities (profitability), and the personal safety of personnel.

Thus, during the period when the enterprise is in the “risk zone,” the economic security policy should become aggressive. Due to the fact that in order to overcome a crisis situation, the enterprise must apply strategic measures, which are presented in table 1.

Table 1

Methods to reduce the risk of bankruptcy.

| Methods | Implementation methods |

| Elimination of insolvency | Resolving insolvency through the sale of liquid assets; savings on semi-variable costs; |

| Restoring financial stability | Improving business processes aimed at increasing efficiency. Increasing the competitiveness of goods and services. Changes in marketing policy; |

| Ensuring financial balance | Carrying out local activities to improve financial condition. Reorganization of the enterprise. Providing state and municipal guarantees for fulfilling obligations to creditors, provided they reduce their debt burden; |

| Diversification | Allows the company to carry out an even distribution of capital among various types of economic regulation, which will allow areas with profitable investments to compensate for unprofitable aspects of the enterprise's economy. |

| Rescheduling of production | In cases where the goods or services of an enterprise are not competitive in the market, the enterprise needs to produce new products; this will only be possible if the enterprise is provided with multifunctional equipment; |

| Sale of part of illiquid property | Will allow the company to receive additional profit to cover current obligations. |

To implement all these methods, it is necessary to ensure a state of the enterprise in which the risk of exposure to other threats is minimized, and this can only be achieved with an effective system of economic security of the enterprise.

Literature:

- Bogomolov, V. A. Introduction to the specialty “Economic Security”. Tutorial. UMC stamp “Professional textbook”. Grif of the Scientific Research Institute of Education and Science / V. A. Bogomolov. - M.: UNITY, 2012. - 279 p.

- Baykina S.G.: Accounting and analysis of bankruptcies. - M.: Dashkov and K, 2011

- Belyaeva O. Bankruptcy in a new way // EZh-Lawyer, 2010, No. 7

- Federal Law of October 26, 2002 No. 127-FZ (as amended on December 29, 2014) “On Insolvency (Bankruptcy)”

- Adamova V.B., Markov P.A., Spakhova N.M. Problematic issues in the practice of applying bankruptcy legislation // Bulletin of the Moscow Arbitration Court, 2008, No. 4.

Key terms

(automatically generated)

: economic security of the enterprise, bankruptcy, enterprise, amount of debt, economic security, occurrence of a crisis, crisis situation, obligation, state of the enterprise, elimination of insolvency.

Consequences

If management ignores and does not pay attention to emerging signs of bankruptcy, the consequence of such passive behavior may be the insolvency of the company.

The result of such actions may be:

- opening of bankruptcy proceedings;

- financial recovery;

- appointment of bankruptcy proceedings;

- fulfillment of obligations to creditors;

- appointment of a bankruptcy trustee;

- on the basis of a report provided to the court on the results of satisfying the claims of creditors, bankruptcy proceedings may be terminated;

- liquidation of a legal entity.

There are certain consequences of bankruptcy of a legal entity. How to file for bankruptcy as an individual. faces? See here.

What documents are required to file bankruptcy for an individual? Full list here.

Thus, companies in whose activities the first signs of bankruptcy have been identified must conduct an assessment of the enterprise’s activities and develop a set of measures to eliminate them.

Otherwise, there will be negative consequences in the form of termination of the enterprise’s activities and declaring it bankrupt.

Using the above tips, you can avoid all possible risks of bankruptcy and improve the economic activity of a legal entity.

The scale of bankruptcy risk, assessment of financial and other crises

In order to identify the degree of threat to the enterprise, it is necessary to conduct an assessment of production and economic activities. The most common and dangerous for companies and enterprises are industry, financial, regional, and macroeconomic risks. Industry sectors are closely related to the raw materials market. They may imply reduced or increased prices for raw materials and components. The cost of heat, water, and electricity has a significant impact. Bankruptcy risks can also be financial - associated with the purchase or sale of manufactured products. Regional financial risk is caused by the infrequent use of productive resources. The financial underdevelopment of the economy and infrastructure has a significant impact. All these factors can significantly affect the economy of the enterprise; it is important to give them the correct characteristics and assessment in order to avoid bankruptcy and use suitable methods.

Macroeconomic financial risk can be caused by the underdevelopment of inter-trade relations, the absence of any government guarantees, and inactive participation in the national economy. Increases in interest rates in banks, inflation, and exchange rate instability have a significant impact on risk. In order to prevent risk, it is necessary to carefully analyze and evaluate all industries that contribute to its occurrence. It is important to diagnose the enterprise and identify at what stage of bankruptcy it is.

Factors that should be assessed and identified as bankruptcy are divided into 2 main types: external and internal. External types of risk do not depend on the head of the enterprise or on the organization as a whole, while internal types directly depend on the activities of the organization. External risk factors depend on the overall economic development of the country; circumstances that have a negative impact on overall economic activity are taken into account. As a result, there may be a risk of bankruptcy. Market factors are taken into account, the assessment of which is essential. In this case, an analysis of commodity and financial relations takes place, and an immediate assessment of the circumstances that contribute to the emergence of risk associated with bankruptcy is carried out. Effective methods should be used to prevent a crisis.

Internal factors often become the cause of enterprise bankruptcy. Among them are those related to production, financial activities and the development of investment relations. After all bankruptcy risk factors have been analyzed, it is necessary to assess their impact on the crisis state of the enterprise. The crisis of an enterprise may be influenced by one of the above risk factors or several. It is important to identify the degree of influence of each factor on the crisis state, determine the state of the enterprise and give a detailed assessment of the current circumstances.

The risk of insolvency is that the company will not be able to fulfill its obligations to counterparties due to a lack of cash or other highly liquid assets. The main factors influencing the risk of insolvency are the company's ability to attract, if necessary, borrowed funds and independently generate cash flow by selling its own assets.

A company can limit the risk of insolvency by maintaining the required amount of liquid assets, but their excess leads to a loss of profit. Insolvency risk is affected by the speed with which a company can convert liquid assets into cash. There are three sources of insolvency risk: systemic, individual and technical.

Systemic risk arises when the required amount of funds is not available in the settlement systems or the funds are not transferred to their destination within the specified time frame. Such a risk may also arise as a result of erroneous actions of regulatory authorities. Individual market participants are not able to influence this insolvency risk factor, and systemic risk should be perceived as inevitable.

The individual risk consists of a possible change in the opinion of market participants about the solvency of the company and a corresponding revision of the relationship with it. The reason can be both objective and subjective factors. To avoid this type of liquidity risk, companies can be advised to monitor their reputation in the market and pay attention to corporate culture in order to prevent the possibility of unwanted leakage of information about the state of the company.

Technical risk consists of an unbalanced structure of future payments and is the most serious component of insolvency risk. There are two components in it: 1) imbalance of expected income and expenses and 2) high uncertainty in the size of future payments.

The first component can be easily minimized. The uncertainty of future payments requires maintaining a reserve of liquid funds. As a rule, a company uses borrowed funds or liquid assets that can be quickly converted into cash as such funds.

In crisis situations, both of these sources may not be available in the required volume. To reduce this type of risk, a historical analysis of the company’s payment structure should be carried out to plan the volume of liquid funds.

To manage the technical component of liquidity risk, the following algorithm is recommended: 1) analyze known future payments; 2) make a forecast of the occurrence of possible future obligations; 3) allocate deterministic and stochastic parts for each expected payment; 4) estimate, using probabilistic methods, the expected value of stochastic payments and their possible spread; 5) draw up the dependence of the required volume of liquid funds on time and estimate the maximum and minimum value of this volume; 6) assess the company’s ability to raise funds and, if necessary, revise the structure of future payments.

Popular articles:

Risks of client insolvency

These risks are associated with the client's disability and unemployability and must be borne by him. However, banks, trying to avoid situations in which they will have to use the procedure for selling collateral, require the client to insure his life and ability to work in favor of the bank for the amount of the loan received.

The major risks of death and disability can be covered through standard accident insurance policies. But banks should pay attention to a number of standard exclusions from coverage under such a policy. Typically, compensation is not paid in cases where death or disability occurred during any type of intoxication, sports, as a result of suicide or intent on the part of the victim, as well as due to a number of chronic diseases.

A significant portion of the normal exclusions will be waived if the bank rather than the customer becomes the insured.

Failure to fulfill obligations by participants in the mortgage lending process

This risk can be significantly reduced if participants have insurance that protects against the main hazards associated with their activities:

v client – a policy of voluntary medical insurance, liability insurance (automotive and to co-owners of the house) and property insurance;

v client's guarantor – insurance policies for property (especially real estate), business interruption and civil liability;

v bank – insurance policy “against all banking risks”;

v realtor – realtor liability insurance policy;

v insurance company – liability reinsurance contracts.

It should be noted that in our country the importance of having an insurance policy is clearly underestimated even by banks that are professionally closest to insurance. A Western bank will not talk about loans with either a large company or an individual without first making sure that they have insurance policies for their main interests. Moreover, having a policy has a deeper meaning than simply guaranteeing the client’s solvency. The policy testifies, firstly, to the availability of property, professionally assessed by the insurance company, and secondly, to the seriousness and thoroughness of the insured himself.

To summarize, we can draw the following conclusions.

1. An insurance company participating in the mortgage lending process may assume the main risks of a natural and man-made nature, as well as the risk of physical damage caused by illegal actions or negligence.

2. To avoid an unreasonable narrowing of insurance coverage, it is advisable for the bank to conclude insurance contracts directly for the collateral and the client’s ability to work. This allows you to reduce the costs of the insurance company, which in this case receives the data necessary for insurance in a primarily processed form. Accordingly, the cost of insurance is reduced. It is also obvious that it is convenient for the client, who can perform all actions related to obtaining a loan in one place.

3. To reduce the risk of non-fulfillment of obligations by participants in the mortgage lending process, it is advisable for the bank to include in the general requirements it imposes on clients, guarantors, etc., the requirement to submit insurance policies for the main risks.

Currently, the St. Petersburg branch of the gas industry insurance company SOGAZ has developed a package of documents that take into account the features of mortgage lending risks considered in the thesis; however, the accepted documents need to be finalized, since the approach proposed in the diploma can significantly reduce the risks of those participating in the mortgage bank lending and reduce the cost of the loan.

Insurance as a tool for reducing risks in mortgage lending

Credit organizations providing loans to the population for the purchase of housing under a long-term mortgage program must necessarily use a special insurance program as one of the types of collateral. Its required elements are listed below.

1. Property interests related to the life, health, and ability to work of the borrower - personal insurance.

Personal insurance must include life and disability insurance for the borrower. Insured events must be the following events that occurred during the validity period of the insurance contract both on the territory of the Russian Federation and abroad:

v death of the insured due to any cause;

v partial or complete loss of ability to work by the insured (assigning him the status of a disabled person) as a result of an accident. At the same time, the date of formal completion of the procedure for assigning disability status to a citizen should not affect the classification of the specified case as an insurance case.

The amount of insurance compensation should not depend on the disability group assigned to the insured person.

2. Property interests associated with the ownership, use and disposal of property - property insurance.

The first object of property insurance should be housing provided with a mortgage as collateral for a loan. The second object of insurance is the owner’s ownership of such housing. The insurance contract must cover the risk of loss by the owner of the title to the property for any reason, with the exception of its alienation by the owner with the consent of the mortgagee and alienation as a result of foreclosure on the subject of insurance by a mortgage lender. The insured event for this type of insurance must be a court decision that has entered into legal force, as a result of which the borrower lost ownership rights to the mortgaged item (including what happened after the end of the insurance period, if the lawsuit was filed during the validity period of the insurance contract).

Insurance is carried out at the expense of the borrower. The insured under insurance contracts must be the borrower. The first beneficiary under insurance contracts must be the credit institution that provided the mortgage loan for the purchase of an apartment. In the event of an assignment of claims under a loan agreement on the secondary mortgage market, the rights of the first beneficiary must transfer to the new lender.

Recently, both at the federal and regional levels, various programs have been developed using the mortgage mechanism as security for the fulfillment of obligations. In particular, by Decree of the Moscow Government No. 625 dated August 11, 1998. The Concept for the Development of Mortgage Lending in Moscow was adopted, which, in particular, defined the insurance program implemented for mortgage lending. The components of this program are:

v property insurance as the main element of the insurance program. Insurance of the collateral (housing owned by an individual - the borrower) is a mandatory condition that ensures the interests of the pledge holder - the lender. The insurance contract is concluded with the borrower at his expense;

v insurance of civil liability of participants in the housing mortgage lending market. As an example of such insurance, we can consider liability insurance of appraisal organizations, carried out in accordance with Moscow Law No. 3 of February 11, 1998. “On valuation activities in the city of Moscow”;

v life and disability insurance for individuals – borrowers. It is carried out within the framework of voluntary accident insurance, when this is provided for as one of the internal lending conditions operating in creditor banks. Insurance is carried out in favor of the creditor bank;

v credit risk insurance. Carried out as part of voluntary insurance of business risk of financial institutions (for example, creditor banks) participating in the Moscow mortgage program. The creditor bank insures in its favor the risk of losses due to violation by an individual borrower of its obligations under the loan agreement.

The amount of insurance compensation is determined in accordance with the requirements of the loan agreement and for each specific date of the loan period must be no less than the balance of the borrower's obligations under the secured obligation. It is necessary to develop a special mortgage insurance program, in which there will be a gradual reduction in the amount of insurance compensation (with the borrower fulfilling obligations to partially repay the mortgage loan), but the so-called "underinsurance". Insurance compensation must be received

to a special account of the first beneficiary.

The validity period of insurance contracts must be no less than the loan term or be concluded for a period of at least 12 months with subsequent renewal of the contracts.

The lender must monitor the borrower's fulfillment of obligations to pay insurance premiums under insurance contracts that serve as collateral for the mortgage loan. It is recommended to pay insurance premiums periodically (quarterly, monthly) in equal installments during the term of the insurance contract simultaneously with partial fulfillment of obligations under the mortgage loan itself.

Thus, the set of documents regulating the relationship between the parties during insurance in the mortgage lending process should include:

v contract of life insurance and disability of the borrower, concluded between the borrower (insured person) and the insurance organization - personal insurance contract;

v insurance contract for the risk of loss and damage to the apartment - the subject of collateral, concluded between the borrower and the insurance organization - property insurance contract;

v contract of insurance of the property rights of the owner of the apartment - the subject of collateral, concluded between the borrower and the insurance organization - property insurance contract.

In Russia, property insurance is carried out on a contractual basis. It follows from this that the insured amount is determined and stipulated by the insurance contract. Law No. 4015-1 of November 27, 1992 “On the organization of insurance business in the Russian Federation” established that the amount of the insured amount cannot exceed the actual value of the property at the time of conclusion of the contract (Article 10). This value, fixed in the contract, is called the insured value of the property. If the insured amount determined by the insurance contract exceeds the insured value of the property, the contract is considered invalid to the extent of the insured amount that exceeds the actual value of the property at the time of concluding the contract.

Based on this norm, insurance companies, as a rule, establish payments based on the principle of a proportional (share) insurance system. In other words, when the insured amount is lower than the insured value of the insured property, the amount of insurance compensation is reduced in proportion to the ratio of the insured amount to the insured value of the property. Then the amount of insurance compensation (IC) will be calculated as follows:

, Where

FU – amount of actual loss; S – sum insured under the contract;

VA is the actual value of the property.

In this case, an important role is played by determining the amount of the insurance premium paid by the policyholder. In long-term property insurance (in the case of property insurance as collateral for mortgage lending), the following formula is usually used to calculate the amount of the insurance premium (SV):

, Where

T – tariff rate in percent; n – insurance period in months.

Let's look at an example. The policyholder wishes to insure property, the cost of which is 100 USD. e., and the insured amount under the contract is 90 USD. e. It is necessary to calculate the insurance premium for an insurance period of 5 years, a rate of 5% and determine the amount of payment in the event of damage in the amount of 50 USD. e.

SV = 90 * 5 / 100 *5 = 0.225 cu. e.

CB = 50 * 90 / 100 = 45 cu. e.

Thus, the insurance premium will be 0.225 USD. e., and the amount of compensation is 45 USD. e. Based on the calculations and the above arguments, we can conclude that determining the real value of the property pledged as collateral is one of the most important tasks of both the lender and the borrower. In this regard, we will consider some aspects of assessing the market value of mortgaged objects.