Appeal against a court decision on a loan

› Recently, the consideration of litigation on financial issues of debtors is one of the most common categories of civil cases. Today we invite you to talk about how you can challenge a court decision, there is a special procedure for this, and what a sample for a corresponding application looks like. After this, the realization comes that you have not calculated all the possibilities and have not taken into account your financial capabilities.

Even if you have carefully calculated your income, and it allows you to easily pay off your debts, no one is immune from job loss, serious illness, decreased earnings, etc., which does not have the best effect on your financial situation. When issuing a loan, banks and other financial organizations rely on the responsibility and integrity of the borrower, i.e. that he will make the required payments on time and in full.

However, every year the number of those who, for whatever reason, cannot fulfill their obligations is steadily growing. If the debtor, upon the occurrence of such a situation, immediately contacts the bank to solve his problem, they will probably meet him and offer debt restructuring or a deferment on payments. But if the borrower hides from bank representatives, and the loan is overdue for 2-3 months or more, then the bank can go to court demanding early repayment of the loan.

Then there are two options: The bank turns to the magistrate to collect the debt. In this case, no court hearing is held, the parties are not summoned to the hearing, the decision is made solely by the judge based on an application from the bank.

In 95% of cases it is accepted, i.e. the court sides with the creditor.

Within 5 days, the decision will be transferred to the bailiffs, the parties will be notified. If the amount is large, then an appeal to the district court is used, where a full consideration of the case takes place, where the plaintiff and defendant are invited. It is this option that is most beneficial to the debtor, because

What to do if the bank sues over a loan?

If the bank has applied to the judicial authorities to collect loan debt, firstly, it is necessary to understand what the claims consist of. As a rule, the legal services of credit institutions, in addition to the amount of the debt itself, impose significant penalties for collection, fines for late payments, interest accrued on the interest and not on the body of the debt, etc. All of the above requirements can be challenged by reducing them to a reasonable level within the framework of Art. 333 Civil Code of the Russian Federation.

The recognition of the loan agreement as not concluded in terms of the provision of insurance services, bank commissions, or the recognition of the loan agreement as not concluded (executed) in its entirety will help to significantly minimize claims. It should be remembered that a court decision made against a debtor in itself does not give rise to new obligations, however, legal proceedings (even initiated by bankers) can effectively protect one’s rights.

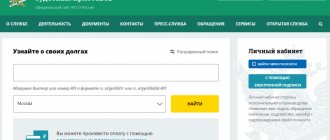

Free legal consultation: For any questions

Example: I took out loans from a microfinance organization to renovate an apartment and treat an illness.

I realized late that these were unaffordable loans for me. They call and threaten with various methods of influence.

What should I do? Moscow St. Petersburg By clicking the SEND button, you accept the terms and conditions Send Send

Moscow Government

Ministry of Justice of the Russian Federation

Rospotrebnadzor Latest questions Full comprehensive service From the moment you contact us until the issue is completely resolved, we are ready to accompany our clients, providing them with the necessary services and advice.

Free detailed analysis of the situation Our specialists will study your situation in detail, review all available documents, and draw up a clear picture of the problem. Working for results We are interested in the success of your business! Your victories are our victories. We are exclusively results-oriented.

Drawing up documents If necessary, the lawyers of our company will take upon themselves the preparation of all the necessary documents for a positive resolution of the case. Free study of options Only after a detailed analysis of the available documents and immersion in the current situation will we be able to work out solutions and the feasibility of their use. Submitting documents We take care of everything.

Compilation. Collection of the necessary package of documents. Submission to the authorities. Tracking. Control of every movement of the case.

There is always a possibility that the client does not need to go to court or draw up a claim and other documents, since there is no prospect of winning and the client will waste time and money, or worse, worsen his situation.

This is why our company’s lawyers first do a free analysis of the situation, study the available documents, and only after that offer solutions, if any. Why

Samples of loan appeals

admin 07/07/2018 07/07/2018Consultations Contents:

- Filing a cassation appeal

- Total

- APPELLATION against the decision of the Central District Court of Novosibirsk dated ___________ 2012 in civil case No. 2 - ________/2012 on the claim of Bank _____________ CJSC against __________ R .IN.

on debt collection under a loan agreement - Author's project of Timofey Vasiliev

- Appeal to the magistrate

- Appeal against the decision to collect debt under a loan agreement

- APPELLATION against the decision of the Central District Court of Novosibirsk dated ___________ 2012 in civil case No. 2 - ________/2012 on the claim of Bank _____________ CJSC against __________ R .IN. on debt collection under a loan agreement

- APPENDIX in copies:

- See also:

- What to do if the court did not reduce the amount of the penalty?

- Procedure for filing an appeal

- See also:

- Write a complaint against a court decision on a loan

- APPENDIX in copies:

- Send an open letter

- APPELLATION against the decision of the Central District Court of Novosibirsk dated ___________ 2012 in civil case No. 2 - ________/2012 on the claim of Bank _____________ CJSC against __________ R .IN. on debt collection under a loan agreement

- APPENDIX in copies:

- Appealing a court decision

- Procedure for filing an appeal

- Appeal against a court decision to collect loan debt

- Filing an appeal

Appeal against the decision to collect debt under a loan agreement Below is an appeal compiled by us against the decision of the Central District Court of the city.

Novosibirsk on debt collection under a loan agreement. To the Collegium for Civil Cases of the Novosibirsk Regional Court (630091, Novosibirsk, Pisareva St., 35) from the Defendant: (full name, address, telephone) Plaintiff: CJSC "Bank _____________" branch address: 630091,

Novosibirsk, st. __________ R.V.

on the collection of debt under a loan agreement on __________ 2012, the Central District Court of Novosibirsk made a decision in civil case No. 2 - 4903/2012 on the claim brought by ZAO Bank _____________ against __________ R.V. on debt collection under a loan agreement.

Example of a loan appeal

To appeal (challenge) a court decision on a loan is the right of the party that lost the process, in case of disagreement with the court’s position in whole or in part. As a rule, such a party is the borrower-debtor. Unfortunately, in credit legal relations, both legislation and judicial practice are on the side of banks, at least with respect to key requirements. And the main violator of the terms of the loan agreement is almost always the borrower who stops payments on the loan, makes serious delays or completely refuses to repay his obligations.

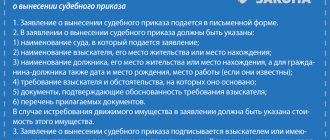

Despite the fact that such behavior of the debtor usually has good reasons (loss of job, decrease in income, difficult family situation, etc.), this does not provide grounds for exemption from the obligation to make loan payments on time and in full. Insolvency borrower is the main reason for banks to go to court. Accordingly, the main category of court cases is the consideration of applications for the issuance of a court order or claims for debt collection. Most often, borrowers appeal:

- The decision of the magistrate to issue a court order. In this case, we are talking about canceling the order, which is the unconditional right of the borrower.

- Decisions of courts of first instance on claims of banks. The reason for appeal is usually the court's satisfaction of all claims made by the bank, including the principal debt, interest on the loan and penalties. Borrowers, in turn, by appealing, try to reduce the amount to be recovered, usually by reducing the amount of the penalty.

- An absentee decision of the court of first instance, made following the consideration of a case without the participation of the defendant. Such a decision, like an order, can be canceled, and if it doesn’t work out or the deadline has expired, it can be appealed.

Appealing court decisions on a loan is no different from similar actions in other disputes and cases. The order is the same. Depending on the situation, it will be necessary to file an appeal or cassation complaint. Peculiarities

What is an appeal?

An appeal is a way of challenging a judge’s decision or other acts that have not entered into force. More than half of debt collection orders are submitted for review and review.

Types of debt collection

Debt repayment through the court is carried out in the following ways:

- by means of a court order for collection, if the amount collected is small;

- filing a claim;

- by concluding a settlement agreement at any stage of the process.

In the first case, the judge considers the case without the presence of the parties. The decision is made and rendered promptly based on the evidence collected by the applicant. To cancel or challenge an order, it is enough to file a petition.

If there is a claim, the parties are required to attend the court hearing. The plaintiff and defendant have the right to defend their own positions and present evidence. The disadvantage of this method is the length of the process, the advantage is the complexity of the appeal.

Attention!

It is possible to appeal a court decision in a higher court, provided that a violation has been recorded.

To appeal a court decision, an appellate complaint and a cassation complaint are drawn up. Its consideration is possible if it is properly completed and all required documents are available.

Appeal against a decision to collect funds under a loan agreement

To the Moscow City Court through the Meshchansky District Court.

Moscow PLAINTIFF: VTB 24 Bank (PJSC) RESPONDENT: Trading House LLC Case No. ** APPEAL against the decision of the judge of the Meshchansky District Court of Moscow on the statement of claim for the collection of amounts under a loan agreement, credit agreement July 16, 2020

judge of the Meshchansky District Court

Moscow, the claim of VTB 24 Bank (PJSC) against the Limited Liability Company “Trading House” for the termination of loan agreements, collection of debt under them and foreclosure on the pledged property was satisfied. On August 17, 2017, the defendant filed a short appeal against the court’s decision. On August 18, 2020, the court made a final decision.

On August 18, 2017, the court issued a ruling to leave the short appeal without progress, providing a deadline for correcting the shortcomings until October 2, 2017.

In accordance with this determination, this complaint is submitted with the elimination of the shortcomings indicated by the court. We consider the decision of the Meshchansky District Court.

Moscow in the case of termination of credit agreements, collection of debt under them and foreclosure on pledged property, considered in the claim of VTB 24 Bank (PJSC) against the Limited Liability Company "Trading House" is unfounded on the following grounds. 1) When considering the case at the court hearing on June 8, 2017, the defendant’s representative filed a written request to request from the plaintiff documents confirming the authority of the plaintiff’s representatives to enter into loan agreements, surety agreements, and pledge agreements.

According to the defendants, when concluding these agreements, the plaintiff’s representative acted without properly formalized authority to conclude these agreements, and therefore, in relation to these agreements, the issue of declaring them invalid was subject to resolution. The defendants did not have the opportunity to obtain these documents on their own, since the plaintiff unmotivatedly refused to provide them with them.

Stages of collection of funds

It is worth highlighting the main points of the enforcement procedure for the execution of acts of the judicial authority and other special bodies.

The first stage includes opening an enforcement case and making a certain decision. Upon application in the form of a letter from the claimant and on the basis of enforcement documentation, the bailiff in the court makes a decision to open a case. The decision is made within 6 days from the moment the enforcement documentation was received by the bailiff service.

The special body in court then sends its decision to both the bank and the debtor. The indicated statement specifies the time for the probable voluntary implementation of the court decision. This period is equal to 5 days from the moment the debtor receives the decision. At the end of the five-day period, the bailiff takes measures to forcibly collect the debt.

A complete list of conditions for refusing to open proceedings to enforce a case is given in article of legislation No. 229-FZ.

The second stage should include the discovery of the debtor's property. The legislation described above provides legal opportunities for a court bailiff to enter, without the debtor's consent, a residential property occupied by a person, with permission in the form of a letter from the senior bailiff.

The next stages include preserving the debtor's property until collection is applied to him, imposing a ban on the debtor leaving the country, collecting finances from the debtor, and a fee for the execution of the case. The final process is represented by the completion of the proceedings.

Collection can be carried out either from the debtor’s account in any bank or using funds from a bank card owned by the debtor client

How to challenge a court decision on a loan

To appeal (challenge) a court decision on a loan is the right of the party that lost the process, in case of disagreement with the court’s position in whole or in part. As a rule, such a party is the borrower-debtor. Unfortunately, in credit legal relations, both legislation and judicial practice are on the side of banks, at least in terms of key requirements.

And the main violator of the terms of the loan agreement is almost always the borrower who stops payments on the loan, makes serious delays or completely refuses to repay his obligations. Despite the fact that usually such behavior of the debtor has good reasons (loss of job, decrease in income, difficult family situation, etc.), this does not provide grounds for exemption from the obligation to make loan payments on time and in full. The insolvency of the borrower is the main reason for banks to go to court.

Accordingly, the main category of court cases is the consideration of applications for the issuance of a court order or claims for debt collection. Most often borrowers appeal:

- The decision of the magistrate to issue a court order. In this case, we are talking about canceling the order, which is the unconditional right of the borrower.

- An absentee decision of the court of first instance, made following the consideration of a case without the participation of the defendant. Such a decision, like an order, can be canceled, and if it doesn’t work out or the deadline has expired, it can be appealed.

- Decisions of courts of first instance on claims of banks. The reason for appeal is usually the court's satisfaction of all claims made by the bank, including the principal debt, interest on the loan and penalties. Borrowers, in turn, by appealing, try to reduce the amount to be recovered, usually by reducing the amount of the penalty.

Appealing court decisions on a loan is no different from similar actions in other disputes and cases.

Absentee decision

A default court decision on debt collection is when the debtor was absent from the arbitration process. There are two conditions for its acceptance:

- The debtor was warned about the arbitration process. But he didn't come. The debtor did not write an application for permission to consider the case in his absence and did not explain the reason for his failure to appear.

- The plaintiff agrees to hold the court hearing without the presence of the defendant.

If one of the conditions is not met, the arbitration process will be postponed.

If the meeting nevertheless took place without the debtor, the resolution comes into force after three stages:

- A week has passed since the defendant received a copy of the court order to collect the debt. He is given time to file an application to appeal the default judgment.

- Ten days from the date of appeal of the court's conclusion by the defendant. This period is given for a possible appeal.

- Ten days from the date of refusal of the debtor to appeal the court decision.

What reasons are considered valid for absence from a meeting? There are two of them:

- Health status. The defendant was under medical supervision and simply could not get to the right place.

- It is located outside the country. The court hearing may be postponed until his return, or may be held as usual without his presence.

However, a situation may also occur where the defendant did not actually receive an invitation to court. He learns about his decision only when the bailiffs come to the house and declare that, according to the conclusion of justice, the property has been seized. And the meeting took place without his participation. The defendant's rights were not respected.

In this case, the debtor must fight to have the default judgment overturned. First of all, he must receive a copy of the court opinion. The next step is to contact a good law firm. They renew the deadline for filing an application to overturn the decision.

There are benefits from the abolition of an absentee judgment on debt collection:

- The amount owed will be reduced because it will not include fees and penalties.

- Temporary removal of seizure from property.

Appeal against the decision of the Kirovsky District Court

- Question No. 5067476

Tomsk • Questions: 4 10/08/2014 at 2:24 pm APPEAL against the decision of the Kirovsky District Court of the city.

Tomsk dated September 09, 2014 in civil case No. on the claim of OJSC "MDM Bank" k.

On September 9, 2014, the court made a decision in a civil case on the claim of MDM Bank OJSC for the collection of debt under a loan agreement.

The court decision satisfied the plaintiff's demands in full.

From the defendant. In favor of MDM Bank OJSC, to collect against the debt under the loan agreement No. dated March 22, 2013, the amount of debt for the payment of the principal debt, interest debt for the amount of the principal debt not overdue for repayment, interest debt for the amount of the principal debt overdue for repayment, debt for the commission for the provision of banking services, as well as the cost of paying the state fee and the cost of notarization of documents. This decision was made in final form on September 15, 2014.

I consider this court decision to be illegal and unfounded, adopted with a significant violation of the norms of procedural law and therefore subject to unconditional cancellation on the following grounds.

1. In accordance with paragraphs 1, 2, 3 of December 19, 2003 No. 23 On a court decision, the decision must be legal and justified (Part 1 of Article 195 of the Code of Civil Procedure of the Russian Federation).

A decision is legal when it is made in strict compliance with the rules of procedural law and in full compliance with the rules of substantive law that are subject to application to a given legal relationship, or is based on the application, where necessary, of an analogy of law or an analogy of law (Part 1 of Article 1, part 3 of article 11 of the Code of Civil Procedure of the Russian Federation). The decision is justified when the facts relevant to the case are confirmed by evidence examined by the court that meets the requirements of the law on their relevance and admissibility, or by circumstances that do not require proof (Articles 55, 59 - 61, 67 of the Code of Civil Procedure of the Russian Federation), and also when it contains exhaustive conclusions of the court arising from the established facts.

Samples of statements of claim and claims

IN ….

court Address: Plaintiff: Full name of Resident at: Tel.: Defendant: Closed Joint Stock Company "VTB24" Branch No. 5440 Legal address: 101000,

Moscow st. Myasnitskaya, house 35 Postal address: 630112,

Novosibirsk, st. Frunze, house. 232;234; 234/1. APPEAL against the court decision Case No. ***** was pending in the proceedings of ...... the city court. On March 13, 2014, by decision of the ****** City Court, the full name’s claims were denied.

According to this decision, the court found that, by virtue of Art. 934 of the Civil Code of the Russian Federation, under a personal insurance contract, one party (the insurer) undertakes, for a fee stipulated by the contract (insurance premium) paid by the other party (the policyholder), to pay a lump sum or pay periodically the amount stipulated by the contract (the insurance amount) in the event of harm to the life or health of the policyholder himself or another citizen (insured person) named in the contract, when he reaches a certain age or when another event (insured event) provided for in the contract occurs in his life.

The right to receive the insurance amount belongs to the person in whose favor the contract was concluded.

As established at the court hearing and not disputed by anyone, between the full name, as the borrower, and the Bank, as the lender, “.” November 2012, a loan agreement No. ******* was concluded, according to which the lender provided the borrower with a loan in the amount of 937,197.51 rubles. for up to "." November 2020, interest rate 15% per annum.

Clause 1.3 provides for the amount under the borrower’s life insurance agreement in the amount of RUB 109,284.51. The plaintiff paid the fee. The plaintiff was issued an insurance policy under the program “Protection of the CAR LOAN Borrower”, Insurance Conditions for this program (these documents were presented by the plaintiff).

The court finds that the above insurance is security for the fulfillment of the borrower's obligations under the loan agreement dated November 8, 2012.

The court has no grounds to consider such insurance as an imposed service.

The court finds that by providing a loan in the amount of 937,197.51 rubles.

Sample appeal under a loan agreement

Contents To appeal (challenge) a court decision on a loan is the right of the losing party in the case of disagreement with the court’s position in whole or in part. As a rule, such a party is the borrower-debtor.

Unfortunately, in credit legal relations, both legislation and judicial practice are on the side of banks, at least in terms of key requirements. And the main violator of the terms of the loan agreement is almost always the borrower who stops payments on the loan, makes serious delays or completely refuses to repay his obligations.

Despite the fact that usually such behavior of the debtor has good reasons (loss of job, decrease in income, difficult family situation, etc.), this does not provide grounds for exemption from the obligation to make loan payments on time and in full.

The insolvency of the borrower is the main reason for banks to go to court. Accordingly, the main category of court cases is the consideration of applications for the issuance of a court order or claims for debt collection. Most often borrowers appeal:

- The decision of the magistrate to issue a court order. In this case, we are talking about canceling the order, which is the unconditional right of the borrower.

- Decisions of courts of first instance on claims of banks. The reason for appeal is usually the court's satisfaction of all claims made by the bank, including the principal debt, interest on the loan and penalties. Borrowers, in turn, by appealing, try to reduce the amount to be recovered, usually by reducing the amount of the penalty.

- An absentee decision of the court of first instance, made following the consideration of a case without the participation of the defendant. Such a decision, like an order, can be canceled, and if it doesn’t work out or the deadline has expired, it can be appealed.

Appealing court decisions on a loan is no different from similar actions in other disputes and cases.

The order is the same. Depending on the situation, it will be necessary to file an appeal or cassation complaint.

Can a bank win a case without a court hearing?

The bank can exercise its right to obtain a court order to collect the entire debt directly, bypassing the meeting procedure - based on filing an application with the magistrate court.

If such a requirement is satisfied, then the order goes into enforcement proceedings. This “lightweight” option for resolving the issue of collection is extremely convenient for the banking company, but disadvantageous for the debtor. During the process, the borrower can provide evidence that he is currently unable to make regular payments.

It could be:

- discharge from hospital,

- notice of staff reduction at work,

- order of dismissal due to retirement.

In the same case, if there was no meeting, and you learned about the existence of a decision on your case after the fact, then you can appeal it. To do this, within the time limits established by law, an appeal is filed with the body that issued the document with the decision. We talk about this in more detail here.

After the ruling of justice, the debt will be collected by the court forcibly. Funds are debited from the debtor's account, and penalties and fines are taken into account. The borrower also pays for the arbitration process and other procedures.

The debt according to the decision of the arbitration court will be collected in the following order:

- Preparation of documentation containing evidence that the debt actually exists. These include: a loan agreement, issuing invoices and an application for the issuance of money.

- The debtor is presented with claims in writing.

- An application for debt collection is being prepared to be submitted to court.

- Arbitration process.

- Court ruling in favor of the bank.

During debt collection, the bank may petition to seize the debtor's property. This means that the borrower is temporarily unable to use his property. The applicant must justify the reason and necessity of such action. The application must comply with all legal requirements. The court will decide to what extent this is justified and, if the answer is positive, will determine the amount of the debtor’s property that will be seized.

After the trial, both parties have the right to appeal the debt collection order. The filing deadline is specified in the Code, but most often it is 15 days.

In what cases is an appeal appropriate?

There are several grounds for filing an appeal against a court decision to collect a debt:

- All relevant circumstances have not been identified.

- There is no evidence for some circumstances.

- The conclusions stated in the court ruling do not correspond to the circumstances of the case.

- Violation of substantive or procedural law.

List of violations of substantive law:

- Application of a law that is not subject to application.

- Not applying the law that is to be applied.

- Misinterpretation of the law.

List of violations of procedural law by the court when deciding to collect a loan:

- Illegal composition of the court.

- Absence of the applicant, debtor or other persons participating in the case. But only if he was not warned about the arbitration process.

- The court decision is associated with persons who have no bearing on the case.

- The court's conclusion was signed by a stranger or not signed at all. Only a judge can sign it.

- The minutes of the court hearing are incorrectly drawn up or are missing altogether.

- An outsider influenced the court.

If these norms were violated during the trial, there is a basis to appeal the conclusion.

You can apply to the court again if, after some time, facts appear that may change the decision.

The procedure for judicial collection of loan debt is regulated by the norms of the current civil procedural legislation, in accordance with which the banking organization has the right to apply with the appropriate requirements to the magistrate or to the district court.

The main procedures for debt collection through the court are:

- Order decision. In this case, the court considers the application on its own, without holding a meeting or inviting the parties to the conflict. A court order is issued in favor of the applicant and is a document subject to enforcement.

- Claim. The creditor files a statement of claim with the court demanding collection of the debt, and the final decision is made by the court at the end of the trial. Notification with a summons to the parties to a court hearing is a mandatory condition of the judicial procedure. However, in case of failure of the defendant-debtor to appear, the court has the right to make a decision on this case without his presence, that is, in absentia.

Russian legislation provides the debtor with the opportunity to challenge a court decision if he believes that his rights and interests have been violated. To do this, you must file a complaint or application against the court's decision in the appropriate manner.

The statute of limitations for a loan by a court decision, depending on the procedure applied, is:

- appeal to a higher court - within 1 month after the decision is made;

- An application for a court decision in absentia is submitted to the court that issued it within 7 days from the moment the debtor received a copy of the decision in hand.

We invite you to read: What is an encumbrance on a land plot and how to remove the restriction on use in Rosreestr?

If the court refuses to satisfy the complaint, the debtor can challenge the decision through an appeal; the deadline for filing a complaint is 1 month after the end of the 7-day period.

An appeal against a court decision is the right of every losing party. As practice shows, in credit legal relations the court most often takes the side of the creditor bank, the defendant is the debtor-borrower, who has repeatedly violated the fulfillment of debt obligations, has made a large number of late payments or has completely refused to repay the loan.

It is worth noting that even if the borrower-debtor has compelling reasons that do not allow him to make timely loan payments (decrease in income, dismissal, family problems, etc.), this does not give him grounds for defaulting on debt obligations.

The main reason when a bank files a lawsuit is the insolvency of the borrower, and, as practice shows, the financial organization uses the court as the last resort for debt collection when no influence on the debtor has helped, in particular, we are talking about pre-trial settlement of the conflict.

In this case, borrowers most often apply for:

- appeal against decisions of courts of first instance made to satisfy claims of banking organizations with demands for collection of the principal debt, as well as interest, fines and penalties, often at inflated rates; in this way, borrowers try to reduce the amount to be collected;

- appealing the decision of the magistrate to issue a court order; the unconditional right of the borrower is to submit an application demanding the cancellation of the court order;

- appealing a decision in absentia of the court of first instance, made without the participation of the defendant.

The procedure for filing a complaint against a court decision on a loan is, in principle, similar to actions in other controversial cases. Depending on the situation, the person against whom a court decision was made to collect the debt may file one of the following complaints:

- appeal - which is filed before the decision enters into legal force no later than 1 month from the date of the decision;

- cassation - filed against a valid court decision or order no later than 6 months from the date of entry into force.

A cassation appeal can be used to appeal a decision made not in favor of the debtor at the appeal stage. Filing an appeal suspends the entry into force of the court decision.

An appeal is the first instance to challenge a court decision made on a claim for repayment of a loan debt. A complaint can be filed either to a district court (against a decision of magistrates) or to a court of a constituent entity of the Russian Federation (if the decision was made by a district court).

Attention

The court will decide to what extent this is justified and, if the answer is positive, will determine the amount of the debtor’s property that will be seized. The statute of limitations for the seizure of property by decision of justice The statute of limitations for the collection of debt by a court decision expires after 3 years, from the date of issuance of the writ of execution to creditors. The bank has a lot of opportunities and powers. Therefore, the statute of limitations for debt collection may not end after 3 years, and the debt may pass to the heirs.

You should not rely on the statute of limitations. Only people who really have no real estate or material resources can wait for him. And this is a very rare occurrence. Thanks to the wide range of possibilities, bailiffs can come to a person’s current place of residence or work. This will make the debt collection process very frustrating.

Important

Very often, defendants try to cancel a court order that has already entered into force. This is a little more difficult to do, but still doable. The reasons for motivation are similar. Where to apply A court order is a document issued by a magistrate.

There are two ways to submit objections to the magistrate:

- send the document by mail.

- name of the court;

- details of the person filing the complaint;

- information about the decision being appealed;

- the applicant’s demands (they cannot go beyond the requirements that were stated earlier when considering the case on the merits);

- the grounds on which the applicant decided to appeal the court decision and considers it incorrect;

- evidence of the existence of grounds for appeal and the need to satisfy the complaint (you cannot refer to evidence that was not presented and examined by the court earlier, or you must convincingly argue your inability to present such additional evidence during the trial);

- list of application documents.

Sample appeal under a loan agreement

Arbitration practice Leninsky District Court of Vladivostok, Primorsky Territory, composed of: presiding judge Ostapenko A.V.

at the secretary Atlasova Yu.A., having considered in open court a civil case on a statement of claim "" in the face of Mustafin FULL NAME8 for the collection of the amount of debt under a loan agreement with an appeal from Mustafin FULL NAME9 against the decision of the magistrate of the court district No. Leninsky district dated 10/19/2011 year, Established: The plaintiff appealed to the judicial district No. of the Leninsky district of the city.

with a claim against the defendant, in support of the stated requirements, indicating that on 04/05/2007 between “” (OJSC) and Mustafin M.A.

a loan agreement No. was concluded, under the terms of which the lender issued the borrower, on the terms of urgency, repayment and payment, a loan in the amount No. for urgent needs with a repayment period of 04/05/2011.

The interest rate on the loan was 16% per annum.

According to clause 4.1 of the agreement, in case of violation of the deadline for payment of the next payment, a penalty in the amount of 0.5% of the amount of the overdue debt is charged for each such violation. At the time of filing this claim, the total amount of the defendant’s debt to the bank is No., including: No. – the amount of the principal debt; № - interest debt; No. – fine.

He asked to recover from Mustafin M.A. debt under loan agreement No. dated 04/05/2007 in the amount No., including: No. - the amount of the principal debt; № - interest debt; No. – fine, expenses for payment of state duty in the amount of No. By the decision of the magistrate of court district No. Leninsky district.

dated October 19, 2011, collected from Mustafin M.A. in favor of "" represented by the debt under loan agreement No. dated 04/05/2007 in the amount No. - the amount of the principal debt; № - interest debt; No. - penalties; expenses for payment of state duty in the amount of No., total collected No. The rest of the stated demands were left unsatisfied.

The defendant did not agree with the said Decision and filed an appeal, stating in support that he believed that the court had incorrectly interpreted clause 4.1 of the contract.

Sample appeal under a loan agreement

/ / Contents Representatives of the defendant appeared at the court hearing, recognized the claims in part, and asked to reduce the amount of the penalty, in accordance with Art.

333 of the Civil Code of the Russian Federation, at the same time they explained to the court that the debt arose due to the fact that ___________________________________ himself is in prison. By the decision of the _____________ district court of the city of ______________ dated _______________________________, the claims of OJSC AKB "__________________________________" to ___________________________ for the collection of debt on the loan, partially satisfied.

The court made the following decision: to recover from R_____________________________________________ in favor of OJSC AKB "_______________________" the loan debt in the amount of ___________________________________, of which: the principal debt in the amount of ________________ rubles, the interest debt in the amount of __________________________, a penalty taking into account Art.

333 of the Civil Code of the Russian Federation ___________________., the cost of paying the state duty in the amount of _____________________ rubles. Unlike an appeal, in cassation the case and the decision are reviewed.

This means that a well-founded complaint is the basis for a re-trial, which will be carried out in a cassation court. There is a better chance of achieving the desired result than with an appeal. But the problem is that not all complaints are recognized as justified, which blocks the judicial proceedings. The complaint is sent directly to the cassation court, so copies of all previously made decisions in the case must be attached to it.

If necessary, simultaneously with filing the complaint or in its text, a petition may be filed to suspend the appealed decision. Thus, the conclusions of the court of first instance about proper notification and the possibility of considering the case in my absence are unfounded, and the court decision is subject to cancellation as a ruling

Appeal ruling No. 33-9539/2015 dated June 29, 2015

in case No. 33-9539/2015

— Civil Essence of the dispute: Claims for the collection of amounts under a loan agreement, credit agreement Judge Zakharenko L.V case No. 33-9539/2015 APPEAL DECISION June 29, 2020 Rostov-on-Don Judicial panel for civil cases of the Rostov Regional Court composed of presiding Zinkina I .V., judges Senik Zh.Yu., Fetinga N.G., with secretary Avediev L.G., considered in open court a civil case on the claim of AK BARS BANK OJSC against E.A. Ivanovskaya.

on termination of the agreement, collection of debt under the loan agreement, on the appeal of OJSC AK BARS BANK against the absentee decision of the Leninsky District Court of Rostov-on-Don dated March 25, 2015. Having heard the report of judge Senik Zh.Yu., the judicial panel, established: OJSC AK BARS (hereinafter referred to as the bank) filed a lawsuit against E.A. Ivanovskaya.

on termination of the agreement, collection of debt under the loan agreement. In support of the claims, the bank indicated that the DATE OF THE year between OJSC JSCB AK BARS and Ivanovskaya E.A. a loan agreement was concluded in the amount of INFORMATION IMPERTIFIED rubles for a period up to and including the DATE IMPERTIFIED at 21.9% per annum. Payments of the principal amount of the loan and interest payments for using the loan until December 2013 were made in compliance with the schedule established by the agreement.

The last payment on the loan was received on the DATE OF THE year. Since January 2014, no funds have been received from the borrower. DATE UNPERSONALIZED The bank sent a demand to the borrower for full early repayment of the debt, however, to date the debt has not been repaid and no funds have been received. debt under the loan agreement, including: debt on the principal amount of the loan in the amount of INFORMATION IS IMPERSONAL., interest for the use of the loan for the period from DATE OF IMPERSONAL to DATE OF IMPERSONAL in the amount of INFORMATION IS IMPERSONAL., interest for the use of the loan accrued

How to delay a lawsuit with a bank?

If the terms for repayment of credit debt are violated, banking organizations begin to take collection measures.

Employees of a specialized department of the bank make telephone calls, report the presence of late payment of loan installments, find out the reasons, and can offer various conditions for paying the debt. Then they send demands for payment, after which they can go to court.

According to the law, the bank can sue already on the first day of delay. But due to the fact that conducting court cases is quite an expensive and troublesome task, since you need to prepare a package of documents, take part in court hearings, pay state fees, before applying for judicial protection, banks try to peacefully resolve the issue.

As a rule, banks prefer to comply with the claims procedure. Before going to court, they send the debtor a claim demanding repayment of the debt and warn that if the debt is not repaid, they will file an application with the judicial authorities. After 30 days, the bank applies for collection to the court.

From the moment of delay to the application to the court, a different amount of time can pass: from several weeks to several years. Sometimes credit institutions are deliberately in no hurry to go to court in order to increase the size of the debt and the period of overdue debt, for which additional fines and penalties can be charged. There are even cases when a bank files an application to court after the statute of limitations has expired. But this is more a rarity than a rule.

To increase the duration of consideration of a case by the court, there are procedural tools. There are quite a lot of these methods. Their application is individual in each specific case.

The choice of means to delay the trial depends on many factors. So, when a court order is issued, it can be canceled by filing an application to the court for cancellation. And if a decision is made, you can appeal the judicial act through the appellate and cassation procedures.

During the trial, the following legal mechanisms can be used:

- file motions to postpone the trial for various reasons (illness, hospitalization, business trip);

- file motions to stay the process

- counterclaim

- clarify counterclaims

- apply for the involvement of third parties, and possibly co-defendants, in the process

- ask for assistance in obtaining evidence

- petition for witnesses

- file new claims against the bank that prevent the consideration of the present case

- appeal rulings, protocols and other acts of the judge

- ask for a postponement, installment plan for the execution of a court decision

You can delay the process even at the stage of enforcement proceedings by submitting applications to the bailiff service, appealing the actions, inactions, decisions of bailiffs.

There are many ways to delay the process, but their use is strictly individual, and the preparation of such actions requires certain professional skills and experience in conducting business.

This approach can be both effective and vice versa. Therefore, it is important to understand what mechanisms should be used in each specific case, and what the use of each procedure in a trial may lead to.

Appeal against a court decision on loan obligations

» Below is the appeal we compiled against the decision of the Central District Court of the city.

Based on the foregoing, the plaintiff asked the court to terminate the loan agreement. recover from Ivanovskaya E.A.

Novosibirsk on debt collection under a loan agreement. To the Collegium for Civil Cases of the Novosibirsk Regional Court (630091, Novosibirsk, Pisareva St., 35) from the Defendant: (full name, address, telephone) Plaintiff: CJSC "Bank _____________" branch address: 630091, Novosibirsk, st. _________ Filing an appeal is your chance to cancel a court order or decision regarding the collection of loan debt from the debtor in favor of the bank.

Such a complaint can act as a tool that makes it possible to reduce the amount of the penalty, will allow you to postpone the moment of forced sale of property or find time to come to an agreement with the bank and peacefully resolve the debt issue.

on the decision of the __________ district court of __________ dated _________________. By the decision of _____________ district court

______________ dated _______________________________, the claims of OJSC AKB "_________________________________" to ___________________________ for the collection of loan debt were partially satisfied.

The court made the following decision: to collect from R_____________________________________________ in favor of OJSC AKB “_______________________” the loan debt in the amount of ___________________________________, of which: the principal debt in the amount of ________________ rubles. The rest of the claim of OJSC AKB “___________________________” against ________________________________ is to be dismissed. Satisfying the claims of OJSC AKB "________________________________" for the collection of loan debt, the court of first instance refers to the fact that on _______________________, a loan agreement No. _____________________________ was concluded between OJSC AKB "__________________" and ______________________, according to which the plaintiff issued to the defendant on urgent terms, repayment and repayment of the loan in the amount of ___________________________ rub.

for consumer purposes for a period of ___________________________, with an interest rate of _______%.