Litigation with a banking organization allows a citizen to recover illegally withheld funds, increase a credit rating by correcting errors in the credit history, and receive compensation for moral or material damage caused by the unlawful actions of a financial institution. You can sue on the basis of any violations of the law or contract committed by bank employees. In practice, most legal proceedings are devoted to the collection of unlawfully withheld amounts (interest on a loan, deposit), while the plaintiff (citizen) demands compensation for material damage and the return of funds due.

Filing a claim against a bank and legal proceedings with a financial organization require payment of state fees, legal costs, and paperwork costs. Many plaintiffs additionally pay for the services of a lawyer representing the citizen’s interests in court. Consideration of the circumstances of the case and making a decision can take from several weeks to a year and require additional expenses, so before filing a lawsuit, you need to compare the expected amount of compensation and the amount of costs.

In what cases is it necessary to file a claim against a bank in court?

Clients who have encountered serious violations by banking organizations are recommended to study the regulations of the financial organization, legal norms and judicial practice at the first stage. Additionally, you should seek advice from a lawyer to assess the prospects for a positive outcome of the case. For example, legal disputes regarding a bank’s unlawful refusal to return a deposit are resolved in two or three hearings. Most clients file lawsuits against banks in the following situations:

- The bank illegally debited commissions and other obligatory payments from the client’s current account. For example, an additional commission is charged for transfers between client accounts opened in the same bank. Most financial institutions resolve such issues pre-trial, however, if the bank refuses to peacefully resolve the dispute, the client may go to court.

- The bank unreasonably refused to return the client’s deposit and interest on it. Due to the unstable economic situation, many banking organizations are trying to preserve the amount of cash by refusing to issue deposits and interest to customers. Such cases are typical for banks under the supervision of the Central Bank of the Russian Federation before the revocation of their license.

- The bank unlawfully blocked a separate transaction or froze the client’s account. Banking organizations automatically write off funds from customer accounts based on enforcement documents (for example, a court order from a magistrate, a writ of execution). If a financial organization writes off amounts without an order from state regulatory authorities, the client can go to court.

- The bank significantly changed the terms of the agreement, which worsened the client’s situation. For example, a bank sharply reduces interest on deposits and sets a fee for early withdrawal of deposits. The client has suffered material damage, so he turns to the bank to recover the amount of the deposit, interest due and compensation for damage.

- The bank uses illegal methods to collect overdue debts. For example, a mortgage loan payer received a demand to evict from a mortgaged apartment for late payment; the bank unlawfully inflated the amount of the penalty for the delay in the next installment. As a rule, payers of long-term loans for large amounts go to court to obtain compensation and agree on a forced payment schedule.

- The bank unmotivatedly refused to restructure or defer payments to the client. For example, a borrower lost his job due to layoffs, and before the first delay occurred, he contacted the bank to obtain a deferred payment for the period of job search (three months). The bank sent the client a written refusal to provide preferential terms, so the citizen goes to court to force a deferment.

- The bank intentionally misled the client regarding products or services. For example, a bank employee hid additional conditions for obtaining a loan from the client, provided deliberately false information about interest rates, did not warn about the amount of monthly payments, or hid other important information. In the modern financial services market, such cases are rare.

- The bank sent false information to the credit history bureau. Russian legislation requires banking organizations to transmit information about loan applications submitted by clients, as well as to record payment discipline for loans already issued. Sometimes, due to errors by bank employees, inaccurate information is entered into the client’s file, the scoring score (credit rating) is reduced, and the citizen cannot obtain new loans on favorable terms.

Before preparing and filing a lawsuit, the client should send a written claim to the bank in order to comply with the requirements of the law on pre-trial dispute resolution. The text of the pre-trial claim should set out the contact details of the parties, the circumstances of the case and the borrower’s requirements. The completed document can be delivered in person or sent by registered mail with acknowledgment of receipt. After receiving a negative response from the bank, you can go to court.

Which MFOs do not sue debtors?

Again, it is impossible to compile a list of microfinance organizations that do not sue debtors. Occasionally, stories emerge that one or another microcredit company about the borrower did not transfer materials to solve the debt problem in court, but these are isolated cases.

Why don’t microfinance organizations sometimes sue debtors? Most likely, the matter is a mistake by a company employee. People work at the ICC, and people tend to make mistakes. Your case could be lost, a tired employee could accidentally miss you in the database or forget to prepare documents. As you can see, all these reasons are nothing more than luck.

There is another reason why a microfinance company may not file a complaint with the judicial authorities - if the microfinance company is afraid to appear before the law. We are talking about black lenders - companies without registration and license. According to the law, the borrower has the right not to repay the microloan taken out if it was issued by an MFO without registration. Black lenders can be identified by the following characteristics:

- the loan agreement was not drawn up according to the rules, it only has a couple of pages, the rights and obligations of both parties are spelled out as vaguely as possible;

- the company actively uses the services of debt collectors;

- MCC has microloans with an interest rate of more than 1 percent, and the loan is issued for a period of less than 365 days.

If there is no subpoena from the court, collectors are actively harassing you, and the company seems suspicious to you - call the Central Bank of Russia and ask if the microfinance organization with which you are dealing is registered. If it turns out that there is no license, you need to go to the police and court yourself.

How to choose a court to file a claim?

Before drawing up a statement of claim, a citizen should choose a court (or jurisdiction), taking into account the requirements of the law and the provisions of the contract. Filing an application in violation of jurisdiction will lead to refusal to consider the claim, so before choosing a court you need to take into account a number of factors:

- Provisions of the agreement concluded with the bank. Most loan and banking agreements specify the address of a specific court. The information is located in the part of the agreement dedicated to the procedure for resolving disputes. The agreement may indicate an arbitration court (the proceedings are conducted by a private individual or an arbitrator organization), a court of general jurisdiction (a magistrate or a district court). Sometimes the agreement specifies alternative jurisdiction - the ability of the parties (bank and client) to choose any court to consider the case.

- Status of the client filing the claim. If the plaintiff (drawer of the lawsuit) is a legal entity or has the status of a private entrepreneur, you need to apply to the arbitration court. Typically, the contract indicates the address of the court; if the necessary information is not available, the plaintiff can choose any arbitration court located at the legal address of the bank branch.

- Amount of the claim (for individuals). If a client tries to recover amounts not exceeding 50 thousand rubles, he should contact a magistrate. If the amount of the claim is greater, you need to submit documents to the district court, choosing an instance taking into account the legal address of the bank branch.

- Availability of a claim from a banking organization. If the client plans to file a counterclaim (the bank filed the claim first), the case must be considered by the court examining the bank's application. This procedure is called alternative jurisdiction.

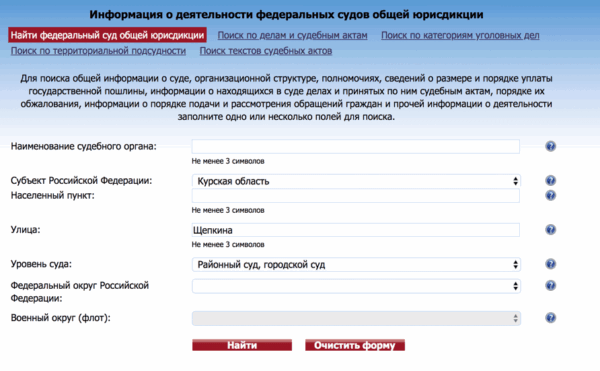

Typically, the client must file a claim with the court determined by the provisions of the agreement with the bank. If there is no information about jurisdiction in the contract, you need to estimate the amount of the claim, take into account the status of the plaintiff (individual, organization or individual entrepreneur) and the presence of counter-statements from the financial organization. You can find out the details of a suitable court on the website of the GAS (state automated system) Justice project at sudrf.ru.

An error in determining the right court leads to a refusal to consider the claim, so a citizen is recommended to consult with a lawyer before filing documents. Filing a claim is accompanied by the payment of a state fee, so it is advisable to determine the jurisdiction in advance.

What happens for non-payment of a loan?

It is difficult to disagree with the statement that it is better to repay the loan on time and in full. Everyone understands this. But in the life of any person a situation may arise that excludes the possibility of paying one’s debt obligations.

Features of problem debts

There are also cases when a person deliberately ignores his obligations to the bank, hoping that “somehow it will happen” and “maybe it will pass.” All borrowers who are in arrears are divided into 2 types: forced and malicious defaulters. There is a significant difference between them.

- A persistent offender obtains loans from numerous financial institutions, and then hides from the lender, ignores calls, and does not make contact.

Banks take various measures to combat such people and, first of all, blacklist defaulters. Even if a fairly long period of time passes, it will be difficult, or rather almost impossible, to get a loan from a banking organization. There may be a “loophole”, but you will only be able to take a small amount.

- Involuntary debtors are those who are trapped by adverse circumstances. Delays are usually associated with delays in wages, health problems, and other problems that must be reported to the lender. In such cases, banks meet halfway and can offer, for example, a restructuring service, more about it here.

Restructuring is a review of the terms of the loan agreement and their changes in order to maximally satisfy the interests of the borrower. Typically, the procedure involves extending the term to reduce the monthly payment. However, the final cost of repaying the loan increases significantly. On the other hand, for those who find themselves in a difficult financial situation, this is one of the best solutions.

Sometimes credit holidays may be provided, that is, a deferment of payments on the principal debt, and only the payment of interest. During the deferment period, the payer has the opportunity to improve his financial situation.

What happens for non-payment

Borrowers often wonder what happens when payments are missed for a long time? Of course, the bank does not forgive such clients, and the longer the delay lasts, the greater the liability.

Measures may vary depending on the size of the debt and the time of delay. For example:

- subpoenas,

- seizure of your salary card account and debiting funds from there,

- visits of collectors - how they work with debtors, we tell you here,

- ban on traveling abroad if the bank wins in court,

- bailiffs have the right to confiscate the collateral property, as well as the property that you own. Household appliances and electronics, jewelry, luxury goods, vehicles, real estate, etc. can be used.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

One way or another, reminders from the bank will not stop over time, but will become more stringent, in addition, fines and penalties will also increase.

If the debtor does not pay the loan and does not contact the bank for more than 90 calendar days, the latter has every right to file a lawsuit against him with an application for forced collection of the entire amount of the debt from the borrower. The occurrence of a debt under a loan agreement by a person is not a criminal offense.

Since for this it is necessary to prove that the debtor is a willful defaulter who does not take any actions to return the money, has been avoiding obligations for more than six months, has the opportunity to pay, but deliberately does not do so. It is possible to prove that the client deliberately evades payments only if he himself admits his guilt.

How to find out if a bank has filed a lawsuit

The greater and longer your delay, the more likely it is that the bank will sue to get their money back. Usually the client finds out about this through a subpoena that he receives in the mail.

You can check the authenticity of this document. To do this, you need to go to the website of the court that sent the summons and use the search by name in the appropriate section.

In some cases, they may call instead of a summons. But sometimes such calls are made from both the banking company and collection agencies in order to put pressure on the debtor.

It happens that a banking organization calls and reports that a claim has been filed, but you still have the opportunity to settle everything. If you learn about the existence of a statement of claim by telephone, then find out the name of the court, the date and time of the hearing in order to check this information on the website.

If you do not specify the name, searching for information will take much longer. First, determine where you live and where the lender is located. Then you can access the online portal. If you did not find your last name, then the claim was not filed.

List of banks that provide loans without refusal ⇒

You might also be interested in these articles:

Six tips in a situation where a bank sues over non-payment of a loan

So the bank sued. What's next? Of course, you need to try your best to avoid such situations, as this will affect not only your nerves, but also your credit history. Although litigation is not the worst thing, dealing with debt collectors is much worse.

HELP IN OBTAINING A LOAN ⇒

And at the hearing, you have every chance to write off excess fines and penalties. The recommendations below will help you develop the right strategy of behavior and not make any mistakes.

1. The first thing that should not be allowed under any circumstances is panic or depression. Remember, in any, even the most difficult situation, you can find your positive moments - this is once; Even from the most seemingly hopeless situation there is always a way out - these are two.

So, we maintain the first (calmness and psychological balance) and look for the possibility of the second - the optimal solution to the issue in our favor. By the way, a positive thing is the termination of the accrual of penalties and other penalties on your debt.

Read more about the cancellation of fines on this page.

TOP most profitable loans with low interest rates ⇒

2. You should not hide from court. Even if an application from a financial institution is already under consideration, you can try to negotiate an “amicable” resolution of the issue with the lender; you can write an application for restructuring or the provision of a “credit holiday” service.

As a rule, having started legal proceedings, companies refuse such requests (as they say: “we should have thought earlier”), but it’s worth a try!

3. If the banking organization has not responded positively to your requests to restructure the debt or provide a deferment, a meeting with its representative in court cannot be avoided.

Under no circumstances should you ignore subpoenas! You must show yourself from the best side, demonstrating such qualities as responsibility, pedantry, diligence, and so on.

This will give you a better chance that the judge will hear the arguments you provide to explain why you have not paid for such a long period of time, and make a positive decision in your case (for you). How to sue banking institutions, read here

4. You should not delay contacting an experienced lawyer. Provide him with the loan agreement and related documents.

If the agreement reveals at least one fact of violation of Russian legislation on the part of the bank, you will have significant chances to legally avoid paying the debt or part of it.

In addition, an experienced specialist who has seen dozens of similar cases has valuable practical knowledge in this area and can find some loophole that will help declare you bankrupt, achieve restructuring, or even win the case completely in your favor.

So, this point (seeking help from a qualified specialist) is especially important! More details about bankruptcy of individuals can be found on this page.

If you do not have a legal education, then you will not be able to independently confront the lawyers from the creditor bank who deal with such cases every day. Talking about the difficult financial situation and trying to press for pity is useless, since only clear arguments with references to articles of the law will be considered.

Apply for a cash loan right now ⇒

5. If, nevertheless, a decision is made in favor of the bank , the bailiffs will begin to fulfill their duties, which include the sale of the debtor’s valuable property (if any) in order to repay the entire amount of the debt or part of it.

You don’t have to wait for the bailiffs and sell your valuable property yourself. There is a possibility that they will make a more lenient decision, simply ordering a forced deduction in favor of the creditor of a certain percentage of your salary.

6. You should know that there are certain categories of property that cannot be taken away! These are state awards, memorial signs, food, household items, clothing, shoes. Leaving a debtor without the minimum subsistence level is also illegal.

According to the law, a person cannot be deprived of his only home, and it does not matter whether it is an old Khrushchev building or a luxurious apartment in an elite building. However, sometimes courts make a decision on the alienation of part of the property. That is, if you have a five-room apartment, then the debt can be covered by selling part of it.

List of banks that issue loans without checking credit history ⇒

It is also worth noting that if the claim was filed for a mortgage, then the housing is written off first, regardless of whether you have an alternative.

And finally, two important nuances

- proceedings between the debtor and the creditor can last for months and even years, during this time you can find the opportunity not only to turn the tide of the case in your favor, but also financial resources to pay the debt; — there is such a thing as a “statute of limitations”; for loans it is 3 years. Don't forget about it!

How is the meeting going?

The collection process takes place in 2 stages:

- First: a preliminary meeting, at which the parties get acquainted with the case materials, submit additional documents, and learn about the date of the second meeting.

- Second: the main hearing, which includes several hearings. The defendant needs to seriously prepare: objections to the bank’s claims with references to the law, detailed tables with calculations of payments, documents confirming the inability to repay the debt (for example, a certificate of dismissal), etc.

List of banks that issue money per hour using a passport ⇒

What will happen to the debtor after

After the court has made a decision, the borrower can file an appeal, but practice shows that this is a useless matter and will not change anything. An appeal is needed if you want to stall for time, the process will drag on for 2 months. You can also ask for installments for several months.

During this time, you will be able to find buyers for your property and sell it profitably. If you don't do this, it will still be seized by bailiffs and sold cheaply.

Submit a loan application online ⇒

If you want to transfer your property to relatives, then you should have done this before the decision. Otherwise, such transactions will be challenged, and in addition, you may be accused of fraud.

If, after selling everything, you still don’t have enough money to pay off the debt in full, then most likely the bailiffs will contact your employer, after which they will begin to deduct a certain amount from your salary each month to pay off the debt.

Is there a decision in favor of the borrower?

It is impossible to win a case with an overdue debt, but you can achieve a reduction in the amount. Typically, banks charge high interest and fines for violations, which sometimes exceed the amount of the loan originally issued.

If you do not use the help of a qualified specialist, that is, a credit lawyer, you will most likely end up with the entire amount due. A competent lawyer will help reduce it several times.

Which bank will give a loan with a bad credit history ⇒

Can they be imprisoned?

Punishment for even the most malicious evasion of payments does not include imprisonment. However, the Criminal Code of the Russian Federation has a corresponding article on forced labor for up to 2 years.

The worst defaulters with simply huge debts can still be imprisoned for six months if fraud is proven. This does not apply to consumer loans, which do not involve large amounts.

Often banks prefer to contact collection agencies, which can be more unpleasant for the borrower than going to court. Read more about the activities of such companies here.

How to file a statement of claim in court?

Russian legislation allows individuals and organizations to draw up a statement of claim in the prescribed form; it is important to indicate the details of the parties (bank, plaintiff and court), provide suitable evidence and substantiate the claims. In general, the judge’s position during the first hearing depends on the quality of the claim, so the document must be prepared in compliance with all legal requirements. A citizen can choose one of three ways to prepare a claim.

Payment for full legal support of the case . In this case, the client (plaintiff) contacts a lawyer, pays for the services of studying the case materials, preparing a legal position (arguments for speaking in court) and drawing up a statement of claim. The lawyer will draw up a claim in accordance with the law and current judicial practice, and will independently collect and present evidence. This option is suitable for clients filing a claim for a large amount and who do not have experience interacting with the courts. In general, preparing a claim by a lawyer guarantees that the document will be accepted in court.

Payment for initial consultation with a lawyer and independent preparation of the claim. In this case, the plaintiff pays for the first consultation with a lawyer, receives information about the nuances of preparing a statement of claim, and the prospects of winning the case. A legal consultation employee studies the case materials, offers the client methods of defense, and introduces possible strategies for conducting legal proceedings. This option is suitable for clients with a limited budget who have experience interacting with the courts. During the consultation, a lawyer or attorney will assess the complexity of the case and advise the client to either represent his interests independently (if the claim is typical and the likelihood of winning is high), or contact a lawyer (if the likelihood of winning is low).

Independent study of judicial practice and preparation of a claim . In this case, the plaintiff studies the provisions of the agreement, banking regulations for working with similar cases, reads court decisions on similar cases, gets acquainted with samples of filling out a statement of claim and submits documents independently. This option is suitable for clients who have a limited budget, legal or financial education, and experience in communicating with judicial authorities. Independently preparing documents and presenting your position in court requires free time (the proceedings with the bank take several months). It is advisable to appear independently in court if the bank’s violation is obvious and the citizen has indisputable evidence.

How to win a lawsuit against a bank over a loan with a large overdue loan

In order for the loan trial to go according to the debtor’s scenario and end in his favor, every little detail must be taken into account. First of all, whether the bank’s actions were legal, whether the statute of limitations has expired, whether the delay was due to the fault of the credit institution, whether debt collection was carried out with violations, etc.

If the case has been transferred, and the borrower does not know how to win a lawsuit with the bank over a loan, it is better not to risk it and contact a lawyer. Professional lawyers, like no one else, know what the court takes into account, what arguments and evidence need to be presented, how to properly prepare for the trial, and how long the trial lasts. The lawyer will help reduce the amount of debt, thus working off his fee, or conduct the case in such a way that legal costs will fall on the shoulders of the losing party, that is, the bank.

According to the law, the borrower must repay the principal amount and accrued interest, fines, and penalties. In practice, if the court ordered the payment of a certain amount, it took into account the financial situation of the borrower. Sometimes he cooperates, but not always. After notification of the commencement of enforcement proceedings has been received, the borrower’s property can be sold, and his income (salaries, pensions, etc.)

) will be withheld up to 50% of the proceeds towards repayment. Lawyers advise to always save payment documents and control repayment even after the trial. In case of discrepancies, an appeal must be made. If you are summoned to court, you need to prepare all documents and evidence that payments were made. Winning against the bank is not easy, but it is possible.

Settlement agreement

The best option for the borrower and lender is a settlement agreement with the bank on the loan. The parties come to a certain compromise, which allows the issue to be resolved peacefully.

Typically, the lending bank offers new, more acceptable repayment terms for consumer, auto or mortgage lending, taking into account the client’s current solvency.

Rules for preparing a lawsuit against a bank

A citizen preparing a claim on his own should decide on the subject and basis of the claim. The subject of the claim is a list of demands put forward by the citizen (plaintiff) to the banking organization. For example, reduce the interest rate on a loan, issue a deposit and interest income. The basis of the statement of claim is a list of arguments (provisions of the contract, judicial practice, Russian laws) confirming the position of the plaintiff. The lawsuit consists of several blocks.

Contact details of the parties . The statement of claim begins with the name of the court, index and address of its location, then jurisdiction should be indicated. For example, alternative jurisdiction in accordance with clause 22 of the loan agreement. This is followed by information about the plaintiff, including full name, date of birth, place of registration, mobile or work telephone number, and it is also advisable to indicate an email address. Information about the defendant must contain the full name of the banking organization, registration data (TIN, OGRN), legal address, telephone number and email.

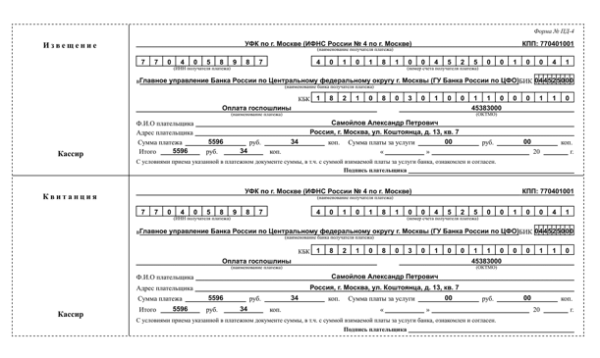

Information about the claim. At the end of the claim header, you should indicate the price of the claim (the amount that the citizen plans to receive as compensation) and the state fee paid (the amount of the fee is calculated on the State Autonomous Administration Justice website). The calculation of the cost of the claim should be provided as a separate document attached to the application.

Description of the factual circumstances of the case. The bulk of the statement of claim should be devoted to a description of the essence of the dispute with references to supporting documents and legal norms. It is recommended that the text be divided into subsections to facilitate the perception and consideration of the claim. For example, a client files a claim to recover unlawfully accrued interest. In this case, the first section of the claim is devoted to a description of the loan agreement (with references to specific provisions), the payment discipline of the plaintiff is considered (with references to the account statement), then the defendant’s guilt is indicated (a calculation of illegally accrued interest is provided and a link to the bank statement). The second section of the claim will be devoted to the client’s pre-trial claim against the bank (with reference to the document itself and the bank’s refusal) and the recalculation of interest payments. In the final part, you need to indicate the need to file a statement of claim.

The plaintiff's position on procedural issues. The plaintiff is recommended to include in the application comments regarding jurisdiction and compliance with the claim (pre-trial) procedure for resolving disputes. This information will protect the plaintiff from the possibility of transferring the proceedings to another court (convenient for the bank), and will also draw the court’s attention to the requirements of the agreement with the bank. For example, the amount of a lawsuit against a bank is 150 thousand rubles, the agreement does not indicate jurisdiction. In the section on procedural issues, the plaintiff refers to Article 24 of the Code of Civil Procedure of the Russian Federation and indicates the need to consider the claim in the district court at the place of registration of the bank according to territorial jurisdiction.

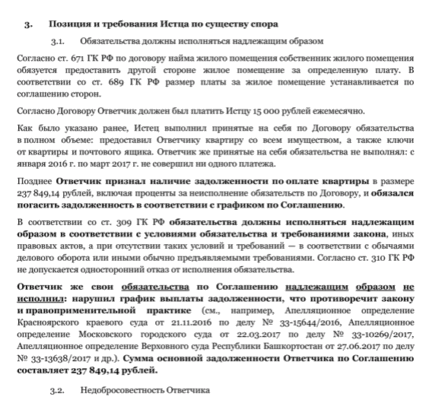

The plaintiff's claims on the merits of the dispute. In this section, the citizen must set out all violations committed by the defendant during the period of validity of the agreement with references to the legislation and provisions of the agreement. It is advisable to point out the defendant’s dishonesty, refusal to settle the dispute pre-trial, and also provide a calculation of the total amount of payments. When drawing up demands, you should emphasize the bank’s guilt, referring to the appendices to the statement of claim.

The plaintiff's requests (the pleading part of the claim). At the conclusion of the statement of claim, the client’s demands to the court should be stated. For example, to recover from the bank the amount of excessively accrued interest on a loan in the amount of 150 thousand rubles. A citizen should ask for reimbursement of the state fee paid for filing a claim, demand payment of a penalty (for using the client’s money) in the amount of the key rate of the Central Bank of the Russian Federation (according to Article 395 of the Civil Code of the Russian Federation).

List of attachments to the claim. After the petition part, the citizen lists all the documents attached to the statement of claim. The bank client needs to submit the original receipt for payment of the state fee; other documents can be submitted in the form of notarized copies. If correspondence by email is attached to the claim, you need to obtain a protocol from the notary for examining the electronic mailbox. At the end of the document there should be the date the claim was filed, the full name and signature of the plaintiff.

In general, the statement of claim should be drawn up in as much detail as possible, using lists, references to laws and contract provisions. Detailed calculations should be provided in the appendices; the citizen is advised to emphasize the guilt of the bank (defendant). The finished document should be as simple as possible for the judge to understand.

Probusinessbank. Materiel for litigious people. Part 2.

As promised earlier, I’m moving on to part number 2 of the practical guide for those who argue with Probusinessbank represented by the DIA in court. Perhaps the issues of reducing interest for using a loan and reducing the payment on the principal debt may seem insignificant to someone when compared with the part about reducing the penalty and realizing that this is the most time-consuming part of the dispute, but this is not so.

Without understanding the mechanism for calculating monthly payments, not only will it not be possible to draw up a counter-calculation, which will differ less from the proposed DIA, but it will also not be possible to correctly apply the statute of limitations. In other words, you will have to “strain” a little. Unlike the first part, I promise not only a lot of letters, but also a lot of numbers, so this is dedicated to people who adhere to the school view that “mathematics will never be needed in real life (c)”...

So, if you look at any loan through the eyes of a consumer, the total amount of payments to the bank will depend on:

- the amount of the principal debt,

- interest on the loan and its repayment period,

- penalties,

- and other unnecessary charges for an ordinary person: fees for imposed insurance, various types of commissions to the bank, etc., depending on the imagination of the drafters of the contract.

The penalty was discussed in the first part of the article, let’s move on to interest for the use of credit funds, the principal debt and statute of limitations.

As you know, as a general rule, interest for using a loan is not subject to reduction by the court, which the Supreme Court of the Russian Federation is already tired of talking about. Here, however, it should be noted that for microloans this is very possible, for example, when the amount of interest contradicts the Federal Law of July 2, 2010 No. 151 “On microfinance activities and microfinance organizations.” But, since this law is not applicable in cases with banks, we will assume that you will have to pay interest on the loan. For those who will object, there is Resolution of the Plenum of the Supreme Court of the Russian Federation No. 13, Plenum of the Supreme Arbitration Court of the Russian Federation No. 14 of October 8, 1998 “On the practice of applying the provisions of the Civil Code of the Russian Federation on interest for the use of other people's funds.”

So, about the procedure for calculating loan payments.

So as not to immediately scare off with an introduction like: “there are two main types of calculation of regular payments: annuity and differentiated,” I will simply try to show the whole essence with examples.

Every person, without exception, has encountered a loan. It usually looks like this: Vasya borrowed 1000 rubles from Kolya for a year at 20% per annum. If Vasya is lucky and Kolya returns the money, then he will receive as much as 1,200 rubles.

If Kolya wants to act completely according to the law and knows the norm specified in paragraph 3 of Art. 809 of the Civil Code of the Russian Federation, then he will pay interest monthly. In the end, the same 1,200 rubles, but Vasya is a little calmer.

Just? Very. But this is only when the amount of the principal debt is repaid at a time. But if Vasya, for his peace of mind, demanded that Kolya, in addition to interest, repay the principal debt itself in installments throughout the year, then the amount of payments equal to 1000 rubles / 12 = 83 rubles 33 kopecks he will return from the amount of the principal debt, and the rest is interest. Accordingly, the size of the principal debt will constantly decrease, as a result of which the interest for using the loan will also decrease. As a result, we get, in rubles:

| monthly payment amount | of which the main debt | accrued interest on the balance |

| 100,00 | 83,33 | 16,67 |

| 98,61 | 83,33 | 15,28 |

| 97,22 | 83,33 | 13,89 |

| 95,83 | 83,33 | 12,50 |

| 94,44 | 83,33 | 11,11 |

| 93,06 | 83,33 | 9,72 |

| 91,67 | 83,33 | 8,33 |

| 90,28 | 83,33 | 6,94 |

| 88,89 | 83,33 | 5,56 |

| 87,50 | 83,33 | 4,17 |

| 86,11 | 83,33 | 2,78 |

| 84,72 | 83,33 | 1,39 |

If you add everything up, then Vasily will receive only 1108 rubles 33 kopecks, but in exchange for some loss in money, he will receive additional peace of mind, because Every month a portion of the debt is returned to him along with interest.

This type of payment calculation is called differentiated and will be used in settlements in court.

As you would expect, the banks are a little more cunning than Vasya and want to get more money from Kolya and even more peace of mind about repaying the loan. At the same time, you need to pretend that their conditions are more favorable. Therefore, the bank, having met Kolya, offered him this. Still the same debt of 1000 rubles at the same 20 percent per annum, but with the same monthly payment amount.

For those who studied mathematics at school, it is not difficult to find a formula for calculating the annuity payment and check the accuracy of the calculations. Everyone else will have to take their word for it.

Based on the calculation we get:

| monthly payment amount | of which the main debt | accrued interest on the balance |

| 92,63 | 75,97 | 16,67 |

| 92,63 | 77,23 | 15,40 |

| 92,63 | 78,52 | 14,11 |

| 92,63 | 79,83 | 12,80 |

| 92,63 | 81,16 | 11,47 |

| 92,63 | 82,51 | 10,12 |

| 92,63 | 83,89 | 8,75 |

| 92,63 | 85,29 | 7,35 |

| 92,63 | 86,71 | 5,93 |

| 92,63 | 88,15 | 4,48 |

| 92,63 | 89,62 | 3,01 |

| 92,63 | 91,12 | 1,52 |

As a result, Kolya will pay a little more - 1111 rubles 61 kopecks, but in equal parts. True, Kolya will not understand the essence of the calculation, but in general, the final difference in the overpayment of 3 rubles between the annuity and differentiated calculations will not particularly bother him, even taking into account the fact that at first he pays mostly interest, and only at the end of the loan term most of the loan.

What is the catch for the loan recipient and at the same time the inconvenience for his future representative in court?

For the first, this is that due to the complexity of the calculation, it is difficult to understand the real interest on the loan. Well, for a lawyer-representative, this is that the vast majority of him are more of a humanist than a mathematician, and when he hears the word “calculation” he begins to feel nauseous. And you need to count everything and always, because with a conscientious approach you need to provide a counter payment.

Demonstration of the first example here:

The borrower probably planned to take out a loan of 201,000 rubles at 18.29% per annum, but took it if we make a reverse calculation based on the monthly payment amount of 6,414 rubles per month - at 29.28%. The shorter the loan period, the higher the percentage, as a rule. According to the first payment schedule that came my way for 3 years, I got an interest rate of 42.33% per annum. Well, actually it’s my own fault - I should have read the contract, and not watched the advertising on TV.

Accordingly, taking into account the agreement with the bank, the initial payment schedule executed by the bank and the calculation of the DIA representative proposed in the claim are of secondary importance for us. And the most important thing is our own calculation, which we can justify. By the way, it will differ, even if not significantly, but always to a lesser extent. We take a loan calculator, for example here, set the dates, loan amount and interest on the agreement and enjoy the invention of mankind called a computer.

A small note. In one of the clauses of the agreement there is the phrase “the borrower undertakes ... to ensure that funds are available in the account or deposited into the bank’s cash desk in the amount of the monthly payment specified in the payment schedule, which is an integral part of the agreement.” Perhaps this phrase may scare someone, but how For me, since the subject of the agreement in the form of interest for using a loan is clearly established in the relevant section of the agreement, it should not cause any particular trouble.

Next, we perform the following manipulation with the calculation we received. We find the period before which the borrower made payments (I remind you that some borrowers paid for some time through other banks after the bank was declared bankrupt. Of course, they will be required in court to confirm this in the form of receipts) and determine the amount of the remaining principal debt.

Then, we carry out another action - we carry out a differentiated calculation of interest until the date specified in the DIA claim, or until the date the claim is accepted by the court, using the same calculator.

Now we begin to cut off from it amounts that have gone beyond the limitation period.

Since questions about missing the statute of limitations on credit obligations are asked almost every day, I even made a video so as not to repeat myself. Is the statute of limitations even expired if the loan was taken out more than 3 years ago?

According to the Resolution of the Plenum of the Armed Forces of the Russian Federation No. 43 of September 29, 2015, the countdown of the statute of limitations for a debt, which according to the agreement must be paid in parts, begins to be counted separately for each such part.

The very mechanism of applying statutes of limitations may seem boring to some, but I’ll describe it just in case. We determine the date of filing the claim after which the limitation period is suspended, count back 3 years from this date and apply for everything that before the received date not to be collected for the application of the limitation period. It's simple. Of course, the statute of limitations, if a petition is filed, applies both to part of payments in the form of interest for the use of borrowed funds, and to part of the principal debt.

Taking into account that the bank’s license was revoked in the summer of 2020, the statute of limitations can be applied to almost all claims filed by the DIA and accepted by the court after August 2020, albeit partially. The later the claim is filed, the higher the amount.

For example, a claim was filed in January 2020, the balance of debt on the loan as of the date after which payments ceased to be accepted by the bank was 150,000 rubles as of August 2020, and the interest specified in the agreement is 0.12% per day, then we can “win back” the amount equal to:

| payment for | principal +% | Of these, the main debt | interest |

| August, 2015 | 9 641,67 | 4 166,67 | 5 475,00 |

| September, 2015 | 9 489,58 | 4 166,67 | 5 322,92 |

| October, 2015 | 9 337,50 | 4 166,67 | 5 170,83 |

| November, 2015 | 9 185,42 | 4 166,67 | 5 018,75 |

| December, 2015 | 9 033,33 | 4 166,67 | 4 866,67 |

Total: 46,687 rubles 50 kopecks minus the price of the claim, if you file a petition to apply the deadlines and justify the calculation. Perhaps a small thing, but nice.

ps As a lawyer, I am always ready to provide paid assistance (prepare calculations for the court, objections, including remotely, provide consultation via video conferencing or in writing, provide representation in court). Click the button below to find my contacts, or you can also fill out the form at the bottom of the page “to sign up for a consultation.”

That's all for now. In the first part of the article, I also promised to talk about the moments associated with the loss of the originals of the contract by the plaintiff, about the moments of calculating the state duty, according to the method of calculating the penalty in accordance with Art. 395 of the Civil Code of the Russian Federation and about some issues of the application of judicial practice, but perhaps I will leave this for the third part of the article, so as not to overload it with volume at one time.

With respect, lawyer of the Chamber of Lawyers of the Nizhny Novgorod Region, head of the Kstov branch of the Second Nizhny Novgorod Bar Association “Nizhny Novgorod Lawyer” Kandalov Mikhail Anatolyevich

Rules for filing a prepared statement of claim in court

According to Russian legislation, the court accepts for proceedings (consideration) only claims drawn up in accordance with all procedural norms. For example, a judge may refuse to consider a claim or leave a document without progress if the bank client did not first file a claim, chose the wrong jurisdiction, or formulated the requirements vaguely (the pleading part of the claim).

A completed statement of claim can be filed in court in several ways:

- Filing a claim with the court office. The statement of claim and attachments in triplicate (for the plaintiff, the defendant and the court) can be submitted in person by contacting the court office. You can find out the time for accepting statements of claim on the court’s website or by phone; you need to have a passport and a power of attorney with you (if the claim was not filed by a citizen in person).

- Sending the claim by registered mail. The completed statement of claim can be sent by a valuable letter with a list of attachments or by registered mail with acknowledgment of receipt. Statements of claim sent by mail are considered accepted on the day of delivery to the post office.

- Filing a claim electronically. A scanned copy of the statement of claim can be sent on the Electronic Justice or My Arbitrator websites using a user account on the State Services project.

The law requires the court to make a decision on whether to consider or reject claims within five working days. The status of the claim can be found in the court office or on the website. If all procedures are followed, once the claim is filed, the first hearing will be scheduled and the trial will begin.

Loan without receipt

If, when receiving the money, the receipt was not drawn up in writing, and the agreement on the period and procedure for their return was oral, then the procedure for repaying the loan becomes significantly more complicated. In this case, you will have to act according to a different scheme: through law enforcement agencies or the court.

Contacting the police

The debtor can be brought to criminal liability, even if there is no document confirming the fact of providing money at interest. To do this, you need to contact the police, following the following procedure in your actions:

- Obtain evidence of the transfer of funds for personal use to the borrower. According to Art. 162 of the Civil Code of the Russian Federation, in the absence of written confirmation of the conclusion of a credit transaction, when demanding repayment of the debt, the lender may refer to other evidence with the exception of witness testimony. These include: correspondence with the defaulter by email, on social networks or via SMS messages, as well as an audio recording, which should be made in compliance with the provisions of Article 77 of the Code of Civil Procedure of the Russian Federation. If the debtor does not deny the existence of the debt, then under any pretext you can ask him to write in his own hand that he took the money for personal use and describe the conditions for its return.

- File a police report. Based on Art. 159 of the Criminal Code of the Russian Federation, the creditor must write a statement to the police, based on the fact that the debtor took the money by deception or by abusing his trust. The procedure for filing and consideration of such applications is regulated by Order of the Ministry of Internal Affairs No. 736 dated August 29, 2017. To ensure that the accusations do not turn out to be groundless, it is necessary to attach the collected evidence. An accepted application is considered by an official and a decision is made to initiate (or refuse to initiate) a criminal case. You can appeal a refusal during consideration within 3 days from the date of notification.

- Write a complaint to the Ministry of Internal Affairs

Attention! If it is not possible to obtain at least one proof of a loan, contacting the police or court will have no meaning. In such circumstances, it is almost impossible to collect the debt.

Lawsuit

If the lender does not want to bring the debtor to criminal liability, then he can go to court, providing evidence confirming the issuance of the loan for personal use. In this manner, you can also appeal the refusal to initiate a criminal case if the police did not previously accept a statement about the unlawful actions of the defaulter or considered the evidence collected by the creditor to be unreliable or contrary to the law.

To force a debt to be repaid, you must:

- Notify the debtor of the current delay in payment and your intention to resort to enforcement by sending a letter with return receipt.

- Determine where to file the claim based on the defaulter’s last known place of residence or registration. This can be done by using the free Russian Federation directory, where you need to fill out a short form.

- If you wish, file a claim for compensation for moral damage, based on the provisions of Article 151 of the Civil Code of the Russian Federation. The court, based on the severity of the consequences caused by the violation of the lender’s personal rights, can determine the amount of moral compensation for the inconvenience caused.

- Pay the statutory fee, the amount of which must be calculated based on the requirements of the Tax Code.

- File a claim indicating that the money was received without any document.

- Submit a claim and a complete package of documents (the list is the same as when filing a claim to recover a loan with a receipt). In addition, evidence of receipt of funds should be attached, indicating them in the inventory.

The lender can file a claim even after initiating a criminal case against the defaulter, which is provided for in Article 44 of the Criminal Code of the Russian Federation. In this case, you can avoid the mandatory payment of state fees, as happens when filing a civil claim.

Important! If the debtor voluntarily agreed to write a receipt for the receipt of funds, then, having a legal basis to demand repayment of the debt, the lender can immediately go to court.

Results

A citizen can file a claim against the bank in case of any violations of the provisions of the contract or legal requirements committed by the financial organization. Typically, lawsuits are filed by borrowers who have suffered from unlawful accrual of interest on loans, and litigation is also conducted by depositors who were unreasonably denied a deposit and interest income.

Before filing a lawsuit, you should compare the expected costs and the amount of compensation, study the provisions of the contract, legal norms and judicial practice. A citizen can prepare a claim on his own, contact a lawyer for initial advice, or pay for the services of a lawyer representing the interests of the plaintiff in court.

What are the consequences of going to court with a bank over a loan?

Filing a statement of claim stops the accrual of penalties on the loan and, in fact, breaks the contract. The defendant owes the entire amount at once, along with interest and fines that accrued during the period of delay.

Litigation under loan agreements in 90% of cases ends in favor of the bank. For the debtor, this means the beginning of enforcement proceedings against him, that is:

- arrest of bank, salary, social accounts;

- writing off part of the income in favor of the creditor;

- arrest and restrictions on the disposal of property;

- sale of property;

- ban on traveling abroad;

- restriction on the right to drive a car.

Execution of a court decision in proceedings with a bank

Upon receipt of the writ of execution, the bank transfers it to the bailiffs. They, in turn, begin production and describe the property to pay off the debt. Many debtors are afraid that the bailiffs will leave them without a single thing on the street.

When work is underway, you need to know that they do not have the right to take away from you:

- housing or land in the case where this is the only place of residence. If the bank sues for a mortgage, then the residential premises are described first, and it does not matter whether you have an alternative;

- lands allocated for subsidiary farming and agriculture;

- property that is a working tool. Even cars qualify for this item. The cost of equipment should not exceed 100 minimum wages;

- coal and firewood for heating homes and cooking;

- medals and cups;

- special transport and other equipment intended for disabled people. It is necessary to provide a certificate of relation to this category;

- furniture and other household items;

- clothing, footwear and food;

- money in the amount of the minimum wage for the debtor and each dependent.

Those who do not have jewelry and other luxury items, good household appliances and vehicles not used for work have practically nothing to fear. To prevent the debt from being registered and causing troubles in the form of frequent visits by bailiffs, it is recommended that the court draw up a debt repayment schedule or pay the amount in installments through the FSSP.

Thus, if the bank filed a claim, the debtor should not be afraid of anything, much less ignore the meetings. Use this chance to protect yourself and reduce your debt.

Actions if the bank sues

In this case, there is no need to give up and, first of all, you should familiarize yourself with the bank’s claims set out in the statement of claim. It is best to involve an experienced lawyer who works in this field.

If you cannot pay for his services, then you can try to take care of your defense yourself. In this case, the chances of a successful outcome of the case will be much less, but in any case you should not succumb to circumstances.

When considering papers received from the bank, there are several points that are worth paying special attention to.

| What to pay attention to | How can this help? |

| Calculation of final debt | The fact is that people calculate the final amount, and no one is immune from mistakes. In some cases, it is easy to find a very significant difference due to a simple typo; it can be tens of thousands more. |

| Commissions | Regardless of what commission was specified in the contract, it is worth trying to challenge it and even cancel it completely. |

| Property valuation amount (for targeted lending for a car or other real estate) | The bank takes property as collateral for some types of loans, which will be sold if there is a delay in payment. Often the bank's assessment of the value of this property is significantly underestimated and will not pay off the entire debt. |

| Penalty amount | Typically, in claims, the bank demands refund of the full amount with all fines, penalties and interest. Such sanctions can be for a fairly large amount. Example: the loan was initially 100,000 for three years, of which payments were made consistently for one year. In the statement of claim, the bank demands a return of 130,000. If you approach the matter with knowledge of the laws, you can actually reduce it significantly. |

The fact that you have a debt is not a fault that carries criminal liability.

According to the Criminal Code, you have the right to be charged only if it is proven that the non-payment was intentional. To do this, you must prove that you are not a willful defaulter. It is defined by several main features:

- inaction to repay the loan;

- avoidance of obligations for more than 6 months;

- having the ability to repay the loan, but deliberately failing to fulfill one’s obligations to the bank.

It is possible to prove that the borrower deliberately avoids committing a debt only if he himself admits his guilt in it or if he owns several real estate objects and other valuables. If there is evidence, liability arises under Articles 177 and 159 of the Criminal Code of the Russian Federation.

Debt collection by a bank through a court order

Most often, banks make their life easier and apply for a court order. For the bank in this case, the advantage is that the meeting is not held and, accordingly, you cannot protect yourself.

This is an easy and quick way to collect debt; from the moment you submit the application, it can only take a week until you receive the order.

According to Art. 122 of the Code of Civil Procedure, the judge has grounds to make a decision on his own without your presence, since the lending transaction is a written agreement. The most important thing is that a writ of execution can replace it and the bank has the right to transfer it to the FSSP.

Canceling an order is quite easy. To do this, you will need to protest it within 10 days after receiving it. It is necessary to write a statement to the magistrate who issued it, which will indicate why you consider the order to be unlawful:

- incorrectly calculated amount of debt;

- penalty disproportionate to the violation;

- objections regarding the subject of the dispute.

If you learned about the court order from the bailiff, then you need to indicate that you want to terminate the enforcement proceedings.

The magistrate's court most often, on the basis of this application from the debtor, cancels the order. However, when applying to cancel this decision, be prepared to find out that the bank has filed a lawsuit. In order to turn the situation in your favor in this case, the training and assistance of a competent specialist is necessary.